Global Automated Material Handling Equipment Market

Market Size in USD Billion

CAGR :

%

USD

61.40 Billion

USD

114.30 Billion

2024

2032

USD

61.40 Billion

USD

114.30 Billion

2024

2032

| 2025 –2032 | |

| USD 61.40 Billion | |

| USD 114.30 Billion | |

|

|

|

|

Automated Material Handling Equipment Market Size

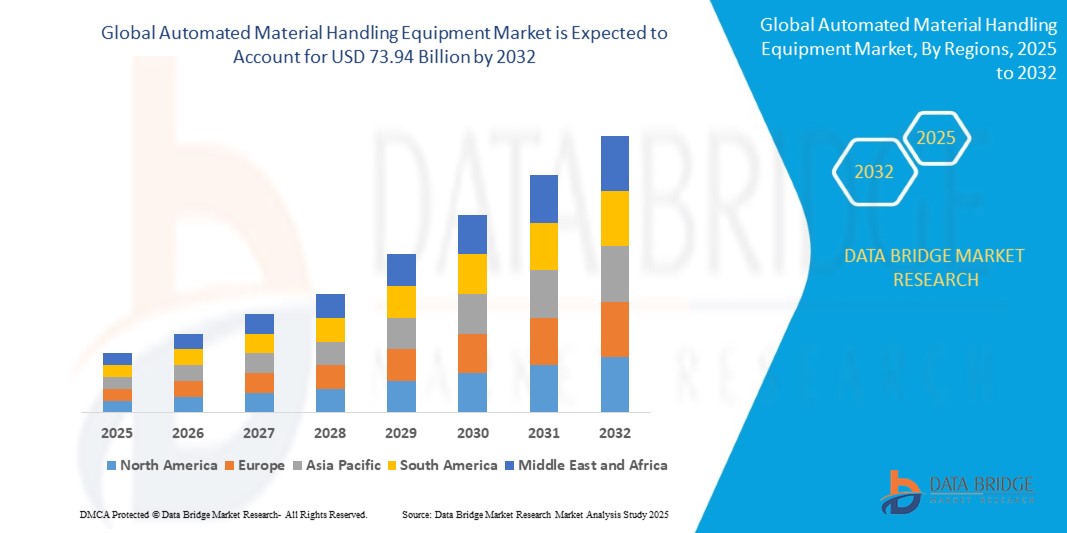

- The global automated material handling equipment market size was valued at USD 34.77 billion in 2024 and is expected to reach USD 73.94 billion by 2032, at a CAGR of 9.89% during the forecast period

- This growth is driven by factors such as rising demand for automation in manufacturing, rapid expansion of e-commerce, and increasing focus on workplace safety and operational efficiency

Automated Material Handling Equipment Market Analysis

- Automated material handling equipment (AMHE) plays a crucial role in enhancing productivity, reducing labor costs, and improving safety across industries such as manufacturing, logistics, automotive, and e-commerce

- The demand for AMHE is significantly driven by the surge in e-commerce, need for efficient warehousing solutions, and increasing adoption of Industry 4.0 technologies

- Asia-Pacific is expected to dominate the automated material handling equipment market with largest market share of 39.4%, due to surging demand for cranes and hoists in the mining sector. This demand is further fueled by increased industrialization activities within the region, particularly in mining and construction industries

- North America is expected to be the fastest growing region in the automated material handling equipment market during the forecast period due to technological innovation, which is driving the development of new and more advanced automated material handling (AMH) equipment

- Robots segment is expected to dominate the market with largest market share of 22.01% due to the increasing demand for flexible, precise, and efficient handling solutions across various industries. Robots offer significant advantages in terms of speed, accuracy, and ability to operate continuously with minimal human intervention, making them ideal for applications in automotive, electronics, food and beverage, and e-commerce sectors

Report Scope and Automated Material Handling Equipment Market Segmentation

|

Attributes |

Automated Material Handling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Automated Material Handling Equipment Market Trends

“Integration of AI, IoT, and Robotics in Material Handling Systems”

- One prominent trend in the automated material handling equipment market is the increasing integration of artificial intelligence (AI), Internet of Things (IoT), and robotics to create smart, adaptive handling systems

- These technologies enable real-time data analysis, predictive maintenance, and autonomous decision-making, significantly enhancing efficiency, throughput, and system reliability in warehouses and manufacturing environments

- For instance, AI-powered robotic systems can dynamically optimize picking routes and adapt to variable product flows, while IoT-enabled conveyors and storage systems provide continuous operational feedback to streamline supply chain operations

