Global Ngs Services Market

Market Size in USD Billion

CAGR :

%

USD

14.57 Billion

USD

71.51 Billion

2025

2033

USD

14.57 Billion

USD

71.51 Billion

2025

2033

| 2026 –2033 | |

| USD 14.57 Billion | |

| USD 71.51 Billion | |

|

|

|

|

Next-Generation Sequencing (NGS) Services Market Size

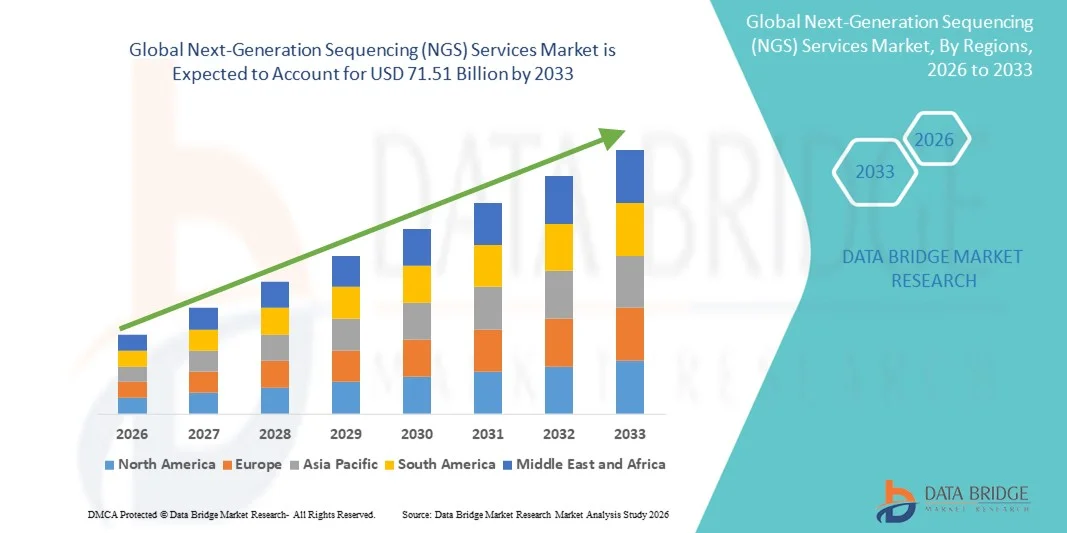

- The global next-generation sequencing (NGS) services market size was valued at USD 14.57 billion in 2025 and is expected to reach USD 71.51 billion by 2033, at a CAGR of 22.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced genomic research and precision medicine, driving demand for high-throughput and accurate sequencing solutions

- Furthermore, rising investment in drug discovery, biomarker identification, and personalized healthcare, coupled with the growing prevalence of genetic disorders and chronic diseases, is establishing Next-Generation Sequencing (NGS) Services as a critical tool for research and clinical applications. These converging factors are accelerating the uptake of NGS services solutions, thereby significantly boosting the industry's growth

Next-Generation Sequencing (NGS) Services Market Analysis

- Next-Generation Sequencing (NGS) services, offering high-throughput genomic analysis and precision diagnostics, are increasingly vital components of modern healthcare, research, and biotechnology applications due to their enhanced accuracy, speed, and integration with bioinformatics platforms

- The escalating demand for NGS services is primarily fueled by the widespread adoption of genomics and personalized medicine, growing research and clinical sequencing activities, and a rising preference for cost-effective, rapid, and reliable genetic analysis

- North America dominated the next-generation sequencing (NGS) services market with the largest revenue share of 44% in 2025, driven by well-established healthcare and research infrastructure, high R&D expenditure, and the presence of key industry players. The U.S. experienced substantial growth in NGS services adoption across hospitals, clinical laboratories, and research institutes, supported by innovations in multi-omics analysis, AI-driven data interpretation, and automated sequencing platforms

- Asia-Pacific is expected to be the fastest-growing region in the next-generation sequencing (NGS) services market during the forecast period, with a CAGR, owing to increasing investments in genomics research, growing healthcare infrastructure, rising prevalence of genetic disorders, and expanding adoption of advanced sequencing technologies in countries such as China, India, and Japan

- The Sequencing by Synthesis (SBS) segment dominated the largest market revenue share of 42.8% in 2025, due to its high accuracy, reproducibility, and established use in clinical and research laboratories

