Europe Hla Typing Transplant Market

Market Size in USD Million

CAGR :

%

USD

282.92 Million

USD

515.95 Million

2025

2033

USD

282.92 Million

USD

515.95 Million

2025

2033

| 2026 –2033 | |

| USD 282.92 Million | |

| USD 515.95 Million | |

|

|

|

|

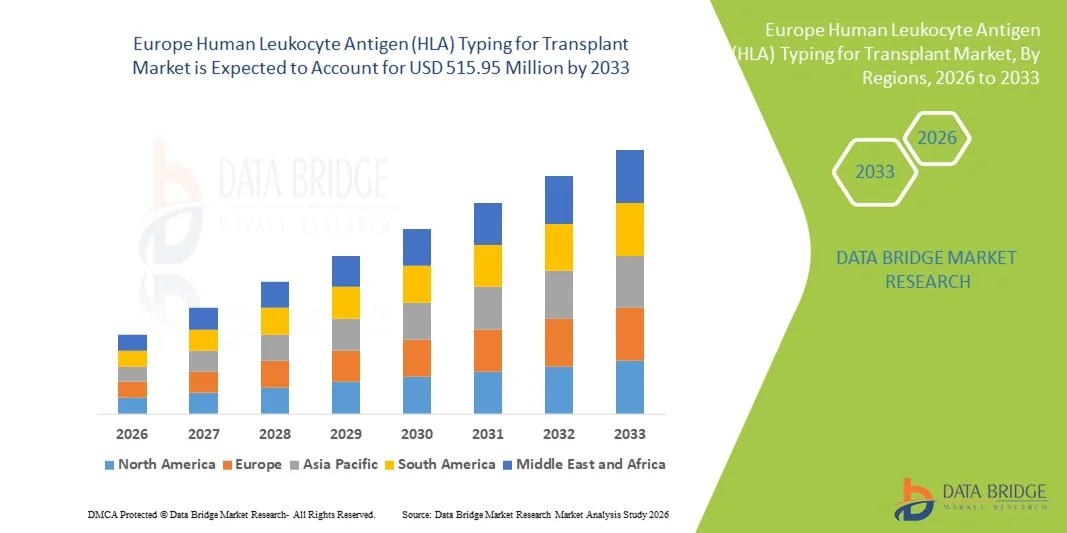

Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market Size

- The Europe Human Leukocyte Antigen (HLA) typing for transplant market size was valued at USD 282.92 million in 2025 and is expected to reach USD 515.95 million by 2033, at a CAGR of 7.80% during the forecast period

- The market growth is largely driven by the increasing number of organ and stem cell transplant procedures across Europe, coupled with rising awareness regarding the importance of precise donor-recipient matching to reduce transplant rejection and improve clinical outcomes

- Furthermore, continuous technological advancements in molecular diagnostics, including next-generation sequencing (NGS) and PCR-based typing methods, along with supportive government initiatives and expanding donor registries, are positioning HLA typing as a critical component of modern transplant medicine. These converging factors are accelerating the adoption of advanced HLA typing solutions, thereby significantly boosting the market’s growth

Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market Analysis

- Human Leukocyte Antigen (HLA) typing for transplant, involving molecular and serological techniques to match donors and recipients for organ and stem cell transplantation, is a critical component of modern transplant medicine across hospitals, diagnostic laboratories, and transplant centers due to its essential role in reducing graft rejection and improving long-term transplant outcomes

- The escalating demand for HLA typing services is primarily fueled by the rising number of organ and hematopoietic stem cell transplants in Europe, growing awareness of the importance of precise immunogenetic matching, and continuous advancements in molecular diagnostic technologies such as PCR and next-generation sequencing (NGS)

- Germany dominated the Europe HLA typing for transplant market with the largest revenue share of 28.64% in 2025, characterized by a well-established healthcare infrastructure, strong presence of leading diagnostic companies, and active national donor registries

- France is expected to be the fastest growing country in the Europe HLA typing for transplant market during the forecast period due to expanding transplant programs, supportive regulatory frameworks, and increasing investments in precision diagnostics