- This digital transformation is revolutionizing material handling processes, reducing downtime, improving resource utilization, and fueling the shift toward fully automated and intelligent logistics ecosystems

Automated Material Handling Equipment Market Dynamics

Driver

“Surging Demand for Automation Across Warehousing and Manufacturing”

- The growing need for operational efficiency, labor cost reduction, and enhanced productivity is driving the widespread adoption of automated material handling equipment across industries such as e-commerce, automotive, food & beverage, and pharmaceuticals

- As global supply chains become increasingly complex and demand for fast, accurate order fulfillment rises, companies are turning to automation to streamline processes, reduce errors, and improve safety in their operations

- The surge in e-commerce activities, especially post-pandemic, has placed immense pressure on warehouses and distribution centers to handle large volumes of inventory efficiently, further accelerating the adoption of automation

For instance,

- According to the International Federation of Robotics (IFR), the global installation of industrial robots reached 553,052 units in 2022, marking a 5% increase from the previous year—underscoring the rising reliance on automation in material handling and logistics

- As a result, the push for operational excellence and faster throughput is significantly increasing the demand for automated material handling equipment, making it a critical enabler of next-generation industrial and logistics infrastructure

Opportunity

“Growth in E-Commerce and Online Retailing Driving Demand for Automation”

- The rapid growth of e-commerce and online retailing is significantly fueling the demand for automated material handling solutions, as businesses seek faster, more efficient ways to manage large volumes of goods and ensure quick order fulfillment

- Automated systems like robotic pickers, conveyor belts, and automated storage and retrieval systems (AS/RS) are becoming essential to handle high order volumes, improve accuracy, and speed up processing times in distribution centers and warehouses

- The demand for real-time inventory management, faster shipping, and error-free order picking is driving the need for sophisticated automation technologies

For instance,

- In February 2024, according to a report by Statista, global e-commerce sales were projected to surpass USD 5 trillion in 2025, with more than 50% of these sales being processed through automated warehouses and fulfillment centers. This growth in online retailing creates a substantial market opportunity for AMHE providers to develop innovative solutions that can handle complex logistics and meet customer expectations for rapid delivery

- The continued expansion of the e-commerce sector is creating significant opportunities for automated material handling systems, particularly in last-mile delivery and warehouse automation, positioning the market for sustained growth in the coming years

Restraint/Challenge

“High Initial Investment and Maintenance Costs Hindering Market Growth”

- The high upfront cost of automated material handling equipment, along with ongoing maintenance and operational expenses, poses a significant challenge for businesses, particularly in emerging markets and small-to-medium enterprises (SMEs)

- Automated systems, which often require substantial capital investment in infrastructure, software, and integration, can range from tens of thousands to millions of dollars depending on the complexity and scale of the solution

- This financial burden can discourage smaller businesses from adopting automation, forcing them to rely on manual labor or outdated equipment, which hampers productivity and efficiency

For instance,

- In October 2024, according to a report by the International Federation of Robotics (IFR), the high initial costs and long payback periods of automated systems are some of the main barriers for companies in developing regions to adopt advanced material handling solutions. The reluctance to invest in these systems results in slower adoption rates, particularly among businesses with limited budgets and smaller operations

- As a result, such limitations can hinder the widespread adoption of automation, especially in price-sensitive sectors, ultimately restricting the overall growth of the AMHE market

Automated Material Handling Equipment Market Scope

The market is segmented on the basis of product, system type, software and services, function, and industry

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By System Type |

|

|

By Software and Services |

|

|

By Function |

|

|

By Industry |

|

In 2025, the robots is projected to dominate the market with a largest share in product segment

The robots segment is expected to dominate the automated material handling equipment market with the largest share of 22.01% due to the increasing demand for flexible, precise, and efficient handling solutions across various industries. Robots offer significant advantages in terms of speed, accuracy, and ability to operate continuously with minimal human intervention, making them ideal for applications in automotive, electronics, food and beverage, and e-commerce sectors

The e-commerce is expected to account for the largest share during the forecast period in industry segment

In 2025, the e-commerce segment is expected to dominate the market with the largest market share of 20.01% due to increased penetration of online shopping platforms, the existence of large online merchants, and rising logistics infrastructure are expected to drive the demand for this product in the e-commerce industry. Several grocery stores have evolved into convenience stores that provide fast-food-like services, including frozen food, ready-to-eat meals, and fresh items, which has led to the rise of the food industry