Report Scope and Next-Generation Sequencing (NGS) Services Market Segmentation

|

Attributes |

Next-Generation Sequencing (NGS) Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Illumina (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Next-Generation Sequencing (NGS) Services Market Trends

Expansion of Genomic Research and Clinical Applications

- A significant and accelerating trend in the global next-generation sequencing (NGS) services market is the growing integration of NGS technologies into research and clinical workflows, enabling high-throughput sequencing for personalized medicine, oncology, rare diseases, and infectious disease monitoring

- For instance, major NGS service providers are expanding their capacity to handle large-scale genomic projects and offer multi-gene panels, whole-exome sequencing, and whole-genome sequencing solutions to research institutions and clinical labs

- NGS adoption is increasingly driven by the need for faster, more accurate genomic data analysis, supporting drug discovery, biomarker identification, and diagnostic applications

- The market is witnessing collaborations between sequencing service providers and hospitals, academic institutions, and pharmaceutical companies to accelerate genomic research and precision medicine initiatives

- High-throughput sequencing platforms are being enhanced to improve accuracy, scalability, and turnaround time, enabling researchers and clinicians to access actionable genomic insights more efficiently

- NGS technologies are becoming central to clinical trials and large population-based genomics studies, facilitating data-driven medical decision-making

- Integration with advanced bioinformatics pipelines allows for automated data interpretation, reducing manual effort and enhancing workflow efficiency

- The trend toward NGS-driven diagnostics and research is reshaping expectations in genomics, as stakeholders demand comprehensive, cost-effective, and high-quality sequencing services

- Companies are developing expanded service portfolios to address oncology, inherited disorders, pharmacogenomics, and microbiome studies

- The demand for NGS services is growing rapidly across academic research, pharmaceutical development, and clinical diagnostic sectors, as institutions prioritize precision, scalability, and turnaround speed

Next-Generation Sequencing (NGS) Services Market Dynamics

Driver

Growing Demand for Precision Medicine and Genomic Research

- The increasing emphasis on personalized healthcare and targeted therapies is a primary driver for the global NGS services market. Genomic insights enable identification of disease-related mutations and tailored treatment strategies

- For instance, in 2023, several NGS service providers expanded their oncology-focused sequencing panels to support clinical and research applications, demonstrating the rising reliance on sequencing services in precision medicine

- Large-scale population genomics studies and cancer genome projects are fueling demand for comprehensive NGS services capable of handling high-throughput data

- NGS services facilitate early diagnosis, improved patient outcomes, and reduced healthcare costs, encouraging hospitals and research institutions to adopt sequencing solutions

- The growing availability of multi-gene panels, whole-exome sequencing, and whole-genome sequencing is making NGS an essential tool for modern healthcare and biomedical research

Restraint/Challenge

High Costs and Regulatory Complexity

- High initial costs for sequencing infrastructure, advanced instrumentation, and skilled personnel can hinder adoption, particularly in developing regions or smaller clinical labs

- Strict regulatory requirements for clinical and diagnostic sequencing create barriers to market entry and expansion, requiring compliance with regional and international standards

- Management of sensitive genomic data raises privacy concerns; providers must maintain secure data storage, encryption, and patient confidentiality to comply with HIPAA, GDPR, and other regulations

- For instance, in March 2024, a leading European clinical lab delayed expansion of its NGS services due to stringent EU data privacy regulations and the need for extensive compliance verification, illustrating how regulatory complexity can affect market growth

- While technological advancements are reducing costs, the perceived expense and operational complexity can slow widespread adoption in some markets

- Addressing these challenges through scalable service models, compliance with regulatory frameworks, and investment in data security is crucial for sustained growth in the NGS services market

Next-Generation Sequencing (NGS) Services Market Scope

The market is segmented on the basis of type, technology, application, and end user.

