Global Internet Of Things Iot Security Market

Market Size in USD Billion

CAGR :

%

USD

43.44 Billion

USD

275.47 Billion

2024

2032

USD

43.44 Billion

USD

275.47 Billion

2024

2032

| 2025 –2032 | |

| USD 43.44 Billion | |

| USD 275.47 Billion | |

|

|

|

|

Internet of Things (IoT) Security Market Size

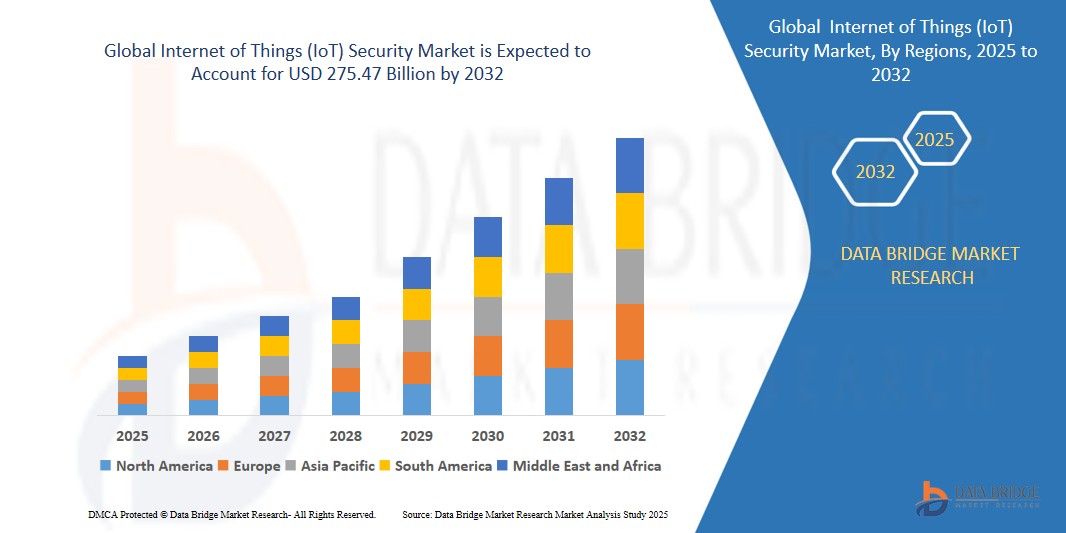

- The global Internet of Things (IoT) Security market size was valued at USD 43.44 billion in 2024 and is expected to reach USD 275.47 billion by 2032, at a CAGR of 30.2% during the forecast period

- This growth is driven by the rapid proliferation of IoT devices, increasing cyber threats, and stringent regulatory requirements for data protection across industries.

Internet of Things (IoT) Security Market Analysis

- The Internet of Things (IoT) Security market encompasses solutions and services designed to protect IoT devices and networks from cyber threats, ensuring data integrity, privacy, and system reliability through encryption, authentication, and threat detection technologies.

- The demand for IoT security solutions is significantly driven by the surge in IoT device connections, with 18.8 billion connected devices projected by the end of 2024, and the rising incidence of cyberattacks, with 60% of organizations reporting IoT-related breaches in 2024.

- North America is expected to dominate the IoT Security market due to its advanced technological infrastructure and presence of key vendors like Cisco and IBM, holding a 35.0% market share in 2024.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid IoT adoption, government initiatives for smart cities, and increasing cybersecurity investments in countries like China and India.

- The Solutions segment is expected to dominate the market with a market share of 67.0% in 2025 due to the critical role of comprehensive security software, including encryption and threat detection, in safeguarding IoT ecosystems.

Report Scope and Internet of Things (IoT) Security Market Segmentation

|

Attributes |

Internet of Things (IoT) Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Internet of Things (IoT) Security Market Trends

“Adoption of AI-Driven Threat Detection in IoT Security”

- A prominent trend in the IoT Security market is the integration of artificial intelligence (AI) and machine learning (ML) into security solutions, enabling proactive threat detection and real-time response, with 55% of IoT security solutions leveraging AI by 2024.

- Cloud-based security solutions are gaining traction due to their scalability and flexibility, with the cloud security segment projected to grow at a CAGR of 27.5% during the forecast period.

For instance, in June 2024, Cisco Systems introduced an Intelligent Industrial IoT Network to support AI and ML applications, enhancing security for industrial IoT deployments.

- This trend is driving demand for advanced, scalable IoT security solutions that address the evolving threat landscape.

Internet of Things (IoT) Security Market Dynamics

Driver

“Rapid Proliferation of IoT Devices and Rising Cyber Threats”

- The exponential growth of IoT devices, projected to exceed 30 billion by 2025, and the increasing sophistication of cyberattacks, with ransomware incidents on IoT devices rising by 35% in 2024, are significantly contributing to the IoT Security market growth.,

- IoT security solutions provide robust protection through encryption, authentication, and threat detection, reducing data breach risks by 30% in enterprises adopting these technologies.

