Global Bioburden Testing Market

Market Size in USD Billion

CAGR :

%

1.41 USD

4.82 USD

2024

2032

1.41 USD

4.82 USD

2024

2032

| 2025 –2032 | |

| 1.41 USD | |

| 4.82 USD | |

|

|

|

|

Bioburden Testing Market Size

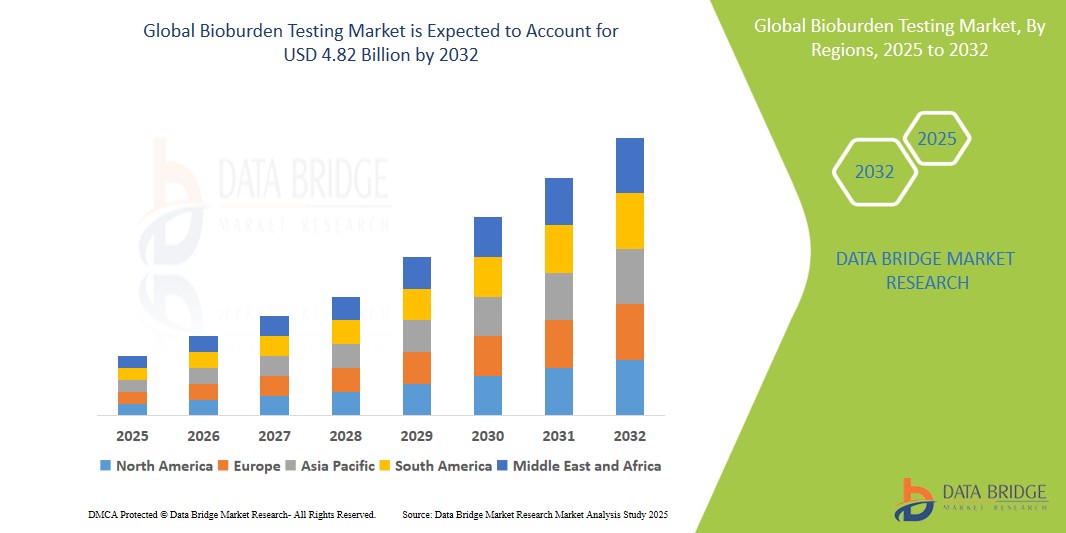

- The global Bioburden Testing market size was valued at USD 1.41 billion in 2024 and is expected to reach USD 4.82 billion by 2032, at a CAGR of 16.6% during the forecast period

- The market growth is largely fueled by the stringent regulatory requirements for product safety and sterility, coupled with increasing awareness of the importance of microbial contamination control.

- Furthermore, the rising prevalence of healthcare-associated infections (HAIs) and the growing complexity of manufacturing processes are establishing bioburden testing as an essential step in ensuring product quality and patient safety. These converging factors are accelerating the uptake of bioburden testing methods and services, thereby significantly boosting the industry's growth.

Bioburden Testing Market Analysis

- Bioburden testing involves the quantification of viable microorganisms present in or on a product, raw material, or manufacturing environment. It is a critical quality control measure across various industries, including pharmaceuticals, medical devices, food and beverage, and cosmetics.

- The escalating demand for bioburden testing is primarily fueled by the increasing globalization of supply chains, growing focus on risk management, and rising demand for advanced testing technologies.

- North America dominates the Bioburden Testing market with the largest revenue share of 42.21% in 2025, characterized by stringent regulatory frameworks, high healthcare expenditure, and a strong presence of leading pharmaceutical and medical device companies. The U.S. plays a key role in market growth due to the presence of major industry players and advanced healthcare infrastructure.

- Asia-Pacific is expected to be the fastest growing region in the Bioburden Testing market during the forecast period driven by rapid growth in the pharmaceutical and medical device industries, increasing regulatory focus on product quality, and rising healthcare expenditure.

- consumables segment is expected to dominate the Bioburden Testing market with a market share of 48.2% in 2025, driven by the recurring need for reagents, culture media, and other materials in bioburden testing procedures.

Report Scope and Bioburden Testing Market Segmentation

|

Attributes |

Bioburden Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bioburden Testing Market Trends

“Increasing complexity of manufacturing processes”

- A significant and accelerating trend in the bioburden testing market is the development and adoption of rapid microbiological testing methods and automated platforms. This evolution is significantly enhancing laboratory efficiency, reducing turnaround times, and improving the speed and accuracy of results.

