Global Animal Growth Promoters Performance Enhancers Market

Market Size in USD Billion

CAGR :

%

USD

13.72 Billion

USD

21.84 Billion

2024

2032

USD

13.72 Billion

USD

21.84 Billion

2024

2032

| 2025 –2032 | |

| USD 13.72 Billion | |

| USD 21.84 Billion | |

|

|

|

|

Animal Growth Promoters and Performance Enhancers Market Size

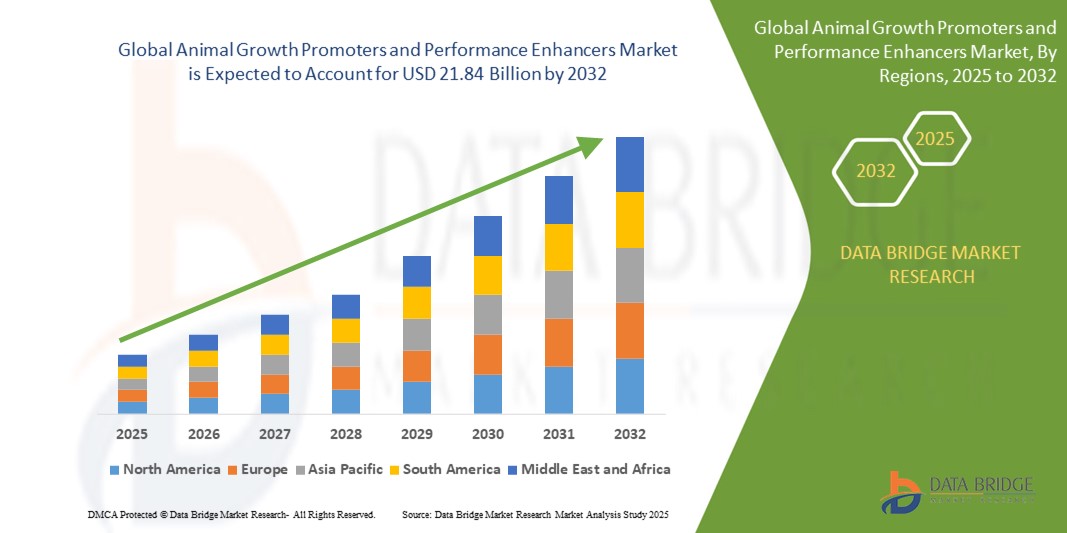

- The global animal growth promoters and performance enhancers market size was valued at USD 13.72 billion in 2024 and is expected to reach USD 21.84 billion by 2032, growing at a CAGR of 6.10% during the forecast period.

- This growth is primarily driven by factors such as the rising global demand for animal protein, increasing focus on feed efficiency and weight gain, and emergence of non-antibiotic growth promoters due to growing regulatory restrictions and consumer awareness.

Animal Growth Promoters and Performance Enhancers Market Analysis

- Animal growth promoters and performance enhancers are critical feed additives or veterinary substances used to boost growth rates, improve feed conversion ratios, enhance immunity, and increase overall livestock productivity. These agents play a key role in improving profitability in the meat and dairy industries by optimizing animal health and production efficiency.

- The market is witnessing sustained expansion, particularly in developing countries where meat consumption is rising, and modern animal farming practices are gaining traction.

- The Non-Antibiotic segment, including probiotics, prebiotics, phytogenics, and enzymes, is rapidly gaining market share due to consumer pushback against antibiotic use and growing regulatory restrictions, especially across Europe and North America.

- The Poultry segment is expected to dominate the market with a significant share, driven by high global poultry meat consumption, shorter production cycles, and sensitivity to performance enhancers.

- Growth Promotion remains the leading function segment, accounting for a major portion of the demand due to its direct impact on meat yield and profitability, followed closely by feed efficiency enhancement.

- Based on source, Natural growth promoters such as plant-derived phytogenics and organic acids are witnessing increasing adoption due to their safety profile, reduced antibiotic resistance concerns, and support from organic livestock farming trends.

- The Asia-Pacific region leads the market with a share of over 38.12%, owing to the large livestock base, rapid urbanization, and rising meat consumption, particularly in China and India.

- North America is expected to grow at a robust pace due to increasing adoption of alternative growth enhancers, technological advancements in feed formulation, and stringent regulatory reforms favoring non-antibiotic solutions.

