Europe X Ray Systems Market

Market Size in USD Billion

CAGR :

%

USD

2.58 Billion

USD

6.47 Billion

2025

2033

USD

2.58 Billion

USD

6.47 Billion

2025

2033

| 2026 –2033 | |

| USD 2.58 Billion | |

| USD 6.47 Billion | |

|

|

|

|

Europe X-Ray Systems Market Size

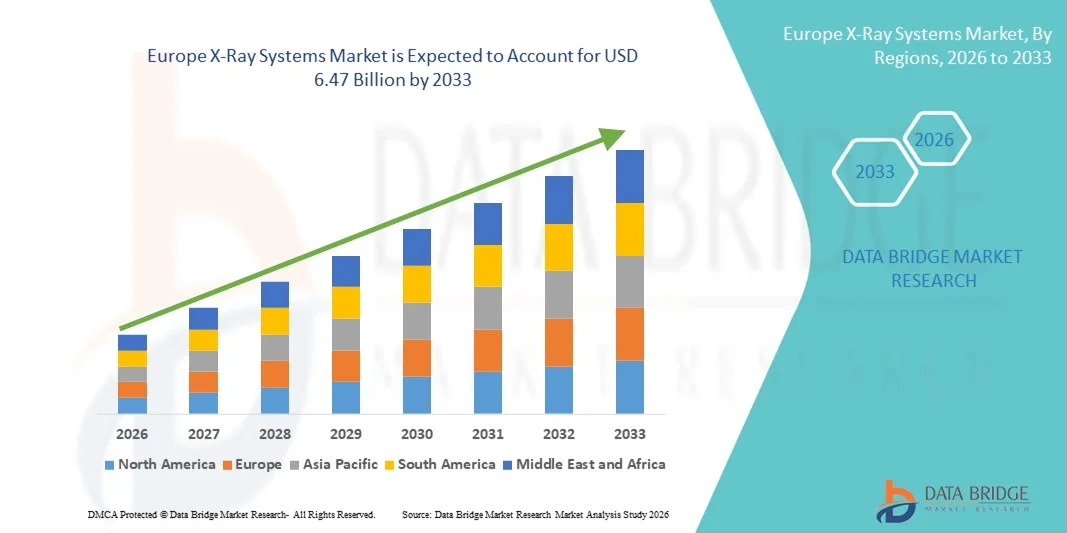

- The Europe X-Ray Systems market size was valued at USD 2.58 billion in 2025 and is expected to reach USD 6.47 billion by 2033, at a CAGR of 12.20% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced diagnostic imaging, rising prevalence of chronic diseases, and growing adoption of digital healthcare technologies, leading to higher utilization of X-ray systems across hospitals, diagnostic centers, and specialty clinics

- Furthermore, rising patient awareness for early disease detection, the need for faster and more accurate diagnostic solutions, and continuous technological advancements such as digital radiography, portable X-ray systems, and AI-assisted imaging are establishing X-ray systems as essential components of modern medical diagnostics. These converging factors are accelerating the uptake of X-Ray Systems solutions, thereby significantly boosting overall market growth

Europe X-Ray Systems Market Analysis

- X-ray systems, including digital radiography, computed radiography, and portable X-ray devices, are increasingly vital components of modern medical diagnostics across hospitals, diagnostic centers, and specialty clinics due to their ability to provide fast, accurate, and high-resolution imaging for disease detection and treatment planning

- The escalating demand for X-ray systems is primarily fueled by rising prevalence of chronic and acute diseases, increasing patient awareness for early diagnosis, growing adoption of digital and portable imaging solutions, and continuous technological advancements such as AI-assisted imaging, low-dose radiation systems, and cloud-enabled image management

- The U.K. dominated the X-Ray Systems market with the largest revenue share of 28.7% in 2025, characterized by advanced healthcare infrastructure, high adoption of digital radiography technologies, strong reimbursement policies, and a robust network of hospitals and diagnostic centers integrating AI-enabled imaging systems

