Global Laboratory Centrifuge Market

Market Size in USD Billion

CAGR :

%

USD

2.06 Billion

USD

2.90 Billion

2024

2032

USD

2.06 Billion

USD

2.90 Billion

2024

2032

| 2025 –2032 | |

| USD 2.06 Billion | |

| USD 2.90 Billion | |

|

|

|

|

Laboratory Centrifuge Market Size

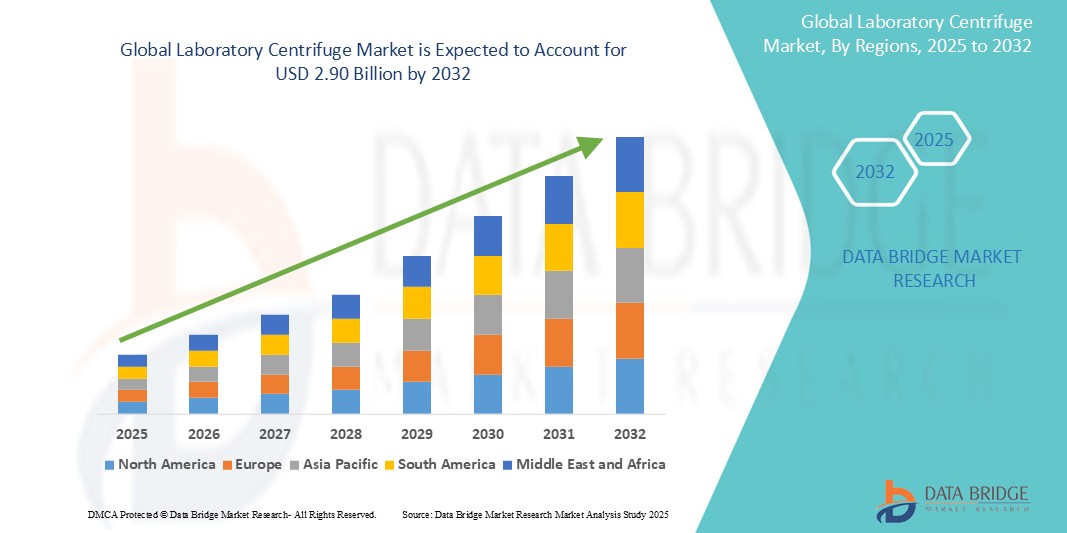

- The global laboratory centrifuge market size was valued at USD 2.06 billion in 2024 and is expected to reach USD 2.90 billion by 2032, at a CAGR of 4.36% during the forecast period

- This growth is driven by factors such as the increasing demand for advanced diagnostic techniques, rising investments in biotechnology and pharmaceutical research

Laboratory Centrifuge Market Analysis

- A laboratory centrifuge is a device used to separate components of a mixture based on their density by spinning the mixture at high speed. The centrifuge works on the principle of centrifugal force, which pushes heavier materials to the outer edge of the spinning container, allowing for the separation of different substances within the sample

- Laboratory centrifuges are commonly used in scientific research, clinical laboratories, and industrial applications to isolate and purify cells, viruses, subcellular organelles, proteins, nucleic acids, and other biological molecules

- North America is expected to dominate the laboratory centrifuges market with 35.60% due to advanced healthcare infrastructure, high research and development (R&D) investments

- Asia-Pacific is expected to be the fastest growing region in the laboratory centrifuge market during the forecast period due to significant investments in biotechnology and pharmaceutical research

- Floor standing centrifuge segment is expected to dominate the market with a market share of 55.33% due to its advancements in technology and continuous innovation. Due to increased demand for high-capacity and high-speed centrifugation in research and clinical labs

Report Scope and Laboratory Centrifuge Market Segmentation

|

Attributes |

Laboratory Centrifuge Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Laboratory Centrifuge Market Trends

“Rising Demand in Healthcare and Life Sciences”

- The global rise in chronic diseases such as cancer, diabetes, and cardiovascular conditions is significantly driving the demand for laboratory centrifuges

- Innovations in centrifuge technology, such as high-speed and ultra-speed models, improved rotor designs, and the integration of automation and digitalization, are enhancing the efficiency and accuracy of laboratory processes

- These advancements enable faster sample processing and analysis, meeting the growing demands of healthcare and life sciences sectors

- The growth of the biotechnology and pharmaceutical sectors, especially in emerging economies, leads to higher demand for laboratory centrifuges for research, development, and quality control purposes.