Report Scope and Animal Growth Promoters and Performance Enhancers Market Segmentation

|

Attributes |

Animal Growth Promoters and Performance Enhancers Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Animal Growth Promoters and Performance Enhancers Market Trends

“Shifting Preference Towards Natural and Antibiotic-Free Growth Promoters”

- Growing consumer demand for antibiotic-free meat and dairy products is encouraging the shift towards natural growth enhancers such as phytogenics, probiotics, and enzymes

- Regulatory bans and restrictions on antibiotic growth promoters in regions like the EU, China, and the U.S. are accelerating the adoption of alternative solutions

- Companies like Cargill (U.S.) and Phibro Animal Health Corporation (U.S.) are expanding their portfolios with natural and sustainable performance enhancers

- Increasing investment in R&D for plant-based and organic acid-based additives is driving innovation in antibiotic-free feed solutions

- The trend aligns with global sustainability goals and consumer-driven clean-label demands

Animal Growth Promoters and Performance Enhancers Market Dynamics

Driver

“Rising Demand for High-Quality Animal Protein”

- Global population growth and rising incomes, especially in Asia-Pacific and Latin America, are driving demand for meat, milk, and eggs

- Livestock producers are increasingly adopting growth promoters to improve feed efficiency, weight gain, and disease resistance

- Companies such as DSM Nutritional Products (Netherlands) and Elanco Animal Health (U.S.) are offering high-efficiency enzyme and vitamin-based additives for poultry, swine, and cattle

- Improved feed conversion ratios help lower production costs and increase profitability in commercial livestock operations

- Demand for protein-rich diets and efficient farming practices is fueling sustained adoption of performance enhancers

Restraint/Challenge

“Regulatory Restrictions on Antibiotic Growth Promoters”

- Growing global concerns over antimicrobial resistance are leading to strict regulations or bans on antibiotic growth promoters

- Countries like those in the EU have completely banned AGPs, while others like India and China are phasing them out

- Regulatory compliance is forcing companies to reformulate or discontinue antibiotic-based product lines

- Transitioning to non-antibiotic solutions increases R&D expenses and raises production costs, especially for small- and mid-sized manufacturers

- Resistance from some livestock producers due to performance variability and cost of alternatives presents an adoption challenge in price-sensitive markets

Animal Growth Promoters and Performance Enhancers Market Scope

The market is segmented on the basis of product, livestock, function, and source.

- By Product

On the basis of product, the Animal Growth Promoters and Performance Enhancers Market is segmented into Antibiotic and Non-Antibiotic. The Antibiotic segment holds the largest revenue share of 46.3% in 2025, primarily due to its historical dominance and cost-effectiveness in improving animal growth rates and feed efficiency in commercial livestock production. Despite regulatory pressures, antibiotics continue to be used in several developing countries due to lack of affordable alternatives.

However, the Non-Antibiotic segment is expected to register the highest CAGR of 6.87% during the forecast period of 2025–2032. This growth is driven by growing consumer preference for antibiotic-free meat, regulatory bans on AGPs in several regions, and increased adoption of natural alternatives such as probiotics, phytogenics, and organic acids across the animal feed industry.

- By Livestock

On the basis of livestock, the market is segmented into Poultry, Swine, Cattle, and Aquaculture. The Poultry segment dominates the market with a revenue share of 39.6% in 2025, owing to high global demand for chicken meat and eggs, shorter production cycles, and greater feed efficiency requirements in poultry farming. Growth promoters are widely used to optimize weight gain and improve immunity in broilers and layers.

However, the Aquaculture segment is anticipated to witness the highest CAGR of 7.24% during the forecast period. This is due to the rapid expansion of aquaculture in Asia-Pacific and the Middle East, increasing demand for fish protein, and the growing use of performance enhancers in fish feed to improve digestion, survival rate, and disease resistance in intensive aquaculture operations.

- By Function

On the basis of function, the market is segmented into Growth Promotion, Performance Enhancement, Immunity Boosting, and Feed Efficiency. The Growth Promotion segment held the largest share of 33.8% in 2025, as producers continue to rely on additives that accelerate weight gain and shorten production cycles, particularly in poultry and swine.

The Immunity Boosting segment is expected to grow at the highest CAGR of 7.45% during 2025–2032, fueled by increased concerns over animal health, rising disease outbreaks in intensive livestock systems, and greater demand for additives that improve gut health and immune response, especially in antibiotic-free production systems.

