Global Companion Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

8.00 Billion

USD

22.58 Billion

2024

2032

USD

8.00 Billion

USD

22.58 Billion

2024

2032

| 2025 –2032 | |

| USD 8.00 Billion | |

| USD 22.58 Billion | |

|

|

|

|

Companion Diagnostics Market Size

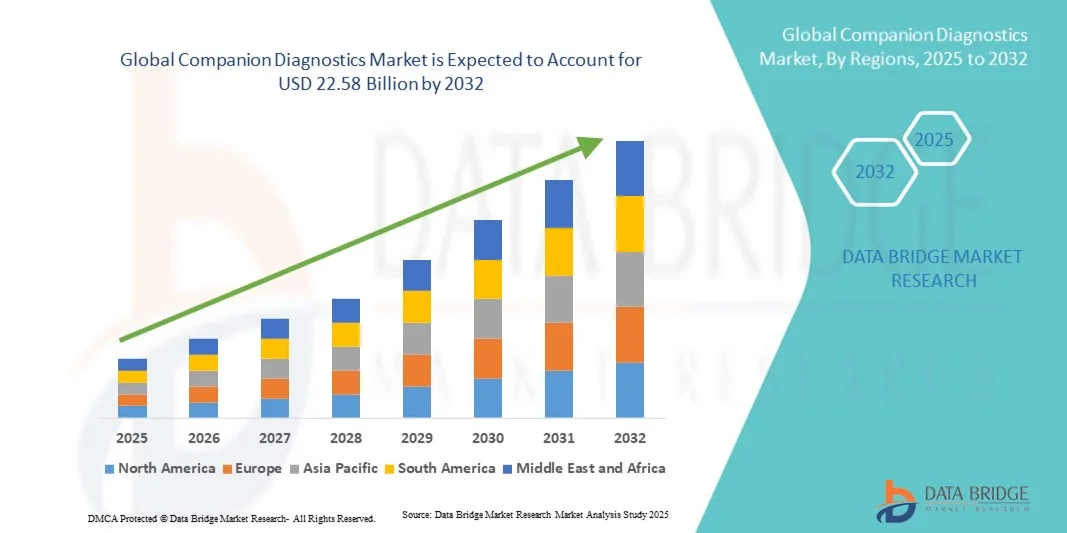

- The global companion diagnostics market size was valued at USD 8.00 billion in 2024 and is expected to reach USD 22.58 billion by 2032, at a CAGR of 13.85% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancements in personalized medicine, leading to enhanced precision in disease diagnosis and treatment

- Furthermore, rising demand from healthcare providers and patients for accurate, efficient, and targeted diagnostic solutions is positioning companion diagnostics as a critical tool in modern healthcare. These converging factors are accelerating the uptake of companion diagnostic solutions, thereby significantly boosting the industry's growth

Companion Diagnostics Market Analysis

- Companion diagnostics, offering personalized testing solutions to guide targeted therapies, are increasingly vital components of modern healthcare due to their ability to improve treatment outcomes and support precision medicine initiatives

- The escalating demand for companion diagnostics is primarily fueled by the rising prevalence of chronic and complex diseases, growing adoption of targeted therapies, and increasing awareness among healthcare providers and patients about personalized medicine

- North America dominated the companion diagnostics market with the largest revenue share of 40.5% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, high disposable incomes, and a strong presence of key industry players. The U.S. experienced substantial growth in companion diagnostics installations, particularly in hospitals, clinics, and diagnostic centers, fueled by innovations from both established companies and startups focusing on AI-enabled and precision medicine solutions

- Asia-Pacific is expected to be the fastest-growing region in the companion diagnostics market during the forecast period, owing to increasing urbanization, rising prevalence of chronic diseases, expanding healthcare infrastructure, and growing access to advanced diagnostic technologies in countries such as China, India, and Japan

- The Oncology segment dominated the companion diagnostics market with a revenue share of 46.3% in 2024, driven by the rising global prevalence of cancer and the increasing adoption of targeted therapies that require companion diagnostic testing

Report Scope and Companion Diagnostics Market Segmentation

|

Attributes |

Companion Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Companion Diagnostics Market Trends

Enhanced Precision and Personalized Healthcare Solutions

- A significant and accelerating trend in the global companion diagnostics market is the growing integration of advanced molecular testing, genomic profiling, and biomarker-driven analysis to support personalized medicine. This trend enables healthcare providers to tailor therapies to individual patient profiles, improving treatment outcomes and reducing adverse effects

