Global Cancer Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

110.11 Billion

USD

199.32 Billion

2024

2032

USD

110.11 Billion

USD

199.32 Billion

2024

2032

| 2025 –2032 | |

| USD 110.11 Billion | |

| USD 199.32 Billion | |

|

|

|

|

Cancer Diagnostics Market Size

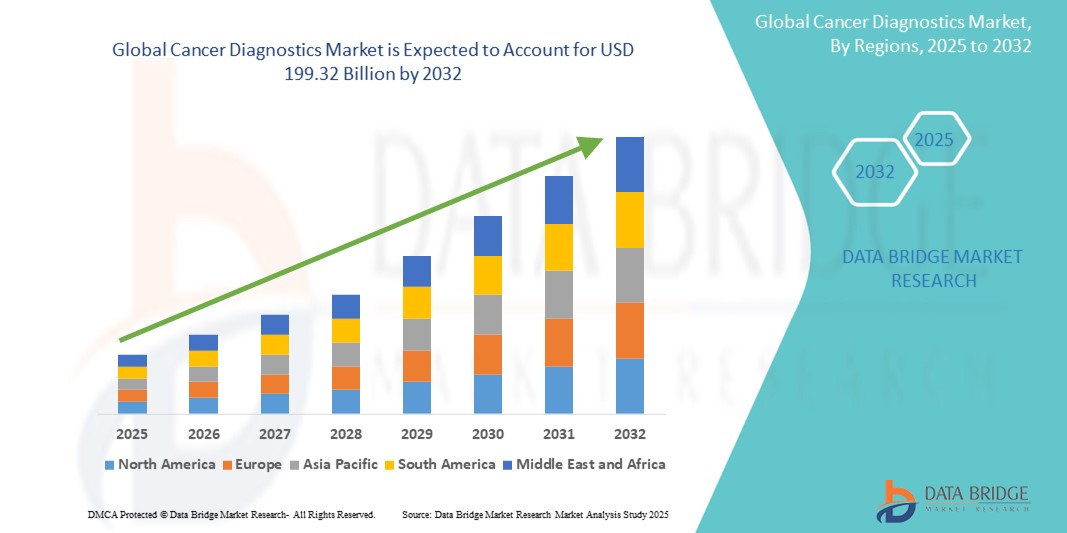

- The global cancer diagnostics market size was valued at USD 110.11 Billion in 2024 and is expected to reach USD 199.32 Billion by 2032, at a CAGR of 7.70% during the forecast period

- This growth is driven by factors such as the rising global cancer burden, growing awareness about early cancer detection, and advancements in diagnostic technologies including liquid biopsy and AI-powered imaging

Cancer Diagnostics Market Analysis

- Cancer diagnostic tools are essential in the early detection, diagnosis, and monitoring of various cancer types, utilizing methods such as imaging, biopsy, tumor markers, and molecular diagnostics

- The demand for cancer diagnostics is significantly driven by the increasing global cancer incidence, growing awareness about the benefits of early detection, and technological advancements in diagnostic modalities

- North America is expected to dominate the cancer diagnostics market with largest market share of 41.18%, due to well-established healthcare infrastructure, high cancer prevalence, and significant investments in research and development

- Asia-Pacific is expected to be the fastest growing region in the cancer diagnostics market during the forecast period due to growing aging population, increased healthcare spending, and expanding access to diagnostic services

- In vitro diagnostic testing segment is expected to dominate the market with a largest market share of 52.1% due to the increasing adoption of IVD owing to rise in testing amid COVID-19 pandemic. Development of automated IVD systems for hospitals & laboratories that offer accurate, efficient, and error-free diagnosis is expected to fuel market growth

Report Scope and Cancer Diagnostics Market Segmentation

|

Attributes |

Cancer Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cancer Diagnostics Market Trends

“Emergence of AI, Liquid Biopsy, and Multi-Cancer Early Detection (MCED) as Game-Changing Trends”

- One prominent trend in the global cancer diagnostics market is the rapid integration of artificial intelligence (AI), liquid biopsy, and multi-cancer early detection (MCED) technologies into mainstream diagnostic practices

- These innovations are reshaping the diagnostic landscape by enabling earlier, more precise, and less invasive detection of multiple cancer types from a single sample