- Germany is expected to be the fastest growing country in the X-Ray Systems market during the forecast period, driven by increasing healthcare expenditure, rising demand for diagnostic imaging in both public and private healthcare facilities, expanding adoption of portable X-ray systems, and growing investments in AI-assisted and low-dose radiography technologies

- Fixed systems dominated the largest market revenue share of 57.1% in 2025, driven by their deployment in hospitals, specialty imaging centers, and high-volume diagnostic facilities

Report Scope and X-Ray Systems Market Segmentation

|

Attributes |

X-Ray Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe X-Ray Systems Market Trends

Advancements in Imaging Technology and Workflow Efficiency

- A significant and accelerating trend in the Europe X-ray systems market is the adoption of advanced imaging technologies such as digital radiography, cone beam CT, and portable X-ray solutions. These innovations are improving image quality, reducing radiation exposure, and enhancing workflow efficiency in hospitals, clinics, and diagnostic centers

- For instance, the Carestream DRX-Evolution Plus digital radiography system enables rapid image acquisition with high-resolution imaging, streamlining diagnostics and improving patient throughput. Similarly, Planmeca ProX offers compact and user-friendly solutions for dental and orthopedic imaging applications

- Integration of advanced software solutions for image analysis, dose management, and reporting is becoming increasingly common. These tools allow radiologists to detect abnormalities faster and provide accurate diagnostic support, improving clinical outcome

- The growing demand for mobile and portable X-ray systems, particularly in emergency and critical care settings, is also shaping the market. Portable solutions facilitate point-of-care imaging, reduce patient transfer requirements, and support tele-radiology services in remote areas

- This trend towards high-precision, efficient, and patient-friendly X-ray systems is transforming diagnostic practices and setting new expectations for imaging quality and operational effectiveness

Europe X-Ray Systems Market Dynamics

Driver

Rising Demand for Early Diagnosis and Improved Healthcare Infrastructure

- The increasing prevalence of chronic diseases, traumatic injuries, and cancer is driving the need for timely and accurate diagnostic imaging, boosting demand for X-ray systems across Europe

- For instance, in March 2024, Siemens Healthineers launched its Multix Impact digital X-ray platform designed to optimize workflow in high-volume hospitals and outpatient facilities. Such initiatives by key players are expected to propel market growth during the forecast period

- Expanding healthcare infrastructure, particularly in urban centers and multi-specialty hospitals, is creating greater adoption of modern X-ray systems. Hospitals and clinics are investing in both fixed and portable units to enhance diagnostic capabilities

- Furthermore, increasing government initiatives to improve healthcare accessibility, implement national screening programs, and modernize imaging facilities are supporting market growth

- Technological upgrades, such as low-dose imaging and advanced detectors, combined with training programs for radiology professionals, are enabling healthcare providers to deliver higher quality care and improve patient safety

Restraint/Challenge

High Initial Costs and Regulatory Compliance

- The high capital expenditure required for acquiring advanced X-ray systems poses a significant barrier, especially for smaller clinics and diagnostic centers in Europe. Procurement, installation, and maintenance costs can restrict market penetration

- For instance, the cost of premium digital radiography or cone-beam CT systems may limit adoption in rural healthcare settings or among budget-conscious providers

- In addition, stringent regulatory standards governing radiation safety, device certification, and compliance with health authorities (such as the European Medicines Agency and national radiation protection agencies) can slow down system deployment

- Maintaining and calibrating complex X-ray systems requires skilled personnel, which adds operational costs and may pose challenges for facilities with limited technical resources

- Overcoming these challenges through cost-effective solutions, leasing models, vendor training, and compliance support will be critical to sustaining long-term growth in the European X-ray systems market

Europe X-Ray Systems Market Scope

The market is segmented on the basis of type, technology, price, portability, system, application, mobility, and end user.