- For instance, the approval of HER2-targeted therapies in breast cancer has been closely coupled with companion diagnostic tests, ensuring only eligible patients receive the treatment, which maximizes efficacy and minimizes unnecessary exposure. Similarly, EGFR mutation testing in non-small cell lung cancer patients allows oncologists to select the most effective targeted therapies based on specific genetic markers

- Companion diagnostics are increasingly integrated with next-generation sequencing (NGS) and digital pathology platforms, allowing comprehensive patient profiling and streamlined workflow in clinical laboratories. These innovations enable earlier and more accurate disease detection, monitoring of disease progression, and timely adjustments to treatment plans

- The expansion of precision medicine programs and growing collaborations between pharmaceutical companies and diagnostic providers are driving the adoption of companion diagnostics across therapeutic areas such as oncology, cardiology, and immunology

- This trend towards highly personalized, data-driven healthcare is reshaping patient management, enabling clinicians to deliver optimized therapies and improve overall outcomes. Consequently, companies such as Roche, Qiagen, and Thermo Fisher are advancing their portfolio of companion diagnostic solutions with enhanced sensitivity, multiplexing capabilities, and automation

- The demand for companion diagnostics is growing rapidly across both developed and emerging markets, as healthcare systems increasingly focus on precision medicine, treatment efficacy, and cost optimization in patient care

Companion Diagnostics Market Dynamics

Driver

Rising Adoption of Targeted Therapies and Personalized Medicine

- The increasing prevalence of chronic diseases and cancer, coupled with the growing adoption of targeted therapies and precision medicine, is a key driver for the companion diagnostics market

- For instance, in March 2025, Roche launched an expanded portfolio of companion diagnostic tests for oncology patients, enabling personalized treatment selection and improving patient outcomes. Such strategic developments by leading diagnostic companies are expected to accelerate market growth during the forecast period

- Healthcare providers are increasingly relying on companion diagnostics to identify eligible patients for specific therapies, reduce trial-and-error treatments, and improve overall clinical outcomes

- Furthermore, the increasing focus on early disease detection, biomarker identification, and risk stratification in personalized medicine is boosting demand for advanced diagnostic assays

- Technological advancements, such as multiplex assays, digital pathology integration, and automated platforms, are making companion diagnostics faster, more accurate, and cost-effective, further encouraging adoption in hospitals, oncology centers, and clinical laboratories worldwide

Restraint/Challenge

High Cost, Regulatory Complexity, and Limited Awareness

- The high cost of companion diagnostic tests and the associated targeted therapies can limit adoption, particularly in price-sensitive markets and developing regions

- Regulatory complexities and varying approval pathways across countries pose a challenge for the widespread commercialization of companion diagnostics, as companies must comply with stringent validation and clinical evidence requirements

- In addition, limited awareness among healthcare providers and patients regarding the benefits and applications of companion diagnostics can impede market penetration

- The need for specialized laboratory infrastructure and trained personnel to perform and interpret companion diagnostic tests can be a barrier for smaller clinics and emerging healthcare facilities

- Inconsistent reimbursement policies across regions and limited coverage by insurance providers further constrain the adoption of companion diagnostics, particularly in emerging economies

- Data privacy and ethical concerns related to genomic and biomarker testing can create hesitancy among patients and healthcare providers, impacting market growth

- Challenges in standardizing diagnostic assays, harmonizing test sensitivity and specificity, and ensuring reproducibility across laboratories can slow widespread implementation

- Addressing these challenges requires robust clinical validation, simplified regulatory pathways, enhanced healthcare provider education, and greater investment in accessible and cost-effective testing solutions. Strategic initiatives, including public-private partnerships and government incentives, will also be crucial to overcoming adoption barriers and sustaining market growth

Companion Diagnostics Market Scope

The market is segmented on the basis of product and services, technology, indication, application, and end users.

