Europe Spirometer Market

Market Size in USD Billion

CAGR :

%

USD

312.90 Billion

USD

630.36 Billion

2025

2033

USD

312.90 Billion

USD

630.36 Billion

2025

2033

| 2026 –2033 | |

| USD 312.90 Billion | |

| USD 630.36 Billion | |

|

|

|

|

Europe Spirometer Market Size

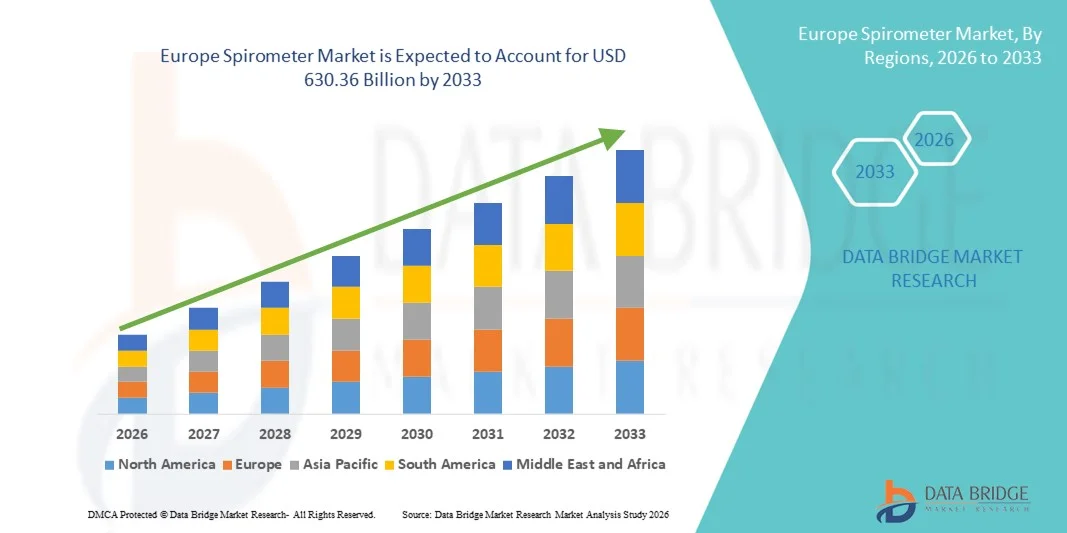

- The Europe spirometer market size was valued at USD 312.90 billion in 2025 and is expected to reach USD 630.36 billion by 2033, at a CAGR of 9.15% during the forecast period

- The market growth is largely fueled by the rising prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and other pulmonary disorders, along with growing awareness regarding early diagnosis and lung function monitoring, leading to higher adoption of spirometer solutions across hospitals, clinics, and diagnostic centers

- Furthermore, increasing patient preference for accurate, easy-to-use, and portable respiratory monitoring devices, coupled with continuous technological advancements such as digital spirometers, handheld devices, and connectivity with electronic health records (EHR) and mobile health apps, is establishing spirometer solutions as essential tools in modern pulmonary care. These converging factors are accelerating the uptake of Spirometer solutions, thereby significantly boosting overall market growth

Europe Spirometer Market Analysis

- Spirometers, including handheld, desktop, and digital spirometry devices, are increasingly vital components of modern pulmonary care across hospitals, clinics, and diagnostic centers due to their ability to accurately measure lung function, monitor respiratory conditions, and support early diagnosis and treatment planning

- The escalating demand for spirometers is primarily fueled by the rising prevalence of respiratory diseases such as COPD, asthma, and cystic fibrosis, increasing awareness of lung health, growing adoption of digital and connected spirometry devices, and technological advancements that enable portable, user-friendly, and AI-assisted lung function testing

- The U.K. dominated the Spirometer market with the largest revenue share of 29.6% in 2025, characterized by advanced healthcare infrastructure, strong emphasis on early respiratory disease diagnosis, high adoption of digital and portable spirometry solutions, and robust presence of specialized pulmonary clinics

- Germany is expected to be the fastest growing country in the Spirometer market during the forecast period, driven by increasing prevalence of respiratory disorders, rising geriatric population, expanding investments in pulmonary diagnostics, and growing adoption of portable and connected spirometry devices in hospitals and homecare settings

- The Diagnostics segment dominated the largest market revenue share of 53.5% in 2025, driven by its extensive use in diagnosing respiratory conditions such as asthma, COPD, bronchitis, and emphysema across hospitals and clinics

