Europe Interventional Neurology Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

2.54 Billion

2025

2033

USD

1.35 Billion

USD

2.54 Billion

2025

2033

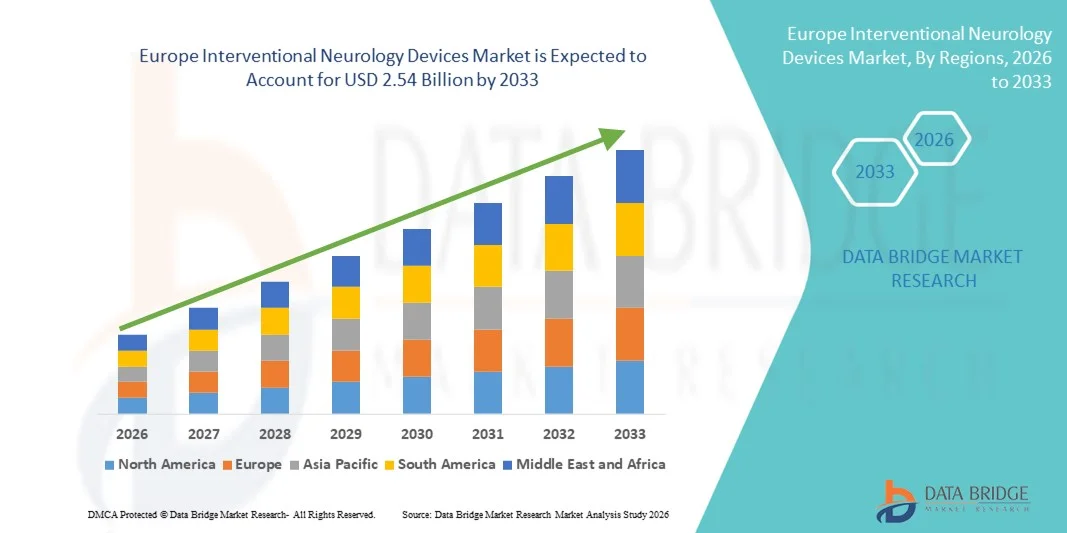

| 2026 –2033 | |

| USD 1.35 Billion | |

| USD 2.54 Billion | |

|

|

|

|

Europe Interventional Neurology Devices Market Size

- The Europe interventional neurology devices market size was valued at USD 1.35 billion in 2025 and is expected to reach USD 2.54 billion by 2033, at a CAGR of 8.25% during the forecast period

- The market growth is largely fueled by the rising prevalence of neurological disorders such as stroke, aneurysms, and intracranial vascular diseases, coupled with growing adoption of minimally invasive and image-guided interventional procedures in both hospitals and specialty neurocenters

- Furthermore, increasing patient preference for safer, precise, and faster recovery treatments, along with continuous technological advancements in neurovascular devices such as stents, embolic coils, catheters, and thrombectomy systems, is establishing interventional neurology devices as essential tools in modern neurovascular care. These converging factors are accelerating the uptake of Interventional Neurology Devices solutions, thereby significantly boosting overall market growth

Europe Interventional Neurology Devices Market Analysis

- Interventional neurology devices, including neurovascular stents, embolic coils, thrombectomy devices, and microcatheters, are increasingly vital components of modern neurological care across hospitals and specialty neurocenters due to their ability to enable minimally invasive, precise, and effective treatment of stroke, aneurysms, and other cerebrovascular disorders

- The escalating demand for interventional neurology devices is primarily fueled by the rising prevalence of cerebrovascular diseases, increasing adoption of image-guided and minimally invasive procedures, growing patient awareness, and continuous technological advancements in neurovascular devices that improve safety, procedural success, and recovery time

- The U.K. dominated the European interventional neurology devices market with the largest revenue share of 28.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of minimally invasive neurovascular procedures, strong reimbursement policies, and the presence of leading hospitals and neuro-interventional centers driving device utilization

- Germany is expected to be the fastest growing country in the European interventional neurology devices market during the forecast period, driven by rising incidence of stroke and aneurysms, increasing investments in neuro-interventional technologies, adoption of innovative thrombectomy and coil systems, and expanding healthcare expenditure focused on minimally invasive treatments

- The Ischemic Strokes segment held the largest revenue share of 52.1% in 2025, attributed to the high prevalence of stroke among the elderly and increased detection through advanced imaging

Report Scope and Interventional Neurology Devices Market Segmentation

|

Attributes |

Interventional Neurology Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Interventional Neurology Devices Market Trends

