Global Lighting Control System Market

Market Size in USD Billion

CAGR :

%

USD

7.20 Billion

USD

12.40 Billion

2024

2032

USD

7.20 Billion

USD

12.40 Billion

2024

2032

| 2025 –2032 | |

| USD 7.20 Billion | |

| USD 12.40 Billion | |

|

|

|

|

Lighting Control System Market Size

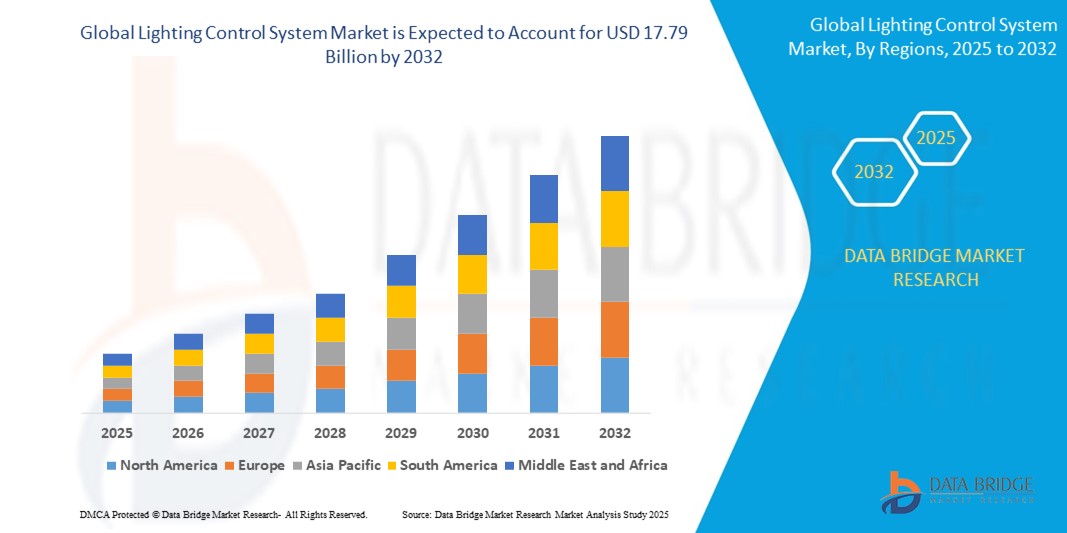

- The global Lighting Control System market size was valued at USD 12.21 billion in 2024 and is expected to reach USD 17.79 billion by 2032, at a CAGR of 18.47% during the forecast period

- This growth is driven by factors such as increasing demand for energy-efficient lighting solutions, rising adoption of smart building technologies, supportive government regulations promoting sustainability, and advancements in wireless communication and IoT integration within lighting systems.

Lighting Control System Market Analysis

- The lighting control system refers to the technology that comprises of multiple lighting fixtures connected in a network to control lighting. These systems enhance performance, efficiency and customer value. These systems have various across diverse verticals, including automobiles, home appliances, aircrafts and many other systems.

- The increase in awareness of energy management across the globe acts as one of the major factors driving the growth of lighting control system market. The rise in the use of led lights and luminaries in outdoor lighting applications, and growing acceptance of standard protocols for lighting control systems are accelerate the market growth.

- North America is expected to dominate the lighting control system market due to the growing adoption and penetration of lighting control systems across the region for reducing energy consumption within the region

- Asia-Pacific is expected to be the fastest growing region in the lighting control system market during the forecast period because of the rapid infrastructure building activities in the region

- Hardware segment is expected to dominate the market with a market share of 56.22% due to the essential role of physical components such as sensors, dimmers, switches, and control modules in both new and retrofit lighting systems, alongside rising adoption of automated lighting in commercial and residential spaces

Report Scope and Lighting Control System Market Segmentation

|

Attributes |

Lighting Control System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lighting Control System Market Trends

“Advancements in Smart Lighting & IoT Integration”

- A key trend is the integration of AI, wireless protocols (Zigbee, Bluetooth Mesh), and cloud-based lighting management systems, enabling real-time adaptive control.

- These innovations enhance energy efficiency (up to 80% savings) and user customization through automated scheduling, occupancy sensing, and daylight harvesting.