Report Scope and Spirometer Market Segmentation

|

Attributes |

Spirometer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Spirometer Market Trends

Enhanced Convenience Through Technological Advancements

- A significant and accelerating trend in the Europe Spirometer market is the integration of advanced digital technologies, including portable spirometry devices, AI-assisted diagnostic algorithms, and cloud-based patient monitoring platforms. These innovations are significantly improving ease of use, accuracy of pulmonary function testing, and remote patient management capabilities

- For instance, the MIR Spirobank Smart device allows healthcare professionals to connect patient spirometry data to mobile applications and cloud platforms, enabling real-time monitoring of lung function in patients with asthma or COPD. Similarly, ndd Medical Technologies’ EasyOne Air offers wireless connectivity and integrated reporting, facilitating seamless workflow in both hospital and home settings. These innovations are enhancing patient compliance and clinical efficiency, while enabling telehealth services to expand across Europe

- The adoption of AI-assisted analytics in spirometry devices enables automated interpretation of test results, early detection of pulmonary abnormalities, and personalized patient guidance. For example, some modern spirometers provide predictive alerts for declining lung function based on historical patient data, improving preventive care

- Furthermore, the development of portable and battery-operated spirometers allows for greater mobility and use in remote or outpatient settings, expanding access to pulmonary diagnostics in underserved regions. Integration with electronic health records (EHRs) ensures centralized data management, streamlining follow-ups and improving continuity of care

- The increasing emphasis on patient-centric care, along with the rise in chronic respiratory diseases and growing demand for home-based monitoring solutions, is reshaping clinical expectations and driving innovations in the spirometer segment. Consequently, companies such as ndd Medical Technologies and MIR are investing in cloud-enabled, AI-supported, and portable spirometer solutions to meet these evolving needs

- The demand for technologically advanced, accurate, and user-friendly spirometers is growing rapidly across hospitals, clinics, and home healthcare settings, as healthcare providers increasingly prioritize convenience, workflow efficiency, and data-driven patient care

Europe Spirometer Market Dynamics

Driver

Rising Prevalence of Respiratory Disorders and Increasing Adoption of Digital Diagnostics

- The increasing prevalence of chronic respiratory diseases, including asthma, chronic obstructive pulmonary disease (COPD), and cystic fibrosis, is a primary driver of the Europe Spirometer market. According to the European Lung Foundation, millions of Europeans suffer from these conditions, leading to a growing need for regular pulmonary function monitoring

- For instance, in February 2024, MIR Medical launched an updated Spirobank Smart model with integrated telemonitoring and AI-assisted reporting, designed to support remote management of COPD patients. This initiative exemplifies how innovations in digital spirometry are driving both clinical adoption and patient engagement

- Furthermore, rising awareness among healthcare providers regarding early detection and continuous monitoring of respiratory conditions is contributing to increased demand for spirometry devices. Hospitals and clinics are increasingly implementing digital and portable spirometers to improve diagnostic accuracy and reduce clinical workload

- Government initiatives promoting preventive respiratory care, along with reimbursement policies for diagnostic procedures, are also accelerating market growth. The growing trend of telemedicine and home-based health monitoring is making portable and connected spirometers an essential tool in patient care

Restraint/Challenge

High Initial Costs and Data Security Concerns

- High acquisition costs of advanced spirometer devices, particularly those with AI analytics, cloud connectivity, and integrated software, can be a barrier for small clinics and home healthcare providers in price-sensitive regions

- For instance, some hospitals in Eastern Europe have delayed upgrading to AI-enabled spirometers due to budget constraints, despite clinical benefits. Similarly, while portable devices offer convenience, they often come with a higher upfront cost than traditional tabletop spirometers

- Concerns regarding data privacy and cybersecurity in cloud-enabled spirometer systems pose an additional challenge. Healthcare providers are increasingly cautious about storing sensitive patient data digitally, particularly with remote monitoring and telehealth applications. For instance, a 2023 report highlighted vulnerabilities in certain cloud-connected medical devices, prompting hospitals to invest in secure platforms and robust encryption protocols

- While costs are gradually decreasing and user-friendly models are entering the market, perceived premiums for advanced features still limit adoption in smaller clinics and outpatient centers. Ensuring affordability without compromising data security will be key to sustaining long-term growth in the Europe Spirometer market

- Overcoming these challenges through enhanced cybersecurity measures, clinician training, patient education, and the development of cost-effective devices will be crucial for expanding market penetration across diverse healthcare settings

Europe Spirometer Market Scope

The market is segmented on the basis of type, technology, mechanism, disease, disposable components, application, end-user, and distribution channel.

