Europe Healthcare It Market

Market Size in USD Billion

CAGR :

%

USD

114.99 Billion

USD

367.21 Billion

2024

2032

USD

114.99 Billion

USD

367.21 Billion

2024

2032

| 2025 –2032 | |

| USD 114.99 Billion | |

| USD 367.21 Billion | |

|

|

|

|

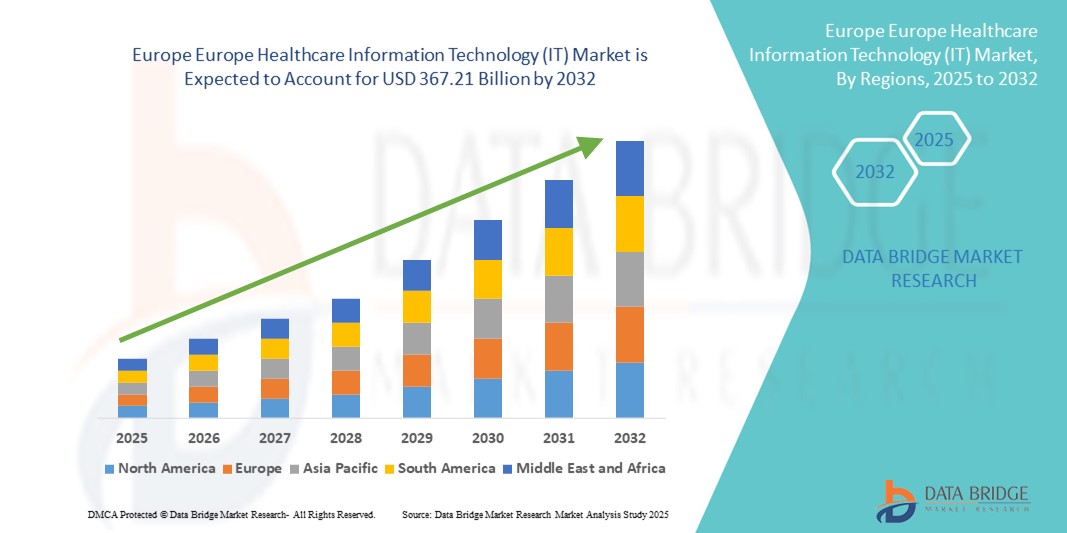

Europe Healthcare Information Technology (IT) Market Size

- The Europe healthcare information technology (IT) market size was valued at USD 114.99 billion in 2024 and is expected to reach USD 367.21 billion by 2032, at a CAGR of 15.62% during the forecast period

- The market growth is largely fueled by increasing digital transformation initiatives in healthcare, adoption of electronic health records (EHRs), telemedicine expansion, and growing demand for data-driven healthcare solutions across hospitals and clinics

- Furthermore, stringent government regulations promoting healthcare digitization, rising investments in health IT infrastructure, and the need to enhance patient outcomes and operational efficiency are driving adoption. These factors are collectively accelerating the integration of advanced healthcare IT systems, significantly propelling market growth

Europe Healthcare Information Technology (IT) Market Analysis

- Healthcare IT solutions in Europe include electronic health records (EHRs), telemedicine, health information systems, and data analytics tools, which are essential for improving patient outcomes, operational efficiency, and regulatory compliance across hospitals and clinics

- The rising demand is driven by government initiatives to digitize healthcare, increasing chronic disease prevalence, and expanded telehealth adoption accelerated by the COVID-19 pandemic, enabling remote patient monitoring and virtual care services

- Germany dominated the Europe healthcare information technology (IT) market with the largest revenue share of 16.3% in 2024, supported by advanced healthcare infrastructure, strong regulatory frameworks, and significant investments in integrated health IT and AI-based diagnostics

- Poland is expected to be the fastest-growing country in the Europe healthcare information technology (IT) market during the forecast period, fueled by increasing healthcare digitization efforts, EU funding programs, and expanding telehealth services to improve rural healthcare access

- The Healthcare Provider Solutions segment dominated the Europe healthcare information technology (IT) market with a share of 52.8% in 2024, driven by widespread adoption of EHRs, clinical decision support, and telemedicine platforms among hospitals and clinics aiming to enhance patient care quality.

Report Scope and Europe Healthcare Information Technology (IT) Market Segmentation

|

Attributes |

Europe Healthcare Information Technology (IT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Healthcare Information Technology (IT) Market Trends

Accelerated Adoption of AI and Telehealth Solutions

- A prominent and rapidly growing trend in the Europe healthcare IT market is the integration of artificial intelligence (AI) and telehealth technologies, transforming diagnostics, patient care, and healthcare delivery across hospitals and clinics

- For instance, in late 2024, Siemens Healthineers introduced AI-powered imaging tools that enhance diagnostic accuracy, while Babylon Health expanded virtual care services in the UK and Germany, improving access to remote consultations

- AI enables predictive analytics, personalized treatment plans, and automation of administrative workflows, while telehealth facilitates virtual visits, remote monitoring, and chronic disease management, boosting patient engagement and reducing costs

- The combination of AI, telehealth, and mobile health apps supports continuous patient data collection and real-time clinical decisions, advancing precision medicine and proactive car

