Global Flavours Fragrances Market

Market Size in USD Billion

CAGR :

%

USD

35.90 Billion

USD

51.10 Billion

2024

2032

USD

35.90 Billion

USD

51.10 Billion

2024

2032

| 2025 –2032 | |

| USD 35.90 Billion | |

| USD 51.10 Billion | |

|

|

|

|

Flavours - Fragrances Market Size

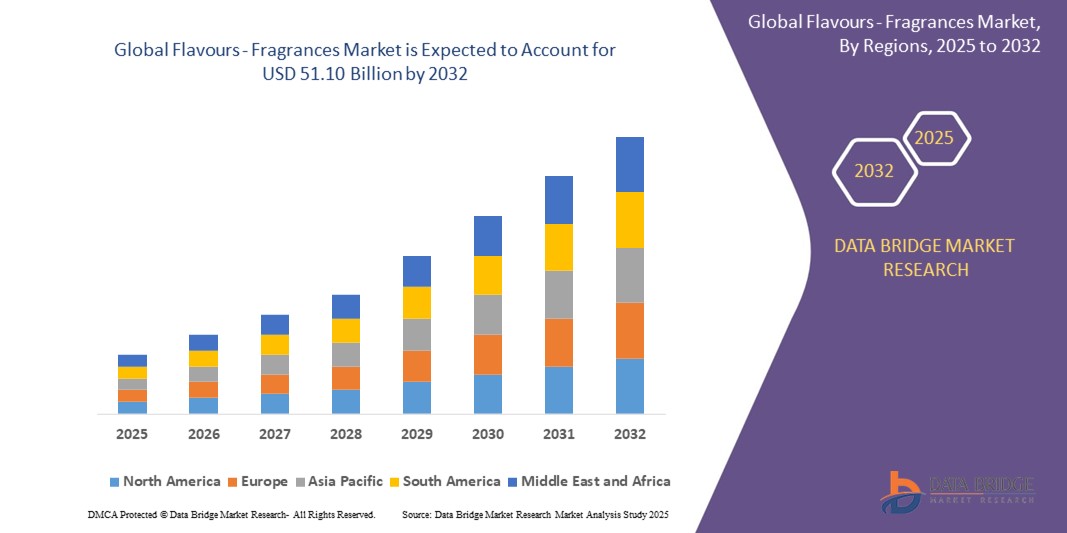

- The global flavours - fragrances market size was valued at USD 35.90 billion in 2024 and is expected to reach USD 51.10 billion by 2032, at a CAGR of 4.51% during the forecast period

- This growth is driven by factors such as the increasing consumer demand for natural and clean-label products, the expansion of the food and beverage industry, and the rising popularity of personalized and sustainable fragrances

Flavours - Fragrances Market Analysis

- Flavour and fragrance are two senses flavour is felt with the tongue whereas fragrance is felt with the nose. Fragrance is a sweet and pleasant smell and flavour is a distinctive taste

- However, flavour and fragrance cannot be considered as distinct things since the flavour is often a result of both smell and taste. Thus, fragrance has a main effect on flavour

- Europe is expected to dominate the flavours - fragrances market with 31.81% due significant consumption in the production of fine fragrances and cosmetics

- Asia-Pacific is expected to be the fastest growing region in the flavours - fragrances market during the forecast period due to increasing consumer demand and industry expansion

- Natural segment is expected to dominate the market with a market share of 74% due to its increasing product usage in various application industries such as pharmaceuticals, aromatherapy, and natural cosmetics

Report Scope and Flavours - Fragrances Market Segmentation

|

Attributes |

Flavours - Fragrances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flavours - Fragrances Market Trends

“Rise of Natural and Clean-Label Products”

- There's a significant consumer shift towards natural and clean-label products, especially in food, beverages, and personal care sectors. Consumers are increasingly seeking products with transparent labeling and natural ingredients, driving the demand for natural flavors and fragrances

- The growing health and wellness trend is influencing consumer choices, with many opting for products that align with their lifestyle preferences. This shift is prompting manufacturers to develop and offer natural and organic flavors and fragrances

- Regulatory support for natural ingredients is encouraging manufacturers to invest in natural alternatives to comply with standards and meet consumer demand. This support is fostering innovation in sourcing methods and extraction techniques

- Companies are focusing on manufacturing innovative natural flavors and fragrances with multifunctional properties to meet end-customer demands and strengthen their market position

Flavours - Fragrances Market Dynamics

Driver

“Expansion in Emerging Markets”

- Rapid urbanization and rising disposable incomes in emerging economies are driving the demand for flavored and fragranced products in food & beverages, personal care, and home care sectors

- Shifting consumer lifestyles and preferences are influencing the demand for diverse and innovative flavors and fragrances, prompting companies to adapt their offerings

- The increasing penetration of e-commerce in these regions is facilitating market growth by making products more accessible to consumers

- Countries such as India, with rich biodiversity, offer opportunities for sourcing organic fragrant raw materials, catering to the global demand for natural ingredients

- Companies are exploring these markets to tap into the growing consumer base and expand their global footprint, employing strategies such as local partnerships and tailored product offerings

Opportunity

“Emphasis on Sustainability and Eco-Friendly Practices”

- Increasing awareness about environmental issues has led to a rise in demand for sustainable and eco-friendly products, prompting companies to adopt environmentally friendly practices

- Major players in the food and beverage, personal care, and household product sectors are investing in the development and marketing of natural and organic product lines to cater to evolving consumer preferences

- Companies are focusing on sustainably and ethically sourcing raw materials such as spices, flowers, and essential oils, ensuring traceability and compliance with environmental standards

- Investments in sustainable production processes, such as reducing water usage, using renewable energy, and minimizing waste, are becoming integral to business strategies

- Educating consumers about the environmental impact of products and providing transparent information about sourcing and production processes are key strategies for building trust and loyalty

