Global Hyperspectral Imaging Systems Market

Market Size in USD Billion

CAGR :

%

USD

14.60 Billion

USD

48.21 Billion

2024

2032

USD

14.60 Billion

USD

48.21 Billion

2024

2032

| 2025 –2032 | |

| USD 14.60 Billion | |

| USD 48.21 Billion | |

|

|

|

|

Hyperspectral Imaging Systems Market Size

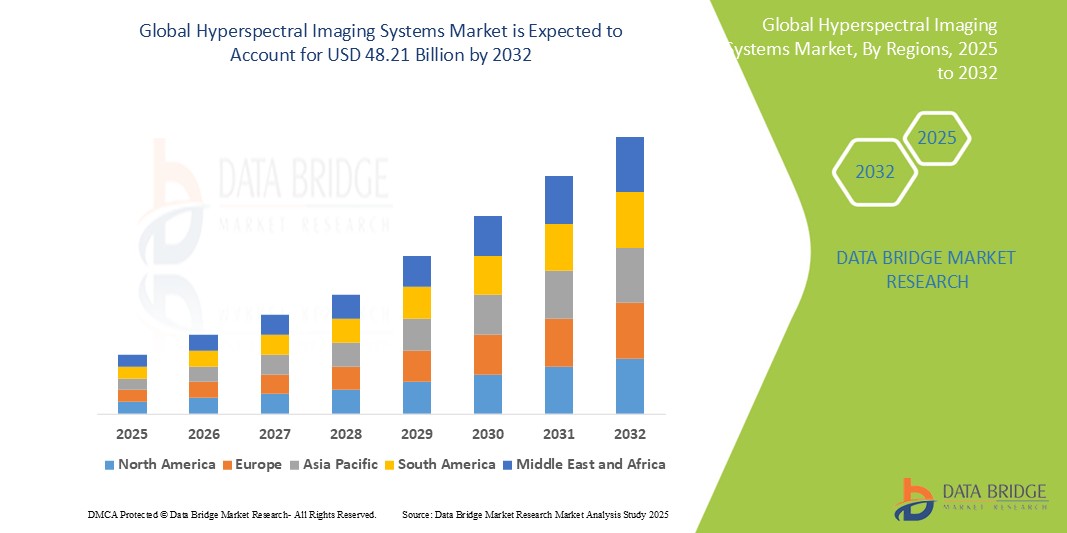

- The global hyperspectral imaging systems market size was valued at USD 10.18 billion in 2024 and is expected to reach USD 48.21 billion by 2032, at a CAGR of 21.46% during the forecast period

- This growth is driven by factors such as increasing demand for advanced imaging technologies in sectors like agriculture, defense, medical diagnostics, and environmental monitoring, along with technological advancements in sensor design and data analysis

Hyperspectral Imaging Systems Market Analysis

- Hyperspectral imaging systems are advanced technologies that capture and analyze a wide spectrum of light across numerous wavelengths, providing detailed information beyond what the human eye can perceive. These systems are widely used in sectors such as agriculture, defense, mining, environmental monitoring, and medical diagnostics

- The demand for hyperspectral imaging systems is significantly driven by the growing need for precise imaging solutions in areas like crop monitoring, disease detection, and military surveillance, as well as increasing adoption in biomedical research and clinical diagnostics

- North America is expected to dominate the hyperspectral imaging systems market with largest market share of 30.01%, due to strong investments in research and development, advanced technological infrastructure, and widespread application in defense and healthcare

- Asia-Pacific is expected to be the fastest growing region in the hyperspectral imaging systems market during the forecast period due to increasing industrialization, expanding agricultural research, and government initiatives supporting remote sensing technologies

- Cameras segment is expected to dominate the market with a largest market share of 71.9% due technological advancements, such as high-speed and low-cost circuits, advanced manufacturing technologies, and novel signal-processing methods in sensor development

Report Scope and Hyperspectral Imaging Systems Market Segmentation

|

Attributes |

Hyperspectral Imaging Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Hyperspectral Imaging Systems Market Trends

“Integration of Hyperspectral Imaging with AI and Real-Time Data Analytics”

- One prominent trend in the evolution of hyperspectral imaging systems is the increasing integration of artificial intelligence (AI), machine learning, and real-time data analytics to enhance image interpretation and decision-making

- These technological advancements allow for faster, more accurate processing of hyperspectral data, enabling real-time insights in applications such as precision agriculture, environmental monitoring, medical diagnostics, and industrial quality control