- By Type

On the basis of type, the X-Ray Systems market is segmented into analog X-ray and digital X-ray systems. The digital X-ray segment dominated the largest market revenue share of 46.2% in 2025, driven by its superior image quality, faster image acquisition, and integration with PACS (Picture Archiving and Communication Systems). Hospitals and diagnostic centers increasingly prefer digital systems for their efficiency, lower radiation exposure, and streamlined workflow. Digital X-rays support advanced image processing and storage capabilities, enhancing diagnostic accuracy. Rising adoption in both developed and emerging regions, coupled with increasing investments in modern healthcare infrastructure, reinforces segment dominance. Moreover, digital X-ray systems reduce long-term operational costs compared to analog systems. Growing government initiatives promoting healthcare digitization further accelerate adoption. Technological advancements, including flat-panel detectors and AI-assisted imaging, enhance clinical utility. The segment also benefits from rising demand in dental, orthopedic, and mammography applications, supporting consistent revenue growth.

The analog X-ray segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, primarily in emerging markets where cost-sensitive hospitals and clinics still rely on conventional imaging. Analog systems are favored for their affordability and lower upfront costs. In regions with limited access to advanced digital infrastructure, analog systems remain critical for general radiography and diagnostic purposes. Continuous improvements in analog imaging techniques enhance image clarity and reliability. Training programs for radiologists in analog technology also support sustained demand. The segment is further boosted by refurbishing initiatives and retrofitting programs in developing countries. Increasing awareness of hybrid systems that combine analog and digital benefits also drives growth. Moreover, small clinics and mobile imaging providers prefer analog solutions for flexible deployment. Overall, analog X-ray adoption is expanding steadily due to accessibility and cost advantages.

- By Technology

On the basis of technology, the market is segmented into computed radiography (CR) and direct radiography (DR). The DR segment held the largest market revenue share of 51.5% in 2025, driven by its direct capture capability, rapid image acquisition, and superior resolution. Hospitals prefer DR for high-throughput environments and emergency imaging needs. Integration with hospital information systems (HIS) and PACS further supports clinical workflow efficiency. DR systems minimize radiation exposure and reduce processing time, enhancing patient safety. Growing adoption in mammography and dental imaging applications strengthens the segment. Additionally, advanced DR systems support AI-based image enhancement and automated diagnostics. The segment benefits from increasing investment in hospital modernization programs globally. DR systems’ adaptability across multiple modalities boosts market penetration. Rising awareness among clinicians regarding improved diagnostic accuracy drives segment dominance.

The CR segment is projected to witness the fastest CAGR of 21.3% from 2026 to 2033, as it serves mid-tier hospitals and diagnostic centers upgrading from analog X-ray. CR technology provides cost-effective digital imaging solutions with moderate investment requirements. Its compatibility with existing film-based infrastructure facilitates transition to digital workflows. Rising adoption in emerging economies is a key growth driver. The segment is also supported by technological upgrades improving scanning speed and image resolution. Training and education programs in CR technology further enhance acceptance. CR systems are preferred in mobile imaging setups due to portability and ease of deployment. Increasing collaborations between manufacturers and healthcare providers stimulate growth.

- By Price

On the basis of price, the market is segmented into low-end, mid-range, and high-end digital X-ray systems. The mid-range segment dominated the largest revenue share of 44.8% in 2025, driven by its balance of cost and performance. Mid-range systems are widely adopted by general hospitals, diagnostic centers, and dental clinics. They provide high-quality imaging suitable for a variety of clinical applications without the high capital expenditure of premium models. Operational efficiency, moderate installation costs, and compatibility with PACS encourage adoption. Many mid-tier hospitals in both developed and developing regions prefer mid-range systems for flexibility and value. Upgradable features and software enhancements add to segment attractiveness. Additionally, robust after-sales service networks support sustained growth.

The high-end segment is expected to witness the fastest CAGR of 20.7% from 2026 to 2033, driven by advanced hospitals, specialty clinics, and research facilities. High-end digital X-ray systems offer features such as tomosynthesis, AI-assisted diagnostics, ultra-high resolution, and reduced radiation exposure. Increasing demand for premium imaging in oncology, cardiology, and mammography applications fuels growth. Government incentives for advanced imaging technologies in developed markets further accelerate adoption. Innovations in detector technology and integration with multi-modality imaging systems enhance clinical capabilities. Rising patient awareness and preference for state-of-the-art diagnostic tools also contribute to segment growth.