- Key players such as Philips and Cerner are developing AI-enabled platforms that integrate clinical, operational, and financial data, driving innovation and adoption among healthcare providers and payers

- Rising patient demand for convenient care and increasing digital health literacy among both providers and consumers are accelerating this trend across Europe’s healthcare ecosystem

Europe Healthcare Information Technology (IT) Market Dynamics

Driver

Increasing Demand for Efficient, Data-Driven Healthcare Delivery

- The growing patient populations, chronic disease prevalence, and cost containment pressures are driving healthcare providers to adopt IT solutions that improve care coordination, workflow efficiency, and value-based care

- For instance, in March 2024, Cerner Corporation launched an enhanced EHR platform for European healthcare providers emphasizing interoperability and advanced analytics to support clinical decision-making

- Government initiatives and mandates for healthcare digitization and telehealth reimbursement are further stimulating market growth

- Providers increasingly seek integrated, cloud-based IT systems that enable seamless real-time data exchange among clinicians, payers, and patients to enhance personalized care.

- The rising use of big data analytics to identify health trends and optimize resource allocation is supporting better population health management and cost savings

- Enhanced focus on patient engagement tools, including mobile health applications and patient portals, is driving demand for user-friendly healthcare IT platforms

Restraint/Challenge

Data Privacy Regulations and Integration Complexities

- The strict regulatory frameworks such as the EU’s GDPR impose heavy compliance burdens on healthcare IT vendors and organizations, increasing operational costs and complexity

- Concerns about cybersecurity and patient data privacy, amplified by rising cyberattacks targeting healthcare infrastructure, remain significant barriers to adoption

- For instance, in early 2024, ransomware attacks affected multiple European hospitals, disrupting healthcare IT systems and patient service

- Technical challenges in integrating legacy systems with modern IT platforms hinder interoperability and data fluidity

- High costs and resource requirements for IT infrastructure upgrades, especially in smaller healthcare facilities, limit widespread adoption of advanced solutions

- Resistance to change among healthcare professionals and lack of adequate digital training create adoption hurdles for new healthcare IT technologies

- Fragmentation of healthcare systems and varying IT standards across European countries complicate unified healthcare IT deployment and data sharing

- Limited broadband and digital infrastructure in rural or remote areas restrict the effective use of cloud-based healthcare IT and telehealth solutions

Europe Healthcare Information Technology (IT) Market Scope

The market is segmented on the basis of product and services, components, delivery mode, and end-users.

- By Product and Services

On the basis of product and services, the Europe healthcare information technology (IT) market is segmented into healthcare provider solutions, healthcare payer solutions, and hcit outsourcing services. The Healthcare Provider Solutions segment dominated the market with the largest revenue share of 52.8% in 2024, driven by the widespread adoption of electronic health records (EHRs), clinical decision support systems, and telemedicine platforms by hospitals and clinics aiming to improve patient care and streamline clinical workflows.

The HCIT Outsourcing Services segment is anticipated to witness the fastest growth during the forecast period, fueled by increasing healthcare organizations outsourcing IT infrastructure management, technical support, and cybersecurity services to reduce costs and improve operational efficiency.

- By Components

On the basis of components, the Europe healthcare information technology (IT) market is segmented into software, services, and hardware. The Software segment led the market with 48.7% share in 2024, supported by growing demand for advanced healthcare applications, interoperability solutions, and predictive analytics tools that enable better clinical and administrative decision-making.

The Services segment is expected to register the fastest CAGR during forecast period, driven by rising demand for consulting, system integration, and ongoing IT support as healthcare IT environments become more complex and technologically advanced.

- By Delivery Mode

On the basis of delivery mode, the Europe healthcare information technology (IT) market is segmented into On-Premise and Cloud-Based solutions. The Cloud-Based segment held the largest market revenue share of 56.1% in 2024, favored for its scalability, cost-effectiveness, and facilitation of remote care and telehealth services.

The On-Premise segment is anticipated to witness the fastest growth during forecast period, in specific sectors such as government hospitals and facilities with stringent data privacy and security requirements that necessitate localized data control.

- By End-Users

On the basis of end-users, the Europe healthcare information technology (IT) market is segmented into Providers and Payers. The Providers segment dominated with the largest market share of 68.4% in 2024, as hospitals, clinics, and diagnostic centers are primary adopters of healthcare IT solutions designed to improve clinical workflows, patient management, and regulatory compliance.

The Payers segment is expected to witness the fastest growth during forecast period, propelled by increasing digital transformation initiatives within insurance companies and government health agencies focused on claims management, fraud detection, and member engagement.

