Global Bacteriological Testing Market

Market Size in USD Billion

CAGR :

%

USD

7.60 Billion

USD

16.10 Billion

2024

2032

USD

7.60 Billion

USD

16.10 Billion

2024

2032

| 2025 –2032 | |

| USD 7.60 Billion | |

| USD 16.10 Billion | |

|

|

|

|

Bacteriological Testing Market Size

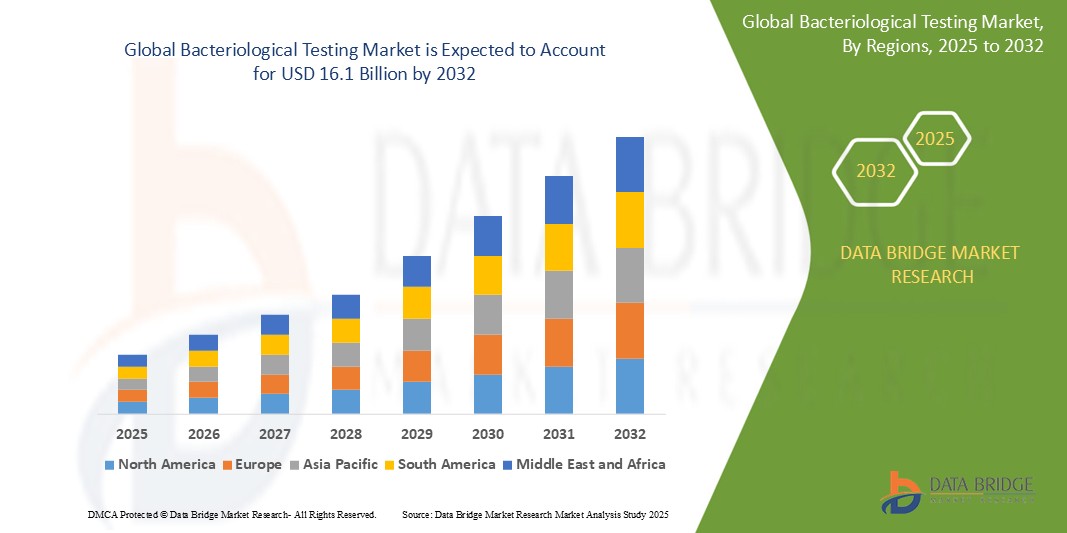

- The Global Bacteriological Testing Market size was valued at USD 7.6 Billion in 2024 and is expected to reach USD 16.1 Billion by 2032, at a CAGR of6.9% during the forecast period

- This growth is driven by factors such as the rise in outbreak of foodborne illnesses and rise in the demand for bacteriological testing in food and beverage industry

Bacteriological Testing Market Analysis

- Bacteriological Testing refers to the laboratory procedures used to identify and quantify microorganisms in food, water, and other products to ensure safety and quality. These tests are critical in detecting harmful bacteria, viruses, and fungi that could lead to foodborne illnesses.

- The demand for Bacteriological Testing is significantly driven by the growing emphasis on food safety, quality assurance, and consumer awareness regarding health. Increasing regulatory pressures and the need for accurate, fast results are also contributing to market growth.

- North America is expected to dominate the Bacteriological Testing market due to stringent food safety regulations, an advanced healthcare infrastructure, and high consumer demand for safe, high-quality food products. The presence of large food processing companies and robust testing services in the U.S. further accelerates this growth.

- Asia-Pacific is expected to register the highest growth rate in the Bacteriological Testing market during the forecast period. This growth is attributed to rapid industrialization, increased demand for processed food, and rising health awareness in countries like China, India, and Japan.

- The Food and Beverage segment is expected to dominate the market with a market share of 56.22% due to the growing popularity of packaged, frozen, and ready-to-eat foods, which are often more prone to contamination.