- By Product and Services

On the basis of product and services, the companion diagnostics market is segmented into assay kits and reagents and software & services. The Assay Kits and Reagents segment dominated the market with a revenue share of 44.1% in 2024, driven by the increasing adoption of biomarker testing and personalized medicine initiatives. These kits enable precise patient stratification for targeted therapies and facilitate early disease detection. The segment’s demand is further fueled by the rising prevalence of chronic diseases and oncology cases, coupled with growing healthcare budgets in developed and emerging regions. Continuous innovations, such as multi-analyte panels and high-sensitivity assays, enhance the clinical utility of assay kits, while strict regulatory approvals ensure reliability and safety. Emerging markets, particularly in Asia-Pacific and Latin America, are increasingly deploying these kits in hospitals, diagnostic centers, and research laboratories to improve access to advanced testing. Moreover, partnerships between diagnostic manufacturers and pharmaceutical companies for companion testing in clinical trials are driving adoption. Environmental sustainability and cost-effectiveness of bulk assay kits also support market growth.

The Software & Services segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032. This segment includes bioinformatics tools, data analytics platforms, and consulting services that support the interpretation of diagnostic results. Growth is driven by the increasing integration of AI and machine learning technologies in companion diagnostics, enabling predictive modeling and patient-specific therapy recommendations. Cloud-based software solutions enhance workflow efficiency for laboratories and pharmaceutical companies, providing secure, scalable, and collaborative platforms. Rising demand for real-time data analysis in clinical trials and hospital networks further propels the segment. The growing emphasis on precision medicine, coupled with regulatory mandates for data standardization, encourages adoption of software-based solutions. Advanced training, consultancy, and post-sale support improve user confidence and reliability. The segment is particularly expanding in North America and Asia-Pacific due to robust digital infrastructure and increasing investments in healthcare IT.

- By Technology

On the basis of technology, the Companion Diagnostics market is segmented into Polymerase Chain Reaction (PCR), Molecular Diagnostics, FISH, CISH, Immunohistochemistry (IHC), Real-time PCR, Next-Generation Sequencing (NGS), Gene Sequencing, and In Situ Hybridization (ISH). The Next-Generation Sequencing (NGS) segment dominated the market with a revenue share of 42.7% in 2024, driven by its high accuracy in detecting genetic mutations, ability to support multiplex testing, and applications in oncology and rare disease diagnostics. NGS enables comprehensive genomic profiling, guiding targeted therapies and personalized treatment plans. Adoption is fueled by increasing oncology incidence, supportive reimbursement policies, and collaborations between diagnostic and pharmaceutical companies. Technological advancements, including faster sequencing platforms and reduced cost per test, improve accessibility in hospitals and reference laboratories. The segment benefits from a rising number of clinical trials using NGS-based companion diagnostics and government initiatives supporting precision medicine.

The Real-time PCR segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032. Its growth is driven by high sensitivity, specificity, and rapid turnaround time for detecting infectious diseases, oncology biomarkers, and other genetic targets. The segment is witnessing increasing demand due to rising outbreak surveillance, preventive healthcare programs, and the need for early diagnosis in clinical and research settings. Technological enhancements, such as multiplex assays and portable PCR systems, support adoption in decentralized laboratories. Rising healthcare awareness in emerging markets and adoption by pharmaceutical companies for clinical trials further accelerate growth.

- By Indication

On the basis of indication, the Companion Diagnostics market is segmented into Oncology, Neurology, and Infectious Diseases. The Oncology segment dominated the market with a revenue share of 46.3% in 2024, driven by the rising global prevalence of cancer and the increasing adoption of targeted therapies that require companion diagnostic testing. Diagnostic solutions for breast, lung, colorectal, and gastric cancers are extensively implemented in hospitals, specialty laboratories, and cancer centers. Supportive reimbursement policies in developed regions further encourage adoption. Advanced molecular assays, biomarker-based testing, and precision medicine approaches ensure high accuracy in patient stratification and therapy selection. The segment is additionally bolstered by significant investments in cancer research, clinical trials, and government initiatives promoting early detection and precision oncology programs, thereby reinforcing the critical role of companion diagnostics in modern oncology care.

The Infectious Diseases segment is expected to witness the fastest CAGR of 20.8% from 2025 to 2032. Growth in this segment is attributed to the rising incidence of infectious diseases, implementation of enhanced disease surveillance programs, and increasing awareness regarding the importance of early detection. Rapid diagnostic kits, molecular assays, and point-of-care testing solutions for viral and bacterial infections are being widely adopted in hospitals, clinics, and reference laboratories. The integration of artificial intelligence, digital platforms, and automated data analytics enhances the efficiency and reliability of infectious disease testing. Expansion of healthcare infrastructure and increased accessibility in emerging economies further support market growth, as healthcare providers seek cost-effective and scalable diagnostic solutions to manage disease outbreaks and routine screening programs.