- By Type

On the basis of type, the Next-Generation Sequencing (NGS) Services market is segmented into Targeted Sequencing/Gene Panels, RNA-Sequencing, De Novo Sequencing, Exome Sequencing, CHiP-Sequencing, Whole-genome Sequencing, Methyl-Sequencing, and Other Services. The Targeted Sequencing/Gene Panels segment dominated the largest market revenue share of 35.6% in 2025, driven by its ability to focus on specific gene regions for high-sensitivity analysis. Clinical laboratories and pharmaceutical companies rely on targeted panels for disease diagnostics, oncology profiling, and biomarker identification. The segment’s leadership is reinforced by its cost-effectiveness, standardized protocols, and faster turnaround time compared to whole-genome approaches. The adoption of targeted panels in personalized medicine and precision oncology continues to rise. Hospitals and research institutes benefit from easier integration with bioinformatics pipelines. Commercially available panels with validated performance simplify clinical decision-making. This segment also supports large-scale genetic screening programs, particularly in oncology and rare disease research. Laboratories prefer it due to the reduced data complexity and lower storage requirements. Advanced software tools enable accurate interpretation of panel results. The segment’s prominence is further strengthened by regulatory approvals for targeted NGS diagnostics. Increasing awareness of gene-specific therapies drives continued adoption. Expansion in emerging markets is further enhancing growth opportunities. The segment offers a balance between cost, accuracy, and clinical utility, maintaining its leadership position.

The Whole-genome Sequencing (WGS) segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, fueled by declining sequencing costs, improvements in computational analysis, and demand for comprehensive genomic data. WGS provides complete genetic information, enabling research in rare diseases, population genomics, and novel biomarker discovery. Technological advancements in library preparation, sequencing chemistry, and high-throughput instruments support rapid growth. The segment benefits from increasing adoption in pharmaceutical R&D and large-scale clinical studies. Researchers prefer WGS for complex genetic disorders and multi-gene analysis. Governments and academic institutions invest heavily in population-level sequencing initiatives. WGS also facilitates precision medicine by enabling tailored treatment strategies. The scalability of WGS platforms allows laboratories to handle high sample volumes efficiently. Cloud-based bioinformatics and AI-assisted interpretation tools improve workflow efficiency. The rise in global genomic initiatives is further boosting adoption. The segment’s growth is supported by collaborations between sequencing providers and clinical centers. WGS is gradually becoming more cost-accessible, expanding into emerging markets. Increasing awareness of the benefits of complete genomic profiling ensures continued high growth.

- By Technology

On the basis of technology, the market is segmented into Sequencing by Synthesis (SBS), Ion Semiconductor Sequencing, Single-Molecule Real-Time (SMRT) Sequencing, and Nanopore Sequencing. The Sequencing by Synthesis (SBS) segment dominated the largest market revenue share of 42.8% in 2025, due to its high accuracy, reproducibility, and established use in clinical and research laboratories. Major players standardize SBS for applications ranging from oncology research to microbial genomics. Its high throughput capabilities support large-scale studies and clinical diagnostics. The technology benefits from extensive reagent availability and validated protocols. Bioinformatics pipelines are optimized for SBS data, enabling faster analysis. SBS provides scalability for both low- and high-volume sequencing needs. Clinical adoption is reinforced by regulatory approvals for SBS-based diagnostics. Hospitals and research centers rely on SBS for targeted panels, exome sequencing, and biomarker discovery. Long-term reliability and low error rates make it preferable for clinical applications. SBS platforms also support integration with automated laboratory workflows. Continuous improvements in sequencing chemistry enhance read accuracy. Global adoption is widespread across North America, Europe, and Asia-Pacific regions.

The Nanopore Sequencing segment is expected to witness the fastest CAGR of 18.5% from 2026 to 2033, driven by portability, real-time sequencing, and the ability to process ultra-long DNA/RNA fragments. Nanopore devices are widely used in field-based studies, infectious disease surveillance, and rapid pathogen detection. Low capital expenditure and minimal infrastructure requirements make nanopore technology attractive for emerging markets. Academic institutions and smaller labs adopt nanopore sequencing for flexible research applications. It allows direct RNA sequencing, eliminating the need for reverse transcription. Real-time data generation enables faster decision-making in clinical and environmental studies. Cloud connectivity supports remote analysis and collaboration. Nanopore sequencing is increasingly used in microbial genomics and epidemiology. The technology supports scalable sequencing without extensive laboratory setup. Improved software and error-correction algorithms enhance data accuracy. Global awareness and adoption are rising due to portable sequencing applications. Integration with bioinformatics tools accelerates research efficiency.