- For Instance, investments in research and development activities, such as the Indian government's Scheme for Promotion of Research and Innovation in the Pharma MedTech Sector (PRIP), further contribute to this demand

- Advancements in digital interfaces and integration with LIMS have streamlined operations in laboratories, enhancing productivity and data management.

- For instance, the Corning LSE Mini Microcentrifuge features a digital control interface and high-speed performance for quick nucleic acid and protein separations, demonstrating the trend towards more efficient and user-friendly laboratory equipment

- Government initiatives to promote research and development in life sciences, along with funding support for laboratory infrastructure, contribute to market expansion

Laboratory Centrifuge Market Dynamics

Driver

“Technological Advancements in Centrifuge Design”

- The development of high-speed and ultra-speed centrifuges has improved the efficiency and accuracy of laboratory processes, enabling faster sample processing and analysis

- Innovations in rotor designs have enhanced the performance of centrifuges, allowing for better separation of components and increased throughput

- The integration of automation and digitalization in centrifuge systems has streamlined laboratory workflows, reduced human error and increased productivity

- The development of compact and user-friendly centrifuge models has made these devices more accessible to smaller labs and research facilities, expanding their adoption

- Advancements in safety features, such as sealed rotors and advanced containment systems, have reduced the risk of exposure to hazardous materials, ensuring a safer working environment for laboratory personnel

Opportunity

“Integration of Automation and Advanced Features”

- The integration of automation in laboratory workflows allows for more efficient and reproducible processes, reducing manual intervention and increasing throughput

- The incorporation of advanced features, such as temperature control and programmable settings, enables centrifuges to handle specialized applications, including the processing of sensitive biological samples

- The ability to remotely monitor and control centrifuge operations enhances flexibility and convenience, allowing for real-time adjustments and oversight

- The integration of centrifuges with LIMS facilitates seamless data management and traceability, improving overall laboratory efficiency

- The development of customizable centrifuge models tailored to specific applications, such as genomics or proteomics, opens new avenues for market growth and diversification

Restraint/Challenge

“High Equipment Costs”

- The high initial investment required for purchasing advanced centrifuge models can be a barrier for smaller laboratories and research facilities with limited budgets

- The ongoing maintenance and operational costs associated with centrifuge equipment, including the replacement of consumables and servicing, can add to the financial burden

- The cost of accessories, such as specialized rotors and tubes, can be substantial, particularly for high-speed and ultra-speed centrifuges, making them less accessible to cost-sensitive institutions

- Intense competition among manufacturers can exert downward pressure on prices, potentially affecting the profitability of companies in the market

- Economic constraints in emerging markets can limit the adoption of advanced centrifuge technologies, hindering market growth in these regions

Laboratory Centrifuge Market Scope

The market is segmented on the basis of product type, model type, rotor design, intended use, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Model Type |

|

|

By Rotor Design |

|

|

By Intended Use |

|

|

By Application |

|

|

By End User |

|

In 2025, the floor standing centrifuge is projected to dominate the market with a largest share in model type segment

The floor-standing centrifuge segment is expected to dominate the laboratory centrifuge market with the largest share of 55.33% in 2025 due to its advancements in technology and continuous innovation. Due to increased demand for high-capacity and high-speed centrifugation in research and clinical labs. These centrifuges are popular for handling larger sample volumes and delivering precise results.

