Global Cosmetic Pigments Market

Market Size in USD Billion

CAGR :

%

USD

704.34 Billion

USD

1,424.17 Billion

2024

2032

USD

704.34 Billion

USD

1,424.17 Billion

2024

2032

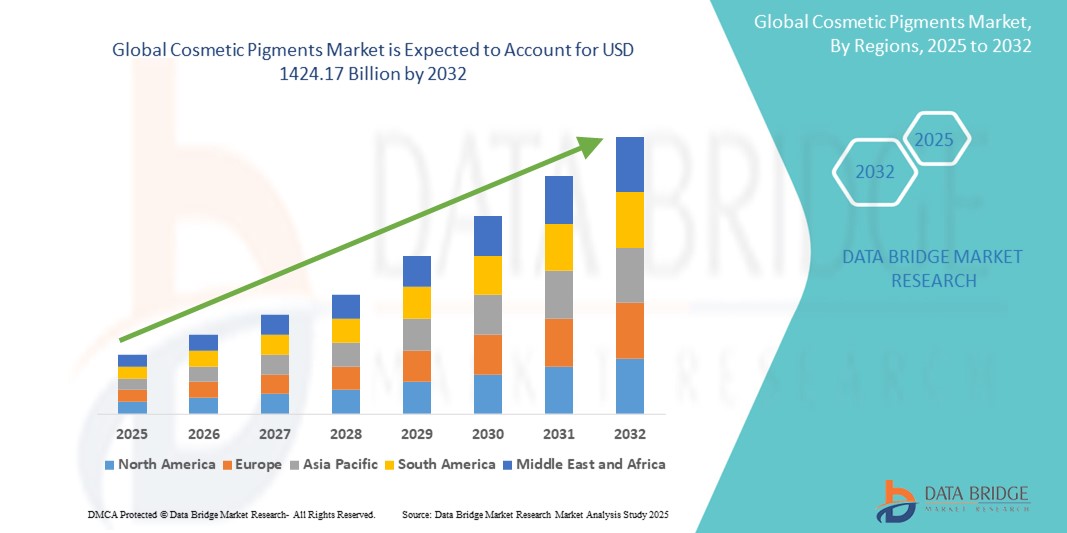

| 2025 –2032 | |

| USD 704.34 Billion | |

| USD 1,424.17 Billion | |

|

|

|

|

Cosmetic Pigments Market Size

- The global cosmetic pigments market size was valued at USD 704.34 billion in 2024 and is expected to reach USD 1,424.17 billion by 2032, at a CAGR of 9.20% during the forecast period

- This growth is driven by factors such as rising demand for natural and sustainable products, technological innovations in pigment formulation and influence of social media and beauty trends

Cosmetic Pigments Market Analysis

- Cosmetic pigments are essential components in various beauty and personal care products, providing color, texture, and visual appeal. They are widely used in products such as facial makeup, eye makeup, lip products, nail enamels, and hair colorants

- The demand for cosmetic pigments is significantly driven by the increasing consumer preference for natural and organic products, as well as the rising awareness of personal grooming and beauty trends. Technological advancements in pigment formulation have also enhanced product performance and safety

- North America is expected to dominate the global cosmetic pigments market, accounting for 41.6% of the market share. This dominance is driven by high consumer spending, significant expenditure on premium cosmetic products, regulatory standards stringent regulations ensuring product safety and quality and market innovation, continuous innovation in cosmetic formulations and packaging

- Asia-Pacific is expected to be the fastest growing region in the cosmetic pigments market, with an estimated CAGR of 8.92%, driven by rising disposable incomes, urbanization, and awareness and demand

- Inorganic pigments segment is expected to dominate the market with a market share of 68.7%, owing to their superior stability, opacity, and safety profile. These pigments, including titanium dioxide and iron oxides, are extensively utilized in various cosmetic applications such as foundations, eye makeup, and facial makeup due to their excellent color strength and non-toxic nature