- By Product Type

On the basis of product type, the Spirometer market is segmented into Table-Top Spirometer, Hand-Held Spirometer, and PC-Based Spirometer. The Table-Top Spirometer segment dominated the largest market revenue share of 46.8% in 2025, owing to its accuracy in measuring lung volumes, flow rates, and comprehensive respiratory parameters. Hospitals and diagnostic centers prefer these devices for routine check-ups, preoperative assessments, and chronic disease monitoring. The ability to integrate with patient management software and electronic medical records enhances workflow efficiency. Advanced features like real-time data visualization, multi-test functionality, and long-term trend analysis drive adoption. Growing prevalence of chronic respiratory diseases such as asthma and COPD further fuels demand. Large-scale screening programs in clinics and hospitals reinforce its dominant position. Integration with AI-assisted diagnostic platforms is an emerging trend. Technological upgrades and robust calibration ensure consistent reliability. The segment is widely supported by established European healthcare distribution channels and strong after-sales support.

The Hand-Held Spirometer segment is expected to witness the fastest CAGR of 12.5% from 2026 to 2033, driven by increasing demand for portable and point-of-care respiratory testing. Lightweight, compact designs allow use in clinics, homecare, and remote monitoring. Telemedicine initiatives and home-based monitoring programs are key adoption drivers. Immediate readouts and smartphone compatibility improve patient convenience. Affordability compared with table-top systems encourages usage in smaller clinics and rural areas. Growing awareness of preventive respiratory care supports adoption. The expansion of school-based and workplace screening programs fuels demand. Portable spirometers are increasingly integrated with digital healthcare platforms. Low maintenance requirements and easy calibration enhance appeal. Healthcare professionals value them for emergency and bedside assessments. Rising prevalence of chronic respiratory diseases among aging populations supports growth. Overall, increasing convenience and cost-effectiveness make hand-held spirometers the fastest-growing segment.

- By Technology

On the basis of technology, the market is segmented into Volume Measurement Spirometer, Flow Measurement Spirometer, and Peak Flow Meter. The Volume Measurement Spirometer segment dominated the largest market revenue share of 44.3% in 2025, preferred for precise lung volume measurements in hospitals and clinics. It is critical for diagnosing restrictive and obstructive disorders. Integration with EMR systems, digital reporting, and trend analysis improves patient management. High reliability, repeatability, and advanced calibration features support clinical use. Large healthcare facilities use volume spirometers for preoperative and chronic disease assessments. The segment benefits from awareness programs emphasizing early detection of respiratory disorders. Increasing adoption of digital health technologies strengthens demand. Research and academic institutions also contribute to adoption. Multi-parameter capabilities make it suitable for comprehensive diagnostics. Hospitals prefer these systems for their superior image quality and software integration. Regulatory approvals and standardization further reinforce dominance.

The Peak Flow Meter segment is expected to witness the fastest CAGR of 13.1% from 2026 to 2033, fueled by home-based monitoring for asthma management. Compact, low-cost, and portable designs support daily self-monitoring. Integration with mobile apps and telehealth platforms drives adoption. School screening programs and preventive care initiatives further increase demand. Patients with chronic respiratory conditions find peak flow meters convenient and easy to use. Increased awareness of asthma action plans contributes to growth. Rising prevalence of COPD and other obstructive diseases supports uptake. Manufacturers are innovating with wireless connectivity and data logging. Growth is strongest in homecare and community health settings. Simplicity and affordability make peak flow meters attractive for first-time users. Rising digital health awareness strengthens adoption. Overall, the segment is expanding rapidly due to convenience and accessibility.

- By Mechanism

On the basis of mechanism, the market is segmented into Flow-Sensing Spirometer and Peak Flow Meters. Flow-Sensing Spirometers dominated the largest market revenue share of 48.7% in 2025, preferred in hospitals and specialty clinics for precise measurement of forced expiratory volume and peak flow. Real-time digital feedback, automatic calibration, and data integration with EMRs reinforce adoption. These devices support early detection and management of chronic respiratory diseases. Comprehensive pulmonary assessments and high patient volumes strengthen hospital adoption. Standardized testing protocols and consistent measurement accuracy are critical factors. Technological upgrades and software compatibility enhance clinical utility. Regulatory compliance and quality certifications ensure reliability. Multi-parameter testing capabilities increase utility in diagnostics. Professional training and support services improve usability. Clinical trials and research institutions contribute to market stability. The segment is widely trusted across Europe for accuracy and reliability.

