Global Organic Food Beverages Market

Market Size in USD Billion

CAGR :

%

USD

256.69 Billion

USD

586.02 Billion

2024

2032

USD

256.69 Billion

USD

586.02 Billion

2024

2032

| 2025 –2032 | |

| USD 256.69 Billion | |

| USD 586.02 Billion | |

|

|

|

|

Organic Food and Beverages Market Size

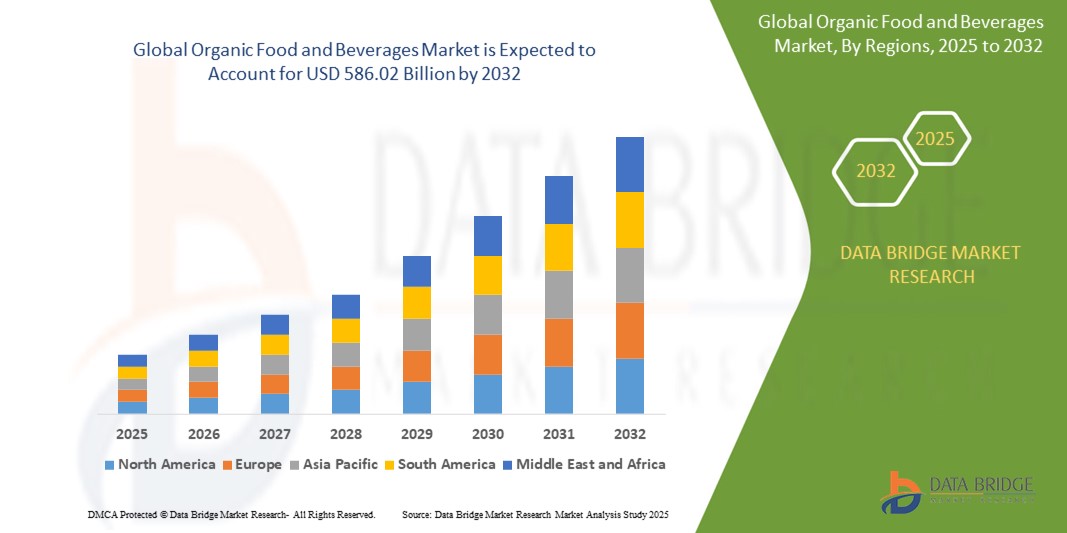

- The global organic food and beverages market size was valued at USD 256.69 billion in 2024 and is expected to reach USD 586.02 billion by 2032, at a CAGR of 10.87% during the forecast period

- This growth is driven by factors such as increasing health consciousness, rising consumer demand for clean-label and chemical-free products, and growing environmental awareness encouraging sustainable agricultural practices

Organic Food and Beverages Market Analysis

- Organic food and beverages refer to products made from ingredients grown without the use of synthetic pesticides, fertilizers, genetically modified organisms (GMOs), or artificial additives. These products cater to consumers seeking healthier and environmentally sustainable food choices

- The demand for organic food and beverages is significantly driven by increasing consumer awareness regarding health and wellness, rising preference for chemical-free diets, and concerns over food safety and environmental impact

- North America is expected to dominate the organic food and beverages market with largest market share of 50.4%, due to strong consumer demand, well-established retail infrastructure, and supportive regulatory frameworks promoting organic certification and labeling

- Asia-Pacific is expected to be the fastest growing region in the organic food and beverages market during the forecast period, driven by rapid urbanization, growing disposable incomes, and increasing awareness of organic and sustainable eating practices

- Organic food segment is expected to dominate the market with a market share of 41.1% due to the growing consumer preference for clean, chemical-free, and nutrient-rich food options. Rising health awareness and concerns over the long-term effects of synthetic pesticides and GMOs have significantly influenced purchasing decisions, especially among urban populations

Report Scope and Organic Food and Beverages Market Segmentation

|

Attributes |

Organic Food and Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Food and Beverages Market Trends

“Growing Shift Toward Clean Label and Sustainable Products”

- One prominent trend in the global organic food and beverages market is the increasing consumer demand for clean label products that are free from artificial additives, preservatives, and genetically modified organisms (GMOs)