- By Application

On the basis of application, the market is segmented into Diagnostics, Drug Discovery, Biomarker Discovery, Microbial Genetics, Agriculture and Animal Research, and Other Applications. The Diagnostics segment dominated the largest market revenue share of 38.4% in 2025, driven by growing prevalence of genetic disorders, cancer, and chronic diseases. NGS-based diagnostics are extensively used in prenatal screening, oncology, and hereditary disease detection. Reimbursement policies and regulatory approvals in developed markets support the segment. Clinical laboratories prefer NGS diagnostics for accuracy, scalability, and high-throughput capabilities. Integration with electronic medical records enhances clinical workflow. Technological advancements allow multiplexed testing and simultaneous analysis of multiple gene panels. The segment supports early disease detection, personalized medicine, and precision therapeutics. Increased awareness among healthcare providers and patients drives adoption. Research centers use diagnostics for population genomics and epidemiology. NGS diagnostics reduce the risk of misdiagnosis and improve patient outcomes. Collaboration between NGS providers and hospitals enhances clinical utility. The segment benefits from continuous improvements in assay sensitivity and specificity.

The Drug Discovery segment is expected to witness the fastest CAGR of 17.9% from 2026 to 2033, due to the increasing focus on precision medicine, biomarker-guided clinical trials, and genomic-driven therapeutic development. Pharmaceutical companies utilize NGS to identify novel drug targets, optimize treatment strategies, and reduce trial costs. Integration with AI and bioinformatics improves drug candidate selection. NGS accelerates translational research and preclinical studies. Large-scale genomic databases facilitate drug repurposing and discovery. Biotech firms adopt NGS to streamline pipeline development. Rising global investments in personalized therapeutics fuel market growth. NGS enables combinatorial studies and multi-omics integration. The segment is supported by collaborations between pharma companies and academic institutions. Regulatory compliance in clinical research encourages adoption. Continuous reduction in sequencing costs expands applicability. Demand for targeted therapies and immunotherapies further boosts growth.

- By End User

On the basis of end user, the market is segmented into Academic and Government Institutes and Research Centers, Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, and Other End Users. The Academic and Government Institutes and Research Centers segment dominated the largest market revenue share of 36.7% in 2025, supported by extensive investments in genomics research, population studies, and disease mapping. Large-scale projects in precision medicine, epidemiology, and basic research drive demand. Access to high-throughput sequencing facilities and bioinformatics infrastructure supports adoption. Collaboration with commercial sequencing providers accelerates research. Funding from government and non-profit initiatives enhances market penetration. Standardized protocols facilitate large cohort studies. Academic research benefits from access to multiple sequencing platforms. Research centers integrate NGS into translational medicine and experimental models. Continuous innovation in sequencing technologies attracts global collaborations. Focus on rare diseases and multi-omics approaches reinforces segment dominance. Training and capacity-building programs expand adoption. Segment leadership is strengthened by extensive publication output and data sharing initiatives.

The Pharmaceutical and Biotechnology Companies segment is expected to witness the fastest CAGR of 16.8% from 2026 to 2033, driven by increasing use of NGS for drug discovery, clinical trial optimization, and biomarker research. Companies leverage NGS for target identification, patient stratification, and therapeutic development. Growth is accelerated by precision medicine initiatives and biologics development. Investment in sequencing infrastructure supports internal R&D activities. Pharmaceutical adoption is boosted by collaborations with genomics service providers. NGS enables efficient design of companion diagnostics and immunotherapies. The segment benefits from rising regulatory focus on genomics-driven clinical trials. Continuous innovation in sequencing platforms supports integration into corporate pipelines. Global adoption expands as emerging markets invest in biotech infrastructure. NGS helps optimize drug safety and efficacy through genomic insights. Integration with AI and analytics enhances R&D productivity. Rising global partnerships between pharma and biotech firms drive market growth.

Next-Generation Sequencing (NGS) Services Market Regional Analysis

- North America dominated the next-generation sequencing (NGS) services market with the largest revenue share of 44% in 2025

- Driven by well-established healthcare and research infrastructure, high R&D expenditure, and the presence of key industry players

- The market experienced substantial growth in NGS services adoption across hospitals, clinical laboratories, and research institutes, supported by innovations in multi-omics analysis, AI-driven data interpretation, and automated sequencing platforms

U.S. Next-Generation Sequencing (NGS) Services Market Insight

The U.S. next-generation sequencing (NGS) services market captured the largest revenue share in 2025 within North America, fueled by increasing adoption of high-throughput sequencing platforms and growing demand for precision medicine. Hospitals, clinical laboratories, and research centers are increasingly integrating AI-powered analytics, automated workflows, and cloud-based data platforms to enhance operational efficiency and improve patient outcomes.