Peak Flow Meters are expected to witness the fastest CAGR of 12.8% from 2026 to 2033, driven by homecare adoption, asthma management programs, and school-based screening initiatives. Lightweight, portable, and low-cost designs facilitate frequent monitoring. Telemedicine and remote monitoring programs are key adoption drivers. User-friendly designs enhance patient compliance. Integration with mobile apps improves data tracking. Preventive healthcare initiatives in European countries accelerate growth. Manufacturers are innovating with digital connectivity features. Community health programs contribute to adoption. Rising awareness among patients and caregivers supports rapid uptake. Accessibility in rural and semi-urban areas drives expansion. Overall, Peak Flow Meters are the fastest-growing mechanism segment.

- By Disease

On the basis of disease, the market is segmented into Asthma, Bronchitis, Emphysema, COPD, Lung Cancer, and Others. The Asthma segment dominated the largest market revenue share of 41.6% in 2025, due to high prevalence in children and adults. Spirometry is critical for diagnosis, monitoring, and management. Hospitals, clinics, and diagnostic centers rely on accurate asthma detection. Preventive care programs and school-based screening strengthen adoption. Awareness campaigns emphasize early detection and proper treatment. Integration with digital health platforms facilitates patient monitoring. Recurrent assessments and chronic disease management support consistent usage. Insurance reimbursement frameworks encourage testing. Long-term trend tracking for patients enhances clinical outcomes. Government initiatives and health campaigns reinforce dominance. Growth is driven by increasing incidence and public awareness.

The COPD segment is expected to witness the fastest CAGR of 13.4% from 2026 to 2033, fueled by rising prevalence among aging populations and smokers. Early detection programs and home-based monitoring initiatives are key drivers. Telehealth integration supports self-management. Awareness of disease progression encourages frequent testing. Adoption in rural and community healthcare centers accelerates growth. Compact devices and affordability increase accessibility. Digital reporting and remote consultation enhance adoption. Support from respiratory therapy programs drives usage. Rising incidence globally and within Europe reinforces expansion. Overall, COPD spirometry monitoring is the fastest-growing disease segment.

- By Disposable Components

On the basis of disposable components, the market is segmented into Filters, Sensors, and Tubes. The Filters segment dominated the largest market revenue share of 49.2% in 2025, essential for preventing cross-contamination and ensuring patient safety in hospitals and clinics. Regulatory mandates, hygiene concerns, and routine hospital protocols support adoption. High turnover in hospitals and clinics ensures consistent demand. Disposable filters maintain device performance and reliability. Suppliers provide bulk distribution contracts for healthcare facilities. Rising awareness of infection control strengthens growth. Standardization and certification reinforce clinical trust. Hospitals prioritize high-quality filters to comply with European medical device regulations. Widespread adoption in diagnostics and research centers supports dominance.

The Sensors segment is expected to witness the fastest CAGR of 12.7% from 2026 to 2033, driven by technological advancements, integration with portable spirometers, and real-time monitoring capabilities. Sensor miniaturization and improved sensitivity enhance device accuracy. Growth is supported by homecare, clinics, and telemedicine adoption. New product launches and innovations in sensor technology drive demand. Integration with mobile applications and remote data transmission accelerates growth.

- By Application

On the basis of application, the market is segmented into Diagnostics and Therapeutics. The Diagnostics segment dominated the largest market revenue share of 53.5% in 2025, driven by its extensive use in diagnosing respiratory conditions such as asthma, COPD, bronchitis, and emphysema across hospitals and clinics. Hospitals rely on diagnostic spirometry for preoperative evaluations, chronic disease management, and pulmonary function monitoring. Standardized protocols ensure repeatability and consistency of results. Integration with electronic health records improves clinical decision-making. Large patient volumes in hospitals, clinics, and diagnostic centers reinforce adoption. Advanced devices now incorporate features such as AI-based analysis, trend tracking, and predictive respiratory insights. Preventive care initiatives and government health screening programs further drive demand. Academic and research institutions utilize spirometry for clinical studies and long-term respiratory research. Insurance reimbursements support adoption in private healthcare. Device manufacturers focus on software-enabled diagnostics for improved accuracy and reporting. European hospitals prioritize reliable and high-throughput systems.