- Reagents and consumables segment dominated the Europe HLA typing for transplant market with a market share of 46.7% in 2025, driven by their recurring usage in routine typing procedures, high testing frequency, and the growing adoption of high-resolution molecular assays in clinical laboratories

Report Scope and Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market Segmentation

|

Attributes |

Europe Human Leukocyte Antigen (HLA) Typing for Transplant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market Trends

Rising Adoption of High-Resolution Molecular and NGS-Based Typing Technologies

- A significant and accelerating trend in the Europe HLA typing for transplant market is the increasing adoption of high-resolution molecular diagnostics and next-generation sequencing (NGS) technologies. This technological advancement is significantly enhancing typing accuracy and transplant compatibility assessment across clinical laboratories and transplant centers

- For instance, leading diagnostic companies such as Illumina and Thermo Fisher Scientific have expanded their NGS-based HLA typing kits and workflows across European transplant laboratories, enabling more comprehensive allele-level resolution and improved donor-recipient matching

- NGS integration in HLA typing enables detailed characterization of complex HLA loci, reduces ambiguity in allele assignment, and supports better prediction of graft-versus-host disease risks. For instance, several European transplant centers are utilizing high-throughput sequencing platforms to process large donor registries efficiently while improving turnaround times and result reliability. Furthermore, automated software solutions assist laboratories in interpreting complex genetic data with greater precision

- The seamless integration of advanced molecular platforms with laboratory information management systems (LIMS) facilitates centralized data management and improved coordination between donor registries, hospitals, and transplant organizations. Through unified digital systems, clinicians can access accurate compatibility data, supporting faster and more informed transplant decisions across borders

- This trend towards more precise, automated, and data-driven HLA typing solutions is fundamentally reshaping clinical standards in transplant immunology. Consequently, companies such as QIAGEN and CareDx are developing enhanced molecular assays and software tools to support high-resolution typing and post-transplant monitoring across European markets

- The demand for advanced molecular HLA typing solutions is growing rapidly across hospitals, reference laboratories, and national donor registries, as healthcare providers increasingly prioritize precision medicine and improved transplant success rates

Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market Dynamics

Driver

Increasing Transplant Procedures and Expansion of Donor Registries

- The rising number of organ and hematopoietic stem cell transplant procedures across Europe, coupled with the expansion of national and international donor registries, is a significant driver for the heightened demand for HLA typing services

- For instance, in recent years, several European countries have strengthened collaboration through organizations such as Eurotransplant to facilitate cross-border organ allocation, thereby increasing the volume of compatibility testing required before transplantation. Such strategies by healthcare authorities and transplant networks are expected to drive the HLA typing market growth during the forecast period

- As transplant programs expand and survival rates improve, clinicians increasingly rely on precise HLA matching to minimize rejection risks and improve long-term graft survival, positioning advanced molecular typing as a critical diagnostic requirement

- Furthermore, the growing focus on precision medicine and personalized healthcare approaches is making high-resolution HLA typing an integral component of transplant protocols, ensuring optimized donor-recipient selection and post-transplant management strategies

- The increasing awareness among healthcare providers regarding the clinical and economic benefits of accurate compatibility testing, along with government support for organ donation initiatives, is propelling the adoption of HLA typing solutions across major European healthcare systems. The ongoing investments in laboratory infrastructure and skilled workforce development further contribute to market growth

Restraint/Challenge

High Cost of Advanced Molecular Testing and Regulatory Complexity

- Concerns surrounding the high cost of advanced molecular typing platforms and consumables, including NGS-based assays, pose a significant challenge to broader market expansion. As high-resolution HLA typing requires specialized equipment, skilled personnel, and quality-controlled reagents, it can create financial pressure on smaller laboratories and healthcare facilities

- For instance, the implementation of NGS workflows often involves substantial upfront capital investment and ongoing maintenance expenses, making some transplant centers cautious about rapid technology adoption despite clinical advantages