- For instance, in agricultural applications, AI-powered hyperspectral platforms can rapidly detect crop stress, nutrient deficiencies, or disease outbreaks before visual symptoms appear, allowing for timely intervention and improved yield outcomes

- This convergence of hyperspectral imaging and intelligent analytics is reshaping industries by enabling more precise, data-driven decisions, thereby accelerating market adoption and expanding the practical utility of hyperspectral systems

Hyperspectral Imaging Systems Market Dynamics

Driver

“Growing Demand for Non-Invasive and High-Precision Imaging Across Industries”

- The increasing need for non-invasive, high-precision imaging solutions across sectors such as agriculture, defense, healthcare, and environmental monitoring is a major driver of growth in the hyperspectral imaging systems market

- Hyperspectral imaging enables the detection and analysis of materials and biological structures with unparalleled accuracy, without physical contact or sample preparation, making it ideal for real-time and remote applications

- As industries prioritize efficiency, accuracy, and early detection, the adoption of hyperspectral imaging is expanding rapidly for tasks such as crop health assessment, wound diagnosis, mineral exploration, and industrial inspection

For instance,

- In 2023 study published in the journal Remote Sensing, hyperspectral imaging was shown to outperform traditional imaging methods in detecting early-stage crop diseases and stress factors, allowing for timely corrective measures and increased yield

- As a result of the demand for precise, real-time insights across a wide range of applications, hyperspectral imaging systems are becoming an indispensable tool for enhancing operational effectiveness and decision-making

Opportunity

“Expanding Use in Precision Agriculture and Food Quality Assessment”

- The increasing focus on sustainable agriculture and food safety presents a major opportunity for hyperspectral imaging systems, which enable early detection of crop diseases, pest infestations, and nutrient deficiencies with high accuracy

- These systems are also gaining traction in food processing and quality control, where they can non-destructively assess food composition, contamination, ripeness, and spoilage, ensuring compliance with safety standards and reducing waste

- By providing farmers and food producers with actionable, real-time insights, hyperspectral imaging supports better resource management, higher crop yields, and improved food quality

For instance,

- In 2023 pilot study by the U.S. Department of Agriculture (USDA), hyperspectral imaging technology enabled early detection of fungal infections in wheat crops with over 90% accuracy, helping reduce crop loss and increase productivity

- As the agriculture and food sectors increasingly adopt precision technologies, hyperspectral imaging stands out as a vital tool for enhancing efficiency, quality, and sustainability across the value chain

Restraint/Challenge

“High System Costs and Data Complexity Limiting Broader Adoption”

- The high cost associated with hyperspectral imaging systems poses a significant challenge to market expansion, particularly affecting adoption in cost-sensitive sectors and developing regions

- These systems require sophisticated sensors, advanced computing infrastructure, and specialized software, with total setup costs often running into hundreds of thousands of dollars depending on application and scale

- In addition to hardware costs, the complexity of hyperspectral data processing demands trained personnel and high-performance computing resources, which can further increase operational expenses and limit accessibility

For instance,

- According to a 2023 report by MarketsandMarkets, the total cost of deploying a full-scale hyperspectral imaging setup for agricultural monitoring—including data acquisition, processing, and interpretation—can exceed USD 250,000, making it unaffordable for small- and medium-scale operations

- These financial and technical barriers can hinder adoption across industries, especially in regions with limited R&D infrastructure, thereby slowing the overall growth of the global hyperspectral imaging systems market

Hyperspectral Imaging Systems Market Scope

The market is segmented on the basis of product, scanning techniques, technology, range, and application

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Scanning Techniques |

|

|

By Technology |

|

|

By Range |

|

|

By Application |

|

In 2025, the cameras is projected to dominate the market with a largest share in product segment

The cameras segment is expected to dominate the hyperspectral imaging systems market with the largest share of 71.9% due technological advancements, such as high-speed and low-cost circuits, advanced manufacturing technologies, and novel signal-processing methods in sensor development

The military is expected to account for the largest share during the forecast period in application segment

In 2025, the military segment is expected to dominate the market with the largest market share of 31.8% due to the advancements in data management, along with component fabrication techniques. Hyperspectral imaging has a wide range of military applications in the domains of tracking and identification of personnel or other objects. Better accuracy and consistency compared to other conventional imaging techniques are contributing to segment growth

Hyperspectral Imaging Systems Market Regional Analysis

“North America Holds the Largest Share in the Hyperspectral Imaging Systems Market”