- By Portability

On the basis of portability, the X-Ray Systems market is segmented into fixed digital X-ray systems and portable digital X-ray systems. Fixed systems dominated the largest market revenue share of 57.1% in 2025, driven by their deployment in hospitals, specialty imaging centers, and high-volume diagnostic facilities. Fixed systems support multi-room integration, consistent image quality, and compatibility with advanced imaging technologies. They are preferred in urban healthcare centers where high patient throughput is essential. Regulatory approvals and infrastructure support further reinforce adoption. Fixed systems also accommodate larger detector sizes and advanced imaging modalities, supporting clinical versatility. Their dominance is fueled by consistent performance and lower per-scan cost over time.

Portable digital X-ray systems are anticipated to witness the fastest CAGR of 22.5% from 2026 to 2033, driven by the rising need for point-of-care imaging in emergency care, mobile clinics, and rural healthcare setups. Portability allows bedside imaging, improved workflow efficiency, and accessibility in remote regions. Growing demand from home healthcare, sports medicine, and mobile diagnostic services supports growth. Advances in battery technology, lightweight designs, and wireless image transfer enhance usability. The segment benefits from increasing government programs promoting rural healthcare access. Growing use in disaster response and field hospitals further accelerates adoption.

- By System

On the basis of system, the market is segmented into retrofit digital X-ray systems and new digital X-ray systems. New digital X-ray systems dominated the largest revenue share of 49.3% in 2025, supported by hospital modernization programs and increasing replacement of outdated analog systems. New systems provide integrated software solutions, higher image quality, and improved clinical workflow. They are preferred in high-patient volume hospitals and specialized imaging centers. Availability of financing options and government incentives further support adoption. High adoption rates in developed markets reinforce segment dominance.

Retrofit digital X-ray systems are projected to witness the fastest CAGR of 21.8% from 2026 to 2033, particularly in emerging markets where hospitals aim to upgrade analog systems at lower cost. Retrofit solutions allow integration of digital detectors into existing analog equipment, enhancing cost-effectiveness and reducing downtime. Increasing awareness regarding operational efficiency and radiation safety drives adoption. Growth is supported by collaborations between system integrators and hospitals.

- By Application

On the basis of application, the market is segmented into general radiography, dental applications, mammography, and fluoroscopy. General radiography dominated the largest revenue share of 45.6% in 2025, driven by widespread adoption in hospitals and diagnostic centers for routine imaging. General radiography covers multiple patient types and supports high patient throughput. Standardization, ease of use, and moderate cost favor adoption. The segment also benefits from integration with PACS and digital reporting systems. Growing patient demand for routine diagnostic imaging in chronic disease management reinforces market leadership.

Mammography is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, driven by increasing awareness of breast cancer screening programs and the adoption of advanced digital mammography systems. Government initiatives promoting early diagnosis, coupled with technological innovations in 3D imaging and AI-assisted analysis, fuel segment growth. Hospitals and specialty clinics are investing heavily in high-resolution mammography solutions. Rising incidence of breast cancer and demand for precise imaging further supports rapid adoption.

- By Mobility

On the basis of mobility, the X-Ray Systems market is segmented into stationary and mobile systems. The stationary systems segment dominated the largest market revenue share of 53.7% in 2025, driven primarily by its deployment in hospitals, specialty imaging centers, and high-volume diagnostic facilities. Stationary X-ray systems are preferred for their ability to deliver consistent image quality, support large detector sizes, and integrate seamlessly with hospital IT and PACS infrastructure. They are widely used in routine radiography, mammography, dental applications, and orthopedic imaging. The segment benefits from long-term cost efficiency due to durability and reduced per-scan maintenance. Hospitals prefer stationary systems for their reliability, high throughput, and compatibility with multi-modality imaging workflows. The availability of advanced imaging features, such as DR detectors, AI-assisted diagnostics, and 3D reconstruction, reinforces segment dominance. Regulatory approvals and standardized installation processes also favor adoption. Increasing urban hospital infrastructure investment and modernization projects in developed markets contribute further. The stationary systems segment remains the backbone of diagnostic imaging in both private and public healthcare facilities, maintaining a steady growth trajectory in developed economies.

