Global Automotive Sensors Market

Market Size in USD Billion

CAGR :

%

USD

27.40 Billion

USD

45.30 Billion

2024

2032

USD

27.40 Billion

USD

45.30 Billion

2024

2032

| 2025 –2032 | |

| USD 27.40 Billion | |

| USD 45.30 Billion | |

|

|

|

|

Automotive Sensors Market Size

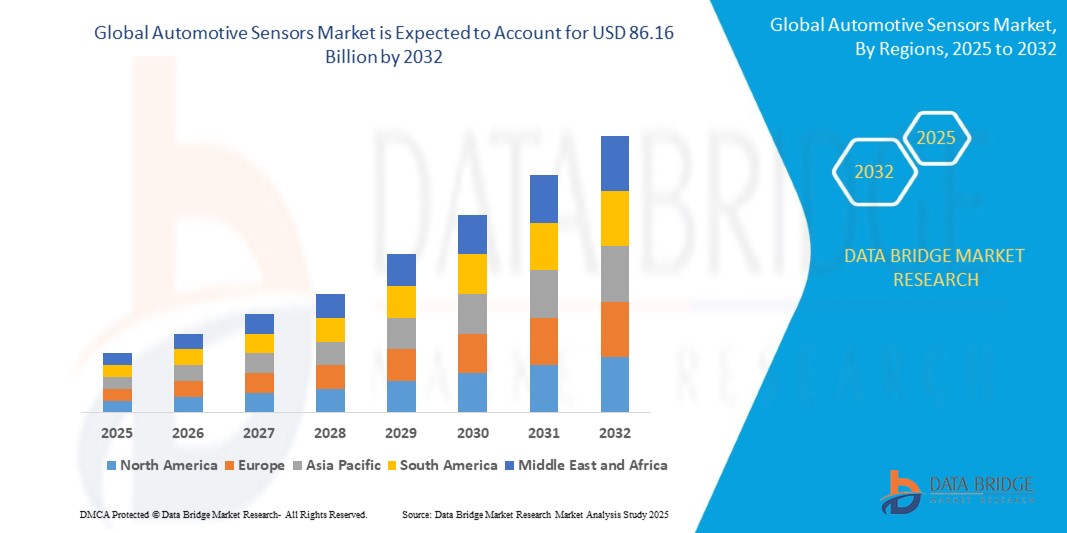

- The Global Automotive Sensors Market size was valued at USD 38.7 billion in 2024 and is expected to reach USD 86.16 billion by 2032, at a CAGR of 9.3% during the forecast period

- This growth is driven by factors such as the Advancements in Automotive Technology, Rising Demand for Advanced Driver Assistance Systems (ADAS), and Proliferation of Electric Vehicles (EVs) technology

Automotive Sensors Market Analysis

- Automotive sensors are the sensors that are scan the surrounding environment and then detect, measure, and transmit the information as an electric or optical signal to the concerned component. The automotive sensors are capacble of sensing heat, light, motion, moisture, and pressure.

- Surging number of collaborations among vehicle original equipment manufacturers and sensor manufacturers, rise in the advancements in production technology and increasing application of automotive sensors for a wide range of applications such as powertrain, chassis, exhaust, safety and control, body electronics, telematics, and others are the major factors attributable to the growth of automotive sensors market.

- North America dominates the automotive sensors market and will continue to flourish its trend of dominance during the forecast period owing to the rising focus towards the adoption of advanced technologies.

- Asia-Pacific will however, score the highest CAGR for this period. This is because of the rising demand and production of vehicles especially in the emerging economies like India and China.

- Temperature Sensors segment is expected to dominate the market with a market share of 54.37% due to their critical role in engine, battery, and HVAC system monitoring for performance and safety.

Report Scope and Automotive Sensors Market Segmentation

|

Attributes |

Automotive Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Sensors Market Trends

“Integration of AI and Sensor Fusion Technologies”

- A major trend shaping the automotive sensor market is the integration of Artificial Intelligence (AI) and sensor fusion. Instead of relying on individual sensor readings, vehicles now combine inputs from radar, LiDAR, cameras, and ultrasonic sensors to build a complete understanding of their environment.

- For instance, in driver assistance systems, AI helps process data from multiple sources to detect pedestrians, obstacles, or lane markings more accurately. This enables quicker, safer decision-making in complex driving scenarios.

- As autonomous technology develops, the demand for smarter, AI-powered sensors that can learn and adapt in real-time will continue to grow.