- For instance, in 2024, a major healthcare provider implemented IoT security solutions to protect connected medical devices, improving patient data security by 25%.

- As organizations prioritize cybersecurity, the demand for IoT security solutions continues to rise, ensuring secure and reliable IoT ecosystems.

Opportunity

“Expansion of IoT Security in Smart City Initiatives”

- The growing adoption of IoT in smart city projects, with 65% of global cities investing in IoT-enabled infrastructure by 2025, offers significant opportunities for market growth by enhancing security for connected urban systems.

- These solutions secure smart grids, traffic management systems, and public safety networks, with deployments projected to reduce cyber incidents in smart cities by 20% by 2025.

For instance, in 2024, Singapore expanded its smart city IoT security framework, partnering with vendors like Fortinet to protect connected infrastructure.

- This opportunity drives market expansion by enabling secure and scalable smart city deployments.

Restraint/Challenge

“Integration Complexity and Lack of Standardization”

- Integration complexity, with 40% of enterprises reporting challenges in deploying IoT security solutions with existing IT infrastructure in 2024, and the lack of standardized protocols across IoT devices, affecting 50% of deployments, pose significant barriers to the IoT Security market.

- These challenges require substantial investments in interoperability and skilled personnel, increasing deployment costs for organizations.

- For instance, in 2024, 35% of SMEs cited high integration costs as a barrier to adopting IoT security solutions.

- These issues can hinder market growth, necessitating interoperable and cost-effective solutions.

Internet of Things (IoT) Security Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Security Type |

|

|

By End-Use Industry |

|

In 2025, the Solution segment is projected to dominate the market with the largest share in the component segment

The Solution segment is expected to dominate the IoT Security market with the largest share of 59.48% in 2025 due to rising cyber threats, regulatory compliance requirements, and demand for real-time threat detection. The surge in connected devices across industries has amplified attack surfaces, prompting organizations to invest in robust security solutions. Advancements in AI-driven threat intelligence and endpoint protection further drive adoption across enterprises and smart infrastructure projects.

The Smart Home segment is expected to account for the largest share during the forecast period in the end user market

In 2025, the Smart Home segment is expected to dominate the market with the largest market share of 48.67% due to increased deployment of connected devices, such as smart speakers, cameras, and thermostats. Rising concerns over privacy, data breaches, and home network vulnerabilities have escalated demand for comprehensive IoT security frameworks. Enhanced consumer awareness, coupled with integration of automated security protocols, further fuels the growth of this segment..

Internet of Things (IoT) Security Market Regional Analysis

“North America Holds the Largest Share in the Internet of Things (IoT) Security Market”

- North America dominates the Internet of Things (IoT) Security market, driven by the early adoption of IoT technologies across industries such as manufacturing, healthcare, and smart cities.

- The U.S. leads the region with strong regulatory frameworks like the IoT Cybersecurity Improvement Act, increasing cyberattack incidences, and significant investments in cybersecurity infrastructure.

- Major market players such as Cisco, IBM, and Palo Alto Networks are headquartered in the region, accelerating innovation in threat detection and prevention.

- The presence of advanced digital ecosystems and growing deployment of smart devices in consumer and industrial settings continue to fuel the demand for robust IoT security solutions.

“Asia-Pacific is Projected to Register the Highest CAGR in the Internet of Things (IoT) Security Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the IoT Security market, fueled by government initiatives for digital transformation and rapid expansion of IoT ecosystems in sectors such as energy, manufacturing, and transportation.

- Countries such as China, India, and South Korea are key contributors due to massive IoT deployments, smart city developments, and increasing cyber vulnerability awareness.

- Japan, with its tech-savvy population and regulatory emphasis on IoT safety standards, is driving demand for advanced security frameworks and secure device authentication systems.

- Rising adoption of 5G networks and increasing penetration of connected devices are pushing both public and private investments in IoT security infrastructure across the region.

Internet of Things (IoT) Security Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Intel Corporation (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Fortinet, Inc. (U.S.)

- Palo Alto Networks, Inc. (U.S.)

- Broadcom Inc. (Symantec Corporation) (U.S.)

- Trend Micro Inc. (Japan)

Latest Developments in Global Internet of Things (IoT) Security Market

- In October 2024, BlackBerry announced its intention to explore options for its Cylance business, aiming to redirect investments towards its profitable secure communications and IoT sectors. This strategic move underscores the company's focus on capitalizing on growth opportunities within the IoT security landscape

- In January 2025, the U.S. government launched the Cyber Trust Mark, a labeling program designed to help consumers identify smart home devices that meet established cybersecurity standards. This initiative aims to enhance consumer confidence and encourage manufacturers to prioritize security in IoT device development

- In January 2023, PTC acquired ServiceMax, strengthening its IoT security portfolio by integrating field service management with advanced IoT analytics and augmented reality.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.