- Addressing these cost-related challenges through reimbursement support, centralized testing facilities, and scalable workflow solutions is crucial for wider accessibility. Companies such as Illumina and Thermo Fisher Scientific are focusing on streamlined platforms and automation to reduce per-sample costs and improve operational efficiency. In addition, stringent regulatory requirements governing in vitro diagnostic devices and genetic testing across European countries can delay product approvals and market entry

- While regulatory oversight ensures patient safety and test reliability, navigating diverse national compliance frameworks can increase administrative burden and time-to-market for new HLA typing solutions

- Overcoming these challenges through harmonized regulatory policies, improved reimbursement frameworks, and cost-optimized molecular technologies will be vital for sustaining long-term market growth across Europe

Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market Scope

The market is segmented on the basis of products and services, technology, transplant type, application, and end user.

- By Products and Services

On the basis of products and services, the market is segmented into reagents and consumables, instruments, and software and services. The reagents and consumables segment dominated the market with the largest revenue share of 46.7% in 2025, driven by their recurring usage in routine HLA typing procedures across transplant centers and reference laboratories. These include PCR kits, sequencing reagents, primers, probes, and other assay-specific materials that are required for each test cycle. The growing number of transplant procedures and donor registry screenings across Europe has significantly increased testing volumes, directly supporting demand for consumables. In addition, continuous innovation in assay chemistry and high-resolution typing kits enhances laboratory efficiency and accuracy. Since reagents are used on a per-sample basis, they generate consistent revenue streams compared to capital equipment. The expansion of national donor programs and cross-border organ exchange further strengthens this segment’s dominance.

The software and services segment is anticipated to witness the fastest growth rate during the forecast period, fueled by the increasing complexity of HLA data interpretation and the shift toward digital laboratory ecosystems. Advanced bioinformatics tools are essential for analyzing next-generation sequencing (NGS) data and minimizing allele ambiguity. Laboratories are increasingly adopting cloud-based platforms for data storage, compliance management, and inter-laboratory coordination. The growing need for technical support, workflow optimization, and validation services further contributes to segment growth. In addition, transplant centers are investing in integrated laboratory information management systems (LIMS) to streamline reporting and regulatory documentation. As precision medicine gains momentum, demand for specialized interpretation services and post-transplant monitoring solutions is expected to accelerate.

- By Technology

On the basis of technology, the market is segmented into sequencing-based molecular assays, molecular assay technologies, and non-molecular assay technologies. The sequencing-based molecular assays segment dominated the market in 2025 due to their superior accuracy and high-resolution allele-level typing capabilities. Next-generation sequencing (NGS) platforms enable comprehensive characterization of HLA loci, reducing mismatches and improving transplant outcomes. European transplant centers increasingly prefer sequencing-based approaches for complex donor-recipient matching cases. These technologies also support large-scale donor registry screening with high throughput. Furthermore, declining sequencing costs and improved automation have enhanced accessibility across developed European healthcare systems. The clinical emphasis on precision matching continues to reinforce this segment’s leading position.

The molecular assay technologies segment is projected to grow at the fastest rate during the forecast period, supported by continuous improvements in PCR-based typing and real-time amplification techniques. These assays offer relatively faster turnaround times compared to full sequencing workflows, making them suitable for urgent transplant scenarios. Many mid-sized laboratories favor molecular assays due to their cost-effectiveness and operational simplicity. Technological advancements in multiplex PCR and digital PCR are expanding their diagnostic capabilities. In addition, improved reagent sensitivity and standardized protocols are increasing reliability across different healthcare settings. The balance between affordability and accuracy is expected to drive rapid adoption in emerging European markets.

- By Transplant Type

On the basis of transplant type, the market is segmented into solid organ transplant and haematopoietic stem cell transplant. The haematopoietic stem cell transplant segment dominated the market in 2025, driven by the critical requirement for precise HLA matching to prevent graft-versus-host disease (GVHD). Stem cell transplantation demands high-resolution typing across multiple HLA loci, increasing test complexity and volume. Europe’s extensive bone marrow donor registries significantly contribute to repeated compatibility testing. The rising incidence of hematological disorders such as leukemia and lymphoma further supports segment growth. In addition, advancements in unrelated donor transplantation have increased dependence on comprehensive HLA profiling. The life-saving nature of these procedures underscores the importance of accurate immunogenetic assessment.