Automotive Sensors Market Dynamics

Driver

“Rising Demand for Driver Monitoring and Cabin Environment Sensors”

- As the industry shifts toward safety and comfort, there is an increasing focus on sensors that monitor the driver and interior cabin environment. With stricter safety regulations and a growing concern about distracted driving, sensors are now used to track driver attention, fatigue levels, and body posture.

- These systems can alert the driver or even take corrective action if unsafe behavior is detected. At the same time, cabin climate, air quality, and personalized passenger comfort are being enhanced through environmental sensors.

- Automakers are embedding these technologies as standard features, especially in high-end or smart vehicles.

For instance,

- Infrared sensors track eye movement to detect signs of drowsiness or loss of focus. CO₂ and humidity sensors regulate cabin air quality, automatically adjusting ventilation. Seat occupancy sensors ensure airbags deploy correctly based on weight and position. Temperature sensors work with climate control systems to maintain ideal comfort for each passenger. Gesture recognition sensors allow touchless control of infotainment systems to reduce distraction.

Opportunity

“Rising Demand for Electric Vehicles (EVs)”

- The transition from combustion engines to electric vehicles is creating a surge in demand for highly specialized sensors.

- EVs need precise sensors to manage battery health, motor efficiency, and thermal stability.

For instance,

- temperature sensors help prevent overheating in lithium-ion batteries, ensuring longer battery life and safer vehicle operation. Current sensors track energy usage and help optimize charging cycles, crucial for driver satisfaction and cost-efficiency.

- As governments push for greener mobility, sensor manufacturers have a growing opportunity to develop EV-specific sensor technologies tailored for next-gen vehicles.

Restraint/Challenge

“High Cost of Advanced Sensor Integration”

- One major restraint in the automotive sensors market is the high cost of integrating advanced sensor systems, especially in mid-range or budget vehicles. Sophisticated sensors like LiDAR, radar, and 3D cameras require specialized materials, complex calibration, and precise software-hardware integration.

- This adds significant cost to vehicle production, which is a challenge in price-sensitive markets. While luxury and electric vehicles often absorb these costs, widespread adoption remains limited in mass-market segments.

- Manufacturers face the balancing act of maintaining affordability while enhancing safety and performance.

For instance,

- Integrating LiDAR systems into vehicles can cost thousands of dollars, raising the overall vehicle pric. Advanced driver-assistance sensors often require costly ECU (Electronic Control Unit) upgrades. Camera-based systems need regular recalibration after repairs, adding to service costs. Many budget vehicles skip certain sensors to keep prices low, limiting safety features. The complexity of multi-sensor fusion increases both development time and production cost

Automotive Sensors Market Scope

The market is segmented on the basis sensor type, vehicle type, application, and technology.

|

Segmentation |

Sub-Segmentation |

|

Sensor type |

|

|

Vehicle type |

|

|

Application |

|

|

Technology |

|

In 2025, the Temperature Sensors is projected to dominate the market with a largest share in segment

In 2025, temperature sensors are expected to take the lead in the automotive sensor market, capturing a dominant share of 54.37%. This growth is mainly due to their essential role in monitoring and managing vehicle systems like engines, batteries, and HVAC units. As vehicles—especially electric ones—become more complex, maintaining the right temperature range is critical for safety and performance. Overheating in EV batteries can lead to major failures, so real-time temperature tracking is a must-have. Internal combustion engines also rely on accurate heat management to prevent breakdowns and reduce emissions.

The Pressure Sensors is expected to account for the largest share during the forecast period in market

Pressure sensors are expected to hold a major 49.32% share of the automotive sensor market during the forecast period due to their wide-ranging applications in vehicle systems. These sensors are essential for monitoring tire pressure, fuel injection systems, oil levels, and braking performance. In modern vehicles, tire pressure monitoring systems (TPMS) are now mandatory in many countries, making these sensors standard in new cars. They help improve safety, fuel efficiency, and driving comfort by providing real-time pressure data.

Automotive Sensors Market Regional Analysis

“North America Holds the Largest Share in the Automotive Sensors Market”

- North America is expected to hold the largest share of the automotive sensors market due to the region’s strong automotive industry and increasing demand for advanced vehicle technologies. The United States, in particular, is a key hub for both traditional and electric vehicle manufacturing. With the rise of autonomous and connected vehicles, North American automakers are incorporating a wide variety of sensors, including temperature, pressure, and motion sensors, into their vehicles.