Mobile systems are expected to witness the fastest CAGR of 22.9% from 2026 to 2033, fueled by the rising demand for bedside imaging, emergency care, and mobile diagnostic services. Mobile X-ray units provide flexibility for imaging in rural, remote, and homecare settings where fixed installations are impractical. Lightweight designs, wireless connectivity, and easy portability enhance operational efficiency and speed of service delivery. Mobile systems are increasingly adopted in ambulatory centers, disaster response units, and field hospitals. Hospitals and clinics use mobile units to expand diagnostic reach without major capital expenditure. Growing awareness of point-of-care imaging and increasing government initiatives to improve rural healthcare access drive adoption. Integration with cloud-based reporting and PACS systems further strengthens utility. Portable systems support rapid imaging for ICU, emergency, and orthopedic applications. Demand in emerging markets is rising due to affordability and deployment ease. Mobile X-ray units are also preferred in sports medicine, homecare diagnostics, and temporary clinical setups, enabling patient-centric care. Continuous innovations in battery life, detector technology, and compact design ensure sustained growth.

- By End User

On the basis of end user, the X-Ray Systems market is segmented into diagnostic centres, hospitals, and mobile imaging centres. The hospitals segment dominated the largest market revenue share of 50.5% in 2025, driven by high patient volumes, multi-specialty departments, and the integration of advanced digital radiology workflows. Hospitals invest in comprehensive imaging suites covering multiple modalities, including general radiography, dental imaging, mammography, and fluoroscopy, strengthening segment leadership. Large-scale healthcare infrastructure, availability of trained radiologists, and consistent maintenance support the dominance of this segment. Adoption of PACS, RIS (Radiology Information Systems), and cloud-based storage enhances workflow efficiency. Hospitals also prefer high-throughput stationary systems for faster turnaround times and optimized patient care. Regulatory approvals, reimbursement frameworks, and government hospital modernization programs further reinforce segment growth. Rising patient awareness about early diagnosis and preventive care increases hospital-based imaging demand. Developed economies continue to drive hospital adoption due to technological sophistication. The segment benefits from integration with AI-based imaging solutions, improving diagnostic accuracy and operational efficiency. Hospitals remain the primary choice for complex diagnostic procedures requiring high-quality imaging.

Mobile imaging centres are expected to witness the fastest CAGR of 24.0% from 2026 to 2033, fueled by the increasing need for portable diagnostic solutions in rural areas, homecare, and emergency response settings. Mobile imaging centres are deployed for field diagnostics, sports medicine events, temporary healthcare setups, and disaster response initiatives. Lightweight, battery-operated, and wireless X-ray units enhance portability and patient accessibility. Government initiatives to improve rural healthcare infrastructure further boost adoption. Mobile centres provide rapid bedside imaging and reduce patient transport requirements, improving workflow efficiency in clinics and hospitals. Emerging markets are witnessing higher penetration due to lower setup costs and flexible deployment. Mobile units are increasingly integrated with cloud-based PACS and tele-radiology platforms, enabling real-time reporting and remote consultations. Adoption by specialty clinics and homecare service providers also contributes to segment growth. Continuous technological advancements in compact detectors, imaging software, and wireless connectivity enhance diagnostic reliability. The segment’s strong CAGR reflects the rising emphasis on patient-centric and decentralized imaging services.