Rising Adoption of Minimally Invasive and Image-Guided Procedures

- A major and accelerating trend in the Europe interventional neurology devices market is the widespread adoption of minimally invasive, image-guided neurovascular interventions

- These procedures, including endovascular thrombectomy, aneurysm coiling, and neurostenting, offer reduced surgical trauma, shorter hospital stays, and improved patient outcomes compared to traditional open surgery. As hospitals seek to optimize efficiency and patient satisfaction, these advanced techniques are increasingly preferred

- For instance, Germany’s leading neurovascular centers are implementing high-precision image-guided navigation systems that allow physicians to accurately position microcatheters during aneurysm repair, reducing the risk of complications. Early clinical data indicates that patients treated with these advanced interventional techniques experience faster recovery and fewer post-procedure neurological deficits, boosting confidence in these devices

- In addition, integration of hybrid operating rooms equipped with real-time fluoroscopy, 3D angiography, and navigation imaging systems is creating new opportunities for the adoption of sophisticated interventional devices. Hospitals in France and the Netherlands are increasingly investing in these hybrid setups to perform complex neurointerventions more safely and efficiently

- The trend is also supported by increasing demand for outpatient-based neurointerventions, where minimally invasive approaches allow faster turnover and reduce costs for healthcare systems

Europe Interventional Neurology Devices Market Dynamics

Driver

Growing Prevalence of Neurological Disorders and Stroke Incidence

- The primary driver of the market is the rising prevalence of neurological disorders, especially ischemic and hemorrhagic strokes, aneurysms, and arteriovenous malformations. With the aging population in Europe, the burden of cerebrovascular diseases continues to increase, necessitating advanced interventional solutions

- For instance, a 2024 European Stroke Organisation report highlighted over 1.2 million stroke cases in Germany and the U.K., with increasing survival rates leading to higher demand for follow-up interventional procedures to prevent recurrence

- Healthcare initiatives aimed at early detection and management of stroke and neurovascular disorders are also promoting market growth. Public awareness campaigns and widespread adoption of neuroimaging screening programs have resulted in higher referral rates for interventional procedures

- Favorable reimbursement frameworks in key countries, including the U.K. and Germany, are facilitating hospital adoption of high-cost interventional devices such as flow-diverter stents, embolization coils, and thrombectomy systems. These policies reduce financial barriers and encourage hospitals to invest in cutting-edge technologies

- Technological advancements in devices are another significant driver. Improvements in catheter design, microcatheter flexibility, low-profile delivery systems, and enhanced visibility under imaging are increasing procedural success rates and safety, thereby accelerating market adoption

- The integration of AI-assisted imaging and robotic-assisted navigation platforms is further enhancing the precision and efficiency of neurointerventions, creating a positive cycle of device adoption and clinical validation

Restraint/Challenge

High Device Costs, Regulatory Hurdles, and Skilled Workforce Shortages

- Despite the market potential, several challenges hinder rapid growth. The high cost of advanced interventional neurology devices, such as MRI-compatible stents, neurovascular flow-diverters, and AI-enabled navigation systems, limits adoption in smaller hospitals or budget-constrained regions

- Stringent European regulatory requirements, including CE marking and compliance with the Medical Device Regulation (MDR), can delay product approvals and increase development and clinical trial costs

- For instance, in 2023, a leading manufacturer of flow-diverter stents experienced a 12-month delay in CE approval due to In addition clinical evidence requirements, postponing market entry in several EU countries. These factors sometimes restrict the timely introduction of innovative devices to the market

- Another key restraint is the shortage of trained neurointerventional specialists. While urban centers have access to skilled neurosurgeons and interventional radiologists, rural and semi-urban regions often lack adequately trained personnel, limiting the reach of advanced devices

- Reliance on continuous training programs for physicians and technicians adds operational costs for hospitals, which can slow the adoption of new technologies

- In addition challenges include procedural risks associated with complex neurointerventions, concerns regarding long-term device durability, and the need for robust post-market clinical evidence to reassure healthcare providers

- Overcoming these challenges requires strategic initiatives such as collaborative physician training programs, cost-effective device development, partnerships with academic and research institutions, and streamlined regulatory pathways for faster approvals. This will be vital for sustained and inclusive growth of the market across Europe

Europe Interventional Neurology Devices Market Scope

The market is segmented on the basis of product type, disease pathology, procedure, and end user.