- For instance, liquid biopsy platforms can detect circulating tumor DNA (ctDNA) in blood, offering real-time insights into tumor mutations without the need for surgical biopsy, while AI-powered imaging tools are enhancing diagnostic accuracy in radiology and pathology

- These trends are driving a shift toward personalized medicine, improving clinical decision-making, and expanding the potential for large-scale cancer screening, particularly in asymptomatic populations

Cancer Diagnostics Market Dynamics

Driver

“Rising Cancer Burden and Need for Early Detection”

- The growing global burden of cancer, driven by aging populations, lifestyle changes, and environmental factors, is significantly increasing the demand for advanced cancer diagnostic tools

- As cancer remains a leading cause of death worldwide, early detection has become a critical public health priority, prompting governments and healthcare providers to invest heavily in screening and diagnostic infrastructure

- The availability of innovative diagnostics—including molecular testing, imaging, and next-generation sequencing—enables earlier intervention and improves survival rates by identifying cancers at treatable stages

For instance,

- According to the World Health Organization (WHO), there were an estimated 20 million new cancer cases and 10 million cancer-related deaths globally in 2022, with projections suggesting a sharp increase in incidence over the coming decades

- As a result of the rising cancer prevalence and the recognized benefits of early diagnosis, the global demand for precise, rapid, and scalable cancer diagnostic solutions is experiencing significant growth

Opportunity

“Expansion of Cancer Screening Programs in Emerging Economies”

- Rapid urbanization, increasing healthcare investments, and improved awareness are driving the expansion of organized cancer screening programs in low- and middle-income countries

- Governments and health organizations are launching initiatives aimed at early detection of high-burden cancers such as breast, cervical, and colorectal cancers, creating significant demand for affordable and scalable diagnostic technologies

- Additionally, the availability of portable diagnostic devices and telemedicine solutions is making it easier to deliver screening services in rural and underserved areas

For instance,

- In October 2023, the World Health Organization (WHO) launched the Global Breast Cancer Initiative to reduce breast cancer mortality globally through improved early detection and timely diagnosis, with a strong focus on supporting low- and middle-income countries

- As global efforts to reduce cancer-related deaths intensify, emerging markets offer substantial growth opportunities for diagnostic companies to introduce cost-effective, accessible, and innovative cancer detection solutions

Restraint/Challenge

“High Cost and Limited Accessibility of Advanced Diagnostic Technologies”

- The high cost of advanced cancer diagnostic tools, such as molecular testing, next-generation sequencing (NGS), and PET/CT imaging, presents a major barrier to widespread adoption—particularly in low- and middle-income countries

- These technologies, while highly accurate, often require sophisticated infrastructure, skilled personnel, and ongoing operational costs, which can strain healthcare budgets in resource-limited settings

- This financial burden limits the scalability of comprehensive cancer screening programs and contributes to late-stage diagnoses, especially in underserved regions

For instance,

- In 2023 report by the International Agency for Research on Cancer (IARC), significant disparities were noted in access to diagnostic services, with low-income countries reporting under 30% diagnostic coverage for cancers like cervical and colorectal—compared to over 80% in high-income countries

- As a result, limited access to advanced diagnostics continues to impede early detection and equitable healthcare delivery, posing a major challenge to the global expansion of cancer diagnostics

Cancer Diagnostics Market Scope

The market is segmented on the basis of product, technology, type, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the In vitro diagnostic testing is projected to dominate the market with a largest share in type segment

The In vitro diagnostic testing segment is expected to dominate the cancer diagnostics market with the largest share of 52.1% due to the increasing adoption of IVD owing to rise in testing amid COVID-19 pandemic. Development of automated IVD systems for hospitals & laboratories that offer accurate, efficient, and error-free diagnosis is expected to fuel market growth

The consumables is expected to account for the largest share during the forecast period in product segment

In 2025, the consumables segment is expected to dominate the market with the largest market share of 58.5% due to developing imaging diagnostic techniques or effective monoclonal antibody-based assays for detecting antigens and small chemicals generated by malignant cells would considerably improve diagnostic medicine. Although mAb technology is still in its early stages, new developments in recombinant antigen synthesis and antibody creation techniques have greatly expanded its potential in diagnosis

Cancer Diagnostics Market Regional Analysis

“North America Holds the Largest Share in the Cancer Diagnostics Market”