The Therapeutics segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, fueled by increasing use in pulmonary rehabilitation programs, respiratory therapy, and telehealth interventions. Hospitals and homecare services leverage therapeutic spirometers for guided breathing exercises and post-operative care. Home-based therapeutic monitoring allows patients with chronic lung diseases to self-manage their conditions. Devices integrating therapy protocols with digital platforms improve adherence. Respiratory therapists and healthcare providers recommend therapeutic spirometers for rehabilitation and training programs. Rising prevalence of chronic respiratory diseases such as COPD and asthma accelerates market growth. Portable therapeutic devices expand accessibility in rural and semi-urban regions. Continuous monitoring via connected apps enhances patient engagement. Telemedicine initiatives drive adoption in homecare settings. Cost-effective designs make them suitable for widespread use. Integration with other pulmonary therapy devices supports multi-functional utility. Manufacturers are investing in ergonomic designs and advanced feedback mechanisms. Overall, therapeutic applications are expanding rapidly due to patient-centric care models.

- By End-User

On the basis of end-user, the market is segmented into Hospitals, Clinics, and Homecare. Hospitals dominated the largest market revenue share of 55.8% in 2025, attributed to high patient volumes, advanced respiratory care departments, and the adoption of sophisticated digital spirometry systems. Hospitals conduct large-scale screenings, preoperative assessments, and chronic disease monitoring. Investments in skilled respiratory therapists and respiratory care infrastructure support consistent adoption. Integration with hospital IT systems and electronic medical records improves workflow efficiency and patient data management. Standardization of testing protocols ensures reliable and repeatable measurements. Hospitals prefer devices with multi-parameter capabilities, AI-assisted analysis, and robust maintenance support. Clinical trials and research applications further reinforce usage. High throughput and long-term durability enhance operational efficiency. Government and private healthcare funding strengthen market penetration. Preventive care programs contribute to routine usage. Established procurement channels ensure reliable supply.

The Homecare segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, driven by growing patient awareness of respiratory health and the rising prevalence of chronic lung diseases. Home-based monitoring programs allow patients to manage asthma, COPD, and other conditions remotely. Integration with telemedicine platforms and mobile apps enables real-time data sharing with healthcare providers. Affordable, compact, and user-friendly devices promote adoption in home settings. Homecare monitoring helps reduce hospital visits and improve patient compliance. Remote monitoring capabilities, combined with trend analysis, support personalized care. Aging populations and increasing chronic disease burden in Europe reinforce demand. Community health initiatives encourage usage among at-risk patients. Device innovations focusing on portability, wireless connectivity, and low maintenance accelerate adoption. Educational programs for home users further strengthen growth. Availability through online and retail channels supports rapid market expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Over the Counter and Direct Tender. The Direct Tender segment dominated the largest revenue share of 51.2% in 2025, driven by bulk procurement by hospitals, clinics, and diagnostic centers. Large healthcare facilities prefer direct tenders for reliable supply, post-sales service, and warranty support. Bulk contracts ensure cost efficiency, streamlined logistics, and strong supplier relationships. Hospitals and diagnostic centers prioritize devices with consistent performance and high throughput. Long-term maintenance agreements strengthen adoption. Government procurement programs and institutional tenders support stable market demand. High-value digital spirometry devices are often distributed via tenders. Regulatory compliance and adherence to European healthcare standards reinforce trust. Academic and research institutions also procure via tenders. Integration with hospital IT infrastructure is more feasible through direct procurement. Clinical training and support packages improve operational efficiency.

The Over the Counter segment is expected to witness the fastest CAGR of 12.6% from 2026 to 2033, fueled by rising demand for home-use and personal spirometers. Retail availability through pharmacies, e-commerce platforms, and medical supply stores enhances accessibility. Homecare and patient self-monitoring programs are major growth drivers. Compact and affordable spirometers appeal to individual consumers and caregivers. Increasing awareness of respiratory health and chronic disease monitoring promotes adoption. Integration with mobile apps and cloud platforms supports user engagement. Portable designs and user-friendly interfaces improve convenience. Growing telemedicine services strengthen usage in remote regions. Awareness campaigns about asthma and COPD contribute to market expansion. Overall, OTC distribution ensures rapid penetration into non-institutional end-users.