Report Scope and Bacteriological Testing Market Segmentation

|

Attributes |

Bacteriological Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bacteriological Testing Market Trends

“Technological Advancements and Enhanced Food Safety Protocols”

- One prominent trend in the Bacteriological Testing market is the growing adoption of advanced technologies, such as molecular diagnostics, rapid test kits, and real-time monitoring systems, to enhance the efficiency and accuracy of bacteriological testing across various food sectors.

- Manufacturers are increasingly integrating high-throughput testing solutions to accelerate the detection of pathogens, providing quicker results and reducing time to market for food products.

- For instance, the use of PCR (Polymerase Chain Reaction) and LAMP (Loop-mediated Isothermal Amplification) technologies is expanding in the food industry to ensure faster pathogen detection and ensure food safety.

- Additionally, there is a shift towards automation in food safety testing, allowing for higher throughput and reducing human error, which is crucial for ensuring consistent and reliable results in the testing of large volumes of food products.

Bacteriological Testing Market Dynamics

Driver

“Rising Awareness of Food Safety and Regulations”

- The increasing demand for food safety, especially in light of several foodborne illness outbreaks in recent years, is a significant driver in the bacteriological testing market

- With growing concerns over contamination from pathogens such as Salmonella, E. coli, and Listeria, food manufacturers are increasingly implementing stringent bacteriological testing protocols to comply with global and regional food safety regulations

- Regulatory agencies such as the FDA and EFSA have introduced stricter safety standards, driving the demand for more comprehensive testing to ensure compliance and protect public health

For instance,

- In 2023, the U.S. Food and Drug Administration (FDA) strengthened regulations for pathogen testing in ready-to-eat food products, prompting manufacturers to invest in more advanced and accurate testing methods.

- Stricter global food safety regulations and growing public health concerns are fueling the widespread adoption of bacteriological testing across the food supply chain.

Opportunity

“Increasing Adoption of Rapid Testing Kits and Real-Time Monitoring”

- One of the key opportunities in the Global Bacteriological Testing Market is the growing demand for rapid testing kits and real-time monitoring systems, which offer significant advantages in terms of speed and convenience.

- These technologies allow food manufacturers to conduct on-site testing and receive real-time results, reducing the risk of contamination and ensuring that products meet safety standards before distribution.

- As more food companies focus on increasing operational efficiency, there is a growing opportunity for the development of portable testing devices and smart solutions that enhance the flexibility and scalability of bacteriological testing

For instance,

- In 2024, Thermo Fisher Scientific launched a rapid pathogen detection kit for dairy and meat products, designed to provide results in under an hour, significantly reducing time-to-market for food producers

- The demand for faster, on-site, and reliable pathogen detection is opening new avenues for innovation in rapid bacteriological testing technologies.

Restraint/Challenge

“High Testing Costs and Complexity of Regulatory Compliance”

- Despite the significant growth of the bacteriological testing market, high testing costs and complex regulatory compliance remain key challenges.

- The cost of advanced testing technologies, including PCR and immunoassays, can be prohibitive for small- and medium-sized food producers, limiting their ability to maintain consistent food safety protocols.

- Additionally, manufacturers must navigate varying regulatory standards across different countries and regions, which can increase the complexity and costs of compliance

For instance,

- According to a report by the European Commission (2023), food manufacturers in Europe face rising costs for pathogen testing as a result of tighter regulations and the need to upgrade testing infrastructure to meet updated food safety laws

- These challenges may deter some manufacturers from implementing frequent or comprehensive testing procedures, particularly in emerging markets where cost pressures are higher.

Bacteriological Testing Market Scope

The market is segmented on the basis of component, bacteria, technology and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Bacteria |

|

|

By Technology |

|

|

By End User |

|

In 2025, the food and beverage is projected to dominate the market with a largest share in application segment

The food and beverage segment is expected to dominate the bacteriological testing market with the largest share of 56.22% in 2025 due to the rising focus on food safety, hygiene, and regulatory compliance. This segment requires rigorous testing to detect harmful pathogens such as Salmonella, Listeria, and E. coli, ensuring consumer health and maintaining brand reputation in both processed and fresh food categories.

