Global Bone Densitometer Devices Market

Market Size in USD Million

CAGR :

%

USD

335.70 Million

USD

410.29 Million

2024

2032

USD

335.70 Million

USD

410.29 Million

2024

2032

| 2025 –2032 | |

| USD 335.70 Million | |

| USD 410.29 Million | |

|

|

|

|

Bone Densitometer Devices Market Size

- The global Bone Densitometer Devices Treatment market was valued at USD 335.7 million in 2024 and is expected to reach USD 410.29 Million by 2032, at a CAGR of 4.2%, during the forecast period

- The growth of the Global Bone Densitometer Devices Market is primarily driven by the increasing incidence of osteoporosis and other bone-related disorders, particularly among the aging population. The rising global burden of fractures and the growing emphasis on early diagnosis and preventive healthcare have led to higher adoption of bone densitometry technologies in both clinical and research settings.

Bone Densitometer Devices Market Analysis

- Bone Densitometer Devices are essential diagnostic tools used to measure bone mineral density (BMD) and assess the risk of fractures, particularly in individuals with osteoporosis or other metabolic bone diseases. These devices, including dual-energy X-ray absorptiometry (DXA) and quantitative ultrasound (QUS), play a critical role in early detection, enabling timely intervention to prevent serious complications such as fractures and mobility loss.

- North America emerges as a leading region in the Bone Densitometer Devices Market, supported by a well-established healthcare infrastructure, high awareness of osteoporosis, and the widespread implementation of routine bone health screening programs among at-risk populations, especially postmenopausal women and the elderly.

- The region’s continuous investments in advanced imaging technologies, growing geriatric population, and favorable reimbursement policies are driving the adoption of bone densitometry systems across hospitals, diagnostic centers, and specialty clinics, further boosting market growth and innovation in bone health diagnostics.

Report Scope and Bone Densitometer Devices Segmentation

|

Attributes |

Bone Densitometer Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bone Densitometer Devices Market Trends

“Rising Adoption of Early Diagnostic Tools and Technological Advancements in Bone Health Monitoring”

- A key trend in the Global Bone Densitometer Devices Market is the growing preference for early, non-invasive diagnostic tools to detect osteoporosis and assess fracture risk, particularly among aging and postmenopausal populations.

- Advanced dual-energy X-ray absorptiometry (DXA) systems are gaining traction due to their enhanced accuracy, low radiation exposure, and capability to evaluate both bone density and body composition in a single scan.

- For instance, recent innovations include portable DXA systems and devices with AI-powered software that provide automated, real-time assessments to improve clinical efficiency and patient care.

- The shift toward point-of-care diagnostics and integration of bone densitometry into routine health screenings is supporting preventive healthcare models and enabling timely intervention.

- Additionally, the growing use of bone densitometry in oncology, endocrinology, and pediatric care expands the clinical application of these devices beyond traditional osteoporosis diagnosis.

- This trend toward precision diagnostics, patient-centric care, and technological integration is reshaping the bone health landscape and driving sustained growth in the global Bone Densitometer Devices Market.

Bone Densitometer Devices Market Dynamics

Driver

“Increasing Prevalence of Osteoporosis and Bone-Related Diseases”

- The global rise in osteoporosis, osteopenia, and other metabolic bone disorders—particularly among aging populations—continues to drive demand for early and accurate bone health diagnostics. Factors such as hormonal changes in postmenopausal women, sedentary lifestyles, vitamin D deficiency, and increased life expectancy are significantly contributing to the burden of low bone mineral density (BMD) worldwide.

- Bone densitometers, particularly Dual-energy X-ray Absorptiometry (DXA) systems, offer a non-invasive, gold-standard method for assessing bone health, aiding in the early diagnosis and treatment planning of osteoporosis and fracture risk management. These devices are critical for preventing long-term complications such as hip and vertebral fractures.

For instance,

- In December 2023, the International Osteoporosis Foundation (IOF) reported that over 200 million people worldwide are affected by osteoporosis, with one in three women and one in five men over the age of 50 expected to experience osteoporotic fractures.

- A 2024 report from the U.S. National Osteoporosis Foundation highlighted that nearly 54 million Americans are at risk for osteoporosis or low bone mass, a number projected to rise with aging demographics.