Automated Material Handling Equipment Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Automated Material Handling Equipment Market”

- Asia-Pacific is the dominant region in the global AMHE market with the largest market share of 35% of the market share in 2023

- China is a significant contributor to this growth with a largest market share of 23.3%, driven by its robust manufacturing sector, large-scale e-commerce operations, and government initiatives promoting automation

- India and Southeast Asian countries such as Thailand, Vietnam, and Indonesia are rapidly adopting automation technologies to enhance productivity and meet the demands of expanding industries such as automotive, electronics, and logistics

“North- America is Projected to Register the Highest CAGR in the Automated Material Handling Equipment Market”

- North America, particularly the U.S., is experiencing significant growth in the AMHE market, with the U.S. projected to grow at a CAGR of 10.5% from 2025 to 2032

- The region's growth is fueled by advancements in AI, robotics, and IoT technologies, leading to the development of more efficient and intelligent material handling systems

- The automotive and e-commerce sectors in the U.S. are major drivers of this growth, with companies investing heavily in automation to improve efficiency and reduce labor costs

Automated Material Handling Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Daifuku Co., Ltd. (Japan)

- Dematic (KION Group) (Germany)

- SSI Schaefer Group (Germany)

- Honeywell Intelligrated (U.S.)

- Vanderlande (Toyota Advanced Logistics Group) (Netherlands)

- Knapp AG (Austria)

- Murata Machinery Ltd. (Japan)

- Material Handling Systems (MHS) (U.S.)

- WITRON Integrated Logistics (Germany)

- Interlake Mecalux (Mecalux) (Spain)

- Beumer Group GmbH (Germany)

- Siemens Logistics (Germany)

- TGW Logistics Group GmbH (Austria)

- Swisslog AG (KUKA Robotics) (Switzerland)

- Fives Intralogistics (Fives Group) (France)

- Kardex AG (Switzerland)

- Bastian Solutions (Toyota Advanced Logistics Group) (U.S.)

- Elettric 80 (Italy)

- AutoStore AS (Norway)

- System Logistics SpA (Italy)

Latest Developments in Global Automated Material Handling Equipment Market

- In March 2023, THiRARobotics Co., Ltd. unveiled its next-generation autonomous mobile robots, marking a major advancement in logistics, warehousing, manufacturing, and healthcare operations. These cutting-edge robots represent a significant technological leap, offering improved efficiency, adaptability, and versatility across multiple sectors. This development underscores the increasing demand for intelligent, autonomous solutions to streamline material handling processes and enhance operational productivity

- In March 2022, Toyota Industries Corporation strengthened its logistics portfolio by acquiring Viastore, a prominent provider of material handling systems. This strategic acquisition enhances Toyota Industries' ability to offer advanced automation solutions, particularly designed for small and medium-sized enterprise distribution centers, further solidifying its leadership in the sector. This move highlights the growing trend of industry consolidation and the increasing demand for scalable, efficient automation solutions for diverse business sizes

- In September 2020, Bohus partnered with Jungheinrich to develop a state-of-the-art central warehouse near Oslo, Lillestrøm. The project integrates a comprehensive suite of automation solutions, including Miniload systems, conveyor technology, and high pallet racking warehouses. This initiative reflects Bohus’ commitment to optimizing its logistics operations and significantly enhancing the efficiency of its goods handling processes. This development exemplifies the growing demand for advanced automation technologies in warehouse and logistics operations. The integration of such innovative solutions underscores the industry's drive for improved operational efficiency, faster throughput, and cost-effectiveness, contributing to the continued expansion and evolution of the AMHE market globally

- In March 2025, Bastian Solutions merged with Viastore North America, integrating its operations into the Toyota Automated Logistics Group. This strategic collaboration combines Bastian Solutions’ expertise in systems integration with Viastore’s specialization in automated pallet handling technologies, thereby enhancing their combined capabilities in warehouse automation and storage solutions. This merger highlights the growing trend of consolidation within the industry to offer more comprehensive and advanced automation solutions

- In March 2024, OTTO Motors, a leader in autonomous mobile robots (AMRs), became a key player in autonomous production logistics, a groundbreaking sector within manufacturing innovation. With the acquisition of OTTO Motors into its portfolio, Rockwell Automation significantly expanded its material handling capabilities, providing a comprehensive solution for optimizing operations across entire facilities. This acquisition underscores the growing trend of integrating autonomous robotics into material handling systems to enhance efficiency, flexibility, and scalability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automated Material Handling Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automated Material Handling Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automated Material Handling Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.