- By Product Type

On the basis of product type, the Interventional Neurology Devices market is segmented into Aneurysm Coiling and Embolization Devices, Cerebral Balloon Angioplasty and Stenting Systems, Support Devices, and Neurothrombectomy Devices. The Aneurysm Coiling and Embolization Devices segment dominated the largest market revenue share of 47.5% in 2025, driven by its widespread use in treating cerebral aneurysms and preventing ruptures. Hospitals and neurology clinics rely on these devices due to their minimally invasive nature, precision, and ability to reduce patient recovery time. Technological innovations such as detachable coils and improved embolic materials have enhanced procedural safety and outcomes. The growing prevalence of cerebral aneurysms in aging populations, coupled with rising awareness of endovascular procedures, further supports adoption. Government initiatives promoting advanced neurocare devices, reimbursement schemes, and increasing infrastructure of neurointerventional suites also drive demand. Device availability across Europe and North America contributes to market leadership.

The Neurothrombectomy Devices segment is expected to witness the fastest CAGR of 13.2% from 2026 to 2033, fueled by increasing incidence of ischemic strokes worldwide and growing adoption of rapid clot retrieval procedures. Hospitals and stroke centers increasingly prefer neurothrombectomy devices for their efficacy in restoring blood flow and improving functional outcomes. Rising awareness of stroke treatment guidelines, higher investment in stroke-ready facilities, and adoption of advanced imaging support the growth trajectory. Market expansion is also aided by improvements in device design, including smaller catheters, improved navigation systems, and safety features, making them more suitable for complex neurovascular cases.

- By Disease Pathology

On the basis of disease pathology, the market is segmented into Ischemic Strokes, Cerebral Aneurysms, Arteriovenous Malformations and Fistulas, and Others. The Ischemic Strokes segment held the largest revenue share of 52.1% in 2025, attributed to the high prevalence of stroke among the elderly and increased detection through advanced imaging. Hospitals and specialized stroke centers rely heavily on devices for mechanical thrombectomy and catheter-based reperfusion. Early intervention and minimally invasive procedures reduce disability and hospital stay durations, reinforcing adoption. Rising patient awareness, availability of skilled neurologists, and government health initiatives further enhance growth. Technological integration with imaging and digital monitoring optimizes treatment planning and post-procedural follow-up.

The Arteriovenous Malformations and Fistulas segment is projected to witness the fastest CAGR of 12.5% from 2026 to 2033, driven by increasing awareness and early diagnosis. Minimally invasive embolization techniques for AVMs and fistulas are preferred due to reduced risk and faster recovery compared with open surgery. Investments in neurointerventional infrastructure and specialized clinics, along with innovation in microcatheters and embolic agents, support rapid adoption. Rising incidence of vascular malformations in both pediatric and adult populations also propels market growth.

- By Procedure

On the basis of procedure, the market is segmented into Embolization, Angioplasty, Neurothrombectomy, and Others. The Embolization segment dominated the largest revenue share of 49.8% in 2025, as it is the preferred method for treating cerebral aneurysms, AVMs, and fistulas. Hospitals and neurology clinics prioritize embolization due to its minimally invasive approach, improved patient safety, and reduced recovery time. Growing awareness of cerebrovascular disease treatments, supportive reimbursement frameworks, and availability of advanced embolization devices drive dominance. Adoption of advanced imaging modalities such as 3D angiography and AI-assisted planning enhances procedural accuracy. Regulatory approvals for innovative coils and embolic materials across Europe further reinforce market share.

The Neurothrombectomy segment is expected to witness the fastest CAGR of 13.6% from 2026 to 2033, fueled by increasing ischemic stroke cases and wider clinical adoption of mechanical clot retrieval devices. Hospitals are adopting neurothrombectomy devices due to their proven efficacy in restoring cerebral blood flow and improving survival and functional outcomes. Rising investment in stroke-ready facilities, updated treatment guidelines, and technological improvements such as smaller, navigable catheters accelerate growth. Early intervention campaigns and public awareness programs also contribute to segment expansion, particularly in developed countries with established stroke care networks.

- By End User

On the basis of end user, the market is segmented into Hospitals, Neurology Clinics, Ambulatory Care Centres, and Others. The Hospitals segment held the largest revenue share of 56.3% in 2025, driven by high patient volumes, advanced infrastructure, and availability of interventional suites. Hospitals prefer comprehensive device portfolios covering aneurysm, stroke, and AVM treatments. Government initiatives, reimbursements, and skilled neurologists further reinforce adoption. Large hospitals also benefit from economies of scale and multi-modality imaging integration, supporting continued dominance.

