Global Animal Antibiotics Antimicrobials Market

Market Size in USD Billion

CAGR :

%

USD

5.08 Billion

USD

7.00 Billion

2024

2032

USD

5.08 Billion

USD

7.00 Billion

2024

2032

| 2025 –2032 | |

| USD 5.08 Billion | |

| USD 7.00 Billion | |

|

|

|

|

Animal Antibiotics Antimicrobials Market Size

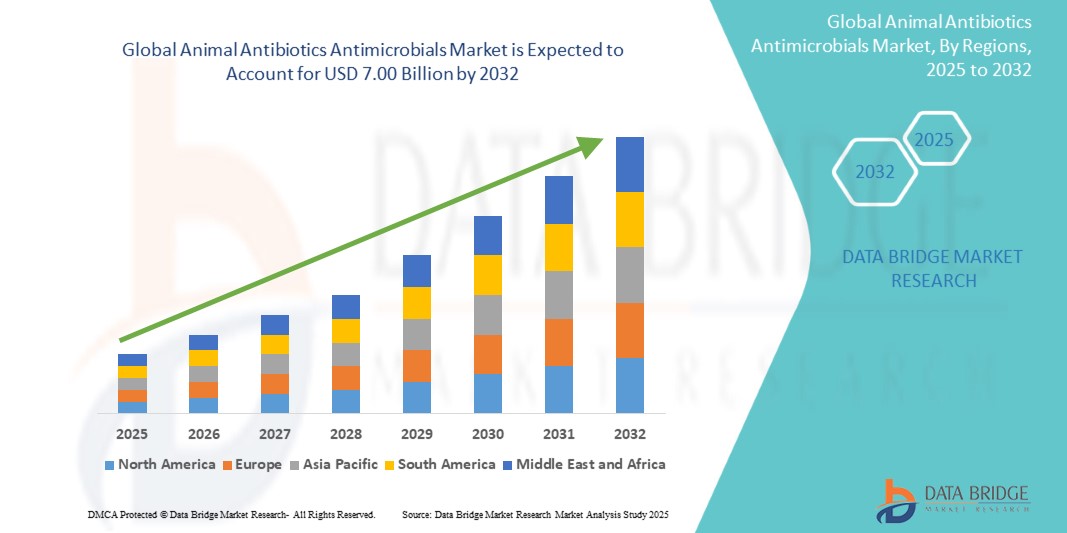

- The global Animal Antibiotics Antimicrobials market size was valued at USD 5.08 billion in 2024 and is expected to reach USD 7.00 billion by 2032, at a CAGR of 4.10% during the forecast period

- This growth is driven by growing concerns for the animal health

Animal Antibiotics Antimicrobials Market Analysis

- Animal antibiotics and antimicrobials play a crucial role in maintaining animal health by treating and preventing bacterial infections in livestock, poultry, and companion animals, thereby improving overall productivity and food safety

- The demand for these products is increasing due to the rising global meat consumption, intensification of livestock farming, and the need to prevent disease outbreaks in animal populations to ensure sustainable food supply chains

- North America is expected to dominate the animal antibiotics antimicrobials market with the largest market share of 37.37%, due to well-established veterinary healthcare infrastructure, high awareness among livestock farmers, and the presence of leading pharmaceutical companies in the region

- Asia-Pacific is projected to register the highest growth rate in the animal antibiotics antimicrobials market during the forecast period, due to growing livestock populations, increasing investments in veterinary health, and rising demand for animal protein in rapidly urbanizing nations such as China, India, and Vietnam

- The antibiotics segment is expected to dominate the type segment with the largest market share of 45.44% in 2025, due to their use for the prevention and treatment of infectious diseases in animals, these drugs are applicable across various species, including livestock, poultry, and companion animals

Report Scope and Animal Antibiotics Antimicrobials Market Segmentation

|

Attributes |

Animal Antibiotics Antimicrobials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Animal Antibiotics Antimicrobials Market Trends

