Global Medical Gloves Market

Market Size in USD Billion

CAGR :

%

USD

20.52 Billion

USD

44.64 Billion

2024

2032

USD

20.52 Billion

USD

44.64 Billion

2024

2032

| 2025 –2032 | |

| USD 20.52 Billion | |

| USD 44.64 Billion | |

|

|

|

|

Medical Gloves Market Size

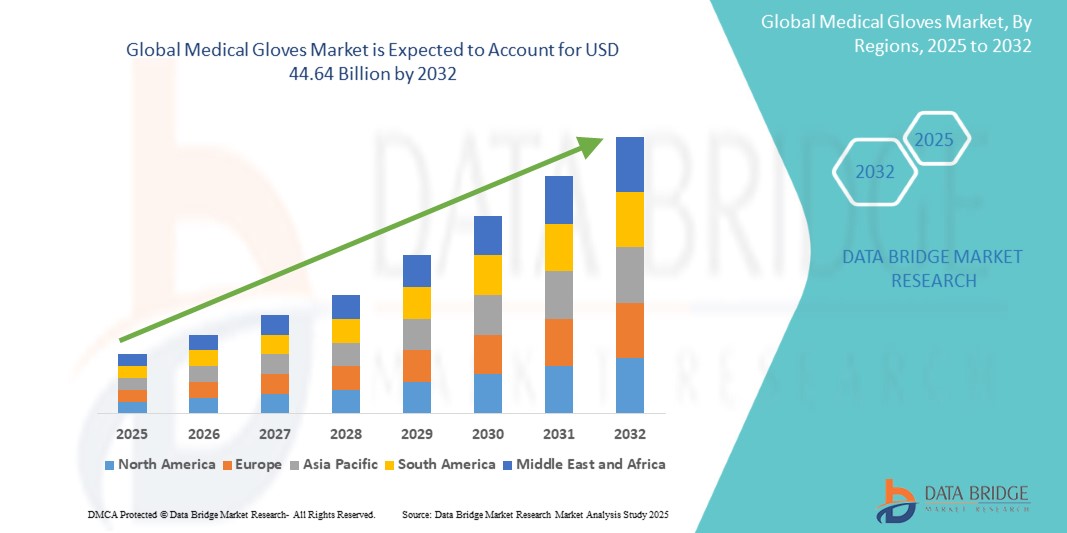

- The global medical gloves market was valued at USD 20.52 billion in 2024 and is expected to reach USD 44.64 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.20%, primarily driven by the anticipated launch of new product.

- This growth is driven by factors such as the increasing adoption of surgical gloves, and increasing rate of hospital visits.

Medical Gloves Market Analysis

- Medical gloves are essential personal protective equipment (PPE) used by healthcare professionals during examinations and surgical procedures to prevent cross-contamination and protect both patients and practitioners from infections. They are available in various types, including latex, nitrile, vinyl, and neoprene, each catering to specific needs based on durability, sensitivity, and allergen concerns

- The demand for medical gloves is primarily driven by rising awareness of hygiene and infection control, a growing number of surgical procedures, and the increased emphasis on safety protocols, particularly after the global COVID-19 pandemic. The market also sees a consistent boost from the expanding healthcare infrastructure in emerging economies

- The Asia-Pacific region is emerging as a significant growth driver in the medical gloves market, largely due to its large-scale manufacturing capabilities, low production costs, and increasing domestic demand. Countries like Malaysia, Thailand, and China are not only major producers but are also witnessing growing internal consumption

- For instance, Malaysia accounts for major portion of the world’s medical glove supply, with its glove manufacturing industry expanding capacity every year to meet the growing global demand

- Globally, nitrile gloves have seen a sharp rise in adoption, especially in developed regions, due to their higher resistance to punctures and chemicals and their hypoallergenic properties compared to latex gloves. Medical gloves rank among the top consumable items in healthcare settings and are critical in maintaining infection control standards across all medical disciplines.