Restraint/Challenge

“Regulatory Compliance and Sustainability Challenges”

- Navigating the complex and varying regulatory frameworks across regions can be challenging for companies, requiring extensive testing and certification processes

- The cost associated with ensuring compliance with stringent regulations, including ingredient labeling and safety standards, can be significant, impacting profitability

- Achieving sustainability and traceability in sourcing raw materials, especially natural flavors and fragrances, can be difficult due to limited availability and strict regulations

- The global supply chains involved in the flavors and fragrances market add complexity, making it challenging to ensure consistent quality and sustainability across all stages

Flavours - Fragrances Market Scope

The market is segmented on the basis of products, form, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Products |

|

|

By Form |

|

|

By End User |

|

In 2025, the natural is projected to dominate the market with a largest share in products segment

The natural segment is expected to dominate the flavours - fragrances market with the largest share of 74% in 2025 due to its increasing product usage in various application industries such as pharmaceuticals, aromatherapy, and natural cosmetics. Furthermore, increasing research spending for development of natural fragrance compounds is expected to have a positive impact on overall industry.

The cosmetics and toiletries is expected to account for the largest share during the forecast period in end user segment

The cosmetics and toiletries segment is expected to dominate the flavours and fragrances market due to the increasing demand for personal care products such as perfumes, deodorants, creams, and shampoos. The rising consumer preference for scented and premium cosmetic items, along with continuous innovation in product formulations, is anticipated to drive the growth of this segment across the industry.

Flavours - Fragrances Market Regional Analysis

“Europe Holds the Largest Share in the Flavours - Fragrances Market”

- Europe held the largest market share in the global flavours and fragrances market, accounting for 31.81%

- The dominance is attributed to the high demand from food and beverage manufacturers, as well as significant consumption in the production of fine fragrances and cosmetics.

- Europe hosts several multinational manufacturers, facilitating ease of trade and innovation in the industry

- There has been a notable increase in the demand for flavors used in liquor-based drinks, further boosting the market in the region

- The region is expected to maintain its leading position due to continuous innovation and strong industry presence

“Asia-Pacific is Projected to Register the Highest CAGR in the Flavours - Fragrances Market”

- The Asia-Pacific region is projected to experience the highest growth rate in the flavours and fragrances market, driven by increasing consumer demand and industry expansion

- Countries such as China, India, and Southeast Asia are witnessing a surge in demand for flavored products, particularly in the food and beverage sector

- There is a growing preference for natural and clean-label products among consumers, influencing market dynamics

- Global companies are investing in the region, establishing R&D facilities and expanding their market presence to capitalize on the growth opportunities

- The region's rapid urbanization and rising disposable incomes contribute to the burgeoning demand for flavours and fragrances

Flavours - Fragrances Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Givaudan (Switzerland)

- Firmenich SA (Switzerland)

- International Flavors & Fragrances Inc, (U.S.)

- Takasago International Corporation (Japan)

- ADM (U.S.)

- Sensient Technologies Corporation (U.S.)

- Mane (EN) (France)

- Robertet SA (France)

- T.Hasegawa USA Inc. (Japan)

- Bell Flavors & Fragrances (U.S.)

- Agilex Fragrances (U.S.)

- Comax MFG Corp (U.S.)

- Biolandes (France)

- doTERRA (U.S.)

- Falcon (U.S.)

- Ungerer & Company (U.S.)

- Akay (India)

- BASF SE (Germany)

- Young Living Essential Oils (U.S.)

- Alpha Aromatics (U.S.)

Latest Developments in Global Flavours - Fragrances Market

- In March 2024, DSM-Firmenich AG opened two modern production facilities for the manufacture of ingredients for perfumes in Castets, Southwest of France

- In March 2023, International Flavors & Fragrances Inc. announced the addition of two new flavor labs at its Europe Innovation Hub in Braband, Denmark. The laboratories will focus on creating gourmet and sweet flavors

- In January 2023 Symrise AG invested in Ignite Venture Studio. It is B2C startup ventures in the personal care sector. Symrise has invested in Ignite Venture Studio to drive product innovations in fragrance and cosmetic ingredients

- In December 2022, -Symrise had partnered with Norwest Ingredients for comprehensive sustainability assessment of peppermint and spearmint raw materials

- In December 2022, Mane Group has opened two new facilities in India. The first site is located at MANE KANCOR Angamaly, Kerala; the second is at MANE KANCOR Byadgi, Karnataka

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FLAVOURS AND FRAGRANCES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FLAVOURS AND FRAGRANCES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL FLAVOURS AND FRAGRANCES MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 SUPPLY CHAIN ANALYSIS