- For instance, On March 12, 2021, Henry Wong of the Bluetooth SIG highlighted barriers in the commercial connected lighting sector, including the need for customer education, proper staff training, and achieving open interoperability. While the technology promises advanced control, energy efficiency, and data-driven insights, challenges such as proprietary systems and high deployment costs are restraining mass adoption and hindering full market potential

- Such advancements are transforming smart homes, offices, and cities, driving demand for next-gen lighting control systems with predictive analytics and voice control (Alexa/Google Assistant).

Lighting Control System Market Dynamics

Driver

“Growing Demand for Energy-Efficient Lighting Solutions”

- The growing demand for energy-efficient lighting solutions is driven by stricter government regulations, rising energy costs, and sustainability goals. Smart lighting controls like occupancy sensors and automated dimming reduce electricity consumption by up to 80%, offering significant cost savings.

- Governments worldwide are enforcing strict energy-efficiency regulations (e.g., EU’s Ecodesign Directive, U.S. ENERGY STAR) to reduce carbon footprints. These policies mandate the use of smart lighting controls (e.g., occupancy sensors, dimmers) in commercial and residential buildings, compelling businesses to adopt compliant systems or face penalties

- Businesses and homeowners increasingly adopt these systems to comply with green building standards (e.g., LEED) and lower operational expenses.

For instance,

- On April 22, 2024, energy-efficient lighting was highlighted as a key strategy for building sustainable workplaces. These solutions lower energy bills, reduce environmental impact by cutting emissions, and enhance employee comfort and productivity. As sustainability becomes central to modern business, efficient lighting plays a vital role in promoting cost savings and creating healthier, more eco-friendly work environments.

- As a result advancements in wireless and AI-powered controls further accelerate adoption, making energy-efficient lighting a key growth driver in the market.

Opportunity

“AI-Powered Predictive Lighting & Li-Fi Technology”

- AI-Powered Predictive Lighting & Li-Fi Technology" presents a transformative opportunity for the Lighting Control System Market. AI-driven predictive lighting uses machine learning to analyze usage patterns and automatically adjust illumination, optimizing energy efficiency by up to 60%.

- Li-Fi (Light Fidelity) enables ultra-fast, secure data transmission through LED lights, revolutionizing IoT connectivity in smart buildings. Together, these technologies enhance automation, reduce costs, and enable innovative applications like real-time indoor navigation and bandwidth-heavy data transfer.

- With smart cities and Industry 4.0 driving demand, early adopters can gain a competitive edge by integrating these solutions, positioning themselves at the forefront of next-generation lighting innovation.

For instance,

- On April 10, 2025, Li-Fi—Light Fidelity—gained attention as a revolutionary alternative to Wi-Fi, using light signals to transmit data at speeds up to 100 times faster. Pioneered by Harald Haas and advanced by Oledcomm, Li-Fi is now being tested in space via Europe’s Ariane 6 mission, offering exciting potential despite current limitations in everyday broadband use.

- The convergence of AI-powered predictive lighting and Li-Fi technology is poised to redefine the lighting control industry, offering unprecedented energy savings, enhanced connectivity, and smarter automation.

Restraint/Challenge

“High Upfront Costs & Interoperability Issues”

- The Lighting Control System Market faces significant growth barriers due to high initial investment requirements and compatibility challenges.

- Advanced smart lighting systems, including IoT-enabled controls and AI-driven solutions, often involve substantial upfront costs for hardware, software, and installation—making them prohibitive for small businesses and budget-conscious consumers.

- Additionally, the lack of universal communication protocols creates interoperability issues, as lighting components from different manufacturers may not seamlessly integrate. For instance, Zigbee, Z-Wave, and proprietary systems often operate in silos, forcing users into single-vendor ecosystems or costly workarounds.

For instance,

- In November 2024, according to an article published by the Ningbo Haishu HONYU Opto-Electro Co., Ltd, one of the main concerns surrounding the high cost of ophthalmic surgical microscopes is its potential impact on healthcare affordability and accessibility. The high cost of ophthalmic surgical microscopes adds to this burden, as it limits the ability of healthcare facilities to invest in the latest technology and equipment, thereby affecting the quality of care provided to patients

Lighting Control System Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Installation Type |

|

|

By Offering |

|

|

By Communication Protocol |

|

|

By End- Use Applications |

|

|

By Distribution Channel

|

|

|

|

|

In 2025, the retrofit installations is projected to dominate the market with a largest share in installation type segment

In 2025, the retrofit installations segment is expected to dominate the Lighting Control System market due to the increasing demand for energy-efficient upgrades in existing buildings. With growing awareness of sustainability and cost-saving measures, commercial and residential spaces are increasingly adopting smart lighting retrofits without major infrastructure changes.