Report Scope and Medical gloves Market Segmentation

|

Attributes |

Medical gloves Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Gloves Market Trends

“Advancements in Smart Glove Technologies”

- A notable trend in the medical gloves market is the development of smart gloves equipped with sensor technologies. These gloves are designed to enhance functionality by enabling features such as real-time health monitoring and improved surgical precision

- For instance, a systematic review published in Sensors discusses the current status of commercial smart gloves, focusing on capabilities like hand and finger pose estimation, motion tracking, and tactile feedback

- These advancements are transforming gloves industry and improving patient outcomes, and driving the demand for medical gloves and boost the growth of global medical gloves market

Medical Gloves Market Dynamics

Driver

“Increasing Incidence of Chronic Diseases”

- The high prevalence of chronic diseases is due to the rapidly increasing population and infections that can be seen globally. Thus, an increase in the prevalence of chronic and acute diseases in older population is resulting in a rise in hospitalization. This, in turn, is boosting the demand for gloves in the market

- Chronic diseases include cardiovascular diseases, stroke, cancer, chronic respiratory diseases, and diabetes, wherein cardiovascular disease is the major cause of death globally. Sterile surgical gloves are required for surgical interventions. Some non-surgical care procedures such as central vascular catheter insertion, also require surgical glove use

- The healthcare sector is one of the prominent end users of natural rubber latex gloves. Powder-free nitrile gloves are best for medical environments. The powdered material is not advised even when non-latex hand protection is used. The nitrile goes through a special process that allows it to have the same benefits as if they were powdered, such as easy removal

For instance,

- According to a published article by National Center for Biotechnology Information, National Institute for Occupational Safety and Health Administration (NIOSHA) in the U.S., mandates that gloves be worn during all patient-care activities involving exposure to blood or body fluids that may be contaminated with blood, including contact with mucous membranes and non-intact skin from the year 2009

- Gloves are designed to serve for care purposes as well as for housekeeping activities in healthcare facilities. The increased risks of these infectious conditions directly enhance the demand for gloves required to reduce such conditions. Thus, the increasing number of chronic diseases is expected to act as a driver for market growth

Opportunity

“Rise in Number of Manufacturing Unit”

- Gloves are mostly used in pharmaceutical, agriculture, energy, F&B, healthcare, and medical industries. These industries have also increased the gloves manufacturers’ production capacity as they expanded their product lines and sales markets worldwide with advanced machines and equipment to enable more product units

- The advanced machines and equipment also increase efficiency and effectiveness in production and directly enhances overall productivity. The usage of gloves increased consequently with the declaration of pandemic that resulted in increased demand even from the public. The pandemic spread rapidly worldwide with devastating consequences for patients, healthcare workers, health systems, and economies

- As it reaches low and middle-income countries, the pandemic puts healthcare workers at high risk and challenges the abilities of healthcare systems to respond to the crisis.

- With this rise in demand and the pandemic outbreak, the government has provided major funding to companies to fulfill the demand for gloves

For instance,

- In March 2020, as much of the nation began shutting down businesses due to COVID-19, Luginbill and Matt Hayes, founder and owner of Unmanned Propulsion Development, recognized that as TechPort entrepreneurs, they were in an ideal position to help. They initially created gloves, masks, shields, and gowns, but quickly realized the materials would run out long before the end of the pandemic. So eight companies were approached for help and two local companies based in Southern Maryland, Burch Oil and Triton Defense, where the box was built which is capable of disinfecting 24,000 N95 masks per day, or other PPE equipment; the “hot box” can provide healthcare personnel the ability to reuse their gear at least 20 times.

- In December 2020, according to a published article by the CDC, a PPE burn rate calculator was developed to aid healthcare facilities' plans as well as optimize the use of gloves in response to COVID-19 in which three general strata had been used to describe surge capacity and can be used to prioritize measures to conserve glove supplies along the continuum of care

- In March 2021, according to a published article by National Center for Biotechnology Information (NCBI), it was reported that to reduce the spread of both cross-infection (COVID-19) and cross-contamination (food safety), proper personal hygiene and hand washing practices were recommended that include face masks, face shields, gloves, and clean uniforms

- The increase in manufacturing units has surely minimized the shortage of gloves. Thus, glove manufacturing companies are enhancing their local manufacturing capacities to address crucial applications in the healthcare, agriculture, energy, and F&B industries during the coronavirus epidemic to avoid high costs associated with transporting products abroad. This is expected to increase the net income of manufacturers and act as a driver for market growth

Restraint/Challenge

“Unregulated Disposal and Wastage of Personal Protective Equipment (PPE)”

- Hospital workers are at a higher risk of exposure to disease. Sharps, fluids, medication, and other waste pose safety issues if not properly discarded. Sanitation workers are susceptible to needle sticks or contact with infectious waste. The amount of hazardous and infectious waste from hospitals is around 15% of total waste

- Although, all medical waste, infectious or not, is a potential risk to public safety. Substances can leak into our oceans and pollute our water supplies. Toxic chemicals in water harm aquatic life and people who come in direct contact with them

For instance,

- It was estimated that 129 billion facemasks and 65 billion gloves are being used monthly. Unfortunately, while PPE is a necessary tool, its increased use is having detrimental effects on the environment, especially the oceans