11.1 OVERVIEW

11.2 LOGISTIC COST SCENARIO

11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

12 CLIMATE CHANGE SCENARIO

12.1 ENVIRONMENTAL CONCERNS

12.2 INDUSTRY RESPONSE

12.3 GOVERNMENT’S ROLE

12.4 ANALYST RECOMMENDATIONS

13 GLOBAL FLAVOURS AND FRAGRANCES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) (KILO TONS)

13.1 OVERVIEW

13.2 FLAVOURS

13.2.1 FRUITY

13.2.1.1. FRUITY, BY TYPE

13.2.1.1.1. APPLE

13.2.1.1.2. APRICOT

13.2.1.1.3. BANANA

13.2.1.1.4. CANTALOUPE

13.2.1.1.5. HONEYDEW

13.2.1.1.6. MANGO

13.2.1.1.7. PAPAYA

13.2.1.1.8. PASSIONFRUIT

13.2.1.1.9. PLUM

13.2.1.1.10. BLOOD ORANGE

13.2.1.1.11. GRAPEFRUIT

13.2.1.1.12. KEY LIMEKUMQUAT

13.2.1.1.13. LEMON

13.2.1.1.14. LIMEMANDARIN ORANGE

13.2.1.1.15. ORANGE

13.2.1.1.16. TANGERINE

13.2.1.1.17. BERRIES

13.2.1.1.17.1 BERRIES, BY TYPE

13.2.1.1.17.1.1. RED RASPBERRY

13.2.1.1.17.1.2. STRAWBERRY

13.2.1.1.17.1.3. BLUEBERRY

13.2.1.1.17.1.4. RASPBERRY

13.2.1.1.17.1.5. GRAPES

13.2.1.1.17.1.6. ACAI BERRY

13.2.1.1.17.1.7. GOJI BERRY

13.2.1.1.17.1.8. MARIONBERRY

13.2.1.1.17.1.9. GOOSEBERRY

13.2.1.1.17.1.10. CRANBERRY

13.2.1.1.17.1.11. MULBERRY

13.2.1.1.17.1.12. ARONIA BERRY

13.2.1.1.17.1.13. CITRUS BERRY

13.2.1.1.17.1.14. BLACK RASPBERRY

13.2.1.1.17.1.15. BLACKCURRANT

13.2.2 SPICY

13.2.2.1. SPICY, BY TYPE

13.2.2.1.1. PEPPER

13.2.2.1.2. GINGER

13.2.2.1.3. CINNAMON

13.2.2.1.4. CUMIN

13.2.2.1.5. TURMERIC

13.2.2.1.6. CARDAMOM

13.2.2.1.7. MUSTARD

13.2.2.1.8. CORIANDER

13.2.2.1.9. CLOVES

13.2.2.1.10. MINT

13.2.2.1.11. SAGE

13.2.2.1.12. SAFFRON

13.2.2.1.13. FENUGREEK

13.2.2.1.14. FENNEL

13.2.2.1.15. ONION

13.2.2.1.16. NUTMEG

13.2.2.1.17. OTHERS

13.2.3 HERBAL

13.2.3.1. HERBAL, BY TYPE

13.2.3.1.1. BASIL

13.2.3.1.2. BERGAMOT

13.2.3.1.3. BLACK TEA

13.2.3.1.4. CHAMOMILE

13.2.3.1.5. EUCALYPTUS

13.2.3.1.6. GREEN TEA

13.2.3.1.7. HIBISCUSJASMINE

13.2.3.1.8. LAVENDER

13.2.3.1.9. MENTHOL

13.2.3.1.10. MINT

13.2.3.1.11. ORANGE BLOSSOM

13.2.3.1.12. PEPPERMINT

13.2.3.1.13. ROSEROSEMARY

13.2.3.1.14. SAGE

13.2.3.1.15. SARSAPARILLA

13.2.3.1.16. SASSAFRAS

13.2.3.1.17. SPEARMINT

13.2.3.1.18. TEA

13.2.3.1.19. WINTERGREEN

13.2.3.1.20. OTHERS

13.2.4 NUTTY

13.2.4.1. NUTTY, BY TYPE

13.2.4.1.1. ALMOND

13.2.4.1.2. CASHEW

13.2.4.1.3. HAZELNUTMACADAMIA NUT

13.2.4.1.4. PEANUT

13.2.4.1.5. PECANPINE NUT

13.2.4.1.6. PISTACHIO

13.2.4.1.7. WALNUT

13.2.4.1.8. OTHERS

13.2.5 DAIRY

13.2.5.1. DAIRY, BY TYPE

13.2.5.1.1. BAVARIAN CREAM

13.2.5.1.2. BUTTER FLAVOR

13.2.5.1.2.1 MEDIUM BUTTERY FLAVOR NOTES

13.2.5.1.2.2 MEDIUM STRONG BUTTERY FLAVOR NOTES

13.2.5.1.2.3 STRONG BUTTERY FLAVOR NOTES

13.2.5.1.2.4 OTHERS

13.2.5.1.3. CREAM

13.2.5.1.4. CREAM CHEESEICE CREAM

13.2.5.1.5. IRISH CREAM

13.2.5.1.6. MOCHA

13.2.5.1.7. NUTELLA TYPESWEET CREAM

13.2.5.1.8. WHIPPED CREAM

13.2.5.1.9. WHITE CHOCOLATE

13.2.5.1.10. YOGURT TYPE

13.2.5.1.11. OTHERS

13.2.6 VEGETABLE EXTRACTS

13.2.6.1. VEGETABLE EXTRACTS, BY TYPE

13.2.6.1.1. CUCUMBER

13.2.6.1.2. WATERMELON

13.2.6.1.3. GARLIC

13.2.6.1.4. MUSHROOM

13.2.6.1.5. ONION

13.2.6.1.6. TOMATO

13.2.6.1.7. TOMATO BASIL

13.2.6.1.8. OTHERS

13.2.7 CITRUS

13.2.7.1. CITRUS, BY TYPE

13.2.7.1.1. BLOOD ORANGE

13.2.7.1.2. GRAPEFRUIT

13.2.7.1.3. KEY LIMEKUMQUAT

13.2.7.1.4. LEMON

13.2.7.1.5. LIMEMANDARIN ORANGE

13.2.7.1.6. ORANGE

13.2.7.1.7. TANGERINE

13.2.7.1.8. OTHERS

13.2.8 COFFEE

13.2.9 CHOCOLATE

13.2.10 TOFFEE

13.2.11 CARAMEL

13.2.12 DATE DERIVATIVES

13.2.13 VEGETABLE OILS

13.2.14 OTHERS

13.3 FRAGRANCES

13.3.1 ESSENTIAL OILS

