Global 3d Printing Market

Market Size in USD Billion

CAGR :

%

USD

13.20 Billion

USD

34.60 Billion

2024

2032

USD

13.20 Billion

USD

34.60 Billion

2024

2032

| 2025 –2032 | |

| USD 13.20 Billion | |

| USD 34.60 Billion | |

|

|

|

|

Global 3D Printing Market Segmentation, By Component (Hardware, Software, and Services), Type (Desktop 3D Printer, and Industrial 3D Printer), Technology (Stereolithography, Fuse Deposition Modeling, Selective Laser Sintering, Direct Metal Laser Sintering, Polyjet Printing, Inkjet printing, Electron Beam Melting, Laser Metal Deposition, Digital Light Processing, Laminated Object Manufacturing, and Others), Software (Design Software, Inspection Software, Printer Software, and Scanning Software), Application (Prototyping, Tooling, and Functional Parts), Vertical (Industrial 3D Printing, and Desktop 3D Printing), Material (Polymer, Metal, and Ceramic) - Industry Trends and Forecast to 2032

3D Printing Market Size

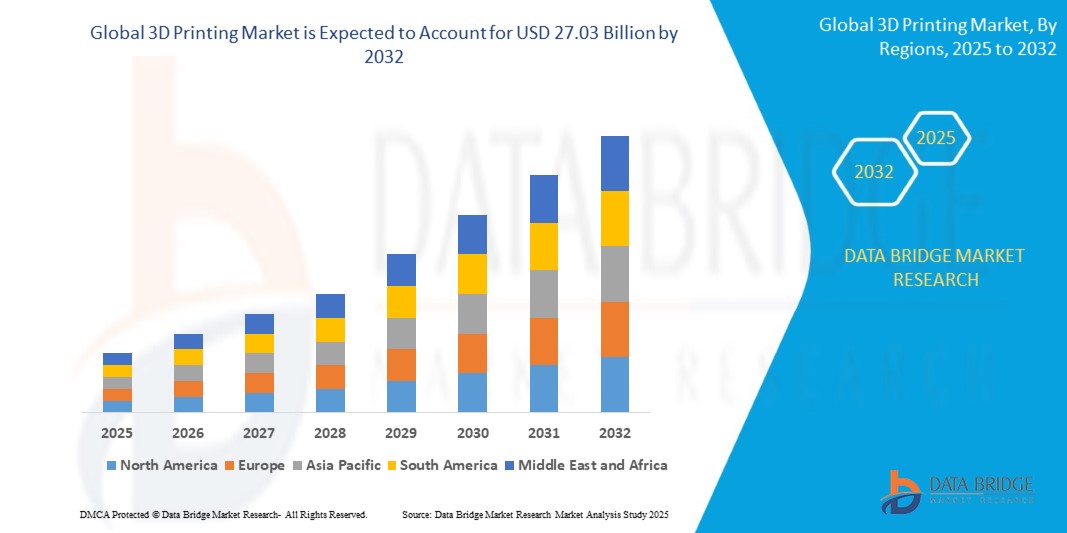

- The global 3D printing market size was valued at USD 8.54 billion in 2024 and is expected to reach USD 27.03 billion by 2032, at a CAGR of 15.50% during the forecast period

- This growth is driven by factors such as rapid industrial adoption, advancements in additive manufacturing technologies, and increasing demand for customized and complex components across various sectors including healthcare, aerospace, and automotive

3D Printing Market Analysis

- 3D printing, also known as additive manufacturing, is a transformative technology used to create three-dimensional objects layer by layer from digital models. It is widely applied in industries such as healthcare, aerospace, automotive, and construction for rapid prototyping and end-use part production

- The demand for 3D printing is significantly driven by the increasing need for customized products, reduction in manufacturing costs, and the ability to produce complex geometries with minimal material waste

- North America is expected to dominate the global 3D printing market with largest market share of 33.01%, due to early technology adoption, strong presence of key market players, and substantial investment in research and development

- Asia-Pacific is expected to be the fastest growing region in the 3D printing market during the forecast period due to expanding industrial sectors, government initiatives supporting digital manufacturing, and increased adoption in countries like China, Japan, and South Korea

- Industrial 3D printer segment is expected to dominate the market with a largest market share of 76.5% due to the extensive adoption of industrial printers in heavy industries, such as automotive, electronics, aerospace and defense, and healthcare. Prototyping, designing, and tooling are some of the most common industrial applications across these industry verticals

