Global Insulin Delivery Devices Market

Market Size in USD Billion

CAGR :

%

USD

15.71 Billion

USD

28.86 Billion

2024

2032

USD

15.71 Billion

USD

28.86 Billion

2024

2032

| 2025 –2032 | |

| USD 15.71 Billion | |

| USD 28.86 Billion | |

|

|

|

|

Insulin Delivery Devices Market Size

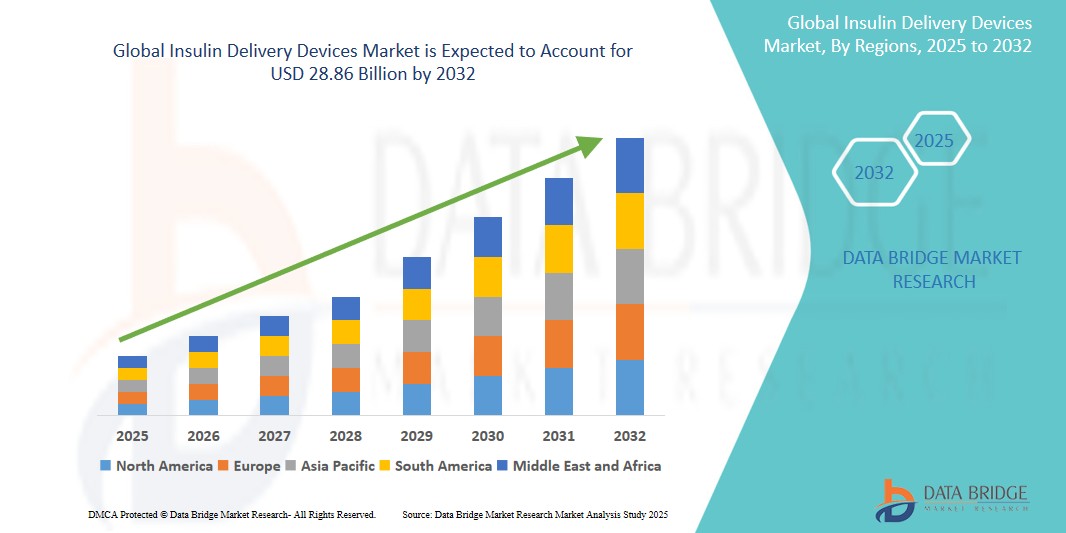

- The global insulin delivery devices market size was valued at USD 15.71 billion in 2024 and is expected to reach USD 28.86 billion by 2032, at a CAGR of 7.90% during the forecast period

- This growth is driven by surge in health expenditure

Insulin Delivery Devices Market Analysis

- Insulin Delivery Devices are essential medical tools used to administer insulin accurately and conveniently, especially for patients with Type 1 and insulin-dependent Type 2 diabetes. These devices include insulin pens, pumps, syringes, and jet injectors, improving patient compliance and glycemic control

- The demand for insulin delivery devices is largely driven by the increasing global prevalence of diabetes, growing awareness about diabetes management, and technological advancements that enhance ease of use and patient comfort

- North America is expected to dominate the insulin delivery devices market with the largest market share of 41.71%, due to its advanced healthcare infrastructure, high adoption rate of innovative delivery technologies, and presence of leading market players

- Asia-Pacific is expected to be the fastest growing region in the insulin delivery devices market during the forecast period, owing to rising diabetes incidence, increasing healthcare spending, and growing awareness regarding insulin therapy

- The insulin pens segment is expected to dominate the market with a largest market share of 44.72%, due to due to its delivery of insulin in convenient, accurate, and less invasive way and is beneficial for individuals with diabetes who need regular injections

Report Scope and Insulin Delivery Devices Market Segmentation

|

Attributes |

Insulin Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insulin Delivery Devices Market Trends

“Rise in Demand for Smart Insulin Delivery Devices”

- A prominent trend in the insulin delivery devices market is the increasing demand for smart insulin delivery devices that offer personalized insulin management through connectivity with mobile apps and continuous glucose monitoring (CGM) systems

- These devices integrate advanced technologies, enabling users to monitor their glucose levels in real-time and adjust insulin doses accordingly, improving overall diabetes management and patient satisfaction

- For instance, smart insulin pens and insulin pumps now come equipped with Bluetooth technology, allowing data to be transmitted to smartphones, where patients can track their glucose patterns and insulin usage over time

- These innovations are transforming the diabetes care landscape, improving patient outcomes, and driving the growth of next-generation insulin delivery systems with integrated digital tools

Insulin Delivery Devices Market Dynamics

Driver

“Growing Global Prevalence of Diabetes”

- The rising global prevalence of diabetes, especially Type 2 diabetes, is a significant driver for the increasing demand for insulin delivery devices, as more patients require insulin therapy for effective diabetes management

- With the aging population and growing urbanization, the number of diabetes cases is increasing, particularly in regions like North America, Europe, and Asia-Pacific

- As more individuals require insulin, the demand for advanced and user-friendly delivery devices, such as insulin pumps and smart pens, is expected to rise

- For instance, according to the International Diabetes Federation (IDF), in 2023, over 500 million adults worldwide were living with diabetes, a number that is projected to rise by 25% over the next decade

- The growing prevalence of diabetes is prompting healthcare systems and manufacturers to focus on creating more efficient, accurate, and convenient insulin delivery solutions, which is expected to drive market growth

Opportunity

“Advancements in Closed-Loop Insulin Delivery Systems”