The hardware microscopes is expected to account for the largest share during the forecast period in technology market

In 2025, The hardware segment is projected to lead the market with the largest share of 56.22%. This dominance is attributed to the essential role of physical components like sensors, dimmers, switches, and relay units, which form the backbone of lighting control systems. Rising adoption in both new constructions and retrofits supports its continued growth.

Lighting Control System Market Regional Analysis

“North America Holds the Largest Share in the Lighting Control System Market”

- North America dominates the Lighting Control System market, driven by widespread adoption of smart building technologies, strong presence of leading lighting control system providers, and robust demand for energy-efficient solutions across commercial, industrial, and residential sectors.

- The U.S. holds a significant share due to rapid implementation of IoT-enabled lighting systems, supportive government initiatives promoting energy conservation, and the growing popularity of home automation and smart lighting solutions.

- The presence of well-established infrastructure, along with favorable regulatory frameworks and growing investments in smart city projects, further strengthens the regional market.

- Additionally, the increasing number of commercial buildings and renovation activities, coupled with the rising adoption of wireless and cloud-based lighting control technologies, continues to drive market expansion across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Lighting Control System Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Lighting Control System market, driven by rapid urbanization, growing construction activities, and rising demand for energy-efficient and automated lighting solutions.

- Countries such as China, India, and Japan are emerging as key markets due to increasing smart city initiatives, expansion of commercial infrastructure, and growing government focus on sustainable energy management.

- Japan, known for its advanced technological landscape, continues to lead in the adoption of intelligent lighting systems, particularly in commercial buildings and public infrastructure projects, enhancing energy efficiency and operational control.

- China and India, with their large-scale residential and commercial developments, are witnessing substantial government and private sector investments in smart infrastructure and lighting automation. The growing presence of global lighting control system manufacturers and improving digital infrastructure further contribute to the region’s strong market growth.

Lighting Control System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Signify Holding (Netherlands)

- Legrand North America, LLC (U.S.)

- Eaton (U.S.)

- GE Current (U.S.)

- OSRAM GmbH (Germany)

- ACUITY BRANDS LIGHTING, INC. (U.S.)

- Lutron Electronics Co., Inc. (U.S.)

- Schneider Electric (France)

- Honeywell International Inc. (U.S.)

- IDEAL INDUSTRIES, INC. (U.S.)

- Hubbell (U.S.)

- Leviton Manufacturing Co., Inc. (U.S.)

- Helvar (Finland)

- Zumtobel Group AG (Austria)

- RAB Lighting Inc. (U.S.)

- Synapse Wireless (U.S.)

- Panasonic Corporation (Japan)

Latest Developments in Global Lighting Control System Market

- On April 15, 2025, Enlighted, a Siemens-owned smart building tech firm, announced it is winding down its core lighting business due to unprofitable growth despite major investments. The company has stopped taking new orders for lighting-related hardware, software, and services, informing partners and agents of the decision via a memo issued last week.

- On March 12, 2025, Enlighted launched Enlighted Eazy, a smart lighting control solution tailored for SMBs. It features laser-based commissioning for 30% faster setup, intuitive app-based management, and wireless installation. Designed to deliver high performance at an affordable price, Enlighted Eazy brings the company’s advanced lighting technology to smaller businesses for the first time.

- On July 2, 2024, lighting control systems emerged as a key trend in corporate and large-scale buildings, driven by energy savings, enhanced employee well-being, and simplified management. With features like occupancy sensors and centralized controls, these systems reduce costs, support sustainability, and improve productivity—making them essential for modern, efficient workplace environments.

- On June 16, 2023, facility managers increasingly embraced advanced lighting controls to manage lighting and HVAC systems centrally. Leveraging IoT, LLLC, and emerging AI technologies, these systems enhance energy efficiency, reduce utility costs, and optimize comfort. Sensors like dimming and occupancy detection also improve building aesthetics and employee well-being, making smart lighting a key tool for modern facility management.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lighting Control System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lighting Control System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lighting Control System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.