Report Scope and 3D Printing Market Segmentation

|

Attributes |

3D Printing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

3D Printing Market Trends

“Advancements in 3D Printing Technologies & Materials”

- One prominent trend in the evolution of the global 3D printing market is the continuous development of new materials and more advanced printing technologies

- These innovations are pushing the boundaries of what 3D printing can achieve, enabling the production of highly complex, durable, and functional parts across industries such as aerospace, automotive, healthcare, and consumer goods

- For instance, the development of metal 3D printing technology is revolutionizing industries that require high-strength, lightweight materials, such as aerospace and automotive manufacturing. Additionally, new biocompatible materials are significantly enhancing the potential for 3D printing in medical devices, prosthetics, and even tissue engineering

- These advancements are transforming manufacturing processes, reducing production costs, and allowing for greater design flexibility, thus driving the demand for next-generation 3D printers with enhanced capabilities

3D Printing Market Dynamics

Driver

“Growing Demand for Customization and Rapid Prototyping”

- The increasing demand for customized products and rapid prototyping across various industries, including healthcare, automotive, and aerospace, is significantly contributing to the growth of the 3D printing market

- As industries shift toward more personalized products, 3D printing provides a flexible, cost-effective solution for creating tailored designs with shorter lead times and minimal material waste

- Industries such as healthcare are increasingly utilizing 3D printing for creating customized implants, prosthetics, and surgical guides, which improve patient outcomes and reduce recovery times

For instance,

- In 2020, according to a report from the American Medical Association, the use of 3D printing in healthcare increased by 28%, with hospitals using the technology to create patient-specific models for surgical planning and implants

- As a result of the growing demand for personalized, high-performance products, 3D printing adoption is accelerating across multiple sectors, driving the market's growth

Opportunity

“Integration of Artificial Intelligence and Automation in 3D Printing”

- AI-powered 3D printing systems are enabling enhanced precision, optimized designs, and improved manufacturing efficiency, offering significant opportunities for industries such as healthcare, automotive, and aerospace

- AI algorithms can analyze complex design data and automatically adjust printing parameters in real-time to ensure better material utilization, improved part quality, and minimized errors during production

- AI can aid in the design optimization process by simulating various conditions and predicting the performance of printed parts, allowing manufacturers to achieve more efficient and reliable outcomes

For instance,

- In 2024, Siemens implemented AI in 3D printing to automate the design and manufacturing process for aerospace components. The system analyzes and optimizes designs for weight reduction while maintaining structural integrity, a critical need in aerospace industries

- The integration of AI in 3D printing presents substantial growth opportunities by enhancing production capabilities, reducing costs, and creating high-performance products for a range of industries

Restraint/Challenge

“High Equipment and Material Costs Hindering Market Growth”

- The high cost of 3D printing equipment, along with expensive specialized materials, poses a significant challenge for widespread adoption, especially in small and medium-sized businesses and developing regions

- Advanced 3D printers, particularly those used for metal or industrial-grade applications, can cost hundreds of thousands of dollars, while high-quality materials (such as specialized metals, composites, and bio-materials) also contribute to overall expenses

- This financial barrier can prevent smaller manufacturers and startups from entering the market or upgrading their existing technology, limiting innovation and scalability

For instance,

- In 2023, McKinsey & Company published a report highlighting that the cost of high-end 3D printing systems and materials remains a major hurdle for industries looking to adopt additive manufacturing at scale. This impacts industries like aerospace, where the need for high-performance materials is critical, but cost constraints often delay full-scale implementation

- Consequently, these limitations can hinder the market's overall growth, especially in emerging markets where cost concerns are even more pronounced

3D Printing Market Scope

The market is segmented on the basis of component, type, technology, software, application, vertical, and material

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Type |

|

|

By Technology |

|

|

By Software |

|

|

By Application |

|

|

By Vertical |

|

|

By Material |

|

In 2025, the industrial 3D printer is projected to dominate the market with a largest share in type segment

The industrial 3D printer segment is expected to dominate the 3D printing market with the largest share of 76.5% due to the extensive adoption of industrial printers in heavy industries, such as automotive, electronics, aerospace and defense, and healthcare. Prototyping, designing, and tooling are some of the most common industrial applications across these industry verticals

The hardware is expected to account for the largest share during the forecast period in component segment

In 2025, the hardware segment is expected to dominate the market with the largest market share of 63.01% due to various factors such as rapid industrialization, increasing penetration of consumer electronic products, developing civil infrastructure, rapid urbanization, and optimized labor costs