13.3.1.1. CITRUS OILS

13.3.1.1.1. LEMON OIL

13.3.1.1.2. ORANGE OIL

13.3.1.1.3. GRAPEFRUIT OIL

13.3.1.1.4. BERGAMOT OIL

13.3.1.1.5. LIME OIL

13.3.1.1.6. TANGERINE OIL

13.3.1.1.7. CITROELLA OIL

13.3.1.1.8. LEMONGRASS OIL

13.3.1.1.9. MANDARIN OIL

13.3.1.1.10. LITSEA CUBEBA OIL

13.3.1.1.11. TAGETES OIL

13.3.1.1.12. OTHERS

13.3.1.2. FLORAL OILS

13.3.1.2.1. CHAMOMILE OIL

13.3.1.2.2. GERANIUM OIL

13.3.1.2.3. JASMINE OIL

13.3.1.2.4. LAVENDER OIL

13.3.1.2.5. NEROLI OIL

13.3.1.2.6. ROSE OIL

13.3.1.2.7. ROSEWOOD OIL

13.3.1.2.8. YLANG-YLANG OIL

13.3.1.2.9. PETITGRAIN OIL

13.3.1.2.10. OTHERS

13.3.1.3. HERBACEOUS OILS

13.3.1.3.1. ANGELICA ROOT OIL

13.3.1.3.2. CLARY SAGE OIL

13.3.1.3.3. EUCALYTUS OIL

13.3.1.3.4. FENNEL OIL

13.3.1.3.5. HYSSOP OIL

13.3.1.3.6. MARJORAM OIL

13.3.1.3.7. MELISSA OIL

13.3.1.3.8. ROSEMARY OIL

13.3.1.3.9. HYME OIL

13.3.1.3.10. OREGANO OIL

13.3.1.3.11. BAY LAUREL OIL

13.3.1.3.12. CATNIP OIL

13.3.1.3.13. SAGE DAMATIAN OIL

13.3.1.3.14. PARSLEY OIL

13.3.1.3.15. TEA TREE OIL

13.3.1.3.16. YARROW OIL

13.3.1.3.17. OTHERS

13.3.1.4. CAMPHORACEOUS OILS

13.3.1.4.1. CAMPHOR OIL

13.3.1.4.2. CAJEPUT OIL

13.3.1.4.3. EUCALYPTUS OIL

13.3.1.4.4. PANNYROYAL OIL

13.3.1.4.5. LAUREL LEAF OIL

13.3.1.4.6. LAVANDIN OIL

13.3.1.4.7. OTHERS

13.3.1.5. MINTY OILS

13.3.1.5.1. SPEARMINT OIL

13.3.1.5.2. WINTERGREEN OIL

13.3.1.5.3. PEPPERMINT OIL

13.3.1.5.4. OTHERS

13.3.1.6. SPICY OILS

13.3.1.6.1. ANISEED OIL

13.3.1.6.2. BASIL OIL

13.3.1.6.3. BLACK PEPPER OIL

13.3.1.6.4. CARDAMON

13.3.1.6.5. CINNAMON OIL

13.3.1.6.6. CORIANDER OIL

13.3.1.6.7. CUMIN OIL

13.3.1.6.8. DINGER OIL

13.3.1.6.9. NUTMEG OIL

13.3.1.6.10. ALLSPICE OIL

13.3.1.6.11. CASSIA OIL

13.3.1.6.12. CLOVE OIL

13.3.1.6.13. OTHERS

13.3.1.7. RESINOUS / MUSKY OILS

13.3.1.7.1. BENZOIN OIL

13.3.1.7.2. ELEMI OIL

13.3.1.7.3. FRANKINCENSE OIL

13.3.1.7.4. MYRRH OIL

13.3.1.7.5. PERU BALSAM OIL

13.3.1.7.6. OTHERS

13.3.1.8. WOODY / EARTHY OILS

13.3.1.8.1. CYPRESS OIL

13.3.1.8.2. JUNIPER BERRY OIL

13.3.1.8.3. PINE OIL

13.3.1.8.4. SANDALWOOD OIL

13.3.1.8.5. FIR OIL

13.3.1.8.6. CADARWOOD OIL

13.3.1.8.7. PALO SANTO OIL

13.3.1.8.8. ROSEWOOD OIL

13.3.1.8.9. VETIVER OIL

13.3.1.8.10. VALERIAN OIL

13.3.1.8.11. CARROT SEED OIL

13.3.1.8.12. OTHERS

13.3.1.9. OTHERS

13.3.2 AROMA CJHEMICALS

13.3.2.1. YLANG-YLANG

13.3.2.2. OPERANIDE

13.3.2.3. VERASPICE

13.3.2.4. TERPENES

13.3.2.5. BENZENOIDS

13.3.2.6. MUSK CHEMICALS

13.3.2.7. 2 ETHYL PYRAZINE

13.3.2.8. ABBAVERT

13.3.2.9. ACETANISOLE

13.3.2.10. ACETOPHENONE

13.3.2.11. ACETYL ISO EUGENOL

13.3.2.12. ADOXAL

13.3.2.13. LINALOOL

13.3.2.14. CITRAL

13.3.2.15. MENTHOL

13.3.2.16. CIS-3 HEXENOL

13.3.2.17. ISONALINE

13.3.2.18. ALCOHOL

13.3.2.19. ALDEHYDE

13.3.2.20. BENZYL ACETATE

13.3.2.21. BENZYL ALCOHOL

13.3.2.22. BENZYL BENZOATE

13.3.2.23. BENZYL BUTYRATE

13.3.2.24. BENZYL PROPIONATE

13.3.2.25. BENZYL SALICYLATE

13.3.2.26. OTHERS

14 GLOBAL FLAVOURS AND FRAGRANCES MARKET, BY FORM, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 FLAVOURS

14.2.1 DRY

14.2.1.1. POWDER

14.2.1.2. FLAKES

14.2.1.3. GRANULES

14.2.1.4. RESINS

14.2.1.5. OTHERS

14.2.2 LIQUID

14.2.2.1. PASTES

14.2.2.2. OILS

14.2.2.3. OTHERS

14.3 FRAGRANCES

14.3.1 LIQUID

14.3.2 GAS

15 GLOBAL FLAVOURS AND FRAGRANCES MARKET, BY NATURE, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 ORGANIC

15.3 CONVENTIONAL

16 GLOBAL FLAVOURS AND FRAGRANCES MARKET, BY INGREDIENT TYPE, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 NATURAL