- By Source

On the basis of source, the Animal Growth Promoters and Performance Enhancers Market is segmented into Natural and Synthetic. The Synthetic segment accounts for the largest share of 51.2% in 2025, attributed to its proven efficacy, availability, and lower cost in comparison to natural counterparts. Synthetic additives such as beta-agonists and chemical enzymes are still widely used in large-scale production.

Nevertheless, the Natural segment is projected to grow with the highest CAGR of 7.67% during the forecast period. This growth is driven by consumer-driven demand for clean-label and organic animal products, increasing regulatory scrutiny of chemical-based additives, and growing adoption of plant-based and probiotic feed solutions across developed and emerging economies.

Global Animal Growth Promoters and Performance Enhancers Market Regional Analysis

North America Animal Growth Promoters and Performance Enhancers Market Insight

North America accounted for the largest revenue share of 34.8% in the global animal growth promoters and performance enhancers market in 2025, primarily driven by advanced livestock farming practices and high meat consumption per capita. The region benefits from strong regulatory frameworks, high investment in R&D, and widespread use of feed additives to ensure productivity and health standards in poultry, swine, and cattle production. Growing demand for lean meat and increased scrutiny on animal health are encouraging the use of safe, regulated performance enhancers. There is also a rising shift toward precision feeding technologies and customized nutrition to maximize output and minimize antibiotic use. The North American market continues to lead in innovation and commercialization of next-generation feed solutions.

- U.S. Animal Growth Promoters and Performance Enhancers Market Insight

The U.S. holds the dominant share in the North American market, supported by well-established commercial livestock operations and growing demand for protein-rich diets. Increased awareness about feed efficiency, rising prevalence of zoonotic diseases, and the transition to non-antibiotic solutions are driving market growth. Additionally, the presence of major feed additive manufacturers and supportive USDA regulations for natural enhancers further boost innovation and market penetration. Consumer-driven preference for meat labeled as “antibiotic-free” is pressuring producers to adopt safer alternatives. Collaborations between veterinary nutritionists and feed producers are fostering the development of highly targeted, functional feed additives for livestock.

- Canada Animal Growth Promoters and Performance Enhancers Market Insight

Canada is witnessing steady growth due to the modernization of animal husbandry practices and increasing adoption of performance enhancers in beef and dairy production. The market is further supported by government efforts to reduce antibiotic resistance and promote sustainable animal farming. Rising consumer preference for antibiotic-free meat and growing investments in advanced feed formulations are contributing to demand for natural and immunity-boosting additives. The Canadian livestock sector is also leveraging data-driven feeding strategies to improve production outcomes. Additionally, collaborative research between academic institutions and feed companies is spurring the development of innovative bio-based additives.

Europe Animal Growth Promoters and Performance Enhancers Market Insight

Europe remains a mature but steadily growing market, shaped by strict regulatory frameworks that ban the use of antibiotics as growth promoters and promote sustainable livestock practices. The market growth is supported by rising demand for functional feed ingredients and the integration of immunity-boosting and performance-enhancing solutions across livestock categories. The region is witnessing increased investment in R&D for natural feed additives and adoption of circular farming practices. Consumer preferences for organic and welfare-certified meat products are driving innovation in feed strategies. Additionally, Europe is a frontrunner in setting global benchmarks for feed safety, sustainability, and traceability.

- Germany Animal Growth Promoters and Performance Enhancers Market Insight

Germany leads the European market due to its technologically advanced livestock industry and strong focus on sustainable and antibiotic-free meat production. The adoption of probiotics, enzymes, and organic acids is gaining momentum across swine and poultry sectors, supported by consumer pressure, environmental awareness, and EU-backed agricultural policies encouraging precision livestock farming. Feed manufacturers in Germany are also developing integrated nutritional programs that reduce emissions and enhance gut health. The country’s commitment to green farming and digital transformation in agriculture is expected to further shape market dynamics in the coming years.

- France Animal Growth Promoters and Performance Enhancers Market Insight

France is seeing consistent demand for natural animal growth promoters, especially in poultry and dairy segments. Government initiatives supporting organic farming, coupled with consumer preference for clean-label meat, are accelerating the shift toward phytogenic and enzyme-based solutions. The country’s proactive stance on animal welfare and reduced chemical input in feed is creating opportunities for innovative feed additive providers. Public-private partnerships are playing a crucial role in developing sustainable feed technologies. Moreover, increasing exports of high-quality livestock products are encouraging compliance with international feed standards.

