Global Cloud Project Portfolio Management Market

Market Size in USD Billion

CAGR :

%

USD

6.80 Billion

USD

22.51 Billion

2024

2032

USD

6.80 Billion

USD

22.51 Billion

2024

2032

| 2025 –2032 | |

| USD 6.80 Billion | |

| USD 22.51 Billion | |

|

|

|

|

Cloud Project Portfolio Management Market Size

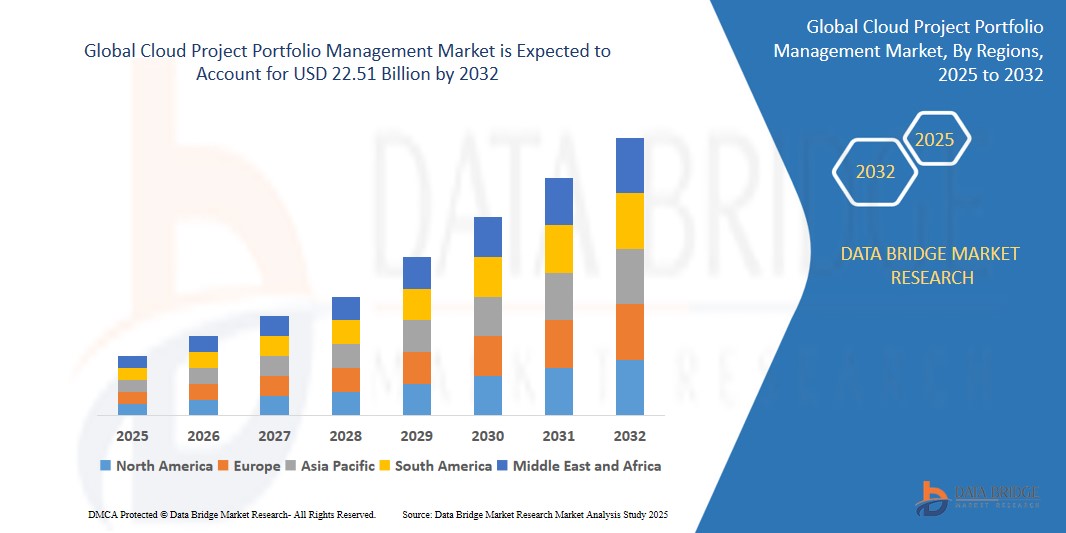

- The global Cloud project portfolio management market size was valued at USD 6.80 billion in 2024 and is expected to reach USD 22.51 billion by 2032, at a CAGR of 16.1% during the forecast period

- This significant growth is propelled by the increasing demand for agile project management tools, the shift toward cloud-based digital transformation, and the need for real-time collaboration and resource optimization across distributed workforces.

Cloud Project Portfolio Management Market Analysis

- Cloud PPM solutions are software platforms that enable organizations to plan, manage, and track multiple projects within a portfolio, optimizing resource allocation, budgets, and timelines through cloud-based infrastructure.

- The market is driven by the growing adoption of remote and hybrid work models, advancements in AI-driven project analytics, and the need for scalable, cost-effective solutions to enhance project delivery.

- North America dominates the market due to its advanced IT infrastructure, widespread adoption of cloud technologies, and the presence of key players like Oracle, Microsoft, and ServiceNow.

- Asia-Pacific is projected to exhibit the fastest growth, fueled by rapid digitalization, increasing IT investments, and government initiatives promoting cloud adoption in countries like China, India, and Singapore.

- The IT and Telecom segment is expected to hold a significant market share of approximately 24.8% in 2025, driven by the need for efficient project management in complex, technology-driven environments.

Report Scope And Cloud Project Portfolio Management Market Segmentation

|

Attributes |

Cloud project portfolio management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cloud Project Portfolio Management Market Trends

“Integration of AI and Automation in Cloud PPM Solutions”

- AI-driven analytics enable predictive insights into project risks, identifying potential delays and resource bottlenecks before they escalate, enhancing project planning accuracy.

- Automation streamlines repetitive tasks like status reporting, task assignments, and budget tracking, reducing manual effort and improving operational efficiency.

- For instance, in June 2024, ServiceNow introduced AI-powered PPM features in its Now Platform, including predictive risk analysis and automated workflow orchestration for complex portfolios.

- These advancements improve decision-making by providing real-time data insights, driving adoption across industries like IT and BFSI.

- The trend supports scalability, allowing enterprises to manage large-scale, multi-project portfolios with greater precision and agility.

Cloud Project Portfolio Management Market Dynamics

Driver

“Rising Demand for Agile and Remote Project Management”

- The global shift to agile methodologies supports iterative project delivery, aligning with fast-paced business needs and enhancing adaptability.

- Remote work trends, accelerated by hybrid work models, demand cloud-based PPM for real-time collaboration across distributed teams.

- For instance, a 2023 Gartner report noted that 65% of organizations adopted cloud PPM tools for hybrid work, up from 50% in 2022, reflecting increased demand.

- Cloud PPM ensures centralized project visibility, enabling alignment with strategic goals and efficient resource management.

- These solutions enhance productivity by providing flexible access to project data, supporting dynamic business environments.

Opportunity

“Expansion of Cloud PPM in Small and Medium Enterprises”

- Cloud PPM offers SMEs cost-effective, scalable tools to manage projects without significant on-premises infrastructure investments.