- For instance, companies are developing automated systems that can perform bioburden tests in a fraction of the time compared to traditional culture-based methods. Similarly, the integration of software solutions for data analysis and reporting streamlines laboratory operations and facilitates the interpretation of complex results.

- The adoption of rapid testing methods, such as qPCR, and automated platforms enables high-throughput screening, which is crucial for processing large volumes of samples in pharmaceutical and medical device manufacturing. Digitalization also allows for the seamless transfer of data to Laboratory Information Management Systems (LIMS), improving data integrity and accessibility.

- The seamless integration of automated bioburden testing systems with laboratory networks and digital platforms facilitates centralized control over testing processes and enables real-time monitoring of equipment and workflows.

- This trend towards more automated and digitalized bioburden testing is fundamentally reshaping laboratory operations and quality control practices. Consequently, companies are investing in the development of advanced automation solutions and software platforms to meet the evolving needs of modern manufacturing and healthcare.

- The demand for bioburden testing solutions that offer seamless automation and digital integration is growing rapidly across various industries, as manufacturers increasingly prioritize efficiency, accuracy, and data management capabilities.

Bioburden Testing Market Dynamics

Driver

“Focus on patient safety and product quality”

- Growing Need Due to Stringent Regulations and Focus on Patient Safety: The increasing emphasis on product safety and the implementation of stringent regulatory requirements across industries are significant drivers for the heightened demand for bioburden testing.

- For instance, regulatory bodies such as the FDA and EMA mandate rigorous bioburden testing for medical devices and pharmaceuticals to minimize the risk of microbial contamination and ensure patient safety. Similarly, the food and beverage industry adhere to strict hygiene standards, driving the need for bioburden testing to prevent foodborne illnesses.

- As manufacturers worldwide focus on maintaining high-quality standards and complying with international regulations, the role of bioburden testing in providing accurate and reliable information becomes increasingly vital. This demand is further driven by the increasing complexity of manufacturing processes and the globalization of supply chains, which heighten the risk of microbial contamination.

- Furthermore, technological advancements in bioburden testing, such as improved sensitivity, specificity, and ease of use, are making them an increasingly essential part of quality control.

Restraint/Challenge

“Need for rigorous quality control”

- Complex Validation Requirements and Cost Considerations: The bioburden testing market is subject to stringent validation requirements to ensure the accuracy and reliability of test results, which can vary across different regions and industries.

- For instance, obtaining regulatory approval for new bioburden testing methods or technologies often requires extensive validation studies and documentation, adding to the time and cost of implementation. Similarly, compliance with quality management systems, such as ISO 13485, adds to the operational burden and costs for manufacturers and testing laboratories.

- Addressing these validation challenges requires manufacturers to invest heavily in research and development, adhere to rigorous quality control practices, and maintain compliance with evolving regulatory standards. The high costs associated with developing and validating new testing methods, coupled with the need for ongoing compliance, can be a significant barrier to entry for smaller companies and may limit innovation in the market.

- Moreover, the increasing complexity of products and manufacturing processes, such as combination medical devices and biologics, often necessitates specialized bioburden testing approaches, further driving up development and validation costs.

- Overcoming these challenges through the development of standardized validation guidelines, greater harmonization of global regulatory standards, and the development of cost-effective testing and quality control solutions will be vital for fostering innovation and ensuring the widespread availability of reliable bioburden testing.

Bioburden Testing Market Scope

The market is segmented on the basis of product, test type, application and end user.

- By Product

On the basis of Product, the Bioburden Testing market is segmented into consumables, instrument. The consumables segment dominates the largest market revenue share of 57.2% in 2025, driven by the recurring need for reagents, culture media, and other materials in bioburden testing procedures. The routine nature of bioburden testing across various industries, including pharmaceuticals, medical devices, and food and beverage, ensures a consistent demand for consumables. The increasing volume of products being manufactured globally, coupled with stringent quality control measures, fuels the growth of the consumables segment.