Europe X-Ray Systems Market Regional Analysis

- The Europe X-Ray systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising demand for advanced diagnostic imaging and the growing prevalence of chronic diseases, trauma cases, and cancer

- The increase in healthcare infrastructure investments, coupled with technological advancements in digital radiography, low-dose imaging, and portable X-ray systems, is fostering adoption across hospitals, clinics, and diagnostic centers

- European healthcare providers are also drawn to the efficiency, precision, and improved patient throughput offered by modern X-ray systems. The region is experiencing significant growth across public and private healthcare facilities, with both new installations and upgrades of existing imaging systems contributing to market expansion

U.K. X-Ray Systems Market Insight

The U.K. X-Ray systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing adoption of digital radiography and AI-assisted imaging technologies. In addition, strong reimbursement frameworks, early disease detection programs, and a robust network of hospitals and diagnostic centers are supporting widespread deployment of advanced X-ray systems. The U.K.’s emphasis on healthcare innovation and high patient awareness regarding preventive care is expected to continue to stimulate market growth. The U.K. dominated the X-Ray Systems market with the largest revenue share of 28.7% in 2025, characterized by advanced healthcare infrastructure, high adoption of digital radiography technologies, strong reimbursement policies, and a robust network of hospitals and diagnostic centers integrating AI-enabled imaging systems.

Germany X-Ray Systems Market Insight

The Germany X-Ray Systems market is expected to expand at a considerable CAGR during the forecast period, fueled by rising healthcare expenditure and increasing demand for diagnostic imaging in both public and private facilities. Germany’s well-developed healthcare infrastructure, combined with government initiatives promoting early diagnosis and patient-centric care, encourages the adoption of portable, low-dose, and AI-assisted X-ray technologies. Growing investments in innovative imaging solutions and clinical workflow optimization further support market expansion Germany is expected to be the fastest growing country in the X-Ray Systems market during the forecast period, driven by increasing healthcare expenditure, rising demand for diagnostic imaging in both public and private healthcare facilities, expanding adoption of portable X-ray systems, and growing investments in AI-assisted and low-dose radiography technologies.

Europe X-Ray Systems Market Share

The X-Ray Systems industry is primarily led by well-established companies, including:

- GE Healthcare Technologies Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Fujifilm Holdings Corporation (Japan)

- Carestream Health, Inc. (U.S.)

- Canon Medical Systems Corporation (Japan)

- Shimadzu Corporation (Japan)

- Planmeca Oy (Finland)

- Vatech Co., Ltd. (South Korea)

- Hitachi, Ltd. (Japan)

- Agfa-Gevaert Group (Belgium)

- Dentsply Sirona Inc. (U.S.)

- Hologic, Inc. (U.S.)

- Neusoft Medical Systems Co., Ltd. (China)

- Trivitron Healthcare Pvt. Ltd. (India)

Latest Developments in Europe X-Ray Systems Market

- In March 2025, Align Technology launched Align X‑ray Insights, an AI‑powered computer‑aided detection (CADe) software in the European Union and the United Kingdom that automatically analyzes 2D radiographic images to support clinical reporting and diagnostic workflows, enhancing the integration of AI in dental and medical imaging

- In January 2025, DMS Group announced the upcoming rollout of its next‑generation Onyx mobile X‑ray system based on carbon nanotube (CNT) technology with enhanced precision and maneuverability, scheduled for initial installations in Q2 2025, reflecting innovation in mobile radiology solutions in Europe

- In March 2024, Varex Imaging launched advanced flat‑panel X‑ray detectors optimized for digital radiography and fluoroscopy that offer improved image quality and faster acquisition speeds, supporting enhanced diagnostic accuracy and workflow efficiency for European hospitals and imaging centers

- In February 2024, Canon Medical Systems introduced a portable digital radiography system with lightweight flat‑panel detectors designed for emergency and ICU applications, enabling rapid point‑of‑care imaging and expanding clinical use cases for digital X‑ray in European healthcare facilities

- In January 2024, Carestream Health unveiled a new CMOS‑based X‑ray detector featuring ultra‑high resolution and low radiation dose, tailored for specialized imaging applications including mammography and diagnostic radiography in European markets, enhancing both image quality and patient safety

- In November 2023, Konica Minolta launched a wireless digital radiography system aimed at improving connectivity and workflow efficiency in clinical and hospital environments, strengthening its presence in the European diagnostic imaging equipment segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.