Global Medical Device Reprocessing Market

Market Size in USD Billion

CAGR :

%

USD

4.94 Billion

USD

17.45 Billion

2024

2032

USD

4.94 Billion

USD

17.45 Billion

2024

2032

| 2025 –2032 | |

| USD 4.94 Billion | |

| USD 17.45 Billion | |

|

|

|

|

Medical Device Reprocessing Market Size

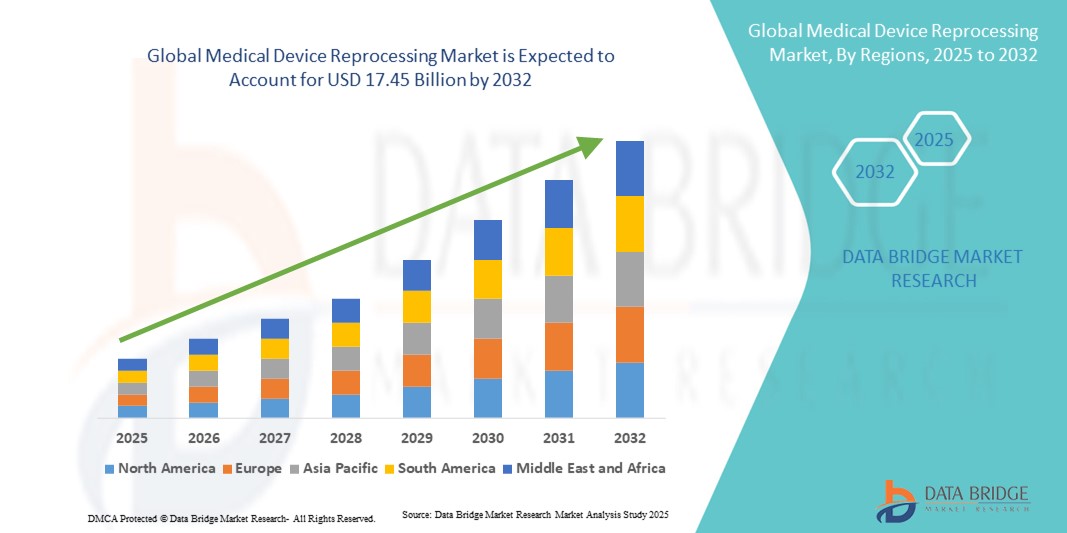

- The global medical device reprocessing market size was valued at USD 4.94 billion in 2024 and is expected to reach USD 17.45 billion by 2032, at a CAGR of 17.10% during the forecast period

- The market growth is largely fueled by the rising need to reduce healthcare expenditure and the increasing emphasis on sustainability, leading to higher adoption of reprocessed medical devices across hospitals and healthcare facilities. The ability of reprocessing to significantly cut down costs while maintaining clinical effectiveness is driving digitalization and standardization in sterile processing departments

- Furthermore, growing regulatory support, heightened awareness regarding medical waste reduction, and the demand for safe, user-friendly, and compliant solutions are establishing medical device reprocessing as a cost-effective and environmentally responsible choice. These converging factors are accelerating the uptake of medical device reprocessing solutions, thereby significantly boosting the industry's growth

Medical Device Reprocessing Market Analysis

- Medical device reprocessing, involving the cleaning, disinfection, sterilization, testing, and reuse of medical instruments, has become an increasingly vital component of cost-containment strategies and sustainability initiatives across hospitals and healthcare facilities worldwide. Its role in reducing medical waste and ensuring regulatory compliance is driving adoption across developed and emerging markets.

- The escalating demand for medical device reprocessing is primarily fueled by rising healthcare costs, the growing emphasis on sustainable practices, and favorable regulatory guidelines encouraging hospitals to adopt reprocessed single-use devices to enhance cost efficiency without compromising patient safety

- North America dominated the medical device reprocessing market with the largest revenue share of 44.0% in 2024, supported by strong regulatory frameworks from the U.S. FDA, early adoption of advanced reprocessing techniques, and the presence of leading reprocessing service providers. The U.S. in particular has witnessed rapid growth in reprocessed device utilization, driven by stringent hospital budget controls and initiatives to minimize environmental impact

- Asia-Pacific is expected to be the fastest growing region in the medical device reprocessing market during the forecast period, projected to expand at a CAGR of 21.5% from 2025 to 2032, owing to increasing urbanization, rising healthcare expenditure, and supportive government policies encouraging cost-effective medical practices. The expanding hospital infrastructure in China and India further accelerates the adoption of reprocessing solutions