16.3 SYNTHETIC

17 GLOBAL FLAVOURS AND FRAGRANCES MARKET, BY SOLUBILITY, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 WATER-SOLUBLE

17.3 OIL-SOLUBLE

17.4 FAT DISPERSIBLE

17.5 OTHERS

18 GLOBAL FLAVOURS AND FRAGRANCES MARKET, BY EXTRACTION PROCESS, 2018-2032 (USD MILLION)

18.1 OVERVIEW

18.2 STEAM DISTILLATION

18.3 COLD PRESSING (EXPRESSION)

18.4 SOLVENT EXTRACTION

18.5 CO₂ SUPERCRITICAL FLUID EXTRACTION (SFE)

18.6 HYDRO DISTILLATION

18.7 MACERATION AND ENFLEURAGE

18.8 FERMENTATION

18.9 CHEMICAL SYNTHESIS

18.1 ENZYME-CATALYZED EXTRACTION

18.11 MOLECULAR DISTILLATION

18.12 SOLID-PHASE EXTRACTION

18.13 OTHERS

19 GLOBAL FLAVOURS AND FRAGRANCES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

19.1 OVERVIEW

19.2 FLAVOURS

19.2.1 FOOD AND BEVERAGES

19.2.1.1. FOOD

19.2.1.1.1. DAIRY PRODUCTS

19.2.1.1.1.1 YOGHURT

19.2.1.1.1.2 CHEESE

19.2.1.1.1.3 ICE CREAM

19.2.1.1.1.4 BUTTER & MARGARINE

19.2.1.1.1.5 MILK, CREAMS, SOUR CREAMS, & CREAMERS

19.2.1.1.1.6 DAIRY ALTERNATIVES

19.2.1.1.1.7 OTHERS

19.2.1.1.2. BAKERY

19.2.1.1.2.1 COOKIES & BISCUITS

19.2.1.1.2.2 BREADS & ROLLS

19.2.1.1.2.3 CAKES & PASTRIES

19.2.1.1.2.4 DONUTS

19.2.1.1.2.5 MUFFINS

19.2.1.1.2.6 SNACK, NUTRITION AND PERFORMANCE BARS

19.2.1.1.2.7 DOUGHS & MIXES

19.2.1.1.2.8 CEREAL, GRANOLA, & ENERGY BARS

19.2.1.1.2.9 OTHERS

19.2.1.1.3. CONFECTIONERY

19.2.1.1.3.1 CHOCOLATES

19.2.1.1.3.2 GUMMIES

19.2.1.1.3.3 HARD CANDIES

19.2.1.1.3.4 SUGAR CONFECTIONERY

19.2.1.1.3.5 MIXES & COATINGS

19.2.1.1.3.6 MINTS & GUMS

19.2.1.1.3.7 OTHERS

19.2.1.1.4. PROCESSED FOOD

19.2.1.1.4.1 PASTA

19.2.1.1.4.2 NOODLES

19.2.1.1.4.3 EXTRUDED SNACKS

19.2.1.1.4.4 SOUPS AND SAUCES

19.2.1.1.4.5 PLANT BASED PROTEIN

19.2.1.1.4.6 MEAT

19.2.1.1.4.7 FERMENTED

19.2.1.1.4.8 PREPARED FOODS & MEAL KITS

19.2.1.1.4.9 SNACKS

19.2.1.1.4.10 BATTER & BREADING

19.2.1.1.4.11 MEAT SUBSTITUTES & ALTERNATIVES

19.2.1.1.4.12 PIZZA

19.2.1.1.4.13 SOUPS, STEWS, STOCKS & BROTHS

19.2.1.1.4.14 OTHERS

19.2.1.1.5. BREAKFAST CEREALS

19.2.1.1.6. INFANT FORMULA

19.2.1.1.6.1 GROWING UP MILK

19.2.1.1.6.2 STANDARD INFANT FORMULA

19.2.1.1.6.3 FOLLOW-ON FORMULA

19.2.1.1.6.4 SPECIALITY FORMULA

19.2.1.1.6.5 OTHERS

19.2.1.1.7. SPORTS NUTRITION

19.2.1.1.7.1 SPORTS NUTRITION BAR

19.2.1.1.7.2 SPORTS PROTEIN POWDER

19.2.1.1.7.3 OTHERS

19.2.1.1.8. DRESSINGS AND SEASONINGS

19.2.1.1.8.1 DIPS

19.2.1.1.8.2 DRESSING

19.2.1.1.8.3 FERMENTED

19.2.1.1.8.4 COOKING & PASTA SAUCES

19.2.1.1.8.5 MARINADE

19.2.1.1.8.6 CONDIMENTS & TABLE SAUCES

19.2.1.1.8.7 OTHERS

19.2.1.1.9. DAIRY ALTERNATIVE FOOD

19.2.1.1.10. MEAT & POULTRY PRODUCTS

19.2.1.1.11. OTHERS

19.2.1.2. BEVERAGES

19.2.1.2.1. ALCOHOLIC BEVERAGES

19.2.1.2.1.1 COCKTAILS

19.2.1.2.1.2 BEER & MALT

19.2.1.2.1.3 TTB

19.2.1.2.1.4 SPIRITS

19.2.1.2.1.5 HARD SELTZERS

19.2.1.2.1.6 RTD BEVERAGES

19.2.1.2.1.7 WINE

19.2.1.2.1.8 OTHERS

19.2.1.2.2. NON-ALCOHOLIC BEVERAGES

19.2.1.2.2.1 YOGURT DRINKS

19.2.1.2.2.1.1. PLANT-BASED

19.2.1.2.2.1.2. SOY

19.2.1.2.2.1.3. ALMOND

19.2.1.2.2.1.4. CASHEW

19.2.1.2.2.1.5. RICE

19.2.1.2.2.1.6. COCONUT