Report Scope and Cosmetic Pigments Segmentation

|

Attributes |

Cosmetic Pigments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmetic Pigments Market Trends

“Advancements in Cosmetic Pigments: Driving Innovation in Beauty Products”

- A prominent trend in the cosmetic pigments market is the increasing consumer demand for natural and sustainable ingredients. This shift is driven by heightened awareness of health and environmental concerns, leading manufacturers to invest in research and development of non-toxic, biodegradable, and allergen-free pigment alternatives that align with consumer preferences

- Technological advancements have led to the development of specialty pigments with unique properties such as color-shifting, pearlescent, and iridescent effects. These innovations enable cosmetic manufacturers to create distinctive and trend-setting formulations that stand out in the competitive beauty market

- For instance, The Unseen Beauty has developed a sustainable, non-toxic black algae colorant used in products such as mascara and eyeliner, offering an eco-friendly alternative to traditional carbon black pigments

- Facial makeup is anticipated to be the leading application segment in the cosmetic pigments market, driven by the high demand for products such as foundations, concealers, and blushes. The segment benefits from continuous product innovations, the popularity of multifunctional cosmetics, and the influence of social media on beauty trends.

Cosmetic Pigments Market Dynamics

Driver

“Rising Demand for Natural and Sustainable Cosmetic Pigments”

- The increasing consumer preference for natural and eco-friendly beauty products is a significant driver of the cosmetic pigments market.

- Manufacturers are responding by investing in research and development to create pigments derived from natural sources such as plant extracts, minerals, and food ingredients

- The adoption of sustainable pigments not only caters to consumer demand but also enhances brand value and market competitiveness

For instance,

- The Unseen Beauty has developed a sustainable, non-toxic black algae colorant used in products such as mascara and eyeliner, offering an eco-friendly alternative to traditional carbon black pigments

- The shift towards natural and sustainable pigments is reshaping the cosmetic pigments market, aligning with consumer values and environmental considerations

Opportunity

“Innovation in Specialty Pigments for Enhanced Cosmetic Effects”

- Advancements in pigment technology have led to the development of specialty pigments that offer unique visual effects, such as color-shifting, pearlescent, and iridescent finishes

- The demand for high-performance pigments that provide long-lasting effects, superior texture, and excellent coverage is growing

For instance,

- DayGlo Color Corp. introduced Elara Luxe, a plant-based fluorescent pigment that delivers vibrant colors while prioritizing environmental friendliness

- Innovative specialty pigments are driving product differentiation and meeting evolving consumer preferences in the cosmetics industry

Restraint/Challenge

“Stringent Regulatory Standards and Compliance Challenges”

- The cosmetic pigments market faces significant challenges due to stringent regulations governing the safety and use of color additives in cosmetic products

- Compliance with these regulations necessitates extensive testing and validation processes, increasing the time and cost associated with product development

- In addition, the variability in regulations across different regions complicates the global distribution of cosmetic products

For instance,

- The European Union's restrictions on the use of lead and cadmium-based pigments due to environmental and health concerns have compelled manufacturers to seek alternative, compliant ingredients, potentially increasing production costs and affecting product formulations

- Navigating complex regulatory landscapes remains a significant hurdle for cosmetic pigment manufacturers, impacting global market expansion and innovation

Cosmetic Pigments Market Scope

The market is segmented on the basis of composition, type and application.

|

Segmentation |

Sub-Segmentation |

|

By Composition |

|

|

By Type |

|

|

By Application |

|

In 2025, the inorganic pigment is projected to dominate the market with a largest share in component segment

The inorganic pigments segment is expected to dominate the cosmetic pigments market with the largest share of 68.7% in 2025, owing to their superior stability, opacity, and safety profile. These pigments, including titanium dioxide and iron oxides, are extensively utilized in various cosmetic applications such as foundations, eye makeup, and facial makeup due to their excellent color strength and non-toxic nature. Their long-lasting color properties and compatibility with skin-friendly formulations align with the growing demand for clean and sustainable beauty products, thereby driving market growth.