- The devices segment dominated the medical device reprocessing market with a revenue share of 55.2% in 2024, as healthcare providers prioritize reprocessing of high-value instruments, including surgical and diagnostic devices, to optimize costs and ensure patient safety

Report Scope and Medical Device Reprocessing Market Segmentation

|

Attributes |

Medical Device Reprocessing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Reprocessing Market Trends

Growing Importance of Cost Efficiency and Sustainability

- A significant and accelerating trend in the global medical device reprocessing market is the increasing emphasis on reducing healthcare costs and minimizing medical waste through regulated reprocessing of single-use devices (SUDs). This approach not only helps hospitals lower their procurement expenses but also supports global sustainability initiatives by reducing the volume of discarded devices

- For instance, cardiovascular catheters and electrophysiology devices are being reprocessed under stringent FDA and EU guidelines, ensuring patient safety while offering hospitals a cost reduction of up to 50% per device compared to new purchases. Similarly, surgical instruments and orthopedic devices are now part of approved reprocessing programs, expanding the scope of the industry

- Regulatory frameworks in regions such as the U.S. and Europe play a central role by establishing strict quality, validation, and sterilization standards for reprocessing facilities. These regulations help build confidence among healthcare providers, encouraging greater adoption of reprocessed devices in clinical practice

- The seamless integration of reprocessing practices within hospital supply chains allows centralized management of device sterilization, tracking, and reuse cycles. Through specialized third-party providers, healthcare systems can optimize their inventory, ensure compliance, and streamline cost savings across multiple departments

- This trend towards sustainability and affordability is fundamentally reshaping hospital procurement strategies worldwide. Consequently, companies such as Stryker Sustainability Solutions and Medline ReNewal are continuously expanding their reprocessing portfolios to cover more high-demand device categories, from electrophysiology catheters to laparoscopic instruments

- The demand for medical device reprocessing is growing rapidly across both developed and emerging economies, as healthcare providers increasingly prioritize patient safety, regulatory compliance, environmental sustainability, and cost-effective operations

Medical Device Reprocessing Market Dynamics

Driver

Growing Need Due to Rising Healthcare Cost Containment and Sustainability Goals

- The rising pressure on healthcare systems to reduce operational costs while maintaining high standards of patient care is a significant driver for the increasing adoption of medical device reprocessing. Hospitals and clinics are recognizing the dual benefit of cost savings and environmental sustainability through regulated reprocessing of single-use devices (SUDs)

- For instance, in April 2024, Stryker Sustainability Solutions announced the expansion of its FDA-approved reprocessing portfolio to include additional electrophysiology and surgical devices. Such strategic expansions by key players are expected to drive the growth of the Medical Device Reprocessing industry during the forecast period

- As healthcare providers become more conscious of financial constraints and sustainability goals, reprocessed devices offer a compelling alternative to purchasing new equipment, enabling savings of up to 50% per device. This also helps reduce the volume of medical waste, supporting hospitals in meeting their environmental responsibility targets

- Furthermore, the growing adoption of circular economy principles in healthcare and the desire for greener practices are making reprocessing programs an integral component of hospital procurement strategies, particularly in developed markets such as the U.S. and Europe

- The assurance of regulatory compliance, strict sterilization protocols, and third-party validation are key factors propelling the confidence and adoption of reprocessed devices in clinical settings. The trend toward hospital partnerships with specialized reprocessing companies further contributes to market expansion

Restraint/Challenge

Concerns Regarding Safety Perceptions and Regulatory Barriers

- Despite its advantages, the Medical Device Reprocessing market faces challenges due to lingering concerns about the safety and efficacy of reprocessed single-use devices. Some healthcare professionals remain cautious, fearing that repeated use may compromise performance or patient safety, even when reprocessed under strict guidelines

- For instance, high-profile debates within the EU regulatory landscape in 2023 emphasized the need for harmonized standards and patient safety assurance, creating hesitation among some hospitals to expand reprocessing programs

- Addressing these safety concerns through transparent validation studies, rigorous sterilization processes, and regular compliance audits is crucial for building confidence in the widespread use of reprocessed devices. Companies such as Medline ReNewal and Vanguard AG are actively investing in education and certification programs to reassure healthcare providers

- In addition, regulatory frameworks can act as both a driver and a barrier. While FDA and EMA approvals boost credibility, inconsistent regulations across countries often slow down market penetration, particularly in emerging markets where reprocessing guidelines are less defined

- Another challenge is the relatively high initial investment required to establish in-house reprocessing infrastructure or secure third-party partnerships, which can deter smaller healthcare facilities from participating. Although outsourcing to specialized vendors is increasingly available, the perceived complexity of adoption continues to act as a restraint

- Overcoming these challenges through harmonized regulations, awareness-building campaigns, and more transparent reporting of clinical success rates will be vital for sustained market growth

Medical Device Reprocessing Market Scope

The market is segmented on the basis of type, product and service, process, devices type, application, and end-user.