19.2.1.2.2.1.7. OTHERS

19.2.1.2.2.1.8. DAIRY-BASED

19.2.1.2.2.1.9. COW

19.2.1.2.2.1.10. BUFFALO

19.2.1.2.2.1.11. GOAT

19.2.1.2.2.1.12. SHEEP

19.2.1.2.2.1.13. OTHERS

19.2.1.2.2.2 JUICES

19.2.1.2.2.3 SODA DRINKS

19.2.1.2.2.4 KOMBUCHA DRINKS

19.2.1.2.2.5 PROBIOTIC WATER

19.2.1.2.2.6 DAIRY BASED DRINKS

19.2.1.2.2.7 CARBONATED SOFT DRINKS

19.2.1.2.2.8 FLAVORED & SPARKLING WATER

19.2.1.2.2.9 RTD BEVERAGES

19.2.1.2.2.10 NUTRITIONAL & MEAL REPLACEMENTS

19.2.1.2.2.11 DRINK MIXES, ELECTROLYTES, ENERGY & SPORTS DRINKS

19.2.1.2.2.12 COFFEE

19.2.1.2.2.13 TEA

19.2.1.2.2.14 OTHERS

19.2.2 PHARMACEUTICALS

19.2.2.1. PHARMACEUTICALS, BY APPLICATION

19.2.2.1.1. GASTROINTESTINAL HEALTH

19.2.2.1.2. IMMUNE SYSTEM MODULATION

19.2.2.1.3. ALLERGY MANAGEMENT

19.2.2.1.4. METABOLIC DISORDERS

19.2.2.1.5. MENTAL HEALTH (PSYCHOBIOTICS)

19.2.2.1.6. CARDIOVASCULAR HEALTH

19.2.2.1.7. INTESTINAL DISORDERS

19.2.2.1.8. LACTOSE INTOLERANCE

19.2.2.1.9. INFLAMMATORY BOWEL DISORDERS

19.2.2.1.10. RESPIRATORY INFECTIONS

19.2.2.1.11. OBESITY

19.2.2.1.12. UROGENITAL INFECTIONS

19.2.2.1.12.1 TYPE-2 DIABETES

19.2.2.1.12.2 CANCER

19.2.2.1.13. ORAL AND DENTAL HEALTH

19.2.2.1.14. OTHERS

19.2.2.2. PHARMACEUTICALS, BY PRODUCT FORM

19.2.2.2.1. TABLETS

19.2.2.2.2. PROBIOTIC DRINKS

19.2.2.2.3. POWDERS

19.2.2.2.4. CAPSULES

19.2.2.2.5. OTHERS

19.2.3 DIETARY SUPPLEMENTS

19.2.3.1. DIETARY SUPPLEMENTS, BY FUNCTION

19.2.3.1.1. IMMUNE HEALTH

19.2.3.1.2. GUT & DIGESTIVE HEALTH

19.2.3.1.3. WOMEN’S HEALTH

19.2.3.1.4. SPORTS FITNESS

19.2.3.1.5. ENERGY & WEIGHT MANAGEMENT

19.2.3.1.6. GENERAL HEALTH

19.2.3.1.7. BONE & JOINT HEALTH

19.2.3.1.8. GASTROINTESTINAL HEALTH

19.2.3.1.9. IMMUNITY

19.2.3.1.10. CARDIAC HEALTH

19.2.3.1.11. DIABETES

19.2.3.1.12. ANTI-CANCER

19.2.3.1.13. SKIN/HAIR/NAILS

19.2.3.1.14. BRAIN/MENTAL HEALTH

19.2.3.1.15. OTHERS

19.2.3.2. DIETARY SUPPLEMENTS, BY PRODUCT FORM

19.2.3.2.1. CHEWABLES & GUMMIES

19.2.3.2.2. SOFT GELS

19.2.3.2.3. CAPSULES

19.2.3.2.4. POWDERS

19.2.3.2.5. OTHERS

19.2.4 ANIMAL NUTRITION

19.2.4.1. ANIMAL NUTRITION, BY CATEGORY

19.2.4.1.1. POULTRY

19.2.4.1.1.1 BROILERS

19.2.4.1.1.2 LAYERS

19.2.4.1.1.3 BREEDERS

19.2.4.1.1.4 CHICKS & POULTS

19.2.4.1.1.5 OTHERS

19.2.4.1.2. RUMINANTS

19.2.4.1.2.1 CALVES

19.2.4.1.2.2 DAIRY CATTLE

19.2.4.1.2.3 BEEF CATTLE

19.2.4.1.2.4 OTHERS

19.2.4.1.3. SWINE

19.2.4.1.3.1 STARTER

19.2.4.1.3.2 GROWER

19.2.4.1.3.3 SOW

19.2.4.1.3.4 OTHERS

19.2.4.1.4. PET

19.2.4.1.4.1 CAT

19.2.4.1.4.2 DOG

19.2.4.1.4.3 RABBIT

19.2.4.1.4.4 HORSE

19.2.4.1.4.5 MICE

19.2.4.1.4.6 OTHERS

19.2.4.1.5. AQUATIC ANIMAL

19.2.4.1.5.1 FISH

19.2.4.1.5.1.1. TILAPIA

19.2.4.1.5.1.2. SALMON

19.2.4.1.5.1.3. CARP

19.2.4.1.5.1.4. TROUT

19.2.4.1.5.1.5. OTHERS

19.2.4.1.5.2 CRUSTACEANS

19.2.4.1.5.2.1. SHRIMP

19.2.4.1.5.2.2. CRABS

19.2.4.1.5.2.3. KRILL

19.2.4.1.5.2.4. OTHERS

19.2.4.1.5.3 MOLLUSKS

19.2.4.1.5.3.1. OYSTERS

19.2.4.1.5.3.2. MUSSELS

19.2.4.1.5.3.3. OTHERS

19.2.4.1.5.4 OTHERS

19.2.4.1.6. OTHERS

19.2.4.2. ANIMAL NUTRITION, BY HEALTH FUNCTION

19.2.4.2.1. FEED INTAKE AND EFFICIENCY