- The growing global awareness of osteoporosis-related morbidity and the cost burden of fractures is accelerating the adoption of BMD screening tools in clinical and community health settings.

- As clinical guidelines increasingly emphasize preventive screening and early intervention, the demand for portable, accessible, and high-precision bone densitometers is expanding, creating a favorable environment for market growth.

Opportunity

“Technological Advancements in Bone Densitometry Devices”

- Continuous innovation in bone densitometer technologies—such as the development of 3D DXA imaging, automated AI-based fracture risk scoring, and compact, portable devices—are transforming diagnostic capabilities in both hospital and outpatient settings. These advancements improve diagnostic accuracy, user experience, and throughput efficiency, especially in primary care and mobile screening environments.

- Integration with electronic health records (EHRs), cloud-based analytics, and telehealth platforms is enhancing diagnostic workflows, remote monitoring, and patient engagement in bone health management.

For instance,

- In early 2024, Hologic Inc. introduced a next-generation DXA system with integrated artificial intelligence that automatically identifies vertebral fractures and estimates body composition alongside BMD measurements.

- Echolight Medical and GE Healthcare launched ultrasound-based and compact DXA solutions aimed at expanding accessibility in rural and resource-limited settings.

- These technological enhancements are enabling broader adoption across varied clinical environments, from specialized bone health centers to general practitioners' offices and community outreach programs.

- Companies investing in user-friendly, cost-effective, and AI-enhanced densitometry platforms are well-positioned to meet the rising global demand for osteoporosis screening, particularly in aging populations and emerging healthcare markets.

Restraint/Challenge

“High Equipment Cost and Limited Access in Resource-Poor Settings”

- Despite clinical advantages, the high upfront cost of bone densitometry equipment, including installation, training, and maintenance, remains a significant barrier to widespread adoption, particularly in low- and middle-income countries (LMICs).

- In addition, limited reimbursement policies and low awareness about osteoporosis screening among primary care providers contribute to underutilization of these devices—even in developed healthcare systems.

- The challenge is compounded by disparities in access to advanced imaging infrastructure and qualified radiology personnel, limiting screening programs and diagnostic follow-up in remote or underserved areas.

For instance,

- A 2023 WHO report noted that fewer than 25% of LMICs have routine access to DXA scanning, despite growing osteoporotic fracture burdens.

- A study published in the Journal of Bone and Mineral Research (2024) found that in over 40% of rural healthcare facilities across Asia and Africa, bone density testing remains unavailable due to cost and logistical limitations.

- Furthermore, ongoing maintenance costs, software updates, and calibration requirements pose long-term affordability concerns for smaller clinics and healthcare providers.

- Addressing these barriers through public-private partnerships, affordable leasing programs, government subsidies, and innovations in low-cost, point-of-care diagnostic tools is crucial to unlocking the full potential of the global bone densitometer devices market.

Bone Densitometer Devices Market Scope

The market is segmented on the technology and end users.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By End Users |

|

In 2025, the Axial Bone Densitometry Segmentis Projected to Dominate the Market with the Largest Share in the technology Segment

The Axial Bone Densitometry segment is expected to dominate the Global Bone Densitometer Devices Market in 2025, accounting for the largest market share of approximately 68.7%. This leadership is primarily driven by its superior accuracy in measuring central skeletal sites like the spine and hip, which are most prone to osteoporotic fractures. Additionally, strong clinical guidelines and widespread adoption in hospital settings reinforce its market dominance.

Hospitals are Expected to Account for the Largest Share During the Forecast Period in end user segment

In 2025, Hospitals are projected to dominate the Global Bone Densitometer Devices Market, accounting for the largest market share of approximately 64.9%. This segment's dominance is fueled by high patient throughput, availability of advanced diagnostic infrastructure, and skilled radiology professionals. Additionally, hospitals often serve as primary centers for osteoporosis screening, diagnosis, and treatment planning.

Bone Densitometer Devices Market Regional Analysis

“North America is the Dominant Region in the Global Bone Densitometer Devices Market”

- North America leads the global Bone Densitometer Devices market, driven by its advanced healthcare infrastructure, high awareness of osteoporosis, and well-established diagnostic protocols for bone health screening.

- The United States holds the largest market share due to a rapidly aging population, high prevalence of osteoporosis and related fractures, and the widespread use of DXA scans in clinical practice.

