Global Immunotherapy Drugs Market

Market Size in USD Billion

CAGR :

%

USD

251.94 Billion

USD

601.87 Billion

2024

2032

USD

251.94 Billion

USD

601.87 Billion

2024

2032

| 2025 –2032 | |

| USD 251.94 Billion | |

| USD 601.87 Billion | |

|

|

|

|

Immunotherapy Drugs Market Size

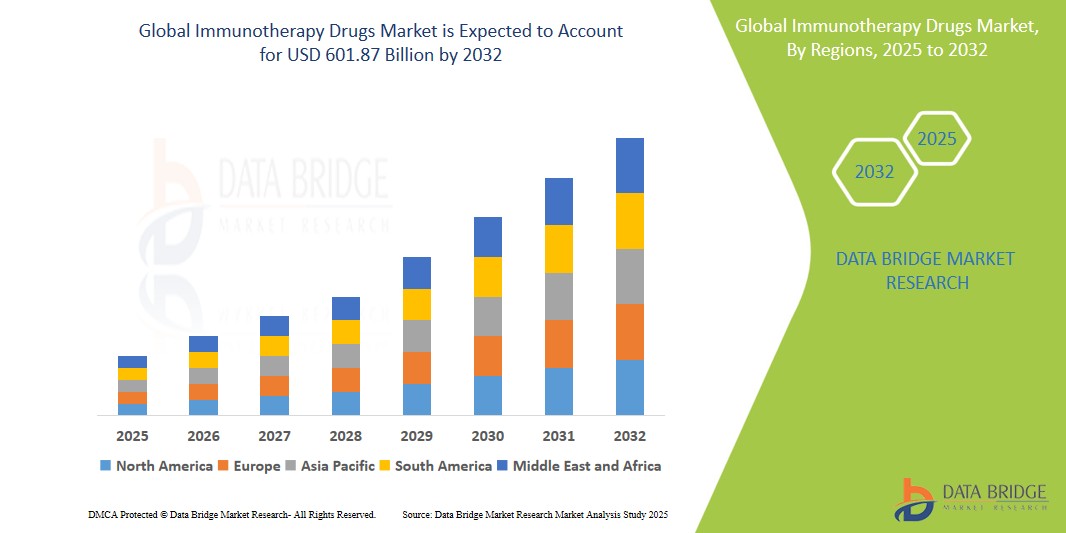

- The global immunotherapy drugs market size was valued at USD 251.94 billion in 2024 and is expected to reach USD 601.87 billion by 2032, at a CAGR of 11.50 % during the forecast period

- This growth is driven by factors such as the increasing prevalence of cancer and other chronic diseases, driving the demand for immunotherapy treatments and advances in research and development leading to the introduction of new and more effective immunotherapy drugs

Immunotherapy Drugs Market Analysis

- The immunotherapy drugs market is expanding as new therapies emerge, focusing on targeting specific cancer cells more efficiently and with fewer side effects. This shift is driving growth, especially in oncology treatments

- Advancements in personalized medicine and the growing understanding of the immune system are allowing for more tailored treatment options, increasing the appeal of immunotherapy as a treatment choice

- North America is expected to dominate the immunotherapy drugs market due to its advanced healthcare infrastructure, high adoption of innovative therapies, and the presence of major pharmaceutical companies investing heavily in immunotherapy research and development.

- Asia-Pacific is expected to be the fastest growing region in the immunotherapy drugs market during the forecast period due to increasing cancer incidence, improving healthcare access, and growing government support for the development of cancer therapies in countries such as China and India.

- The monoclonal antibodies segment is expected to dominate the immunotherapy drugs market with the largest share of 76.7% in 2025 due to its broad applicability across various chronic and autoimmune diseases, high clinical success rates, and increasing R&D investments in biologics for targeted therapies.

Report Scope and Immunotherapy Drugs Market Segmentation

|

Attributes |

Immunotherapy Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Immunotherapy Drugs Market Trends

“Increasing Adoption of Combination Therapies”

- Combination therapies are being actively investigated in clinical trials and clinical practice to achieve optimal clinical outcomes

- The rationale behind combination approaches is to increase treatment effectiveness, break resistance, and address the intricacies of how the immune system reacts against diseases

- For instance, in April 2024, the FDA approved the combination of N-803 with BCG for treating BCG-unresponsive non-muscle-invasive bladder cancer, based on the QUILT 3.032 clinical trial led by UCLA, which demonstrated enhanced survival and efficacy

- The combination of drugs for treating particular cancer diseases drives the immunotherapy drug market

- This combined approach expands the immunotherapy drugs market and provides clinicians with a more versatile toolkit for managing complex cancer cases

Immunotherapy Drugs Market Dynamics

Driver

“Increased Prevalence of Cancer and Other Chronic Diseases”

- The rising prevalence of cancer and chronic conditions such as autoimmune and inflammatory diseases is a primary driver of the immunotherapy drugs market, with millions of new cancer cases reported each year globally

- For instance, the World Health Organization (WHO) projected over 19 million new cancer cases worldwide in 2024

- Immunotherapy has demonstrated strong potential in treating previously untreatable cancers such as melanoma and non-small cell lung cancer, making it a preferred treatment option for oncologists

- For instance, the FDA approved nivolumab for advanced melanoma after it showed improved overall survival in clinical trials

- The success of immune checkpoint inhibitors such as pembrolizumab (Keytruda) and nivolumab (Opdivo) in significantly extending survival rates in cancers such as melanoma and lung cancer supports the growing clinical trust in immunotherapy

- Technological advances have expanded immunotherapy applications beyond oncology to include diseases such as rheumatoid arthritis and multiple sclerosis, increasing the scope and adoption of these therapies