- These platforms enable SMEs to streamline workflows and improve project oversight, leveling the playing field with larger enterprises.

- For instance, in April 2024, Monday.com launched a PPM suite for SMEs with customizable dashboards and integrations with Slack and Microsoft Teams.

- Rapid digital transformation in emerging markets like India and Southeast Asia drives SME adoption of cloud PPM solutions.

- The scalability of cloud platforms supports SMEs’ growth, fostering market expansion in diverse industries.

Restraint/Challenge

“Data Security Concerns and Integration Complexities”

- Storing sensitive project data (budgets, timelines, intellectual property) on cloud platforms raises concerns about breaches and regulatory compliance (e.g., GDPR, CCPA).

- Integrating cloud PPM with existing systems like ERP or CRM is complex, especially for organizations with legacy infrastructure, increasing deployment costs.

- For instance, a 2023 Forrester report indicated that 40% of enterprises faced integration challenges, causing delays in project execution.

- The lack of standardized protocols across cloud PPM vendors complicates interoperability, hindering seamless adoption.

- Addressing security through robust encryption and compliance measures is critical to sustaining market trust and growth.

Cloud Project Portfolio Management Market Scope

The market is segmented based on component, deployment, organization size, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment |

|

|

By Organization Size |

|

|

By End User |

|

In 2025, the IT and Telecom segment is projected to dominate the end-user segment

The IT and Telecom segment is expected to hold a market share of approximately 24.8% in 2025, driven by the need for efficient project management in complex, technology-driven environments requiring rapid deployment and scalability.

The hybrid cloud deployment segment is expected to account for the largest share during the forecast period in the deployment market

In 2025, the hybrid cloud deployment segment is projected to account for a market share of 58.7%, driven by its flexibility, security, and ability to balance on-premises and cloud-based project management needs.

“North America Holds the Largest Share in the Cloud Project Portfolio Management Market”

- North America dominates the market due to its advanced IT infrastructure, early adoption of cloud technologies, and the presence of leading vendors like Oracle, Microsoft, and ServiceNow.

- The U.S. holds a significant share, driven by high cloud penetration, robust digital transformation initiatives, and widespread adoption of PPM in IT and BFSI sectors.

- The region benefits from a thriving ecosystem of technology startups and significant investments in AI and cloud computing.

“Asia-Pacific is Projected to Register the Highest CAGR in the Cloud Project Portfolio Management Marke”

- Asia-Pacific is expected to driven by rapid digitalization, increasing IT investments, and government initiatives promoting cloud adoption in countries like China, India, and Singapore.

- China is projected to exhibit its fast-growing IT sector and digital transformation efforts.

- The region’s strong services outsourcing industry and rising adoption of cloud solutions across BFSI and retail sectors further fuel market growth.

Cloud Project Portfolio Management Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Oracle Corporation (U.S.)

- Microsoft Corporation (U.S.)

- ServiceNow, Inc. (U.S.)

- SAP SE (Germany)

- Atlassian Corporation (Australia)

- Planview, Inc. (U.S.)

- Clarizen (Planview) (U.S.)

- Smartsheet Inc. (U.S.)

- Workfront (Adobe Inc.) (U.S.)

- Monday.com Ltd. (Israel)

Latest Developments In Global Cloud Project Portfolio Management Market

- In February 2023, Oracle enhanced its Fusion Cloud PPM suite by integrating AI-driven predictive analytics, enabling organizations to forecast project risks and optimize resource allocation with greater accuracy. This update included advanced reporting tools and seamless integration with Oracle’s ERP and HCM platforms, targeting large enterprises in BFSI and manufacturing. The enhancements aimed to improve project visibility and decision-making, addressing the growing demand for data-driven project management in complex, multi-project environments.

- In September 2023, Microsoft launched an upgraded version of Microsoft Project for the web, a cloud-based PPM solution designed to support agile and hybrid project management methodologies. The update introduced AI-powered resource scheduling, real-time collaboration features, and enhanced integration with Microsoft 365 and Power Platform. This launch targeted organizations seeking scalable, user-friendly PPM tools to manage distributed teams, reinforcing Microsoft’s position in the cloud PPM market.

- In January 2024, ServiceNow expanded its Strategic Portfolio Management module within the Now Platform, introducing AI-driven scenario planning and automated risk assessment capabilities. This update enabled organizations to align project portfolios with strategic objectives, optimize budgets, and mitigate risks in real time. The solution’s integration with ServiceNow’s IT Service Management (ITSM) tools made it particularly appealing to IT and Telecom enterprises, driving adoption in technology-driven industries.

- In April 2024, Monday.com introduced a tailored PPM suite for small and medium enterprises (SMEs), featuring customizable dashboards, automated workflows, and integration with popular collaboration tools like Slack and Microsoft Teams. This launch focused on simplifying project management for SMEs, offering cost-effective, cloud-native solutions to enhance productivity and scalability. The suite’s user-friendly interface and rapid deployment capabilities addressed the growing demand for accessible PPM tools in emerging markets.

- In October 2024, SAP SE partnered with Planview to enhance its SAP SuccessFactors PPM capabilities, integrating advanced portfolio analytics and resource management features. This collaboration aimed to provide enterprises with a unified platform for aligning projects with business goals, optimizing resource utilization, and ensuring compliance with global standards. The partnership targeted BFSI and manufacturing sectors, where complex project portfolios require robust, cloud-based management solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.