Asia-Pacific Animal Growth Promoters and Performance Enhancers Market Insight

The Asia-Pacific region is projected to register the highest CAGR of 7.94% during the forecast period of 2025–2032, fueled by the rapid expansion of the animal husbandry sector and increasing meat consumption across emerging economies. With rising population, urbanization, and economic growth, the demand for efficient, affordable, and sustainable livestock production solutions is soaring. Technological advancements in feed production and government initiatives supporting livestock development are accelerating the adoption of growth promoters. Additionally, rising concerns over food security and global competitiveness are encouraging investments in modern farming practices. Local manufacturers are also expanding their product portfolios to cater to species-specific and climate-resilient feed solutions.

- China Animal Growth Promoters and Performance Enhancers Market Insight

China represents the largest market in Asia-Pacific due to its massive livestock population and aggressive focus on increasing domestic meat production. The transition to industrial-scale farming and tightening regulations around antibiotic use are encouraging the use of safe and efficient alternatives like phytogenics, organic acids, and probiotics. Additionally, the Chinese government’s emphasis on biosecurity and food safety is propelling the market toward high-quality performance enhancers. Increasing foreign investments and partnerships with global feed additive companies are improving access to advanced nutrition technologies. As demand grows for sustainable production, there is a notable uptick in research around plant-based feed and customized feed premixes.

- India Animal Growth Promoters and Performance Enhancers Market Insight

India is experiencing rapid growth in this market segment, driven by rising poultry and aquaculture production, growing consumption of animal protein, and increased awareness among farmers about feed efficiency. The adoption of non-antibiotic growth promoters is gaining traction, backed by regulatory initiatives, international trade standards, and rising demand for export-quality animal products. Furthermore, the growing presence of domestic and global feed additive companies is expanding access to innovative solutions in rural and urban markets alike. The Indian government is also actively supporting the animal nutrition sector through subsidy programs and veterinary outreach. Increasing digitization in agriculture is further helping farmers make informed choices about feed and health inputs.

Animal Growth Promoters and Performance Enhancers Market Players

The Animal Growth Promoters and Performance Enhancers industry is primarily led by well-established companies, including:

- Elanco Animal Health (U.S.)

- Zoetis Inc. (U.S.)

- Merck Animal Health (U.S.)

- Boehringer Ingelheim Animal Health (Germany)

- Phibro Animal Health Corporation (U.S.)

- Nutreco N.V. (Netherlands)

- ADM Animal Nutrition (U.S.)

- Alltech Inc. (U.S.)

- Cargill Animal Nutrition (U.S.)

- Evonik Industries AG (Germany)

- Kemin Industries (U.S.)

- Novus International, Inc. (U.S.)

- Biomin Holding GmbH (Austria)

- Huvepharma (Bulgaria)

- Zydus Animal Health and Investments Ltd. (India)

Latest Developments in Global Animal Growth Promoters and Performance Enhancers Market

- In May 2025, Cargill introduced a next-generation phytogenic feed additive under its Promote™ brand, targeting improved gut health and feed conversion ratios in poultry and swine. This innovation leverages a proprietary blend of essential oils and plant extracts, aimed at reducing reliance on antibiotic growth promoters. With increasing global regulatory restrictions and consumer demand for clean-label meat, the launch is expected to enhance Cargill’s positioning in the natural growth promoters segment across North America and Asia-Pacific.

- In February 2025, DSM-Firmenich launched RONOZYME® VP, a new enzyme-based feed additive designed to boost nutrient utilization and overall performance in broiler and layer chickens. The product addresses key sustainability goals by improving feed efficiency and reducing nitrogen excretion, contributing to a lower environmental footprint in poultry farming. This development solidifies DSM-Firmenich’s commitment to performance enhancers that align with animal welfare and climate-conscious production practices.

- In October 2024, Alltech unveiled Actigen® Plus, a performance enhancer based on yeast-derived functional carbohydrates, aimed at enhancing immune function and nutrient absorption in swine and poultry. With trials demonstrating significant improvements in weight gain and feed conversion under disease-challenged conditions, this product is expected to gain rapid traction in both emerging and developed markets. The launch reflects Alltech’s focus on gut integrity and antibiotic-free livestock nutrition in response to tightening global regulations.

- In August 2024, Adisseo expanded its specialty feed additives portfolio with the introduction of Alterion® NE, a next-generation probiotic designed for monogastric species. The new formulation shows improved stability and colonization in the gut microbiota, leading to enhanced growth performance and disease resistance. The launch is aimed at expanding Adisseo’s presence in Europe and Latin America, and aligns with the growing shift toward microbiome-focused solutions in animal production systems.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.