19.2.4.2.2. GUT HEALTH

19.2.4.2.3. NUTRITION

19.2.4.2.4. EGG PRODUCTION & QUALITY

19.2.4.2.5. IMMUNITY

19.2.4.2.6. OTHERS

19.2.5 OTHERS

19.3 FRAGRANCES

19.3.1 COSMETICS AND PERSONAL CARE

19.3.1.1. COSMETICS AND PERSONAL CARE, BY CATEGORY

19.3.1.1.1. FACIAL CARE PRODUCTS

19.3.1.1.1.1 CREAMS & LOTIONS

19.3.1.1.1.2 SERUMS

19.3.1.1.1.3 SCRUBS & MASKS

19.3.1.1.1.4 OTHERS

19.3.1.1.2. HAIR CARE PRODUCTS

19.3.1.1.2.1 SHAMPOO

19.3.1.1.2.2 CONDITIONERS

19.3.1.1.2.3 OTHERS

19.3.1.1.3. MAKE-UP PRODUCTS

19.3.1.1.4. SPRAY PERFUMES

19.3.1.1.4.1 EXTRAIT DE PARFUM

19.3.1.1.4.2 EAU DE PERFUME

19.3.1.1.4.3 EAU DE TOILETTE

19.3.1.1.4.4 EAU DE COLOGNE

19.3.1.1.4.5 EAU FRAICHE

19.3.1.1.4.6 OTHERS

19.3.1.1.5. BODY CARE PRODUCTS

19.3.1.1.6. FINE FRAGRANCES

19.3.1.1.7. DEODORANTS

19.3.1.1.7.1 SPRAY

19.3.1.1.7.2 CREAMS

19.3.1.1.7.3 ROLL-ON

19.3.1.1.7.4 OTHERS

19.3.1.1.8. OTHERS

19.3.2 HOME CARE PRODUCTS

19.3.2.1. HOME CARE PRODUCTS, BY TYPE

19.3.2.1.1. TOILET CARE

19.3.2.1.2. LAUNDRY CARE

19.3.2.1.3. AIR CARE

19.3.2.1.4. BLEACH

19.3.2.1.5. DISHWASHING

19.3.2.1.6. INSECTICIDES

19.3.2.1.7. POLISHES

19.3.2.1.8. SURFACE CARE

19.3.2.1.9. SOAPS

19.3.2.1.10. POWDER DETERGENTS

19.3.2.1.11. LIQUID DETERGENTS

19.3.2.1.12. FABRIC SOFTENERS

19.3.2.1.13. DETERGENT TABLETS

19.3.2.1.14. AIR FRESHNERS

19.3.2.1.15. DIFFUSERS

19.3.2.1.15.1 ACTIVE DIFFUSERS

19.3.2.1.15.2 PASSIVE DIFFUSERS

19.3.2.1.16. SCENTED CANDLES

19.3.2.1.17. FABRIC CONDITIONERS

19.3.2.1.18. PERFUME INFUSED WAX

19.3.2.1.19. OTHERS

20 GLOBAL FLAVOURS AND FRAGRANCES MARKET, BY REGION, 2018-2032 (USD MILLION) (KILO TONS)

GLOBAL FLAVOURS AND FRAGRANCES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 NORTH AMERICA

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

20.2 EUROPE

20.2.1 GERMANY

20.2.2 U.K.

20.2.3 ITALY

20.2.4 FRANCE

20.2.5 SPAIN

20.2.6 SWITZERLAND

20.2.7 NETHERLANDS

20.2.8 BELGIUM

20.2.9 RUSSIA

20.2.10 TURKEY

20.2.11 REST OF EUROPE

20.3 ASIA-PACIFIC

20.3.1 JAPAN

20.3.2 CHINA

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 AUSTRALIA & NEW ZEALAND

20.3.6 SINGAPORE

20.3.7 THAILAND

20.3.8 INDONESIA

20.3.9 MALAYSIA

20.3.10 PHILIPPINES

20.3.11 REST OF ASIA-PACIFIC

20.4 SOUTH AMERICA

20.4.1 BRAZIL

20.4.2 ARGENTINA

20.4.3 REST OF SOUTH AMERICA

20.5 MIDDLE EAST AND AFRICA

20.5.1 SOUTH AFRICA

20.5.2 EGYPT

20.5.3 ISRAEL

20.5.4 UAE

20.5.5 SAUDI ARABIA

20.5.6 REST OF MIDDLE EAST AND AFRICA

21 GLOBAL FLAVOURS MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

21.6 MERGERS & ACQUISITIONS

21.7 NEW PRODUCT DEVELOPMENT & APPROVALS

21.8 EXPANSIONS & PARTNERSHIP

21.9 REGULATORY CHANGES

22 GLOBAL FRAGRANCES MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

22.6 MERGERS & ACQUISITIONS

22.7 NEW PRODUCT DEVELOPMENT & APPROVALS

22.8 EXPANSIONS & PARTNERSHIP

22.9 REGULATORY CHANGES

23 GLOBAL FLAVOURS AND FRAGRANCES MARKET, SWOT & DBMR ANALYSIS

24 GLOBAL FLAVOURS AND FRAGRANCES MARKET, COMPANY PROFILES

24.1 DSM

24.1.1 COMPANY SNAPSHOT

24.1.2 REVENUE ANALYSIS

24.1.3 PRODUCT PORTFOLIO

24.1.4 RECENT UPDATES

24.2 ADM