- By Application

On the basis of application, the Companion Diagnostics market is segmented into Colorectal Cancer, Breast Cancer, Lung Cancer, Melanoma, Urology, and Gastric Cancer. The Breast Cancer segment dominated the market with a revenue share of 39.5% in 2024, driven by increasing prevalence rates, robust early detection programs, and widespread adoption of targeted therapies requiring companion diagnostic testing. Hospitals, diagnostic laboratories, and specialized cancer centers extensively use advanced immunohistochemistry (IHC) and gene expression assays to ensure precise diagnosis, patient stratification, and therapy guidance. Supportive regulatory frameworks and reimbursement policies in developed markets enhance adoption, while the growing focus on personalized medicine strengthens the demand for high-quality, validated companion diagnostic tests.

The Lung Cancer segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, propelled by the rising burden of lung cancer globally, the development and approval of targeted therapeutics, and the increasing adoption of molecular testing solutions. Technological advancements, such as multiplex panels, next-generation sequencing (NGS), and highly sensitive biomarker assays, further drive the growth of this segment. Hospitals, oncology centers, and reference laboratories are increasingly deploying these solutions to provide timely and accurate diagnosis, improve treatment outcomes, and enable precision medicine approaches. The segment also benefits from supportive government initiatives, public health screening programs, and a heightened focus on early detection and personalized therapy.

- By End Users

On the basis of end users, the Companion Diagnostics market is segmented into Pharmaceutical and Biopharmaceutical Companies and Reference Laboratories. The Pharmaceutical and Biopharmaceutical Companies segment dominated the market with a revenue share of 44.8% in 2024, driven by the integration of companion diagnostics into clinical trials for drug development and personalized therapy programs. Collaborations and strategic partnerships between diagnostic and pharmaceutical companies enhance the efficiency of drug pipelines, optimize patient-specific treatment strategies, and facilitate regulatory compliance. Adoption of companion diagnostics ensures precise patient selection, improves clinical trial outcomes, and supports the growing demand for targeted therapies, particularly in oncology and chronic disease treatment.

The Reference Laboratories segment is expected to witness the fastest CAGR of 22.0% from 2025 to 2032. Growth in this segment is fueled by the increasing outsourcing of diagnostic testing, the deployment of advanced molecular and NGS platforms, and rising demand for high-throughput, cost-effective testing solutions. Reference laboratories in both developed and emerging regions are expanding capabilities to meet the growing needs of hospitals, clinics, and pharmaceutical companies. The adoption of automated systems, AI-powered analytics, and robust laboratory information management systems enhances operational efficiency, accuracy, and reliability. This, combined with the rising awareness of personalized medicine and precision diagnostics, positions reference laboratories as a key driver of market growth.

Companion Diagnostics Market Regional Analysis

- North America dominated the companion diagnostics market with the largest revenue share of 40.5% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, high disposable incomes, and a strong presence of key industry players

- The market experienced substantial growth in companion diagnostics installations, particularly in hospitals, clinics, and diagnostic centers, fueled by innovations from both established companies and startups focusing on AI-enabled and precision medicine solutions. Rising awareness of personalized medicine, strong regulatory support, and the integration of advanced diagnostic platforms into clinical workflows are reinforcing market dominance

- The region benefits from high patient access to cutting-edge treatments, robust reimbursement policies, and ongoing investments in R&D, enabling the widespread adoption of companion diagnostics for oncology, cardiology, and immunology applications

U.S. Companion Diagnostics Market Insight

The U.S. companion diagnostics market captured the largest revenue share in 2024 within North America, fueled by the rapid uptake of precision medicine and targeted therapies. Hospitals, clinics, and diagnostic centers increasingly utilize companion diagnostics to optimize therapy selection, improve patient outcomes, and minimize adverse effects. The market growth is supported by technological advancements in genomic testing, biomarker identification, and next-generation sequencing (NGS) platforms. Favorable reimbursement frameworks, robust healthcare infrastructure, and increasing patient awareness regarding personalized treatment options further drive market expansion.