“Shift Toward Antibiotic Alternatives and Antimicrobial Stewardship”

- A prominent trend in the animal antibiotics and antimicrobials market is the growing shift toward alternatives such as probiotics, prebiotics, phytogenics, and essential oils to reduce reliance on traditional antibiotics

- This transition is driven by rising concerns over antimicrobial resistance (AMR), increasing regulatory restrictions on antibiotic use in animal feed, and pressure from consumers demanding antibiotic-free meat and dairy

- These alternatives support gut health and immunity in animals, serving as preventative strategies to reduce infection rates without contributing to resistance

- For instance, in 2024, DSM Animal Nutrition & Health expanded its range of antibiotic alternatives by launching Symphiome, a new gut health-promoting feed additive targeted at poultry and swine producers

- This trend is expected to reshape animal health management practices, pushing innovation and reformulation in livestock feed to align with global AMR reduction efforts

Animal Antibiotics Antimicrobials Market Dynamics

Driver

“Increasing Prevalence of Zoonotic Diseases and Livestock Disease Burden”

- The global rise in zoonotic and endemic livestock diseases is driving the demand for effective antibiotics and antimicrobials to prevent large-scale outbreaks and safeguard public health

- Animal diseases such as avian influenza, swine fever, and bovine respiratory disease continue to affect animal populations and the food supply chain, creating urgency for preventive treatments

- Governments and international organizations are promoting responsible antibiotic use to control outbreaks and ensure food security

- For instance, in 2023, Zoetis reported a surge in demand for its Lincomycin-based antibiotics following outbreaks of respiratory disease in poultry farms across Southeast Asia

- This rising disease burden is expected to keep antibiotic use at the forefront of animal health strategies, particularly in intensive farming systems

Opportunity

“Growing Demand in Aquaculture and Emerging Animal Farming Segments”

- Aquaculture, one of the fastest-growing food sectors globally, presents a new opportunity for the use of targeted antibiotics and antimicrobials to combat waterborne pathogens and maintain fish health

- Similarly, antibiotic usage is expanding in emerging animal segments such as rabbits, quail, and exotic pets due to growing commercialization and rising pet ownership

- Market players are now investing in tailored formulations and delivery systems suited for aquatic and non-traditional species

- For instance, in 2024, Phibro Animal Health introduced an oxytetracycline-based water-soluble antibiotic specifically designed for shrimp and tilapia farms across Latin America

- This diversification into niche farming sectors is expected to open new revenue streams and foster targeted product innovation

Restraint/Challenge

“Stringent Regulatory Framework and Antibiotic Usage Bans”

- A major challenge in the animal antibiotics and antimicrobials market is the tightening of global regulations on antibiotic use, especially in food-producing animals, to combat antimicrobial resistance

- Many countries have banned the use of antibiotics as growth promoters and are implementing stricter residue monitoring standards, making compliance more demanding for producers

- This regulatory pressure often leads to increased production costs, product reformulation, and restricted product availability in certain markets

- For instance, in 2023, the European Union enforced a complete ban on medically important antibiotics for prophylactic use in livestock, prompting reformulation across the supply chain

- While these measures aim to protect human and animal health, they pose short-term hurdles for companies navigating regional compliance and reformulating product portfolios

Animal Antibiotics Antimicrobials Market Scope

The market is segmented on the basis of product, type, mode of delivery, and animal type.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Mode of Delivery |

|

|

By Animal Type |

|

In 2025, the antimicrobial is projected to dominate the market with a largest share in type segment

The antimicrobial segment is expected to dominate the animal antibiotics antimicrobials market with the largest market share of 45.44% in 2025, due to their use for the prevention and treatment of infectious diseases in animals, these drugs are applicable across various species, including livestock, poultry, and companion animals.