24.2.1 COMPANY SNAPSHOT

24.2.2 REVENUE ANALYSIS

24.2.3 PRODUCT PORTFOLIO

24.2.4 RECENT UPDATES

24.3 GIVAUDAN

24.3.1 COMPANY SNAPSHOT

24.3.2 REVENUE ANALYSIS

24.3.3 PRODUCT PORTFOLIO

24.3.4 RECENT UPDATES

24.4 KERRY GROUP PLC

24.4.1 COMPANY SNAPSHOT

24.4.2 REVENUE ANALYSIS

24.4.3 PRODUCT PORTFOLIO

24.4.4 RECENT UPDATES

24.5 IFF

24.5.1 COMPANY SNAPSHOT

24.5.2 REVENUE ANALYSIS

24.5.3 PRODUCT PORTFOLIO

24.5.4 RECENT UPDATES

24.6 T.HASEGAWA INC.

24.6.1 COMPANY SNAPSHOT

24.6.2 REVENUE ANALYSIS

24.6.3 PRODUCT PORTFOLIO

24.6.4 RECENT UPDATES

24.7 SYMRISE

24.7.1 COMPANY SNAPSHOT

24.7.2 REVENUE ANALYSIS

24.7.3 PRODUCT PORTFOLIO

24.7.4 RECENT UPDATES

24.8 MANE

24.8.1 COMPANY SNAPSHOT

24.8.2 REVENUE ANALYSIS

24.8.3 PRODUCT PORTFOLIO

24.8.4 RECENT UPDATES

24.9 CORBION

24.9.1 COMPANY SNAPSHOT

24.9.2 REVENUE ANALYSIS

24.9.3 PRODUCT PORTFOLIO

24.9.4 RECENT UPDATES

24.1 TAIYO INTERNATIONAL

24.10.1 COMPANY SNAPSHOT

24.10.2 REVENUE ANALYSIS

24.10.3 PRODUCT PORTFOLIO

24.10.4 RECENT UPDATES

24.11 SOLVAY

24.11.1 COMPANY SNAPSHOT

24.11.2 REVENUE ANALYSIS

24.11.3 PRODUCT PORTFOLIO

24.11.4 RECENT UPDATES

24.12 SYNERGY FLAVORS

24.12.1 COMPANY SNAPSHOT

24.12.2 REVENUE ANALYSIS

24.12.3 PRODUCT PORTFOLIO

24.12.4 RECENT UPDATES

24.13 BELL FLAVORS AND FRAGRANCES, INC.

24.13.1 COMPANY SNAPSHOT

24.13.2 REVENUE ANALYSIS

24.13.3 PRODUCT PORTFOLIO

24.13.4 RECENT UPDATES

24.14 TAKASAGO INTERNATIONAL CORPORATION

24.14.1 COMPANY SNAPSHOT

24.14.2 REVENUE ANALYSIS

24.14.3 PRODUCT PORTFOLIO

24.14.4 RECENT UPDATES

24.15 CARGILL, INCORPORATED

24.15.1 COMPANY SNAPSHOT

24.15.2 REVENUE ANALYSIS

24.15.3 PRODUCT PORTFOLIO

24.15.4 RECENT UPDATES

24.16 MCCORMICK & COMPANY, INC

24.16.1 COMPANY SNAPSHOT

24.16.2 REVENUE ANALYSIS

24.16.3 PRODUCT PORTFOLIO

24.16.4 RECENT UPDATES

24.17 SENSIENT TECHNOLOGIES CORPORATION

24.17.1 COMPANY SNAPSHOT

24.17.2 REVENUE ANALYSIS

24.17.3 PRODUCT PORTFOLIO

24.17.4 RECENT UPDATES

24.18 ABELEI INC

24.18.1 COMPANY SNAPSHOT

24.18.2 REVENUE ANALYSIS

24.18.3 PRODUCT PORTFOLIO

24.18.4 RECENT UPDATES

24.19 AROMATICS + FLAVORS INC

24.19.1 COMPANY SNAPSHOT

24.19.2 REVENUE ANALYSIS

24.19.3 PRODUCT PORTFOLIO

24.19.4 RECENT UPDATES

24.2 BLUE PACIFIC FLAVORS

24.20.1 COMPANY SNAPSHOT

24.20.2 REVENUE ANALYSIS

24.20.3 PRODUCT PORTFOLIO

24.20.4 RECENT UPDATES

24.21 PRINOVA GROUP

24.21.1 COMPANY SNAPSHOT

24.21.2 REVENUE ANALYSIS

24.21.3 PRODUCT PORTFOLIO

24.21.4 RECENT UPDATES

24.22 FLAVORCHEM CORPORATION

24.22.1 COMPANY SNAPSHOT

24.22.2 REVENUE ANALYSIS

24.22.3 PRODUCT PORTFOLIO

24.22.4 RECENT UPDATES

24.23 KINDRED GROUP PLC

24.23.1 COMPANY SNAPSHOT

24.23.2 REVENUE ANALYSIS

24.23.3 PRODUCT PORTFOLIO

24.23.4 RECENT UPDATES

24.24 FLUTTER ENTERTAINMENT PLC

24.24.1 COMPANY SNAPSHOT

24.24.2 REVENUE ANALYSIS

24.24.3 PRODUCT PORTFOLIO

24.24.4 RECENT UPDATES

24.25 EMSA

24.25.1 COMPANY SNAPSHOT

24.25.2 REVENUE ANALYSIS

24.25.3 PRODUCT PORTFOLIO

24.25.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 RELATED REPORTS

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.