- North America dominates the hyperspectral imaging systems market with largest market share of 30.01%, driven by robust R&D activities, strong presence of leading technology companies, and widespread adoption across defense, agriculture, and healthcare sectors

- The U.S. holds a dominant share of approximately 36%, due to extensive government funding for defense and environmental monitoring, advanced healthcare infrastructure, and early adoption of AI-integrated imaging technologies

- The region also benefits from well-established academic and research institutions collaborating on hyperspectral technology development, along with high demand for precision farming and industrial inspection solutions

- Furthermore, the growing focus on space-based imaging and satellite surveillance in North America continues to fuel market growth, particularly through NASA and Department of Defense initiatives

“Asia-Pacific is Projected to Register the Highest CAGR in the Hyperspectral Imaging Systems Market”

- The Asia-Pacific region is expected to witness the fastest growth during the forecast period, fueled by rising industrialization, growing demand for food security, and increased government investment in environmental and agricultural monitoring

- Countries such as China, India, and Japan are emerging as key adopters due to advancements in remote sensing technologies, expanding medical diagnostics capabilities, and the integration of hyperspectral imaging in smart agriculture initiatives

- Japan, with its technological leadership and strong focus on automation and quality assurance, remains a significant market for industrial hyperspectral imaging applications

- Meanwhile, China and India are investing heavily in hyperspectral-enabled agricultural research, urban planning, and environmental conservation programs, supported by government initiatives and expanding tech infrastructure

Hyperspectral Imaging Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Robert Bosch GmbH (Germany)

- Hanwha Group. (South Korea)

- Honeywell International Inc. (U.S.)

- Schneider Electric (France)

- Axis Communications AB (Sweden)

- Johnson Controls (Ireland)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- NetApp (U.S.)

- Dahua Technology USA Inc. (China)

- KEDACOM (China)

- Verint Systems Inc. (U.S.)

- LTIMindtree Limited (India)

- AxxonSoft. (U.S.)

- eInfochips (U.S.)

- Panasonic Corporation (Japan)

- Panopto (U.S.)

- Backstreet Surveillance (U.S.)

- Eagle Eye Solutions Group Plc. (U.S.)

- Arcules, Inc. (U.S.)

Latest Developments in Global Hyperspectral Imaging Systems Market

- In January 2024, Specim, Spectral Imaging Ltd., announced a strategic partnership with GEONA Hyperspectral. Through this collaboration, Specim has designated GEONA as its preferred standalone processing solution for its comprehensive range of airborne hyperspectral sensors. This partnership contributes in advancing the global hyperspectral imaging systems market by enhancing the processing capabilities and operational efficiency of hyperspectral sensors

- In December 2023, SPECIM introduced the FX50 middle-wave infrared hyperspectral camera, offering a spectral range of 2.7 - 5.3 μm. The camera features a 640-pixel spatial resolution, 35 nm spectral resolution, 30 μm pixel size, and a maximum frame rate of 377 fps, making it a highly advanced tool for a wide range of applications. This launch further strengthens the global hyperspectral imaging systems market by enhancing imaging capabilities, enabling more precise analysis and real-time data acquisition across sectors such as industrial quality control, environmental monitoring, and defense

- In October 2023, Axis Communications completed the sale of its subsidiary Citilog to TagMaster, marking the beginning of strengthened collaborations between Axis, Citilog, and TagMaster in the rail and traffic solutions sector. This acquisition enhances their collective efforts in advancing transportation technology. The development highlights the increasing integration of advanced imaging solutions in transportation, including traffic monitoring and safety applications

- In May 2021, Diaspective Vision unveiled TIVITA 2.0, an advanced hyperspectral imaging camera. This innovative device offers non-contact, non-invasive imaging, eliminating risks associated with contamination, ionizing radiation, or contrast agents, ensuring a safe and precise solution for a wide range of applications. The launch of TIVITA 2.0 underscores the growing demand for non-invasive, high-precision imaging technologies across industries such as healthcare, diagnostics, and environmental monitoring

- In April 2021, Headwall Photonics became a member of the Industrial Practitioner Advisory Board for the NSF-funded IoT4Ag initiative. Through this collaboration with the NSF Engineering Research Center, Headwall's hyperspectral sensors, integrated onto UAV systems, facilitate the development of data-driven models for analyzing plant physiology, soil properties, and environmental factors. This partnership enhances advancements in agricultural technology by providing more precise and actionable insights

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hyperspectral Imaging Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hyperspectral Imaging Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hyperspectral Imaging Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.