Global Empty Capsules Market

Market Size in USD Billion

CAGR :

%

USD

3.28 Billion

USD

6.26 Billion

2024

2032

USD

3.28 Billion

USD

6.26 Billion

2024

2032

| 2025 –2032 | |

| USD 3.28 Billion | |

| USD 6.26 Billion | |

|

|

|

|

Empty Capsules Market Size

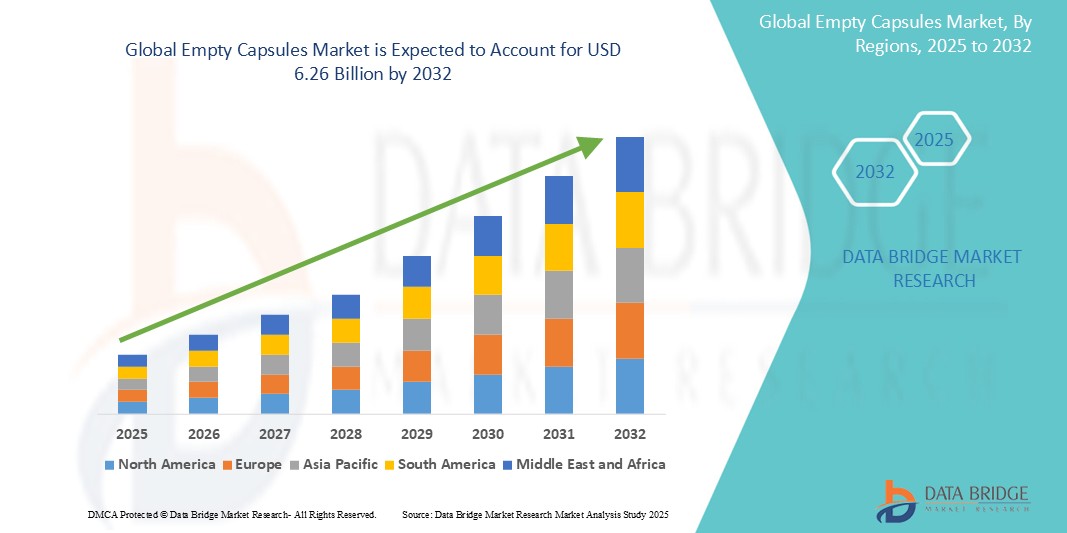

- The global empty capsules market size was valued at USD 3.28 billion in 2024 and is expected to reach USD 6.26 billion by 2032, at a CAGR of 8.40% during the forecast period

- This growth is driven by factors such as the increasing demand for oral drug delivery, a rise in chronic diseases requiring capsule-based medication, and the growing preference for vegetarian capsules due to health and sustainability trends

Empty Capsules Market Analysis

- Empty capsules are widely used in the pharmaceutical industry for the delivery of drugs in solid form, with growing demand for oral drug delivery systems. They offer advantages such as ease of use, precise dosage, and flexibility in formulation, making them essential for both traditional and advanced drug delivery

- The increasing demand for dietary supplements, coupled with the rising prevalence of chronic diseases and the need for efficient drug delivery, is driving market growth

- North America is expected to dominate the empty capsules market with largest market share of 34.8%, due to advanced pharmaceutical manufacturing capabilities, a well-established healthcare infrastructure, and increasing adoption of capsule-based drug delivery systems

- Asia-Pacific is expected to be the fastest growing region in the empty capsules market during the forecast period due to rising awareness about health and wellness, growing pharmaceutical manufacturing hubs, and increasing demand for capsules in emerging economies

- Gelatine capsules segment is expected to dominate the market with a largest market share of 73.6% due to their rapid dissolution rates, ensuring quick release and absorption of active ingredients. This characteristic is particularly advantageous for medications and supplements requiring fast action

Report Scope and Empty Capsules Market Segmentation

|

Attributes |

Empty Capsules Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Empty Capsules Market Trends

“Growing Demand for Plant-Based and Vegetarian Capsules”

- One prominent trend in the global empty capsules market is the growing demand for plant-based and vegetarian capsules, driven by the increasing consumer preference for plant-based, halal, and vegan products

