Global Medical Radiation Detection Monitoring Safety Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

3.37 Billion

2024

2032

USD

2.00 Billion

USD

3.37 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 3.37 Billion | |

|

|

|

|

Medical Radiation Detection, Monitoring and Safety Market Size

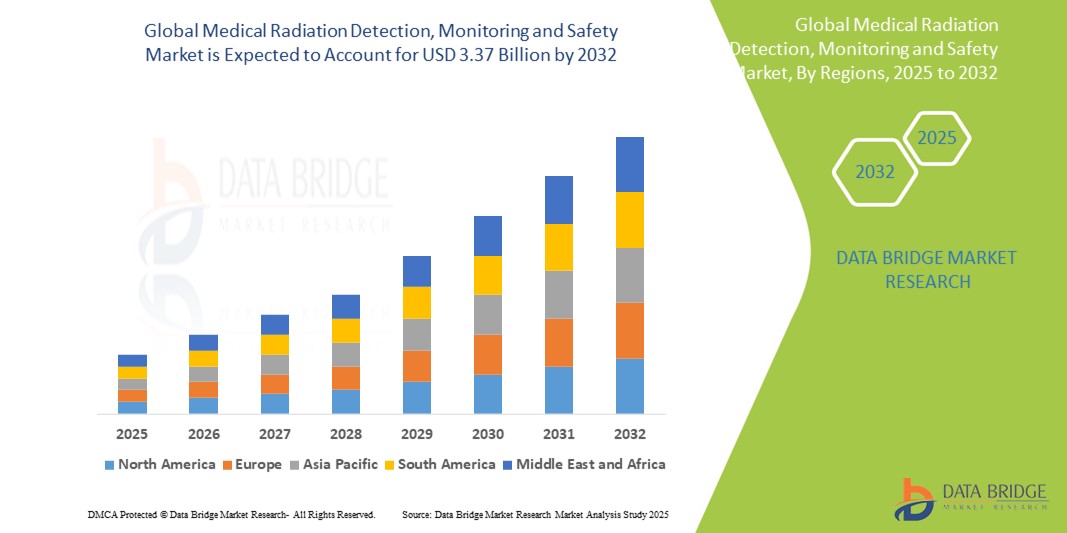

- The global medical radiation detection, monitoring and safety market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 3.37 billion by 2032, at a CAGR of 6.70% during the forecast period

- This growth is driven by factors such as the rising use of radiation therapy in cancer treatment, increasing safety awareness among healthcare workers, and growing adoption of advanced diagnostic imaging equipment globally

Medical Radiation Detection, Monitoring and Safety Market Analysis

- The medical radiation detection, monitoring, and safety market includes critical tools and protective equipment used to measure and shield against harmful radiation exposure during diagnostic imaging and therapeutic procedures. These tools are essential in ensuring the safety of both healthcare workers and patients

- The demand for radiation detection and safety products is significantly driven by the increasing use of diagnostic imaging techniques such as CT scans and X-rays, the growing adoption of radiation therapy for cancer treatment, and stringent regulatory guidelines on radiation safety

- North America is expected to dominate the medical radiation detection, monitoring and safety market with a market share of 35.5%, due to its advanced healthcare infrastructure, high procedural volumes involving radiation, and strict regulatory compliance with occupational safety standards

- Asia-Pacific is expected to be the fastest growing region in the medical radiation detection, monitoring and safety market with a market share of 25.5%, during the forecast period due to rapidly improving healthcare infrastructure and increasing diagnostic imaging volumes

- Gas-Filled Detectors segment is expected to dominate the market with a market share of 43.5% due to its high sensitivity, cost-effectiveness, and wide application in detecting various types of ionizing radiation

Report Scope and Medical Radiation Detection, Monitoring and Safety Market Segmentation

|

Attributes |

Medical Radiation Detection, Monitoring and Safety Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Radiation Detection, Monitoring and Safety Market Trends

“Technological Advancements in Radiation Detection and Wearable Safety Solutions”

- One prominent trend in the global medical radiation detection, monitoring, and safety market is the rapid development of advanced, real-time radiation detection systems and wearable safety solution

- These innovations enhance radiation monitoring accuracy by integrating wireless connectivity, AI-based dose analysis, and compact form factors for seamless usage in clinical environments

- For instance, wearable electronic dosimeters now offer continuous dose tracking and cloud-based data logging, enabling healthcare institutions to monitor staff exposure in real-time and ensure compliance with safety regulations