- By Type

On the basis of type, the medical device reprocessing market is segmented into enzymatic and non-enzymatic detergent. The enzymatic segment dominated the market with a revenue share of 46.3% in 2024, as it is highly effective in breaking down complex proteins, lipids, and biological residues commonly found on critical medical instruments. Hospitals and surgical centers prefer enzymatic detergents due to their proven ability to enhance the effectiveness of subsequent sterilization steps, thereby minimizing the risk of infections. Enzymatic solutions are compatible with both automated and manual cleaning processes, offering flexibility for different healthcare settings. They also help in extending the life of delicate instruments, reducing replacement costs for healthcare facilities. Adoption is further driven by regulatory recommendations and best practice guidelines emphasizing enzymatic cleaning for high-risk instruments. In addition, enzymatic detergents reduce the need for repeated cleaning cycles, which improves operational efficiency and lowers chemical usage. Their widespread acceptance in developed healthcare markets underscores their dominance in the reprocessing industry.

The non-enzymatic detergent segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, owing to its increasing adoption in emerging economies and smaller healthcare facilities where cost-effective solutions are prioritized. Non-enzymatic detergents are easier to handle and require minimal training, making them suitable for clinics, diagnostic centers, and outpatient facilities. They are also compatible with automated cleaning systems, providing flexibility and reliability. The segment’s growth is further supported by the rising focus on operational efficiency and budget optimization, as these detergents provide effective cleaning at lower costs. Increased awareness of their efficacy, along with improvements in formulation to handle a wide range of contaminants, is driving acceptance across global markets. The segment’s rapid adoption is particularly notable in regions like Asia-Pacific and Latin America, where healthcare infrastructure expansion and cost containment are major priorities.

- By Product and Service

On the basis of product and service, the medical device reprocessing market is segmented into reprocessing support and services, and reprocessed medical devices. The reprocessed medical devices segment dominated the market with a share of 52.4% in 2024, driven by hospitals’ and surgical centers’ need to manage high volumes of expensive instruments while maintaining patient safety. Reprocessed devices include critical tools such as surgical instruments, catheters, and orthopedic implants, which are validated for safe reuse under strict regulatory standards. The adoption of these devices allows healthcare providers to significantly reduce procurement costs while ensuring compliance with FDA and ISO regulations. Reprocessed devices also help in reducing medical waste, contributing to sustainability initiatives. The segment’s dominance is enhanced by strong hospital adoption, widespread availability of certified reprocessing programs, and integration into daily clinical operations. Detailed tracking and quality assurance protocols further reinforce trust in reprocessed devices, encouraging wider market penetration.

The reprocessing support and services segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, as healthcare facilities increasingly outsource reprocessing activities to specialized providers. These services offer expertise in sterilization, standardized procedures, and compliance management, allowing hospitals and clinics to focus on patient care rather than operational logistics. Demand is fueled by the growing need for cost-effective solutions and the efficiency gains associated with third-party reprocessing. Outsourced services also provide access to advanced equipment, validated processes, and trained personnel that may not be available in smaller facilities. Regional expansion of certified service providers and partnerships with hospitals are further contributing to rapid adoption. The segment’s growth is particularly strong in Asia-Pacific, Latin America, and the Middle East, where hospitals are increasingly leveraging external expertise to meet quality and safety standards.

- By Process

On the basis of process, the medical device reprocessing market is segmented into presoak, manual cleaning, automatic cleaning, and disinfection. The automatic cleaning segment dominated the market with a revenue share of 48.1% in 2024, due to its ability to deliver standardized and high-quality cleaning results consistently across large volumes of instruments. Hospitals, surgical centers, and multi-specialty clinics favor automatic systems as they reduce human error, optimize water and chemical usage, and improve workflow efficiency. Automatic cleaning ensures that all complex and delicate instruments are properly decontaminated before sterilization, reducing infection risks. Adoption is driven by regulatory recommendations and growing awareness of standardized reprocessing protocols. The segment also supports operational scalability, allowing high-volume facilities to meet increasing procedural demands while maintaining patient safety. Enhanced efficiency, reduced labor requirements, and the ability to integrate with sterilization workflows further strengthen the dominance of this segment.