- This trend is further amplified by growing environmental awareness and the desire for sustainably produced food, pushing manufacturers to adopt eco-friendly farming, packaging, and supply chain practices

- For instance, leading brands are now introducing organic products with transparent ingredient sourcing and eco-conscious labeling, aligning with consumer preferences for ethical and traceable food systems

- This shift is reshaping the food and beverage industry, encouraging innovation in organic offerings, and accelerating the global transition toward more responsible and health-driven consumption

Organic Food and Beverages Market Dynamics

Driver

“Rising Health Awareness and Demand for Chemical-Free Food”

- The growing global awareness about the adverse health effects of synthetic pesticides, additives, and genetically modified organisms (GMOs) is significantly driving the demand for organic food and beverages

- Consumers are increasingly seeking healthier, natural alternatives that offer nutritional benefits without the harmful residues associated with conventional farming practices

- As people become more proactive in managing their health and wellness through diet, the shift toward clean, organic, and minimally processed food is accelerating worldwide

For instance,

- According to a 2023 Organic Trade Association (OTA) report, over 80% of U.S. households reported purchasing organic products, citing health benefits as the top motivator

- As a result, the rising global focus on preventive healthcare and clean eating is fueling consistent growth in the organic food and beverages market across both developed and emerging economies

Opportunity

“Innovation in Organic Functional Foods and Plant-Based Alternatives”

- The growing consumer shift toward health and wellness is creating strong opportunities for innovation in organic functional foods and beverages that offer added health benefits, such as immunity support, gut health, and energy enhancement

- As demand for plant-based diets continues to rise, there is increasing potential for organic brands to develop dairy-free, gluten-free, and meat-free alternatives using certified organic ingredients

For instance,

- In 2024, major food companies expanded their organic portfolios to include fortified plant-based drinks, probiotic-rich snacks, and high-protein vegan meals—catering to health-conscious and ethically motivated consumers

- These innovations not only appeal to a broader consumer base but also allow brands to differentiate themselves in a highly competitive market, fueling growth in both retail and foodservice segments of the global organic food and beverages market

Restraint/Challenge

“High Cost and Limited Accessibility of Organic Products”

- The relatively higher cost of organic food and beverages compared to conventional alternatives poses a significant challenge to broader market adoption, particularly in price-sensitive and developing regions

- Organic farming requires more labor-intensive practices, certification processes, and sustainable inputs, which contribute to increased production costs that are ultimately passed on to consumers

- This cost disparity can deter lower-income consumers from choosing organic options and limit market penetration outside of affluent, urban markets

For instance,

- According to a 2023 report by the Food and Agriculture Organization (FAO), organic products can cost anywhere from 10% to 50% more than conventional goods, making affordability a key barrier to market expansion, especially in regions like Africa, South Asia, and parts of Latin America

- As a result, the high price point and limited distribution in rural or underserved areas may restrict consumer access, slowing the global organic food and beverages market’s growth despite rising demand

Organic Food and Beverages Market Scope

The market is segmented on the basis of product type, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Distribution Channel |

|

In 2025, the organic food is projected to dominate the market with a largest share in product type segment

The organic food segment is expected to dominate the organic food and beverages market with the largest share of 41.1% due to the growing consumer preference for clean, chemical-free, and nutrient-rich food options. Rising health awareness and concerns over the long-term effects of synthetic pesticides and GMOs have significantly influenced purchasing decisions, especially among urban populations

The supermarket/hypermarket is expected to account for the largest share during the forecast period in distribution channel segment

In 2025, the supermarket/hypermarket segment is expected to dominate the market with the largest market share of 60.6%, due to stores have a broad portfolio of branded as well as domestic products. Some of the brick-and-mortar stores provided by this distribution channel and its ability to stock popular brands have been supplementing the growth of this segment. The increasing number of supermarket & hypermarket chains and altering retail landscape, particularly in developing economies, are boosting product sales via this channel

Organic Food and Beverages Market Regional Analysis

“North America Holds the Largest Share in the Organic Food and Beverages Market”

- North America dominates the organic food and beverages market with largest market share of 50.4%, driven by strong consumer awareness, a mature retail infrastructure, and supportive government regulations regarding organic certification and labeling