The instruments segment is anticipated to witness the fastest growth rate of 43.8% from 2025 to 2032 driven by the increasing adoption of advanced and automated testing technologies. Instruments such as automated microbial enumeration systems and rapid detection devices offer higher throughput, faster turnaround times, and improved accuracy compared to traditional methods. The growing need for efficient and high-throughput bioburden testing in large-scale manufacturing facilities is driving the demand for these advanced instruments.

- By Test type

On the basis of Anaerobic Count Testing, the Bioburden Testing market is segmented into into anerobic count testing, mold or fungi count testing, aerobic count testing, spore count testing. Bioburden tests require a consistent supply of reagents, which makes reagents a fundamental and continuously in-demand product segment. The increasing volume of tests performed globally, due to stringent quality control, fuels the reagents market.

The Aerobic Count Testing segment is expected to witness the fastest CAGR from 2025 to 2032 driven by the increasing automation of workflows. Automated analyzers offer high-throughput processing, reduced turnaround times, and improved accuracy. The demand for analyzers is also growing due to the increasing adoption of advanced technologies like robotics and software integration.

- By Application

On the basis of application, the Bioburden Testing market is segmented into into raw material testing, medical devices testing, sterilization validation testing in-process testing, and equipment cleaning validation. The medical devices testing held the largest market revenue share in driven by the critical role of bioburden testing in ensuring the safety and sterility of medical devices. Bioburden testing is essential for preventing infections and ensuring the quality of medical devices. The increasing prevalence of healthcare-associated infections (HAIs) and stringent regulatory requirements contribute to the dominance of this segment.

The sterilization validation testing is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing complexity of medical devices and the growing emphasis on effective sterilization processes. Sterilization validation ensures that medical devices are free from viable microorganisms, and the rising demand for advanced sterilization technologies is fueling the growth of this segment.

- By End users

On the basis of end users, the Bioburden Testing market is segmented into pharmaceutical and biotechnology companies, medical device manufacturers, contract manufacturing organizations (CMO), manufacturers of food and beverage and agricultural products, microbial testing laboratories. The pharmaceutical and biotechnology companies segment accounted for the largest market revenue share in 2024, driven by the high volume of testing conducted within these industries. Pharmaceutical and biotechnology companies utilize bioburden testing extensively for raw material testing, in-process control, and final product release. The increasing focus on drug safety and efficacy, along with stringent regulatory requirements, contributes to the dominance of this segment.

The contract manufacturing organizations (CMO) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing outsourcing of manufacturing activities by pharmaceutical and biotechnology companies. CMOs provide manufacturing services, including bioburden testing, to ensure product quality and compliance. The growth of the pharmaceutical and biotechnology industries, along with the increasing complexity of drug manufacturing, is fueling the growth of this segment.

Bioburden Testing Market Regional Analysis

- North America dominates the Bioburden Testing market with the largest revenue share of 42.21% in 2024, driven by stringent regulatory frameworks, high healthcare expenditure, and a strong presence of leading pharmaceutical and medical device companies,

- The region's well-established healthcare infrastructure, emphasis on quality control, and early adoption of advanced testing technologies contribute to its market leadership.

U.S. Bioburden Testing Market Insight

The U.S. Bioburden Testing market captured the largest revenue share of 83% within North America in 2025, fueled by the increasing prevalence of chronic diseases, rising geriatric population, and the growing demand for safe and effective medical treatments. The presence of numerous leading pharmaceutical and medical device companies in the U.S. drives market growth through continuous innovation and the development of novel testing solutions. Moreover, stringent regulatory oversight by the FDA and the increasing focus on personalized medicine contribute to the market's expansion.

Europe Bioburden Testing Market Insight

The European Bioburden Testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing adoption of advanced manufacturing technologies, rising healthcare expenditure, and growing awareness of infection control. The market is also driven by the increasing prevalence of chronic diseases and the expanding geriatric population across European countries. Additionally, stringent regulatory standards set by the EMA and the presence of well-established healthcare systems contribute to the market's growth.

U.K. Bioburden Testing Market Insight

The U.K. Bioburden Testing market is anticipated to grow at a noteworthy during the forecast period, driven by the increasing focus on patient safety, the rising prevalence of healthcare-associated infections (HAIs), and the expansion of the pharmaceutical and biotechnology industries. The UK's strong healthcare system, coupled with government initiatives to improve infection control practices, is expected to continue to stimulate market growth. Furthermore, the growing adoption of advanced testing technologies and the increasing demand for cost-effective testing solutions are fueling market growth.