- These advancements are redefining radiation safety practices, increasing workplace protection, and fueling demand for intelligent, user-friendly radiation monitoring and protective equipment across the healthcare sector

Medical Radiation Detection, Monitoring and Safety Market Dynamics

Driver

“Rising Use of Radiation-Based Procedures in Diagnostics and Therapy”

- The growing reliance on radiation-based diagnostic imaging procedures such as X-rays, CT scans, and nuclear medicine, along with the increasing use of radiation therapy for cancer treatment, is significantly driving the demand for radiation detection, monitoring, and safety products

- With the global rise in chronic diseases such as cancer and cardiovascular conditions, healthcare providers are performing a higher volume of imaging and therapeutic procedures that involve ionizing radiation, increasing the need for safety and monitoring measures

- The need to ensure safety for healthcare workers and patients alike is prompting the widespread adoption of advanced dosimeters, shielding products, and real-time monitoring systems

For instance,

- In 2022, the International Atomic Energy Agency (IAEA) reported a consistent global increase in radiological procedures, highlighting a sharp rise in CT imaging and radiation therapy, especially in cancer centers and urban hospitals worldwide

- As a result, the expanding application of radiation in modern healthcare, combined with regulatory requirements for radiation protection, continues to fuel demand for effective detection and safety technologies

Opportunity

“Integration of Artificial Intelligence for Smart Radiation Monitoring and Safety”

- The integration of Artificial Intelligence (AI) into radiation detection and monitoring systems offers significant opportunities to enhance accuracy, efficiency, and responsiveness in radiation safety protocols across healthcare settings

- AI-powered systems can analyze real-time exposure data, predict risk patterns, and provide automated alerts for excessive radiation exposure, allowing for timely corrective actions and improved protection for healthcare workers and patients

- In addition, AI algorithms can optimize radiation dose levels during diagnostic imaging, ensuring patient safety while maintaining image quality, especially in procedures such as CT and fluoroscopy

For instance,

- In November 2024, a report from the Radiological Society of North America (RSNA) highlighted the growing use of AI-enabled dose management systems, which can automatically track, analyze, and adjust radiation doses based on patient profiles and procedural requirements. These smart systems are particularly useful in pediatric imaging and oncology, where dose optimization is critical

- The integration of AI in radiation safety devices can lead to more personalized and efficient radiation management, reduced occupational hazards, and enhanced regulatory compliance. By leveraging real-time analytics and predictive modeling, healthcare facilities can significantly improve operational safety and clinical outcome

Restraint/Challenge

“High Equipment and Implementation Costs Limiting Market Expansion”

- The high cost of advanced radiation detection and safety equipment presents a significant restraint for market growth, particularly in low- and middle-income countries where healthcare budgets are limited

- Radiation monitoring systems, personal dosimeters, lead shielding products, and automated safety tools can range in price from several thousand to tens of thousands of dollars, making large-scale adoption financially challenging for smaller healthcare facilities

- Moreover, the integration of advanced systems often requires infrastructure upgrades, specialized training, and ongoing maintenance, further escalating the total cost of ownership and limiting accessibility in under-resourced regions

For instance,

- In October 2024, a report by the World Health Organization (WHO) on global radiation safety in healthcare highlighted that many hospitals in developing regions either underutilize radiation-based diagnostics or operate with minimal safety protocols due to prohibitive costs associated with advanced protective technologies

- As a result, the financial barrier not only restricts the adoption of essential safety equipment but also increases the risk of radiation overexposure, thereby affecting patient and staff safety and impeding broader market penetration

Medical Radiation Detection, Monitoring and Safety Market Scope

The market is segmented on the basis of detector, product, safety type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Detector |

|

|

By Product |

|

|

By Safety Type |

|

|

By End User

|

|

In 2025, the gas-filled detectors is projected to dominate the market with a largest share in detector segment

The gas-filled detectors segment is expected to dominate the medical radiation detection, monitoring and safety market with the largest share of 43.5% in 2025 due to its high sensitivity, cost-effectiveness, and wide application in detecting various types of ionizing radiation. These detectors are particularly favored in healthcare settings for their reliability, simplicity, and effectiveness in monitoring radiation levels during diagnostic and therapeutic procedures. Their ability to provide accurate real-time measurements also supports enhanced radiation safety compliance

The personal dosimeters is expected to account for the largest share during the forecast period in product market