The Ambulatory Care Centres segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, driven by the rising preference for outpatient neurointerventional procedures. Minimally invasive treatments and shorter recovery times are ideal for ambulatory settings. Technological innovations enabling safe and efficient outpatient procedures, along with increased availability of portable imaging and treatment devices, support growth. Adoption by private neurology practices and specialty care centers further accelerates market expansion. Expansion into urban and semi-urban regions with high patient demand also contributes to rapid growth.

Europe Interventional Neurology Devices Market Regional Analysis

- The Europe interventional neurology devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of neurovascular disorders, such as stroke, cerebral aneurysms, and arteriovenous malformations, alongside growing demand for minimally invasive treatment options

- Advancements in device technology, including thrombectomy devices, coil systems, flow diverters, and AI-assisted navigation platforms, are enhancing procedural accuracy and patient outcomes, further fueling market growth. The increasing investments in digital neuro-interventional platforms, coupled with the rising awareness among healthcare providers regarding early intervention and preventive care, are also supporting market expansion

- Moreover, government initiatives promoting stroke care, aging populations, and increasing hospital infrastructure across Europe are contributing to the widespread adoption of these devices in both public and private healthcare settings

U.K. Interventional Neurology Devices Market Insight

The U.K. interventional neurology devices market is anticipated to grow at a noteworthy CAGR during the forecast period, largely driven by advanced healthcare infrastructure, high adoption of minimally invasive neurovascular procedures, and strong reimbursement frameworks. The presence of leading hospitals and specialized neuro-interventional centers ensures consistent utilization of innovative devices, including thrombectomy systems, neurovascular coils, and flow diverters. In addition, growing awareness about early intervention in stroke and aneurysm management, coupled with robust training programs for neuro-interventionalists, supports higher procedural volumes. The U.K.’s proactive healthcare policies, coupled with increasing adoption of AI-assisted imaging and navigation systems, are further expected to accelerate market growth.

Germany Interventional Neurology Devices Market Insight

The Germany interventional neurology devices market is expected to be the fastest growing in Europe during the forecast period, driven by rising incidence of stroke and aneurysms, increasing healthcare expenditure, and substantial investments in advanced neuro-interventional technologies. Hospitals and specialized centers are increasingly adopting innovative devices, including coil embolization systems, stent-assisted thrombectomy devices, and AI-guided navigation platforms, improving procedural efficiency and patient safety. Germany’s focus on minimally invasive treatment approaches, coupled with an aging population and expanding healthcare infrastructure, is fostering widespread adoption of these devices across both urban and semi-urban regions. Moreover, supportive reimbursement policies, ongoing clinical trials, and investments in training programs for neuro-interventional specialists are expected to sustain long-term growth in the country.

Europe Interventional Neurology Devices Market Share

The Interventional Neurology Devices industry is primarily led by well-established companies, including:

- Medtronic plc (Ireland)

- Stryker Corporation (U.S.)

- Boston Scientific Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Penumbra, Inc. (U.S.)

- Terumo Corporation (Japan)

- MicroVention, Inc. (U.S.)

- Johnson & Johnson (U.S.)

- Cerenovus (U.S.)

- Balt Extrusion (France)

- Phenox GmbH (Germany)

- Kaneka Corporation (Japan)

- Asahi Intecc Co., Ltd. (Japan)

- NeuroIntervention AG (Switzerland)

- Pulse Medical Devices Ltd. (U.K.)

Latest Developments in Europe Interventional Neurology Devices Market

- In June 2025, InspireMD announced that its CGuard Prime Embolic Prevention System (EPS) received CE Mark approval under the European Medical Device Regulation (MDR) for use in stroke prevention. The CE Mark enables wider adoption of this embolic protection device across European healthcare systems, offering clinicians a new tool to reduce stroke risk during carotid interventions

- In May 2025, Terumo Interventional Systems commercially launched its FDA‑approved ROADSAVER Carotid Stent System in select European markets. Designed for use with the Nanoparasol Embolic Protection System, the ROADSAVER Stent System provides a minimally invasive solution for treating carotid artery stenosis and expanding therapeutic options for patients at high surgical risk

- In March 2025, Boston Scientific launched an updated FilterWire EZ embolic protection system in select European markets. The updated system features a 110‑micron‑pore filter tip designed to capture embolic debris while maintaining blood flow, improving embolic protection performance in neurovascular procedure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.