3D Printing Market Regional Analysis

“North America Holds the Largest Share in the 3D Printing Market”

- North America dominates the global 3D printing market with largest market share of 33.5%, driven by technological advancements, high adoption of 3D printing solutions across industries, and a strong presence of key market players

- The U.S. holds a largest market share due to the growing demand for rapid prototyping, custom manufacturing, and production of complex components, particularly in sectors like healthcare, aerospace, and automotive

- The presence of well-established research and development hubs, coupled with favorable government initiatives and funding for advanced manufacturing technologies, strengthens the market in the region

- Industries like healthcare benefit from 3D printing’s ability to produce personalized medical devices, prosthetics, and implants, further expanding the market in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the 3D Printing Market”

- The Asia-Pacific region is expected to experience the highest growth rate in the global 3D printing market, driven by rapid industrialization, increasing adoption of digital manufacturing technologies, and significant investments in infrastructure development

- Countries like China, Japan, and India are emerging as key markets due to the rising demand for customized products and solutions, the expansion of automotive and aerospace sectors, and the growing emphasis on sustainable manufacturing processes

- China, with its large-scale manufacturing capabilities and government-driven initiatives to promote 3D printing technologies, is witnessing a surge in the use of 3D printing for industrial production. Japan’s advanced technological expertise and focus on innovation in industries such as electronics and robotics are also contributing to market growth

- India’s burgeoning manufacturing sector, along with increased investments from both the public and private sectors, is pushing the adoption of 3D printing in sectors like automotive, healthcare, and consumer goods. The expansion of local production capabilities and growing interest in custom manufacturing are also fueling market expansion in the region

3D Printing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bright Laser (China)

- Xometry (U.S.)

- Farsoon (China)

- Protolabs (U.S.)

- Stratasys (U.S./Israel)

- Nano Dimension (Israel)

- 3D Systems (U.S.)

- Materialise (Belgium)

- Desktop Metal (U.S.)

- Titomic (Australia)

- BigRep (Germany)

- Markforged (U.S.)

- AML3D (Australia)

- Massivit (Israel)

- Velo3D (U.S.)

- Freemelt (Sweden)

- Steakholder Foods (Israel)

- Sygnis (Germany)

- FATHOM (U.S.)

Latest Developments in Global 3D Printing Market

- In November 2023, Autodesk Inc. introduced Autodesk AI, a cutting-edge technology that integrates generative capabilities and intelligent assistance into their suite of products. This innovation is designed to enhance operational efficiency by automating repetitive tasks and minimizing errors, ultimately streamlining workflows and improving user experience. By leveraging AI-driven automation and generative design, Autodesk is enabling industries involved in 3D printing to accelerate prototyping, reduce material waste, and create more efficient and innovative products

- In April 2023, China unveiled plans to utilize 3D printing technology for the construction of lunar habitats during its Chang'e missions. This initiative represents a major milestone in efforts to establish a sustainable human presence on the moon, with a focus on using reusable resources to support long-term habitation. By leveraging 3D printing to build lunar habitats, China is not only advancing space technology but also demonstrating the potential of additive manufacturing for resource-efficient, scalable construction in extreme environments

- In March 2023, Optomec introduced KEWB, a production control software designed to optimize the manufacturing process of printed electronics. Featuring capabilities such as operator guidance and Industry 4.0 connectivity, KEWB is tailored to applications including 5G antennas and chip integration. The launch of KEWB underscores the growing integration of advanced software solutions within the 3D printing sector, particularly in the production of printed electronics

- In March 2023, 3D Systems, Inc. introduced NextDent Cast and NextDent Base, two advanced printing materials, along with the NextDent LCD1, an intuitive small-format printer. These innovations are designed to improve material performance and expedite the widespread adoption of additive manufacturing technologies. The launch of NextDent Cast, NextDent Base, and the NextDent LCD1 highlights significant advancements in material science and printer accessibility within the 3D printing industry. By enhancing the properties of printing materials and providing a user-friendly solution for small-scale production, these products are poised to drive growth in sectors such as healthcare, dental, and consumer goods

- In February 2022, Dassault Systèmes and Cadence Design Systems formed a strategic collaboration to provide integrated solutions for the development of electronic systems across various sectors, including high-tech and healthcare. By offering integrated design and simulation tools, the collaboration enables more efficient, precise, and innovative development of electronic components, which can be directly applied to 3D printing in industries like healthcare, automotive, and consumer electronics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 3d Printing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 3d Printing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 3d Printing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.