- One major opportunity in the insulin delivery devices market is the continued development of closed-loop insulin delivery systems, which combine insulin pumps with continuous glucose monitors (CGMs) to provide a fully automated insulin delivery process

- These systems, also known as the artificial pancreas, can automatically adjust insulin delivery based on real-time glucose data, offering better glycemic control and reducing the burden on patients to manually monitor and administer insulin

- For instance, in 2023, Medtronic launched its MiniMed 780G, a next-generation insulin pump, which works in combination with its CGM system to deliver more precise insulin doses automatically

- The integration of artificial intelligence and machine learning in these systems holds the potential to revolutionize diabetes management, improving patient quality of life and reducing the risk of complications

Restraint/Challenge

“High Costs of Advanced Insulin Delivery Devices”

- The high costs associated with advanced insulin delivery devices pose a significant challenge for their widespread adoption, particularly in low- and middle-income countries

- Devices such as insulin pumps, continuous glucose monitoring systems, and smart insulin pens can be expensive, limiting their accessibility to a broader patient population

- For instance, a report from the National Diabetes Education Program (NDEP) stated that the high cost of insulin pumps, along with the recurring cost of sensors and other consumables, is a major financial barrier for many patients

- The affordability issue may deter healthcare providers, especially in developing regions, from investing in these advanced technologies, creating disparities in access to cutting-edge diabetes care solutions and hindering overall market growth

Insulin Delivery Devices Market Scope

The market is segmented on the basis of product type, application, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the insulin pens is projected to dominate the market with a largest share in product type segment

The insulin pens segment is expected to dominate the insulin delivery devices market with the largest share of 44.72% in 2025 due to its delivery of insulin in convenient, accurate, and less invasive way and is beneficial for individuals with diabetes who need regular injections.

The Type 1 Diabetes is expected to account for the largest share during the forecast period in application segment

In 2025, the Type 1 Diabetes segment is expected to dominate the market with the largest market share of 56.44% due to need for intensive insulin therapy in individuals with Type 1 diabetes drives a higher adoption rate of advanced insulin delivery devices within this patient group.

Insulin Delivery Devices Market Regional Analysis

“North America Holds the Largest Share in the Insulin Delivery Devices Market”

- North America dominates the insulin delivery devices market with the largest market share of 41.71%, supported by a robust healthcare infrastructure, early adoption of advanced diabetes management technologies, and the strong presence of major insulin delivery device manufacturers

- U.S. accounts for a largest share due to the rising prevalence of diabetes, growing awareness about insulin therapy, and increased preference for user-friendly and less invasive delivery methods such as insulin pens and pumps

- Favorable reimbursement policies, government initiatives promoting diabetes care, and continued investment in research & development by top medical technology companies further strengthen market growth

- The surge in Type 1 and insulin-dependent Type 2 diabetes cases, coupled with the high adoption rate of innovative insulin delivery solutions, is accelerating market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Insulin Delivery Devices Market”

- Asia-Pacific is expected to experience the highest growth rate in the insulin delivery devices market, fueled by expanding healthcare infrastructure, increasing diabetes awareness, and a growing patient population requiring insulin therapy

- Countries such as China, India, and Japan are emerging as key markets due to the rising incidence of diabetes, urbanization-driven lifestyle changes, and improving access to diagnostic and treatment facilities

- Japan, known for its advanced healthcare technologies, is witnessing strong adoption of smart insulin pens and insulin pumps, supported by its aging population and government initiatives promoting effective diabetes management

- China and India, with their large diabetic populations, are benefiting from increased government healthcare spending, growing penetration of global insulin delivery device manufacturers, and enhanced affordability of innovative insulin solutions

Insulin Delivery Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BD (U.S.)

- Medtronic (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Lilly (U.S.)

- Ypsomed AG (Switzerland)

- Novo Nordisk A/S (Denmark)

- Beta Bionics (U.S.)

- Owen Mumford Ltd (U.K.)

- Sanofi (France)

- B. Braun AG (Germany)

- Abbott (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- InsuJet (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Insulet Corporation (Netherlands)

- SHL Medical (Switzerland)

- SOOIL Developments Co., Ltd. (South Korea)

- Johnson & Johnson Services, Inc. (U.S.)

Latest Developments in Global Insulin Delivery Devices Market

- In September 2023, Sanofi collaborated with 35 pharmacies in Berlin, aiming to strengthen its market presence across European countries. This initiative marks a strategic move to expand its business footprint within the region

- In August 2023, Insulet Corporation introduced the Omnipod 5, an automated insulin delivery system, in Germany for Type 1 diabetes patients aged 2 years and older. This launch reinforces the company's commitment to making advanced diabetes care more accessible in Europe

- In July 2023, Tandem Diabetes Care, Inc. received approval from the U.S. FDA for its Tandem Mobi insulin pump, intended for patients aged 6 years and above. This milestone supports the company’s efforts to broaden its product portfolio and enhance pediatric diabetes care

- In March 2023, Diabeloop SA, a prominent provider of automated insulin systems, entered a collaboration with Novo Nordisk A/S to enhance its product offerings and expand its market reach. This partnership is expected to boost innovation and strengthen brand positioning

- In November 2022, Medtronic launched the Medtronic Extended infusion set in the U.S., the world’s first insulin pump infusion set designed for up to 7 days of use. This development signifies a major advancement in insulin pump technology, improving convenience for users

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.