- Ongoing research and development are continuously generating new treatment options, such as CAR T-cell therapies, which have shown impressive results in treating relapsed or refractory blood cancers such as leukemia and lymphoma

Opportunity

“Rising Investment in Research and Development”

- Rising investment in research and development by pharmaceutical companies, biotech firms, and governments is creating major opportunities in the immunotherapy drugs market as efforts intensify to discover innovative treatments for chronic diseases and cancer

- Exploration into combination therapies and personalized medicine is gaining traction, allowing tailored treatments that enhance patient response rates

- For instance, combining checkpoint inhibitors with chemotherapy or radiation has shown improved outcomes in certain cancers

- CAR T-cell therapy, a result of advanced R&D, has revolutionized the treatment of hematological cancers such as leukemia and lymphoma, providing options for patients who previously had limited choices

- Increasing breakthroughs in biomarkers and precision medicine are enabling more targeted and effective immunotherapy treatments, helping clinicians predict patient responses and minimize adverse effects

- Companies focusing on R&D are expanding their product pipelines, positioning themselves to meet the growing demand for diverse treatment options and contributing to long-term market expansion

Restraint/Challenge

“High Treatment Costs and Accessibility”

- The high treatment costs of immunotherapy drugs, including CAR T-cell therapies and immune checkpoint inhibitors, present a major challenge by making them unaffordable for many patients without premium insurance or government aid

- Treatment expenses can run into hundreds of thousands of dollars per patient, covering not just the drug itself but also hospital stays, specialized administration, and ongoing monitoring

- For instance, CAR T-cell therapies such as Kymriah have pricing that exceeds USD 400,000 in some markets

- In low- and middle-income countries, limited healthcare funding and lack of insurance coverage restrict patient access to these advanced therapies, making equitable treatment distribution difficult

- Reimbursement challenges add to the barrier, as policies differ drastically across regions, with some healthcare systems offering partial or no coverage for new immunotherapy treatments

- A shortage of trained professionals and adequate infrastructure to safely administer immunotherapy further limits accessibility in developing and rural regions, worsening health inequities globally

Immunotherapy Drugs Market Scope

The market is segmented on the basis of type of drug, therapy area, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type of Drug |

|

|

By Therapy Area |

|

|

By End User |

|

In 2025, the monoclonal antibodies is projected to dominate the market with a largest share in type of drug segment

The monoclonal antibodies segment is expected to dominate the immunotherapy drugs market with the largest share of 76.7% in 2025 due to its broad applicability across various chronic and autoimmune diseases, high clinical success rates, and increasing R&D investments in biologics for targeted therapies.

The cancer is expected to account for the largest share during the forecast period in therapy area market

In 2025, the cancer segment is expected to dominate the market with the largest market share of 91.9% due rising global incidence, increasing adoption of immunotherapy as a primary treatment option, and growing approvals of immune-based cancer drugs by regulatory authorities.

Immunotherapy Drugs Market Regional Analysis

“North America Holds the Largest Share in the Immunotherapy Drugs Market”

- North America is the dominating region in the global immunotherapy drugs market, holding a market share of 49.9%

- The region's dominance is driven by a high incidence of cancer and autoimmune diseases, leading to increased demand for effective treatments

- Advanced healthcare infrastructure and significant investments in research and development contribute to the development of innovative therapies

- Favourable healthcare policies and increased spending on health services support the adoption of immunotherapy drugs

- The presence of major pharmaceutical companies and a strong industry presence further bolster the region's market position

“Asia-Pacific is Projected to Register the Highest CAGR in the Immunotherapy Drugs Market”

- Asia Pacific is the fastest-growing region in the global immunotherapy drugs market, projected to grow at the highest CAGR over the forecast period

- The region's growth is fuelled by a rising prevalence of cancer, particularly in countries such as India and China

- Increasing healthcare expenditure and demand for advanced cancer treatments contribute to market expansion

- Favourable regulatory environments and government support for research and development enhance market growth

- The emergence of local players offering affordable immunotherapy drugs increases accessibility and adoption

Immunotherapy Drugs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- PerkinElmer Inc. (U.S.)

- Illumina, Inc. (U.S.)

- QIAGEN (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- Johnson & Johnson Services, Inc. (India)

- AbbVie Inc. (U.S.)

- Allergan (Ireland)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- Thermo Fisher Scientific (U.S.

- Teva Pharmaceutical Industries Ltd. (Israel)

- Takeda Pharmaceutical Company Limited (Japan)

- GlaxoSmithKline plc (U.K.)

- Lupin Pharmaceuticals, Inc. (U.S.)

- Lilly (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Medtronic (U.S.)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

Latest Developments in Global Immunotherapy Drugs Market

- In February 2024, AbbVie (U.S.) completed its acquisition of ImmunoGen (U.S.), valued at USD 10.1 billion. The acquisition focuses on enhancing AbbVie’s oncology portfolio, particularly in antibody-drug conjugates, with ImmunoGen’s Elahere for treating platinum-resistant ovarian cancer. This development strengthens AbbVie’s position in the oncology market by adding a new targeted cancer therapy. The acquisition is expected to drive long-term revenue growth despite short-term financial impacts due to acquisition expenses

- In October 2023, Roche (Switzerland) entered into a definitive agreement to acquire Telavant Holdings (U.S.) for USD 7.1 billion. The acquisition grants Roche exclusive rights to develop and commercialize RVT-3101, a promising antibody in Phase 2 trials for inflammatory bowel diseases. This move strengthens Roche's portfolio in autoimmune treatments and accelerates its ability to bring innovative therapies to market. The deal also includes an option to collaborate with Pfizer on a next-generation bispecific antibody

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.