- North America dominates the global cancer diagnostics market with largest market share of 41.18%, driven by advanced healthcare infrastructure, high adoption of cutting-edge diagnostic technologies, and the presence of leading cancer research institutions and diagnostic companies

- The U.S. holds a significant share of 36.4%, due to the increasing prevalence of cancer, a well-established reimbursement system, and continuous advancements in molecular diagnostics and imaging technologies

- Strong government initiatives for cancer research, high healthcare spending, and a growing focus on early cancer detection are key factors driving the market in this region

- Additionally, the expanding availability of personalized and precision medicine, along with high rates of cancer screening, are contributing to the growth of the cancer diagnostics market in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Cancer Diagnostics Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the cancer diagnostics market, driven by rapid advancements in healthcare infrastructure, increasing awareness about cancer, and improving access to diagnostic technologies

- Countries like China, India, and Japan are emerging as key markets due to the growing aging population, rising cancer incidence, and improvements in healthcare facilities

- Japan, with its strong healthcare system and focus on innovative diagnostic solutions, remains a leading market for cancer diagnostics. The country continues to adopt advanced technologies such as AI-based imaging and liquid biopsy for early cancer detection

- China and India, with their large populations and increasing cancer burden, are witnessing heightened investments in cancer screening and diagnostic services. The growing presence of global diagnostic companies and government initiatives to expand healthcare access are further fueling market growth in the region

Cancer Diagnostics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Thermo Fisher Scientific (U.S.)

- Abbott (U.S.)

- Siemens Healthineers (Germany)

- Koninklijke Philips N.V. (Netherlands)

- BD (U.S.)

- GE Healthcare (U.S.)

- Hologic, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Exact Sciences Corporation (U.S.)

- Guardant Health (U.S.)

- Myriad Genetics (U.S.)

- NeoGenomics Laboratories (U.S.)

- BioMérieux SA (France)

- Qiagen N.V. (Germany)

- Leica Biosystems (Germany)

- Cepheid (U.S.)

- Danaher Corporation (U.S.)

- Agilent Technologies (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

Latest Developments in Global Cancer Diagnostics Market

- In July 2024, DELFI Diagnostics announced that it has secured an equity investment from the Merck Global Health Innovation Fund. This strategic funding will accelerate the development of DELFI’s AI-driven fragmentomics platform designed for advanced cancer screening. The collaboration is focused on enhancing diagnostic capabilities and advancing the methodologies used for more accurate cancer detection. This partnership aligns with the growing trend towards AI-powered diagnostic solutions and precision oncology. The investment will support the development of cutting-edge technologies that are poised to revolutionize early cancer detection, driving innovation in the market and expanding the availability of advanced diagnostic tools globally

- In May 2024, Quest Diagnostics revealed the separation of PathAI’s digital pathology laboratory as part of a strategic initiative to deepen its focus on artificial intelligence (AI) integration. This move is designed to expedite the adoption of AI technologies within the company's operations, with the goal of enhancing its digital pathology capabilities and improving diagnostic accuracy. This development highlights the growing trend of incorporating AI-driven solutions into diagnostic workflows. By advancing its digital pathology offerings, Quest Diagnostics is positioning itself at the forefront of the shift toward more precise and efficient cancer detection

- In February 2023, F. Hoffmann-La Roche announced the expansion of its collaboration with Janssen to further advance personalized healthcare initiatives. This strengthened partnership will focus on the development of companion diagnostics, with the goal of improving treatment outcomes for patients by enabling more precise and tailored therapeutic approaches. This collaboration underscores the increasing shift towards precision oncology and the growing importance of companion diagnostics in improving cancer treatment

- In November 2023, Abbott received FDA approval for its HPV test, developed for use with the Alinity m platform. This diagnostic tool is designed for primary screening of HPV and detection of high-risk HPV types linked to cancer, particularly cervical cancer. This approval significantly strengthens Abbott’s portfolio in cervical cancer prevention and diagnosis, aligning with the growing demand for advanced screening solutions in the global cancer diagnostics market

- In 2022, Precipio, Inc. entered into a distribution agreement for its HemeScreen product with a prominent distribution partner in the U.S. The company is strategically pursuing an expansive growth plan for HemeScreen, targeting physician-owned laboratories, national and regional hospital networks, and reference laboratories. This move emphasizes the increasing demand for advanced diagnostic tools that enable more precise and efficient detection of hematologic cancers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.