- Supportive reimbursement frameworks, comprehensive insurance coverage, and proactive preventive healthcare initiatives significantly contribute to regional market dominance.

- Furthermore, the strong presence of key manufacturers such as Hologic Inc., GE Healthcare, and Diagnostic Medical Systems (DMS), along with continuous technological innovation and AI-driven imaging solutions, fuels sustained growth across North America.

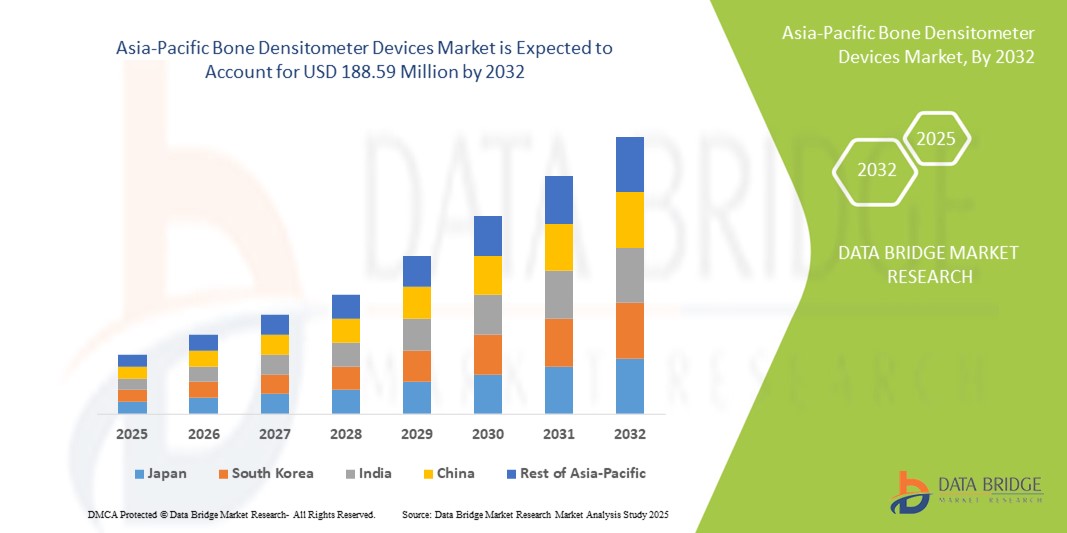

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to experience the fastest growth in the Bone Densitometer Devices market, driven by the increasing burden of osteoporosis, rising healthcare investments, and expanding access to diagnostic technologies.

- Key markets such as China, India, and Japan are witnessing growing demand due to large aging populations, improved healthcare infrastructure, and rising awareness of bone health.

- Japan leads the region in adopting advanced bone densitometry systems, supported by an aging demographic and robust public health policies promoting early osteoporosis screening.

- In China and India, government-led health initiatives, public-private partnerships, and increasing availability of affordable DXA and ultrasound-based devices are accelerating market penetration.

- Additionally, the emergence of local device manufacturers and regulatory streamlining for medical devices are enhancing the region's appeal as a high-growth hub for bone health diagnostics.

Bone Densitometer Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hologic, Inc. (Marlborough, Massachusetts, USA)

- GE HealthCare Technologies Inc. (Chicago, Illinois, USA)

- Diagnostic Medical Systems Group (DMS Imaging) (Gallargues-le-Montueux, France)

- BeamMed Ltd. (Tel Aviv, Israel)

- OSG Corporation (Yokohama, Japan)

- Swissray Global Healthcare Holding Ltd. (Taipei, Taiwan)

- Medonica Co., Ltd. (Seoul, South Korea)

- Furuno Electric Co., Ltd. (Nishinomiya, Japan)

- Shenzhen Xray Electric Co., Ltd. (Shenzhen, China)

- OsteoSys Co., Ltd. (Seoul, South Korea)

Latest Developments in Global Bone Densitometer Devices

- In April 2022, Newman Regional Health added the Hologic Horizon DXA bone densitometry device, enhancing its range of health and wellness offerings for both men and women.

- The first DEXA-C implantation was conducted by Aurora Spine Corporation in March 2022 at Cypress Pointe Surgical Hospital in Louisiana, where the implant density was precisely matched to the patient's bone quality.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.