The clinical centrifuge is expected to account for the largest share during the forecast period in intended use market

In 2025, the clinical centrifuge segment is expected to dominate the market with the largest market share of 45.28% due to its increasing demand for accurate and efficient diagnostic testing in hospitals, research laboratories, and clinical settings. Clinical centrifuges are essential equipment in medical settings, as they play a crucial role in separating various components of biological samples.

Laboratory Centrifuge Market Regional Analysis

“North America Holds the Largest Share in the Laboratory Centrifuge Market”

- North America held the largest share of the global laboratory centrifuge market, accounting for 35.60%. This dominance is primarily attributed to the region's advanced healthcare infrastructure, high research and development (R&D) investments, and the presence of major market

- The region is at the forefront of technological innovations in laboratory centrifuges.

- For instance, Thermo Fisher Scientific introduced the DynaSpin Single-Use Centrifuge system tailored for efficient large-scale cell culture harvesting

- The increasing incidence of diseases such as tuberculosis and HIV in North America drives the demand for laboratory centrifuges.

- For instance, Canada reported 77 active tuberculosis cases, more than double the previous year, highlighting the need for diagnostic tools

- Companies such as Thermo Fisher Scientific, Beckman Coulter, and PerkinElmer are significant contributors to the market's growth, offering a wide range of centrifuge products and services

- Substantial government funding for healthcare and research initiatives further supports the growth of the laboratory centrifuge market in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Laboratory Centrifuge Market”

- he Asia-Pacific region is projected to experience the fastest growth in the laboratory centrifuge market

- Countries such as China, India, and Japan are investing heavily in healthcare infrastructure, leading to increased demand for laboratory equipment, including centrifuges

- Significant investments in biotechnology and pharmaceutical research are driving the need for advanced laboratory technologies in the region

- Government initiatives aimed at improving healthcare access and quality are contributing to the growth of the laboratory centrifuge market in Asia-Pacific

- Collaborations between companies and research institutions are enhancing the availability and adoption of advanced centrifuge technologies in the region

Laboratory Centrifuge Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Andreas Hettich GmbH & Co. KG (Germany)

- Eppendorf SE (Germany)

- NuAire, Inc. (U.S.)

- Danaher Corporation (U.S.)

- Lepu Medical Technology (Beijing) Co., Ltd (China)

- Sartorius AG (Germany)

- Becton, Dickinson and Company (U.S.)

- Kubota Corporation (Japan)

- Agilent Technologies, Inc. (U.S.)

Latest Developments in Global Laboratory Centrifuge Market

- In July 2024, the Hettich Group, a key player offering laboratory centrifuges, formed a growth partnership with Bregal Unternehmerkapital. Under this partnership, Bregal Unternehmerkapital will utilize its international network to support the organic and inorganic expansion of the Hettich Group, especially in Asia and the U.S.

- In January 2024, Hettich Group acquired Kirsch Medical, which manufactures cooling and freezing solutions for laboratories and healthcare. This strategic acquisition is anticipated to support the novel developments of laboratory centrifuges by the Hettich Group.

- In April 2023, Eppendorf launched the Centrifuge 5427 R, its first microcentrifuge featuring hydrocarbon cooling, to promote a more sustainable laboratory environment. This refrigerated device utilizes a natural cooling agent with an almost zero Global Warming Potential (GWP), enabling customers to conduct various molecular and cell biology applications while minimizing environmental impact.

- In August 2023, Boekel Scientific launched a new product line featuring four families of centrifuges: general purpose, STAT, economy and Blood Bank. This line includes a total of 11 centrifuge models, each designed to combine durability and reproducibility while offering versatility in preanalytical specimen preparations. Suitable for laboratories of all sizes, these centrifuges come in various capacities with 6-place, 12-place, and 24-place options, all equipped with removable rotors to meet diverse operational needs.

- In October 2022, Genfolllower introduced a new mini micro-centrifuge designed for personal use. This compact device is designed to be flexible and cost-effective, making it suitable for any workstation needing a 'personal' mini centrifuge

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.