The solid organ transplant segment is expected to witness the fastest growth rate during the forecast period due to increasing organ donation awareness and improved transplant success rates. Advances in immunosuppressive therapies are expanding eligibility criteria for transplant recipients. As organ transplant programs expand across Europe, compatibility testing requirements continue to grow. Rapid diagnostic protocols are being adopted to reduce waiting times and improve organ allocation efficiency. In addition, collaboration among European transplant networks is increasing cross-border organ sharing, further boosting HLA testing demand. Growing investments in transplant infrastructure are expected to accelerate this segment’s expansion.

- By Application

On the basis of application, the market is segmented into diagnostic applications and research application. The diagnostic applications segment dominated the market in 2025 owing to its direct role in pre-transplant compatibility testing and post-transplant monitoring. Accurate HLA typing is essential for reducing rejection risks and improving graft survival rates. Hospitals and reference laboratories routinely conduct diagnostic testing before organ and stem cell transplantation. Increasing transplant volumes across Europe directly correlate with higher diagnostic testing frequency. Regulatory guidelines also mandate standardized compatibility testing prior to transplantation. The consistent clinical demand ensures stable and significant revenue contribution from this segment.

The research application segment is projected to grow at the fastest rate during the forecast period due to expanding studies in immunogenetics and personalized medicine. Academic institutions and biotechnology companies are investing in research focused on HLA diversity and disease associations. Advanced sequencing technologies are enabling deeper exploration of population genetics across Europe. In addition, pharmaceutical companies are studying HLA-linked immune responses to develop targeted therapies. Government-funded research initiatives are further promoting innovation in transplant immunology. The integration of genomics into broader biomedical research is expected to fuel sustained growth in this segment.

- By End User

On the basis of end user, the market is segmented into independent reference laboratories, hospitals and transplant centres, and research laboratories and academic institutes. The hospitals and transplant centres segment dominated the market in 2025, driven by their direct involvement in organ allocation and transplantation procedures. These facilities require rapid and accurate HLA typing to ensure optimal donor-recipient matching. Increasing transplant volumes across major European countries reinforce their leading revenue share. Hospitals often collaborate with national registries, further increasing testing frequency. Investments in advanced molecular diagnostic platforms within tertiary care centers also contribute to dominance. Their central role in patient management sustains consistent demand for high-resolution typing solutions.

The independent reference laboratories segment is anticipated to witness the fastest growth during the forecast period, supported by increasing outsourcing of complex molecular diagnostics. Smaller hospitals frequently rely on specialized reference labs for high-resolution sequencing and data interpretation. These laboratories benefit from economies of scale and advanced automation capabilities. The trend toward centralized testing improves cost efficiency and standardization. In addition, cross-border transplant coordination across Europe is boosting demand for large-scale, high-throughput laboratories. As healthcare systems aim to optimize operational efficiency, reliance on specialized reference facilities is expected to increase significantly.

Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market Regional Analysis

- Germany dominated the Europe HLA typing for transplant market with the largest revenue share of 28.64% in 2025, characterized by a well-established healthcare infrastructure, strong presence of leading diagnostic companies, and active national donor registries

- Healthcare providers in the region highly prioritize precise donor-recipient matching, high-resolution molecular typing technologies, and compliance with stringent clinical standards to improve transplant success rates and minimize graft rejection risks

- This widespread adoption is further supported by strong government backing for organ donation programs, collaborative cross-border transplant networks such as Eurotransplant, and continuous investments in next-generation sequencing platforms, establishing advanced HLA typing as a critical component of transplant medicine across European healthcare systems

U.K. Human Leukocyte Antigen (HLA) Typing for Transplant Market Insight

The U.K. HLA typing for transplant market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding organ donation initiatives and strong integration between transplant centers and national registries. The country’s focus on improving graft survival rates and reducing waiting times is encouraging the adoption of high-resolution molecular typing technologies. Investments in genomic medicine and laboratory automation further support market development. In addition, structured regulatory frameworks and centralized healthcare services enhance standardization in transplant diagnostics.