- These innovations cater to the rising awareness of ethical consumption, dietary restrictions, and environmental concerns. Plant-based capsules, such as those made from Hydroxypropyl Methylcellulose (HPMC) or pullulan, offer an alternative to traditional gelatin capsules, appealing to a broader consumer base

- For instance, the growing adoption of plant-based capsules in pharmaceutical and nutraceutical applications aligns with the increasing demand for clean-label products that meet health-conscious consumer preferences

- This shift towards plant-based capsules is transforming the empty capsules market by creating new opportunities for manufacturers to innovate and expand their product offerings. As a result, plant-based capsules are expected to play a pivotal role in the future growth and diversification of the market

Empty Capsules Market Dynamics

Driver

“Growing Demand for Dietary Supplements and Nutraceuticals”

- The increasing consumer awareness regarding health and wellness, along with a rising preference for preventive healthcare, is driving the demand for dietary supplements and nutraceuticals, significantly contributing to the growth of the global empty capsules market

- As the global population becomes more health-conscious, the consumption of vitamins, minerals, and functional foods has grown, leading to an increased need for efficient and reliable capsule delivery systems

For instance,

- In according to a report by Grand View Research, the global dietary supplement market is expected to reach USD 230.73 billion by 2027, which is fueling the demand for high-quality empty capsules used in the packaging of these products

- As more individuals turn to supplements for overall health improvement and disease prevention, the demand for empty capsules is expected to rise, ensuring effective delivery of active ingredients and driving growth in the market

Opportunity

“Rising Demand for Personalized Medicine”

- The increasing focus on personalized medicine, which tailors treatments and therapies to individual patients based on their genetic makeup, is creating significant opportunities in the global empty capsules market

- As personalized medicine becomes more prevalent in both pharmaceutical and nutraceutical applications, the demand for customized capsule solutions, such as tailored dosage forms and capsule coatings, is growing

For instance,

- In with the rise of personalized drug regimens, capsule manufacturers are exploring ways to develop capsules with specific release profiles, improved bioavailability, and compatibility with individual treatment needs

- The growing trend toward personalized healthcare presents a unique market opportunity for capsule manufacturers to innovate and expand their product offerings, contributing to the market's overall growth as personalized treatment solutions become increasingly popular

Restraint/Challenge

“Stringent Regulatory Requirements”

- The complex and stringent regulatory landscape for the manufacturing and distribution of empty capsules poses a significant challenge for the global empty capsules market, particularly for new entrants and small manufacturers

- Regulatory requirements, such as adherence to Good Manufacturing Practices (GMP), safety standards, and approval processes for materials used in capsule production, increase production costs and time-to-market

For instance,

- In regions such as the U.S. and Europe, the strict regulations imposed by agencies such as the FDA and EMA ensure that capsules meet specific quality and safety standards, which can be challenging for manufacturers, especially those working with new materials such as plant-based or biodegradable capsules

- These regulatory challenges can limit the flexibility of manufacturers, increase operational costs, and slow down the adoption of innovative capsule technologies, thereby hindering the overall growth and expansion of the market

Empty Capsules Market Scope

The market is segmented on the basis of type, functionality, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Functionality |

|

|

By Application |

|

|

By End User |

|

In 2025, the gelatine capsules is projected to dominate the market with a largest share in type segment

The gelatine capsules segment is expected to dominate the empty capsules market with the largest share of 73.6% due to their rapid dissolution rates, ensuring quick release and absorption of active ingredients. This characteristic is particularly advantageous for medications and supplements requiring fast action

The antibiotic and antibacterial drugs is expected to account for the largest share during the forecast period in application segment

In 2025, the antibiotic and antibacterial drugs segment is expected to dominate the market with the largest market share of 54.6% due to the increasing prevalence of bacterial infections, such as respiratory, urinary tract, and skin infections, is a major driver of demand for these drugs. Broad-spectrum antibiotics, which are effective against a wide range of bacteria, are particularly sought after for their versatility in treating various infections

Empty Capsules Market Regional Analysis

“North America Holds the Largest Share in the Empty Capsule Market”

- North America dominates the global empty capsules market with largest market share of 34.8%, driven by its advanced healthcare infrastructure, high demand for dietary supplements, and significant presence of leading capsule manufacturers