The rapid technology is expected to account for the largest share during the forecast period in application market

In 2025, the rapid technology segment is expected to dominate the market with the largest market share of 51.31% due to the growing demand for faster, accurate, and cost-effective detection methods across food and beverage, pharmaceutical, and water testing industries.

Bacteriological Testing Market Regional Analysis

“Europe Holds the Largest Share in the Bacteriological Testing Market”

- Europe dominates the Bacteriological Testing market with a share of 36.45%, primarily due to the region's stringent food safety regulations, strong enforcement of hygiene standards, and advanced infrastructure for food quality testing

- Countries like Germany, France, and the U.K. are leading contributors, supported by the presence of certified laboratories and well-established food processing sectors

- The European Food Safety Authority (EFSA) plays a pivotal role in driving demand for bacteriological testing by mandating microbial safety assessments across food supply chains

- Rising consumer demand for high-quality, pathogen-free food products and increasing incidents of foodborne illnesses are further accelerating testing adoption across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Bacteriological Testing Market”

- The Asia-Pacific region is expected to witness the highest CAGR during the forecast period, driven by rapid urbanization, industrialization of the food sector, and growing consumer awareness of food safety

- Countries such as China, India, and Vietnam are expanding their food production capacities, necessitating stricter quality control and bacteriological testing to meet both domestic and export standards

- Government initiatives promoting food safety modernization, along with the expansion of retail food chains and e-commerce platforms, are contributing to increased demand for testing services

- Investments in laboratory infrastructure, rising cases of foodborne diseases, and increased regulatory enforcement are strengthening the bacteriological testing landscape across Asia-Pacific

Bacteriological Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SGS SA (Switzerland)

- Bureau Veritas (France)

- Intertek Group plc (UK)

- Eurofins Scientific (Luxembourg)

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- bioMérieux SA (France)

- 3M Company (U.S.)

- ALS Limited (Australia)

- Neogen Corporation (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Romer Labs Division Holding GmbH (Austria)

- Microbac Laboratories, Inc. (U.S.)

- Charm Sciences, Inc. (U.S.)

- Mérieux NutriSciences Corporation (U.S.)

- IDEXX Laboratories, Inc. (U.S.)

- QIAGEN N.V. (Netherlands)

- R-Biopharm AG (Germany)

- FOSS (Denmark)

- DuPont Nutrition & Biosciences (U.S.)

Latest Developments in Global Bacteriological Testing Market

- In March 2025, Eurofins Scientific launched an advanced AI-integrated rapid bacteriological testing platform for high-throughput screening of Listeria, Salmonella, and E. coli in dairy and meat products. This platform shortens detection time to under 8 hours and enhances testing accuracy, helping food processors comply with increasingly strict food safety standards.

- In October 2024, SGS SA introduced a portable on-site bacteriological testing kit for small and medium-sized food businesses. Designed for ease of use in remote or low-infrastructure settings, the kit enables real-time detection of bacterial contamination with results available within 12 hours, empowering businesses to take immediate corrective actions and reduce spoilage risks.

- In January 2025, 3M Food Safety Division launched a next-generation Molecular Detection Assay 3 platform, offering enhanced sensitivity and faster results for detecting pathogens like Listeria monocytogenes and Salmonella in processed meat and dairy products. The platform is designed to help food manufacturers comply with evolving international food safety regulations while increasing lab productivity.

- In September 2024, Bio-Rad Laboratories Inc. introduced the iQ-Check Free Listeria Kit, a PCR-based bacteriological testing solution that reduces the time required for contamination detection in food production environments. The kit supports rapid screening of environmental samples without requiring complex sample enrichment, catering to the growing demand for real-time monitoring.

- In August 2024, Neogen Corporation unveiled its updated ANSR® system, incorporating a fully automated pathogen detection protocol with cloud-based data reporting. Designed for food processing plants and central labs, the system allows for the simultaneous detection of E. coli O157:H7, Listeria spp., and Salmonella, significantly reducing turnaround time and improving traceability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bacteriological Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bacteriological Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bacteriological Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.