- The U.S. holds a significant share of approximately 43%, due to increasing demand for clean-label, non-GMO, and chemical-free food products, along with widespread availability across both conventional and specialty retail channels

- The presence of major organic brands, rising investment in sustainable agriculture, and growing consumer inclination toward plant-based and functional foods further fuel market growth

- In addition, the adoption of e-commerce platforms and the expansion of organic private labels in supermarkets contribute to the continued dominance of North America in this sector

“Asia-Pacific is Projected to Register the Highest CAGR in the Organic Food and Beverages Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the organic food and beverages market, fueled by increasing health awareness, rapid urbanization, and growing demand for safe and natural food options

- Countries such as China, India, and Japan are emerging as key markets due to rising disposable incomes, government initiatives promoting organic farming, and shifting consumer preferences toward wellness-oriented diets

- Japan, with its focus on food safety and quality, continues to show strong demand for organic and minimally processed foods, especially among older populations

- In China and India, the growing middle class and concerns over food contamination are prompting consumers to opt for certified organic alternatives. Expansion of modern retail formats and increasing visibility of organic labels also support market growth across the region

Organic Food and Beverages Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hain Celestial (U.S)

- Dole Food Company, Inc (U.S)

- Dairy Farmers of America, Inc. (U.S)

- General Mills Inc. (U.S)

- Danone (France)

- United Natural Foods, Inc. (U.S)

- GCMMF (India)

- THE HERSHEY COMPANY (U.S)

- Amy’s Kitchen, Inc. (U.S)

- Organic Valley (U.S)

- Conagra Brands, Inc. (U.S)

- Nestlé (Switzerland)

- Eden Foods (U.S)

- SunOpta (Canada)

Latest Developments in Global Organic Food and Beverages Market

- In October 2023, Dole Food Company, Inc. launched Dole Organics, a dedicated division, and introduced its 'GO Organic!' consumer brand at Fruit Attraction 2023 in Madrid. The initiative is focused on rejuvenating the organic fresh produce segment by promoting cross-sector collaboration, optimizing supply chains, and ensuring the consistent availability of organic products. This move highlights Dole's commitment to the growing demand for organic foods, aligning with the broader trends in the global Organic Food and Beverages Market, where consumer interest in organic, sustainable, and traceable products continues to rise

- In April 2023, So Delicious Dairy Free, a division of Danone North America, launched its first foray into the oat milk market with the introduction of Organic Oatmilk. Made from organic oats and a blend of other ingredients, the product is offered in two variants: Original and Extra Creamy. This introduction underscores So Delicious Dairy Free’s alignment with the increasing consumer demand for plant-based and organic alternatives in the global Organic Food and Beverages Market, where the shift towards healthier, more sustainable options continues to gain momentum

- In February 2022, Amul, a leading dairy company in India, expanded into the organic food sector by introducing a range of organic products, including rice, flour, honey, chocolates, and potato products. The company also announced plans to establish a "green college" to educate young farmers on natural and organic farming practices, alongside the creation of "organic haats" to directly sell organic products. This move highlights Amul’s commitment to capitalizing on the growing consumer preference for organic products, reflecting broader trends within the global Organic Food and Beverages Market where there is increasing demand for clean, sustainably sourced, and healthier food options

- In May 2022, Organic India, a renowned brand specializing in organic tea and wellness products, introduced two new offerings: Tulsi Detox Kahwa and Peppermint Refresh. Both teas are certified organic and vegan, available in loose-leaf and teabag formats. This launch aligns with Organic India’s ongoing commitment to providing consumers with healthy, sustainable wellness solutions. This initiative is part of the broader trend in the global Organic Food and Beverages Market, where consumers increasingly seek organic, plant-based, and wellness-focused products as part of a health-conscious lifestyle

- In 2021, General Mills Inc., a leading global food company, acquired Tyson Foods, an American multinational corporation and the world's second-largest processor and marketer of chicken, beef, and pork. The acquisition was strategically aimed at reshaping General Mills' portfolio to drive growth and expand its business footprint. By integrating organic and healthier food options, such acquisitions enable companies to meet the growing consumer demand for organic, sustainable, and ethically produced products.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Food Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Food Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Food Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.