Europe Healthcare Information Technology (IT) Market Regional Analysis

- Germany dominated the Europe healthcare information technology (IT) market with the largest revenue share of 16.3% in 2024, supported by advanced healthcare infrastructure, strong regulatory frameworks, and significant investments in integrated health IT and AI-based diagnostics

- The country’s focus on innovation, combined with government-led initiatives to accelerate healthcare digitization and interoperability, has propelled widespread adoption of healthcare IT solutions across hospitals and clinics

- Consumers and providers in Germany increasingly prioritize efficient, data-driven care delivery and value-based healthcare models, supporting sustained growth in telehealth, health information exchanges, and AI-enabled clinical decision support systems

The Germany Healthcare IT Market Insight

The Germany healthcare information technology (IT) market is a dominant player within the Europe market, capturing a revenue share of 16.3% in 2024, fueled by strong regulatory frameworks, government funding for healthcare digitization, and a focus on innovation and sustainability. The country’s healthcare providers are actively implementing AI-driven diagnostic tools, interoperable EHR systems, and telemedicine platforms, promoting efficient care delivery. Germany’s mature IT infrastructure and demand for privacy-compliant solutions also contribute to the rapid adoption of healthcare IT technologies in both public and private healthcare sectors.

U.K. Healthcare IT Market Insight

The U.K. healthcare information technology (IT) market is anticipated to grow steadily, supported by national digital health strategies such as the NHS Long Term Plan which emphasizes widespread EHR adoption, telehealth expansion, and data analytics for population health management. Increasing government funding and public-private partnerships are driving IT infrastructure upgrades across healthcare facilities. Growing patient demand for remote care and enhanced data security further bolster market expansion, with healthcare providers embracing cloud-based solutions and AI-enabled clinical decision support tools.

France Healthcare IT Market Insight

The France healthcare information technology (IT) market is experiencing notable growth in healthcare IT adoption, propelled by government programs focused on digital transformation and interoperability of healthcare data. The integration of healthcare IT with national health insurance systems enhances administrative efficiency and patient care coordination. Increasing investments in telemedicine, mobile health applications, and AI-driven diagnostics are enabling healthcare providers to meet rising patient expectations for personalized, timely healthcare services.

Poland Healthcare Information Technology (IT) Market Insight

The Poland healthcare information technology (IT) market is emerging as the fastest-growing healthcare IT market within Eastern Europe, exhibiting robust expansion driven by extensive government initiatives and substantial EU funding dedicated to healthcare digitalization. The country is rapidly adopting electronic health records (EHRs), telemedicine platforms, and digital patient management systems to modernize its healthcare infrastructure and improve care delivery. Increasing investments in IT infrastructure, along with growing private healthcare services, are accelerating the penetration of advanced healthcare IT solutions across hospitals and clinics. In addition, Poland's focus on interoperability and compliance with European data protection regulations is fostering trust and adoption among healthcare providers.

Europe Healthcare Information Technology (IT) Market Share

The Europe healthcare information technology (IT) industry is primarily led by well-established companies, including:

- Oracle Health (U.S.)

- Epic Systems Corporation (U.S.)

- Allscripts Healthcare Solutions, Inc. (U.S.)

- McKesson Corporation (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- IBM Watson Health (U.S.)

- Oracle Corporation (U.S.)

- Meditech (U.S.)

- Athenahealth, Inc. (U.S.)

- NextGen Healthcare, Inc. (U.S.)

- Change Healthcare, Inc. (U.S.)

- Optum (U.S.)

- NVIDIA Corporation (U.S.)

- Philips Medical Systems Nederland B.V. (Netherlands)

- Cognizant Technology Solutions (U.S.)

- DXC Technology Company (U.S.)

- ZS Associates (U.S.)

- MEDHOST, Inc. (U.S.)

What are the Recent Developments in Europe Healthcare Information Technology (IT) Market?

- In August 2025, Philips announced a collaboration with Epic Systems to integrate its cardiac ambulatory monitoring and diagnostics services with Epic's Aura platform. This partnership aims to provide a comprehensive cardiac care portfolio, enhancing patient outcomes through seamless integration of health data and advanced diagnostics

- In February 2025, NHS England's Digital Health Hub launched its second cohort of innovators, supporting the development of digital health solutions. The program aims to accelerate the adoption of digital technologies in healthcare, focusing on improving patient care and operational efficiency. This initiative reflects the NHS's commitment to integrating digital innovations into the healthcare system

- In January 2025, a study highlighted the integration of Artificial Intelligence (AI) and Blockchain technologies to enhance data security and management in healthcare systems. The combination of AI's data processing capabilities and Blockchain's secure transaction methods aims to protect patient data and streamline healthcare operations. This integration is seen as a step forward in addressing data privacy concerns in the healthcare industry

- In March 2024, Oracle Health's electronic health record (EHR) system became fully operational across the acute care facilities of the North West London Integrated Care System (ICS). This implementation equips caregivers with real-time access to patient information, facilitating informed care decisions and improved care coordination. With the successful integration of Oracle Health's EHR, the 12 acute care facilities within the North West London ICS are unified under a single EHR domain, catering to a patient population of 2.4 million. This marks a significant step towards enhancing digital health infrastructure in the region

-

In March 2024, inHEART, a private medical device firm known for its cutting-edge, AI-driven digital twin technology for the heart, secured FDA 510(k) clearance for its AI software module. This pioneering AI module offers fully automated segmentation of CT images, facilitating the swift creation of 3D cardiac models. This enhancement empowers inHEART to provide its solutions to physicians more rapidly and efficiently, potentially improving patient outcomes through advanced cardiac imaging techniques

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.