Europe Spirometer Market Regional Analysis

- The Europe spirometer market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of chronic respiratory diseases, increasing awareness of early diagnosis, and growing demand for technologically advanced and portable pulmonary monitoring devices

- The region is witnessing an increasing adoption of digital and connected spirometry solutions, enabling both hospital and home-based patient monitoring. Moreover, the growing geriatric population, coupled with increasing air pollution and lifestyle-related respiratory risks, is further propelling the demand for accurate and user-friendly diagnostic tools

- Significant growth is observed across hospitals, specialty pulmonary clinics, and homecare settings, with both portable and tabletop spirometers being integrated into routine respiratory care programs

U.K. Spirometer Market Insight

The U.K. spirometer market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by advanced healthcare infrastructure, strong emphasis on early respiratory disease diagnosis, and a high adoption rate of digital and portable spirometry devices. The presence of specialized pulmonary clinics, coupled with government-supported screening programs for asthma and COPD, encourages widespread use of spirometry testing across both urban and rural populations. In addition, the U.K. has robust reimbursement policies for diagnostic procedures, which enhances accessibility to advanced spirometer devices in hospitals and outpatient care centers. The increasing integration of portable spirometers into telehealth and homecare services is also driving patient-centric monitoring and continuous disease management, further supporting market growth. The U.K. dominated the European Spirometer market with the largest revenue share of 29.6% in 2025, reflecting strong clinical adoption and technological readiness.

Germany Spirometer Market Insight

The Germany spirometer market is expected to expand at a considerable CAGR during the forecast period, fueled by a rising prevalence of respiratory disorders, growing geriatric population, and increasing investments in pulmonary diagnostics. Germany’s well-developed healthcare infrastructure and emphasis on preventive diagnostics promote the adoption of both portable and connected spirometry solutions in hospitals, clinics, and homecare settings. The expanding availability of advanced digital spirometers, often integrated with electronic health records and cloud-based monitoring platforms, supports early detection and continuous management of conditions such as asthma, COPD, and interstitial lung diseases. In addition, the country’s focus on research, innovation, and technologically advanced healthcare devices facilitates the adoption of AI-assisted interpretation and connected spirometry solutions, particularly in urban medical centers. Germany is expected to be the fastest-growing country in the European Spirometer market during the forecast period, driven by increased clinical awareness, supportive healthcare expenditure, and rising adoption of portable and connected devices for patient monitoring.

Europe Spirometer Market Share

The Spirometer industry is primarily led by well-established companies, including:

- Philips Healthcare (Netherlands)

- NDD Medical Technologies (Switzerland)

- Medtronic plc (Ireland)

- Contec Medical Systems Co., Ltd. (China)

- Vitalograph Ltd. (U.K.)

- MIR Medical International Research (Italy)

- nSpire Health, Inc. (U.S.)

- COSMED Srl (Italy)

- Omron Healthcare Co., Ltd. (Japan)

- Schiller AG (Switzerland)

- MIR SpA (Italy)

- Pulmotrack, Inc. (U.S.)

- Trivitron Healthcare Pvt. Ltd. (India)

- COSMED USA, Inc. (U.S.)

Latest Developments in Europe Spirometer Market

- In November 2021, Cipla Ltd. launched Spirofy, India’s first pneumotach‑based portable wireless spirometer on World COPD Day, designed to simplify and strengthen COPD and obstructive airway disease diagnosis, marking a significant early adoption of advanced portable spirometry technology in emerging markets

- In September 2022, RxCap, Inc. partnered with ZEPHYRx to integrate ZEPHYRx’s online spirometry platform with RxCap’s remote surveillance system, enabling corporate clients and healthcare providers to remotely monitor lung health in patients with severe respiratory diseases, expanding the role of connected spirometry in tele‑health and chronic disease management

- In February 2025, Clario entered a strategic collaboration with ArtiQ to incorporate AI‑powered analytics into spirometry devices, aimed at improving remote patient monitoring accuracy and enhancing the utility of spirometers in clinical studies and digital respiratory care platforms globally

- In July 2025, Philips Healthcare launched its next‑generation portable spirometer designed for primary care and home‑based diagnostics, expanding access to affordable, high‑quality respiratory testing and supporting broader adoption of spirometry beyond traditional clinical settings

- In October 2025, Norav Medical introduced the MiniSpiro advanced spirometer with real‑time testing capabilities, automatic BTPS conversion, seamless EHR/EMR connectivity support, and pediatric mode, aimed at enhancing precision diagnostics and improving clinical workflow in hospitals and clinics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.