The manual cleaning segment is expected to witness the fastest CAGR of 20.3% from 2025 to 2032, as it remains essential in smaller healthcare facilities, home healthcare settings, and diagnostic centers. Manual cleaning allows meticulous attention to delicate and complex instruments, ensuring optimal decontamination where automated systems are not feasible. Growth is supported by rising investments in staff training programs and the emphasis on maintaining hygiene standards in low-volume facilities. Manual cleaning also remains vital for specialized instruments that cannot withstand automated cycles. Increasing awareness of effective manual techniques, coupled with growing adoption in emerging markets, is driving significant expansion in this segment. Its continued relevance in healthcare facilities highlights its critical role alongside automated processes.

- By Devices Type

On the basis of devices type, the medical device reprocessing market is segmented into critical devices, semi-critical devices, and non-critical devices. The critical devices segment dominated the market with a revenue share of 54.7% in 2024, as it covers instruments such as surgical tools, cardiovascular catheters, and endoscopes that require thorough cleaning and sterilization to prevent infections. Hospitals and surgical centers prioritize critical device reprocessing to maintain patient safety and regulatory compliance. High surgical volumes and reuse of expensive instruments drive continuous demand. Hospitals often implement validated reprocessing protocols, supported by trained personnel and advanced equipment, to maintain quality standards. The dominance of critical devices is further reinforced by their essential role in life-saving procedures and complex surgeries, where instrument reliability is paramount.

The semi-critical devices segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, driven by increasing usage of devices such as respiratory therapy instruments, dental tools, and imaging accessories. These devices require high-level disinfection and careful handling to ensure patient safety. Growth is supported by rising awareness of safe reprocessing practices, expanding healthcare infrastructure, and increasing adoption in clinics, outpatient facilities, and home care settings. Cost savings and operational efficiency provided by proper semi-critical device reprocessing further contribute to market growth. Emerging markets, where healthcare access is expanding, also provide significant opportunities for this segment.

- By Application

On the basis of application, the medical device reprocessing market is segmented into devices and accessories. The devices segment dominated the market with a revenue share of 55.2% in 2024, as healthcare providers prioritize reprocessing of high-value instruments, including surgical and diagnostic devices, to optimize costs and ensure patient safety. Adoption is driven by regulatory approval for reprocessed devices, hospital acceptance, and integration into clinical workflows. Hospitals and surgical centers benefit from cost efficiency, sustainability, and reduced procurement expenditure. The dominance is further reinforced by the consistent demand for reusable high-value devices, which remain critical to clinical procedures.

The accessories segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, driven by rising demand for reprocessing components such as tubing, connectors, and single-use attachments. These accessories are widely used in outpatient care centers, home healthcare, and clinics where reusing components reduces operational costs while maintaining hygiene standards. Growth is further supported by increasing awareness of accessory reprocessing programs, availability of specialized reprocessing services, and regulatory encouragement in emerging regions. Adoption continues to expand as healthcare providers seek cost-efficient ways to manage device accessories.

- By End-User

On the basis of end-user, the medical device reprocessing market is segmented into hospitals, clinics, home healthcare, diagnostic centers, manufacturers, ambulatory surgical centers, and others. The hospitals segment dominated the market with a revenue share of 57.6% in 2024, as high surgical volumes, complex procedures, and stringent safety standards make hospitals the largest consumers of reprocessed medical devices. Hospitals rely on validated reprocessing protocols, third-party services, and internal sterilization systems to maintain quality and reduce infection risks. Cost optimization, operational efficiency, and adherence to regulatory standards reinforce the dominance of this segment.

The home healthcare segment is expected to witness the fastest CAGR of 21.0% from 2025 to 2032, driven by the increasing prevalence of chronic diseases and the growth of home-based care services that require safe, reusable instruments. Rising awareness among patients and healthcare providers about the benefits of reprocessed devices, along with cost advantages and regulatory support, is accelerating adoption. This segment is especially prominent in developed regions with growing home healthcare infrastructure and in emerging markets where outpatient care is expanding rapidly.

Medical Device Reprocessing Market Regional Analysis

- North America dominated the medical device reprocessing market with the largest revenue share of 44.0% in 2024, supported by strong regulatory frameworks from the U.S. FDA, early adoption of advanced reprocessing techniques, and the presence of leading reprocessing service providers

- The region has witnessed rapid growth in reprocessed device utilization, driven by stringent hospital budget controls, initiatives to minimize environmental impact, and increasing awareness of sustainable healthcare practices

- Hospitals and clinics across the continent are investing in automated cleaning, disinfection, and sterilization systems, further fueling the market's expansion

U.S. Medical Device Reprocessing Market Insight

The U.S. medical device reprocessing market captured the largest revenue share within North America in 2024, fueled by rapid adoption of reprocessed devices across hospitals, clinics, and ambulatory surgical centers. The growth is driven by significant investments in advanced sterilization technologies, stringent regulatory oversight by the U.S. FDA, and the focus on cost-effective healthcare practices. Hospitals are increasingly implementing automated and validated reprocessing workflows to improve device safety, operational efficiency, and compliance with infection control standards. The emphasis on sustainable medical practices and budget optimization further propels the market's expansion in the U.S.