The facial makeup is expected to account for the largest share during the forecast period in application market

In 2025, the facial makeup segment is expected to dominate the cosmetic pigments market with the largest share of 36.6%, driven by the increasing demand for foundational products such as foundations, face powders, and blushers. This segment's prominence is attributed to the growing consumer preference for products that offer enhanced coverage, longer wear, and improved skin compatibility. Innovations in pigment technologies have further bolstered the appeal of facial makeup products, aligning with the rising focus on facial aesthetics and the influence of social media beauty trends.

Cosmetic Pigments Market Regional Analysis

“North America Holds the Largest Share in the Cosmetic Pigments Market”

- North America dominates the global cosmetic pigments market, accounting for 41.6% of the market share. This dominance is driven by high consumer spending, significant expenditure on premium cosmetic products, regulatory standards stringent regulations ensuring product safety and quality and market innovation, continuous innovation in cosmetic formulations and packaging

- U.S leads the North American market, commanding approximately 83.2% of the share driven be premium product demand high demand for luxury and organic cosmetic products, E-commerce Growth, expansion of online retail channels and sustainability trends, increasing focus on eco-friendly and cruelty-free products

“Asia-Pacific is Projected to Register the Highest CAGR in the Cosmetic Pigments Market”

- Asia-Pacific is expected to witness the highest growth rate in the cosmetic pigments market, with an estimated CAGR of 8.92%, is driven by rising disposable incomes, urbanization, and awareness and demand

- China dominates the regional market, holding 62.3% of the Asia-Pacific market share, driven by large manufacturing base, premium product demand

- India is projected to register the highest CAGR of 5.72% in the Asia-Pacific market, driven by celebrity influence, diverse market and urbanization

Cosmetic Pigments Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Merck KGaA (Germany)

- BASF (Germany)

- CLARIANT (Switzerland)

- Sun Chemical (U.S.)

- Sensient Technologies Corporation (U.S.)

- DIC CORPORATION (Japan)

- Sudarshan Chemical Industries Limited (India)

- Neelikon Food Dyes And Chemicals Limited (India)

- LANXESS (Germany)

- Kobo Dynamic (U.S.)

- GEOTECH (The Netherlands)

- Venator Materials PLC (U.K.)

- Croda International Plc (U.K.)

- METRO CHEM INDUSTRIES (India)

- Koel Colours Private Limited (India)

Latest Developments in Global Cosmetic Pigments Market

- In January 2025, Germany's Merck KGaA announced the sale of its Surface Solutions pigments unit to China's Global New Material International (GNMI) for EUR 665 million (approximately USD 721 million). This unit specializes in pigments that provide pearlescent and metallic effects in cosmetics. The deal is expected to close in 2025, with Merck planning to reinvest the proceeds into its core businesses, particularly materials for chip production

- In March 2025, DayGlo Color Corp., a pigment manufacturer based in Cleveland, Ohio, launched a new class of fluorescent pigments derived from rice protein. These pigments are developed using a blend of host polymers and fluorescent dyes, aiming to optimize both fluorescent qualities and functional product properties

- In March 2025, Sun Chemical introduced new effect pigments, highlighting its commitment to providing colorful and sustainable solutions to the beauty sector. The launch emphasized natural colorants and components, aligning with the industry's shift towards eco-friendly products

- In October 2023, the European Union implemented a ban on microplastics, effective October 17, 2023, as part of their Green Deal aiming for climate neutrality by 2050. This ban impacts the sale of microplastics in consumer products, such as cosmetics and detergents, and specifically targets certain types of glitter. Loose plastic glitter commonly used for crafting or cosmetic purposes is banned, while glitter made from biodegradable, natural, or water-soluble materials, as well as metal or glass, is allowed. Despite the ban, retailers are not required to dispose of existing stock, which can continue to be sold until exhausted. Glitter used in makeup, lip, and nail products can be sold until October 16, 2035, if labeled appropriately

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.