Germany Human Leukocyte Antigen (HLA) Typing for Transplant Market Insight

The Germany HLA typing for transplant market is expected to expand at a considerable CAGR during the forecast period, fueled by a well-developed healthcare infrastructure and high transplant procedure volumes. Germany’s emphasis on precision diagnostics and research innovation promotes the adoption of next-generation sequencing and advanced PCR-based assays. Active participation in European transplant networks increases the need for cross-border compatibility testing. Furthermore, continuous investments in digital laboratory systems and immunogenetics research are strengthening market growth.

France Human Leukocyte Antigen (HLA) Typing for Transplant Market Insight

The France HLA typing for transplant market is projected to grow steadily during the forecast period, supported by a strong national organ donation system and increasing adoption of advanced molecular diagnostics. French healthcare authorities emphasize accurate immunogenetic matching to improve clinical outcomes and reduce transplant rejection rates. The expansion of public healthcare funding and research collaborations in transplant immunology is fostering technological advancements. Growing awareness of precision medicine further contributes to the rising demand for high-resolution HLA typing services.

Italy Human Leukocyte Antigen (HLA) Typing for Transplant Market Insight

The Italy HLA typing for transplant market is gaining traction due to increasing transplant activities and strengthened national donor coordination programs. The country’s healthcare system is progressively adopting advanced molecular typing platforms to enhance compatibility assessment. Collaboration with European transplant networks is improving cross-border organ allocation efficiency. In addition, investments in laboratory modernization and training of skilled professionals are supporting the expansion of HLA diagnostic capabilities across major medical centers.

Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market Share

The Europe Human Leukocyte Antigen (HLA) Typing for Transplant industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Netherlands)

- Illumina, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- BD (U.S.)

- Luminex Corporation (U.S.)

- CareDx, Inc. (U.S.)

- Immucor, Inc. (U.S.)

- BAG Diagnostics GmbH (Germany)

- inno-train Diagnostik GmbH (Germany)

- CeGaT GmbH (Germany)

- Bionobis (France)

- ProImmune Ltd (U.K.)

- Eurofins Scientific SE (Luxembourg)

- HistoGenetics, Inc. (U.S.)

- Immudex (Denmark)

- GenDx (Netherlands)

- DiaSorin S.p.A. (Italy)

- Omixon Biocomputing Ltd (Hungary)

What are the Recent Developments in Europe Human Leukocyte Antigen (HLA) Typing for Transplant Market?

- In October 2025, CareDx announced the launch of its next-generation HLA typing solution AlloSeq Tx11, offering enhanced Class II coverage and additional non-HLA marker profiling for improved donor-recipient matching; the company also confirmed that its existing AlloSeq Tx and QTYPE products received In Vitro Diagnostic Regulation (IVDR) certification in the European Union, reinforcing their clinical reliability and regulatory compliance for European transplant labs

- In March 2025, Thermo Fisher Scientific introduced the One Lambda™ HybriType™ HLA Plus Typing Flex Kit, a next-generation sequencing (NGS)-based HLA typing assay that optimizes read balance, minimizes allele dropout, and delivers high-confidence genotype results with streamlined workflow for research and high-resolution typing

- In November 2024, GenDx launched NGS-Pronto®, a high-resolution HLA typing solution compatible with Oxford Nanopore platforms, enabling flexible sample throughput (4-96 samples) and enhancing molecular typing capacity for European histocompatibility labs seeking scalable transplant diagnostics

- In October 2023, GenDx (a Eurobio Scientific company) launched NGS-Turbo, a high-resolution HLA typing solution leveraging Oxford Nanopore sequencing technology to deliver complete HLA genotyping results in as little as three hours, significantly enhancing rapid immunogenetic testing workflows for transplant labs emphasizing speed and precision

- In March 2024, GenDx announced the availability of NGSengine®3.1, an updated software platform for next-generation sequencing (NGS) data analysis in HLA typing, improving usability, expanded allele databases, and analytical robustness for clinical transplant laboratories across Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.