Germany Bioburden Testing Market Insight

The Germany Bioburden Testing market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of product quality and safety, and the demand for high-quality healthcare solutions. Germany's well-developed healthcare infrastructure, combined with its emphasis on research and development, promotes the adoption of innovative testing technologies, particularly in the pharmaceutical and medical device sectors. The increasing focus on personalized medicine and the growing geriatric population are also contributing to the market's expansion.

Asia-Pacific Bioburden Testing Market Insight

The Asia-Pacific Bioburden Testing market is poised to grow at the fastest CAGR of over 21.21% in 2025 driven by the rapid expansion of the pharmaceutical and medical device industries, increasing regulatory focus on product quality, and rising healthcare expenditure in countries such as China, Japan, and India. The region's growing emphasis on improving healthcare infrastructure, coupled with rising disposable incomes and increasing awareness of hygiene and safety, is driving the adoption of bioburden testing. Furthermore, the increasing globalization of supply chains and the growing demand for cost-effective manufacturing are fueling market growth in this region.

Japan Bioburden Testing Market Insight

The Japan Bioburden Testing market is gaining momentum due to the country’s focus on technological advancements in healthcare, a rapidly aging population, and increasing demand for high-quality medical products. The Japanese market places a significant emphasis on precision and reliability in diagnostics and quality control, and the adoption of bioburden testing is driven by the increasing need for accurate and efficient contamination control. Moreover, the growing geriatric population and the increasing prevalence of chronic diseases are driving the demand for advanced medical treatments and devices, further fueling the need for bioburden testing.

China Bioburden Testing Market Insight

The China Bioburden Testing market is experiencing substantial growth, driven by the country's expanding pharmaceutical and medical device industries, increasing government support for the healthcare sector, and rising awareness of product safety and quality. China represents one of the largest and fastest-growing markets for in-vitro diagnostics and pharmaceuticals, with bioburden testing being increasingly utilized in manufacturing facilities, hospitals, and research institutions. The increasing prevalence of infectious diseases, the growing middle class, and rising healthcare expenditure are key factors propelling the market in China.

Bioburden Testing Market Share

The Bioburden Testing industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Merck KGaA (Germany)

- bioMérieux (France)

- Becton, Dickinson and Company (U.S.)

- Sartorius AG (Germany)

- Charles River Laboratories (U.S.)

- Nelson Laboratories (U.S.)

- STERIS plc (U.S.)

- Wuxi AppTec (China)

- Pacific Biolabs (U.S.)

- Eurofins Scientific (Luxembourg)

- Toxikon (U.S.)

- Microbac Laboratories (U.S.)

- SGS SA (Switzerland)

- LuminUltra Technologies Inc. (Canada)

Latest Developments in Global Bioburden Testing Market

- In March 2024, Thermo Fisher Scientific launched the Gibco Countess Automated Cell Counter, a new instrument designed to simplify and accelerate cell counting for bioburden testing and other applications. This innovative cell counter offers improved accuracy, reproducibility, and data management capabilities, enhancing efficiency in quality control laboratories.

- In February 2024, Merck KGaA introduced a new line of MilliporeSigma rapid microbiological testing solutions, enabling faster detection of microbial contamination in pharmaceutical and food samples. These rapid testing kits are designed to reduce turnaround times and improve workflow efficiency, supporting quicker release of products and minimizing production delays.

- In January 2024, bioMérieux announced a partnership with an automation solutions provider to integrate its bioburden testing assays with robotic platforms. This collaboration aims to develop fully automated workflows for bioburden testing, reducing manual handling and improving data integrity in high-throughput laboratories.

- In December 2023, Becton, Dickinson and Company (BD) received FDA clearance for its new rapid microbial detection system, intended for use in pharmaceutical manufacturing. This system provides real-time detection of microbial contamination, allowing for immediate corrective actions and minimizing the risk of product recalls.

- In November 2023, Sartorius AG expanded its portfolio of membrane filtration products with the launch of a new range of filters specifically designed for bioburden testing of viscous solutions. These new filters offer improved flow rates and reduced clogging, enhancing the efficiency of bioburden testing in the pharmaceutical and food and beverage industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.