Europe Companion Diagnostics Market Insight

The Europe companion diagnostics market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent healthcare regulations, rising prevalence of chronic diseases, and growing investments in advanced diagnostic technologies. Urbanization, increasing patient awareness, and the integration of companion diagnostics into precision medicine programs are supporting adoption across hospitals, clinics, and diagnostic centers. Collaborations between diagnostic companies and pharmaceutical firms, along with ongoing technological advancements, are facilitating growth. European countries such as Germany, the U.K., and France are witnessing significant uptake due to well-established healthcare infrastructure and supportive policies promoting personalized medicine.

U.K. Companion Diagnostics Market Insight

The U.K. companion diagnostics market is anticipated to grow steadily during the forecast period, driven by increasing adoption of precision medicine, rising awareness of companion diagnostics, and expanding healthcare investments. Hospitals and specialty clinics are actively implementing companion diagnostics for targeted therapies, particularly in oncology. Government support, robust healthcare systems, and advanced laboratory technologies further encourage adoption.

Germany Companion Diagnostics Market Insight

The Germany companion diagnostics market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong healthcare infrastructure, focus on innovation, and rising prevalence of chronic diseases. Increasing demand for personalized therapies, government initiatives supporting early diagnosis, and integration of companion diagnostics into hospital and clinic workflows are key factors promoting growth. Germany’s emphasis on research-driven healthcare and quality assurance enhances the adoption of advanced diagnostic solutions.

Asia-Pacific Companion Diagnostics Market Insight

The Asia-Pacific companion diagnostics market market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing urbanization, rising prevalence of chronic diseases, and expanding healthcare infrastructure. Countries such as China, India, and Japan are witnessing growing access to advanced diagnostic technologies and precision medicine solutions. Government initiatives to improve healthcare access, growing awareness among patients and providers, and the increasing number of hospitals and diagnostic centers are accelerating adoption. Investments in innovative diagnostic platforms and the expansion of specialty clinics further support market growth in the region.

Japan Companion Diagnostics Market Insight

The Japan companion diagnostics market is gaining momentum due to the country’s advanced healthcare system, high technological adoption, and growing demand for precision medicine. Hospitals and diagnostic centers are implementing companion diagnostics to improve treatment selection and patient outcomes, particularly in oncology and cardiovascular care. Government initiatives promoting personalized healthcare and integration with clinical workflows are key drivers supporting market expansion.

China Companion Diagnostics Market Insight

The China companion diagnostics market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing prevalence of chronic diseases, and rising access to advanced healthcare technologies. Hospitals, clinics, and diagnostic centers are adopting companion diagnostics to enable precise therapy selection and improve patient outcomes. Government programs supporting precision medicine, expanding healthcare coverage, and investments in laboratory infrastructure are key factors propelling market growth. The domestic manufacturing ecosystem for diagnostic technologies and increasing affordability of testing solutions further facilitate widespread adoption across China.

Companion Diagnostics Market Share

The companion diagnostics industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Hologic, Inc. (U.S.)

- BD (U.S.)

- Siemens Healthineers AG (Germany)

- PerkinElmer (U.S.)

- Luminex Corporation (U.S.)

- Guardant Health, Inc. (U.S.)

- Foundation Medicine, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Cepheid (U.S.)

- BioMérieux (France)

- Adaptive Biotechnologies (U.S.)

Latest Developments in Global Companion Diagnostics Market

- In August 2024, Illumina announced that its TruSight Oncology Comprehensive Assay received approval from the U.S. Food and Drug Administration (FDA) as a companion diagnostic for non-small cell lung cancer (NSCLC) and NTRK-positive solid tumors. This assay utilizes next-generation sequencing to detect variants in 517 genes from tumor tissue samples, aiding in the identification of patients who may benefit from targeted therapies. The approval marks a significant advancement in precision oncology, providing clinicians with a comprehensive tool for tumor profiling and personalized treatment decisions

- In June 2024, Qiagen announced its strategy to achieve 7% annual sales growth (adjusted for currency) until 2028, focusing on lab testing machines for infections and cancer. The company plans to enhance its portfolio in genetic testing machines, PCR-based diagnostics, and tests for various infectious diseases and cancer. This strategic move highlights Qiagen's commitment to expanding its presence in the companion diagnostics market by investing in high-growth areas and discontinuing unprofitable products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.