In 2025, the personal dosimeters segment is expected to dominate the market with the largest market share of 39.5% due to its critical role in ensuring radiation safety for healthcare professionals. These devices provide real-time monitoring of individual radiation exposure, allowing for immediate corrective actions and regulatory compliance. Their compact design, ease of use, and integration with digital tracking systems make them essential in high-radiation environments such as hospitals and diagnostic centers

Medical Radiation Detection, Monitoring and Safety Market Regional Analysis

“North America Holds the Largest Share in the Medical Radiation Detection, Monitoring and Safety Market”

- North America dominates the medical radiation detection, monitoring and safety market with a market share of estimated 35.5%, driven, by its advanced healthcare infrastructure, high procedural volumes involving radiation, and strict regulatory compliance with occupational safety standards

- U.S. holds a market share of 60.5%, due to a robust network of diagnostic and therapeutic centers, rising cancer incidence rates requiring radiation therapy, and strong adoption of advanced radiation safety technologies

- The region’s strong focus on staff safety, coupled with the growing number of diagnostic imaging procedures, is significantly propelling the demand for effective detection and protective solutions

- In addition, the well-established reimbursement frameworks and continuous investments in AI-integrated and wireless radiation monitoring devices by leading companies enhance market growth

“Asia-Pacific is Projected to Register the Highest CAGR in the Medical Radiation Detection, Monitoring and Safety Market”

- Asia-Pacific is expected to witness the highest growth rate in the medical radiation detection, monitoring and safety market with a market share of 25.5%, driven by rapidly improving healthcare infrastructure and increasing diagnostic imaging volumes

- Countries such as China, India, and South Korea are emerging as major markets due to rising healthcare investments, increased awareness about occupational radiation risks, and expanding use of radiation therapy in oncology

- Japan remains a critical market with its early adoption of advanced medical technologies and strong regulatory policies promoting radiation safety across healthcare facilities

- India is projected to register the highest CAGR in the medical radiation detection, monitoring and safety market, driven by increasing public and private sector investments in healthcare, rising cancer burden, and a push toward modernizing diagnostic capabilities with integrated safety protocols

Medical Radiation Detection, Monitoring and Safety Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Fortive (U.S.)

- Mirion Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Ludlum Measurements, Inc. (U.S.)

- IBA Worldwide (Belgium)

- AliMed (U.S.)

- UAB Polimaster Europe (Austria)

- AmRay Group (Ireland)

- INFAB, LLC (U.S.)

- Burlington Medical (U.S.)

- BERTIN INSTRUMENTS (France)

- Radiation Detection Company (U.S.)

- Arrow-Tech (U.S.)

- Centronic (U.K.)

- S.E. International, Inc (U.S.)

- ATOMTEX (Belarus)

- Nucleonix Systems (India)

- Alpha Spectra, Inc. (U.S.)

- LND, INC (U.S.)

- BERTIN TECHNOLOGIES. (U.S.)

- Micron Technology, Inc. (U.K.)

- Lite Tech Industries, LLC (U.S.)

Latest Developments in Global ophthalmic Market

- In May 2024, Mirion Technologies joined the CNIC to enhance radiation safety across the nuclear medicine supply chain. This collaboration aims to improve safety from isotope production to patient delivery, supporting advancements in diagnostics and therapeutics

- In March 2024, Thermo Fisher Scientific, in partnership with RDC, introduced NetDose, a Bluetooth-enabled digital dosimeter. This device offers real-time radiation monitoring, eliminating the need for traditional dosimeter exchanges and enhancing dose visibility for healthcare professionals

- In July 17, 2023, Trivitron Healthcare inaugurated a state-of-the-art facility at the Andhra Pradesh MedTech Zone (AMTZ) in Visakhapatnam. This fully automated plant, with an annual capacity of over 200,000 units, focuses on producing lead-free radiation protection gloves, marking a significant advancement in India's healthcare manufacturing sector

- In October 2023, Honeywell launched the FS24X Plus Flame Detector, designed to quickly and reliably detect hydrogen flames, which are invisible to the naked eye. This technology aims to enhance safety in facilities utilizing hydrogen, supporting the transition to alternative fuels

- In January 2023 describes a wireless theranostic smart contact lens designed for monitoring and controlling intraocular pressure (IOP) in glaucoma patients. This lens integrates diagnostic and therapeutic functions, offering a non-invasive approach to managing glaucoma

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.