- The U.S. holds a substantial market share of 40%, due to the increasing prevalence of chronic diseases and the rising consumer interest in health supplements, which are fueling the demand for empty capsules. Additionally, a well-established regulatory framework and high disposable income contribute to the growth of the market in this region

- The growing trend toward plant-based and vegetarian capsules, coupled with ongoing innovations in capsule formulations, further strengthens North America’s position as a market leader

- Moreover, the rising consumer awareness regarding the benefits of nutraceuticals and supplements, coupled with increasing investments by manufacturers in research & development, continues to support market growth in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Empty Capsule Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the global empty capsules market, driven by rapid advancements in healthcare infrastructure, increasing health awareness, and rising consumer demand for dietary supplements

- Countries such as China, India, and Japan are emerging as key markets for empty capsules, with a large population base and growing focus on health and wellness, leading to an increased demand for nutraceutical products

- In particular, China and India, with their expanding middle class and rising disposable income, are becoming major hubs for both the production and consumption of empty capsules, contributing to the rapid growth of the market

- The increasing government initiatives promoting health and wellness, along with the expanding presence of global capsule manufacturers, is further boosting market expansion across the region

Empty Capsules Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ACG. (India)

- CapsCanada (Canada)

- Bright Pharma Caps (US)

- Lonza (Switzerland)

- SavoiurCaps (India)

- Comed Chemicals Limited. (India)

- NATURAL CAPSULES LIMITED (India)

- Wuhan Carma Technology Co., Ltd. (China)

- Goerlich Pharma GmbH (Germany)

- NecLife Lifesciences Ltd (India)

- HealthCaps India Ltd. (India)

- Erawat Pharma Limited. (India)

- QUALICAPS (US)

- SUHEUNG co., ltd. (South Korea)

- Fortcaps. (India)

- SNAIL PHARMA INDUSTRY. (China)

- Roxlor (US)

- Sunil Healthcare Limited. (India)

- H & CARE Incorp. (India)

- Shaoxing kangke capsule co ltd (China)

Latest Developments in Global Empty Capsules Market

- In March 2024, Lonza entered into an agreement with Roche to acquire Genentech's biologics manufacturing facility in California for over USD 1 billion. This acquisition is poised to significantly bolster Lonza’s biologics manufacturing capabilities, positioning the site as one of the largest in the world. This strategic move by Lonza is contributes to the global empty capsules market, as the demand for biologics, particularly in the pharmaceutical and nutraceutical sectors, continues to rise

- In March 2023, VANTAGE NUTRITION, a subsidiary of ACG, acquired ComboCap, Inc. in the United States and BioCap in South Africa, with the strategic aim of expanding its technological capabilities and global presence, particularly in North America. This acquisition reflects the growing demand for advanced capsule technologies, particularly in North America and emerging markets. By integrating ComboCap and BioCap’s expertise, VANTAGE NUTRITION is well-positioned to meet the increasing need for high-quality capsule solutions across various pharmaceutical and nutraceutical sector

- In January 2022, Xi'an Le-Nutra Ingredients Inc. successfully shipped 8.0 million HPMC capsules to Latvia, Europe, without the inclusion of titanium dioxide (TiO2). This move underscores the company's commitment to addressing the growing demand for clean-label, TiO2-free capsules in the region. This development highlights the increasing consumer and regulatory preference for natural, clean-label products

- In July 2020, QUALICAPS Group, previously a part of Mitsubishi Chemical Holdings Corporation (MCHC), transitioned to Mitsubishi Chemical Corporation (MCC). This strategic shift enables QUALICAPS to capitalize on MCC’s extensive network, thereby enhancing its capacity to expand and strengthen its position in the global capsule market. This transition highlights QUALICAPS’ strategic efforts to leverage MCC’s resources and global reach. By tapping into this expanded network, QUALICAPS is well-positioned to meet the growing demand for high-quality capsules across various pharmaceutical and nutraceutical sector

- In June 2020, Lonza launched DBcaps, a double-blinded HPMC capsule specifically designed for clinical trials. This innovative product aims to address the challenges associated with clinical testing by providing an effective solution for maintaining trial integrity and ensuring unbiased results. This development underscores the increasing demand for specialized, high-quality capsules in clinical research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.