- Additionally, government regulations in the region, such as stricter safety and environmental standards, are driving the need for more sensor technologies. The demand for Advanced Driver Assistance Systems (ADAS) and electric vehicles (EVs) is growing rapidly, fueling further sensor adoption.

- North American consumers also show a preference for high-tech, safety-oriented vehicles, which leads automakers to invest heavily in sensor integration. The region’s well-established research and development capabilities, alongside significant investments in smart transportation, continue to support market growth.

“Asia-Pacific is Projected to Register the Highest CAGR in the Automotive Sensors Market”

- Asia-Pacific is projected to register the highest Compound Annual Growth Rate (CAGR) in the automotive sensors market due to the rapid growth of the automotive industry in countries like China, Japan, and India. China, as the world’s largest car market, is driving demand for both conventional and electric vehicles, leading to increased sensor adoption for safety, performance, and connectivity. The region's growing middle-class population and rising disposable incomes are also contributing to higher vehicle sales, further boosting the market.

- In addition, Asia-Pacific is a key manufacturing hub, where major automotive sensor manufacturers are expanding their production capabilities to meet local demand. With governments in countries like Japan and South Korea focusing on smart cities and infrastructure, the integration of sensors into vehicles for connected and autonomous driving technologies is on the rise.

- Moreover, the region's shift towards electric vehicles is accelerating the demand for sensors to monitor battery systems, charging stations, and powertrains. The combination of innovation, government initiatives, and consumer demand makes Asia-Pacific a key growth driver for the automotive sensor market.

Automotive Sensors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are

- NXP Semiconductors.,

- STMicroelectronics,

- Infineon Technologies AG,

- TE Connectivity.,

- Texas Instruments Incorporated.,

- Sensata Technologies, Inc.,

- Littelfuse Inc.,

- Robert Bosch GmbH,

- Continental AG,

- BorgWarner Inc.,

- Analog Devices, Inc.,

- Sensata Technologies, Inc.,

- DENSO CORPORATION,

- Autoliv Inc.,

- Maxim Integrated,

- Hitachi Astemo Americas, Inc.,

- GMS Instruments BV,

- Broadcom.,

- Piher Sensors & Controls

- Elmos Semiconductor SE

Latest Developments in Global Automotive Sensors Market

- In 2025, Sensata developed a new Intelligent Tire Pressure Monitoring System (TPMS) that replaces traditional UHF radio with Bluetooth® low energy wireless technology, enabling two-way communication. This advancement enhances safety, performance, and driving experience by supporting Over-the-Air updates and cybersecurity authentication. A leading North American OEM has selected this solution for its electric vehicles.

- In October 2024, Infineon unveiled the CYFP10020A00 and CYFP10020S00 automotive-grade fingerprint sensor ICs. These sensors are specifically designed to work seamlessly with Infineon's TRAVEO™ T2G microcontrollers, providing accurate fingerprint identification for enhanced in-vehicle personalization and secure payment authentication. Compliant with AEC-Q100 standards, these sensors feature encrypted data output through an SPI interface, ensuring a high level of data security and reliability in automotive applications.

- In December 2023, Continental introduced a valve cap sensor designed for commercial vehicle tires. This new sensor enables real-time tire pressure monitoring and is compatible with tires from all major manufacturers. The sensor integrates smoothly with Continental’s ContiConnect platform, which helps fleet operators monitor tire health, optimize maintenance schedules, and improve vehicle uptime by preventing tire-related issues.

- At CES 2024, Texas Instruments launched the AWR2544, a 77GHz millimeter-wave radar sensor chip that introduces a new level of vehicle sensing capabilities. This cutting-edge chip extends detection ranges beyond 200 meters, significantly improving the performance of Advanced Driver Assistance Systems (ADAS) by enhancing situational awareness. Additionally, TI introduced DRV3946-Q1 and DRV3901-Q1 driver chips for battery management and powertrain systems, offering built-in diagnostics and ensuring functional safety compliance, crucial for reliable electric vehicle operations.

- In April 2024, Infineon expanded its portfolio with the launch of the PSoC™ 4 HVMS family of programmable microcontrollers. These new microcontrollers integrate advanced high-voltage features and analog capabilities, making them suitable for applications like touch-enabled human-machine interfaces (HMIs) and other smart sensing technologies. With AEC-Q100 certification and ISO26262 compliance, these microcontrollers are built to meet stringent safety and reliability requirements for automotive applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.