The poultry is expected to account for the largest share during the forecast period in animal type segment

In 2025, the poultry segment is expected to dominate the market with the largest market share of 41.22% due to their use in poultry feed or water, these substances help prevent and treat infections in chickens, ducks, and other birds. They support the health and well-being of the animals while promoting better growth rates.

Animal Antibiotics Antimicrobials Market Regional Analysis

“North America Holds the Largest Share in the Animal Antibiotics Antimicrobials Market”

- North America is expected to dominate the global animal antibiotics antimicrobials market with the largest market share of 37.37%, driven by the presence of prominent manufacturers, advanced research infrastructure, and robust investments in agricultural science and veterinary medicine

- The U.S. leads the region, supported by high demand for animal health products, substantial funding for agricultural research, and a well-established veterinary pharmaceutical industry

- Ongoing innovations in veterinary diagnostics, increasing focus on sustainable farming practices, and strategic partnerships between academic institutions and industry leaders are expected to maintain North America's dominance throughout the forecast period

“Asia-Pacific is Projected to Register the Highest CAGR in the Animal Antibiotics Antimicrobials Market”

- Asia-Pacific is expected to register the highest compound annual growth rate (CAGR) in the animal antibiotics antimicrobials market, driven by expanding healthcare infrastructure, increasing demand for animal health products, and growing investments in veterinary care

- Countries such as China, India, and Japan are key contributors, with national initiatives such as "Made in China 2025" and India’s "Ayushman Bharat" promoting local innovation and production in animal healthcare, including antibiotics and antimicrobials

- Rapid modernization of agricultural practices in China and India, combined with the growing adoption of advanced diagnostic technologies, is positioning Asia-Pacific as a significant growth region for animal health products

Animal Antibiotics Antimicrobials Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Boehringer Ingelheim International GmbH (Germany)

- Zoetis Services LLC (U.S.)

- Elanco (U.S.)

- Merck & Co. Inc. (U.S.)

- Phibro Animal Health Corporation (U.S.)

- Virbac (France)

- Vetoquinol (France)

- HIPRA (Spain)

- Ceva (France)

- Dechra (U.K.)

- Kyoritsuseiyaku Seiyaku Corporation (Japan)

- China Animal Husbandry Group (China)

- Endovac Animal Health (U.S.)

- Zydus Group (India)

- Indian Immunologicals Ltd (India)

- UCBVET - Saúde Animal (U.S.)

- American Reagent Inc. (U.S.)

- Neogen Corporation (U.S.)

- Huvepharma (U.S.)

- Ashish Life Science (India)

- Inovet (Belgium)

- Lutim Pharma Private Limited (India)

- ECO - Animal Health Ltd (U.S.)

Latest Developments in Global Animal Antibiotics Antimicrobials Market

- In May 2023, Bayer AG introduced a new antibiotic, Ceftiofur, a third-generation cephalosporin designed to treat multiple animal infections such as respiratory, urinary tract, and skin infections. This launch is expected to strengthen Bayer's position in the veterinary antibiotics segment

- In April 2023, Elanco Animal Health announced the launch of Draxxin, a once-daily injectable antibiotic formulated to combat serious gram-negative bacterial infections including E. coli and Klebsiella pneumoniae. The product enhances Elanco’s portfolio for treating life-threatening infections in livestock

- In March 2023, Virbac launched Synulox, a broad-spectrum antibiotic intended for use in treating respiratory, urinary, and skin infections in animals. This product is set to support the company’s growth in the companion and farm animal treatment segments

- In February 2023, Boehringer Ingelheim GmbH unveiled Clavamox, a combination antibiotic containing amoxicillin and clavulanic acid, designed for a wide range of animal infections. The addition of Clavamox enhances Boehringer Ingelheim’s antibiotic treatment options for veterinarians

- In January 2023, Ceva Santé Animale launched Enrofloxacin, a broad-spectrum antibiotic targeting respiratory, urinary, and skin infections in animals. This product reinforces Ceva’s commitment to offering effective antimicrobial solutions for animal health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.