Europe Medical Device Reprocessing Market Insight

The Europe medical device reprocessing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards, growing hospital infrastructure, and increased adoption of sustainable medical practices. Rising demand for cost-effective reprocessing solutions, coupled with advanced infection control initiatives, is encouraging healthcare providers to adopt standardized and automated reprocessing protocols. The region is experiencing significant growth across hospitals, clinics, and ambulatory surgical centers, supporting overall market expansion.

U.K. Medical Device Reprocessing Market Insight

The U.K. medical device reprocessing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on hospital cost optimization, regulatory compliance, and environmental sustainability. Healthcare providers are embracing advanced cleaning and sterilization processes to improve device safety, reduce operational costs, and meet government-mandated reprocessing standards. The rising number of healthcare facilities and ambulatory centers further stimulates market growth.

Germany Medical Device Reprocessing Market Insight

The Germany medical device reprocessing market is expected to expand at a considerable CAGR during the forecast period, fueled by the demand for high-quality sterilization and reprocessing services, robust healthcare infrastructure, and technological innovation. Hospitals and surgical centers are increasingly investing in automated and validated reprocessing systems, emphasizing both operational efficiency and patient safety. Germany’s well-developed medical ecosystem and focus on eco-conscious practices promote widespread adoption of reprocessing solutions.

Asia-Pacific Medical Device Reprocessing Market Insight

The Asia-Pacific medical device reprocessing market is poised to grow at the fastest CAGR of 21.5% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising healthcare expenditure, and supportive government policies encouraging cost-effective medical practices. Countries such as China, India, and Japan are witnessing rapid expansion of hospital infrastructure, which accelerates the adoption of reprocessing solutions. The growing awareness of cost reduction, sustainable healthcare, and regulatory support in emerging APAC markets further fuels the uptake of advanced reprocessing technologies.

Japan Medical Device Reprocessing Market Insight

The Japan medical device reprocessing market is gaining momentum due to the country’s advanced healthcare infrastructure, high-tech culture, and stringent infection control requirements. Hospitals and clinics are increasingly adopting automated cleaning and sterilization solutions to enhance patient safety and operational efficiency. In addition, government policies promoting efficient healthcare practices and sustainable medical procedures are supporting market growth.

China Medical Device Reprocessing Market Insight

The China medical device reprocessing market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding hospital infrastructure, rising healthcare expenditure, and increasing awareness of sustainable and cost-effective medical practices. The government’s supportive policies and the growing adoption of advanced sterilization and reprocessing technologies in both public and private healthcare facilities are key factors propelling market growth in China.

Medical Device Reprocessing Market Share

The medical device reprocessing industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Cardinal Health (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- 3M (U.S.)

- Medivators Inc. (U.S.)

- STERIS (U.S.)

- Vanguard AG (U.S.)

- Avante Health Solutions (U.S.)

- UVC Solutions (Canada)

- Getinge (Sweden)

- SureTek Medical (U.S.)

- SOMA TECH INTL (U.S.)

- Olympus Corporation (Japan)

- ASP (U.S.)

- Belimed INC. (Switzerland)

- Ecolab Inc. (U.S.)

Latest Developments in Global Medical Device Reprocessing Market

- In January 2023, the FDA issued a final guidance titled "Transitional Enforcement Policy for Ethylene Oxide Sterilization Facility Changes for Class III Devices." This guidance provides information regarding FDA recommendations and general principles to be referenced by holders of premarket approval applications (PMAs) and humanitarian device exemptions (HDEs) for Class III devices sterilized by ethylene oxide (EtO)

- In July 2023, the Association of Medical Device Reprocessors (AMDR) reported that hospitals and surgical centers saved over USD465 million and avoided 98 million pounds of greenhouse gas emissions by using regulated, reprocessed single-use medical devices

- In November 2024, the FDA published the "Transitional Enforcement Policy for Ethylene Oxide Sterilization Facility Changes for Class III Devices." This policy aimed to address the challenges faced by sterilization facilities in meeting regulatory requirements, ensuring continued availability of sterilized medical devices while maintaining safety standards

- In July 2025, Innovative Health emphasized the importance of holding reprocessors to high standards. The company highlighted the need for stringent quality controls and adherence to regulatory guidelines to ensure the safety and efficacy of reprocessed medical devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.