Europe Next-Generation Sequencing (NGS) Services Market Insight

The Europe next-generation sequencing (NGS) services market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising genomics research funding, adoption of personalized medicine, and increasing awareness of genetic disorders. The region is witnessing significant growth across academic, clinical, and pharmaceutical research applications, with sequencing services being incorporated into both new research initiatives and ongoing clinical studies.

U.K. Next-Generation Sequencing (NGS) Services Market Insight

The U.K. next-generation sequencing (NGS) services market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s advanced healthcare and biotechnology sector. Government initiatives to promote genomic research and widespread adoption of sequencing technologies in clinical diagnostics are driving market expansion.

Germany Next-Generation Sequencing (NGS) Services Market Insight

The Germany next-generation sequencing (NGS) services market is expected to expand at a considerable CAGR during the forecast period, fueled by strong research infrastructure, increasing government funding for genomics projects, and the adoption of advanced sequencing platforms in clinical and pharmaceutical research.

Asia-Pacific Next-Generation Sequencing (NGS) Services Market Insight

The Asia-Pacific next-generation sequencing (NGS) services market is poised to grow at the fastest CAGR during the forecast period, driven by increasing healthcare investments, rising prevalence of genetic and chronic diseases, and growing adoption of advanced sequencing technologies in countries such as China, India, and Japan. Expanding genomics research initiatives and government support for biotechnology are further boosting market growth.

Japan Next-Generation Sequencing (NGS) Services Market Insight

The Japan next-generation sequencing (NGS) services market is gaining momentum due to rapid advancements in healthcare infrastructure, focus on precision medicine, and rising demand for genomic diagnostics. The integration of high-throughput sequencing and AI-driven data analytics in research institutes and hospitals is fueling market growth.

China Next-Generation Sequencing (NGS) Services Market Insight

The China next-generation sequencing (NGS) services market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising healthcare expenditure, expansion of genomics research centers, and high adoption of sequencing technologies in hospitals, laboratories, and pharmaceutical companies. Government support for precision medicine initiatives and the availability of cost-effective sequencing services are key factors propelling the market.

Next-Generation Sequencing (NGS) Services Market Share

The Next-Generation Sequencing (NGS) Services industry is primarily led by well-established companies, including:

• Illumina (U.S.)

• Thermo Fisher Scientific (U.S.)

• BGI Genomics (China)

• Pacific Biosciences (U.S.)

• Roche Sequencing Solutions (Switzerland)

• Agilent Technologies (U.S.)

• Macrogen (South Korea)

• Novogene (China)

• GENEWIZ (U.S.)

• Eurofins Scientific (Luxembourg)

• F. Hoffmann-La Roche (Switzerland)

• Oxford Nanopore Technologies (U.K.)

• PerkinElmer (U.S.)

• Sophia Genetics (Switzerland)

• WuXi NextCODE (China)

• GenScript (China)

• SeqWell (U.S.)

• Gene by Gene (U.S.)

• DNA Script (France)

Latest Developments in Global Next-Generation Sequencing (NGS) Services Market

- In March 2022, Thermo Fisher Scientific launched its Ion Torrent Genexus Dx Integrated Sequencer, a fully automated NGS platform that can run sample‑to‑report workflows in as little as 24 hours. This system makes in‑house sequencing more accessible for clinical labs, reducing manual steps and fast‑tracking genomic testing

- In September 2022, Illumina introduced its NovaSeq X Series (NovaSeq X and X Plus), high-throughput sequencers capable of processing up to 20,000 genomes per year. These instruments use a new chemistry (XLEAP-SBS) and optics to boost speed and accuracy, while also reducing waste and environmental impact through lower reagent packaging

- In May 2024, SOPHiA Genetics announced a collaboration with Microsoft and NVIDIA to develop a streamlined, scalable whole-genome sequencing (WGS) analytical solution. The new cloud-based WGS application, built on the SOPHiA DDM platform, uses Microsoft Azure and NVIDIA Parabricks to process genomes in minutes, aiming to deliver fully analyzed genomic insights by the end of the year

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.