- According to some reports, nearly 1.56 billion facemasks and gloves entered the oceans in 2020 alone, during the onset of COVID-19. This wastage and disposable of PPE products not only cause a shortage but harmful effects on the earth

- The World Health Organization (WHO) states that PPE should be disposed of in a closed-lid receptable and not a regular garbage bin. This is because used PPE should be treated as infectious or offensive waste; disposal should be handled in a way that prevents the transmission of infectious diseases to a wider population

- The unregulated disposal of PPE will lead to the accumulation of hazardous wastes and lead to a rise in chronic infection. This factor is expected to hinder the market growth

Medical Gloves Market Scope

The market is segmented on the basis product type, sterility, form type, raw material type, usage type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Sterility |

|

|

By Form Type |

|

|

By Raw Material Type |

|

|

By Usage Type

|

|

|

By End User |

|

|

By Distribution Channel

|

|

Medical gloves Market Regional Analysis

“North America is the Dominant Region in the Medical gloves Market”

- North America leads the global medical gloves market, driven by stringent infection control protocols, high awareness of hygiene, and the presence of major manufacturers and suppliers in the region

- The United States, in particular, accounts for a significant market share due to well-established healthcare systems, frequent surgical procedures, and strong regulatory frameworks that mandate the use of PPE, including medical gloves, across medical and dental settings

- The region witnessed a substantial surge in glove demand during the COVID-19 pandemic, and the trend continues with increased focus on preparedness for future health crises

- Government initiatives to maintain strategic stockpiles of protective medical supplies, combined with high per capita healthcare expenditure and continued investments in infection prevention technologies, are further fueling market dominance in North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is projected to exhibit the fastest growth rate in the medical gloves market, fueled by rising healthcare spending, expanding hospital infrastructure, and growing health awareness in countries like China, India, Malaysia, and Thailand

- India and China, with their large and increasingly urban populations, are experiencing rising cases of hospital-acquired infections (HAIs), which in turn boosts the demand for disposable gloves across healthcare settings

- Countries like Malaysia and Thailand play a dual role—as major producers and exporters of medical gloves and as emerging domestic markets, driven by improving healthcare access and expanding private healthcare sectors

- The shift towards nitrile gloves due to concerns over latex allergies and the increasing implementation of regulatory standards for medical safety across the region are also key contributors to market expansion

- Additionally, the growth of local glove manufacturing supported by government incentives and increasing foreign investments into Asia-Pacific-based production facilities are reinforcing its position as a high-growth region in the global medical gloves market

Medical gloves Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cardinal Health. (U.S.)

- Medline Industries, Inc. (U.S.)

- YTY Group. (Malaysia)

- Arista Networks, Inc. (U.S.)

- JIANGSU JAYSUN GLOVE CO., LTD (China)

- Bluesail Medical Co., Ltd. (China)

- Shandong Yuyuan Latex Gloves Co., Ltd. (China)

- Zhanjiang Jiali Glove Products Co., Ltd. (China)

- McKesson Corporation (U.S.)

- Dynarex Corporation. (U.S.)

- Robinson Healthcare (U.K.)

- SHIELD Scientific B.V. (Netherlands)

- PAUL HARTMANN AG (Germany)

Latest Developments in Global Medical gloves Market

- In November 2024, Sybron introduced a new range of biodegradable nitrile single-use gloves targeting sectors such as hospitality, education, healthcare, and facilities management. These gloves are designed to biodegrade by 81% within 491 days, offering an environmentally friendly alternative to traditional nitrile gloves.

- In October 2024, Medtecs unveiled innovations in medical protection and sustainable solutions at MEDICA 2024. These advancements focus on improving resource efficiency in healthcare and addressing the rising demand for healthcare services, particularly in the context of aging populations and infectious diseases.

- In May 2024, Medico inaugurated a new €88 million nitrile glove manufacturing facility in France. This state-of-the-art plant aims to significantly bolster the production capacity of nitrile gloves, catering to the growing demand for high-quality personal protective equipment.

- In March 2024, Kimberly-Clark Professional™ launched its new Kimtech™ Polaris™ nitrile gloves. Designed with advanced features for optimal performance, these gloves provide superior protection, durability, and comfort, addressing the evolving needs of healthcare professionals.

- In March 2022, American Nitrile, a U.S.-based disposable glove manufacturer, secured a USD 105 million strategic partnership with Orion Infrastructure Capital to complete the development of its manufacturing facility in Grove City, Ohio. This partnership aims to enable the production of 3.6 billion nitrile gloves annually, meeting the rising demand for personal protective equipment across industries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.