Dexa Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

2.84 Billion

2024

2032

USD

2.00 Billion

USD

2.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 2.84 Billion | |

|

|

|

|

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Size

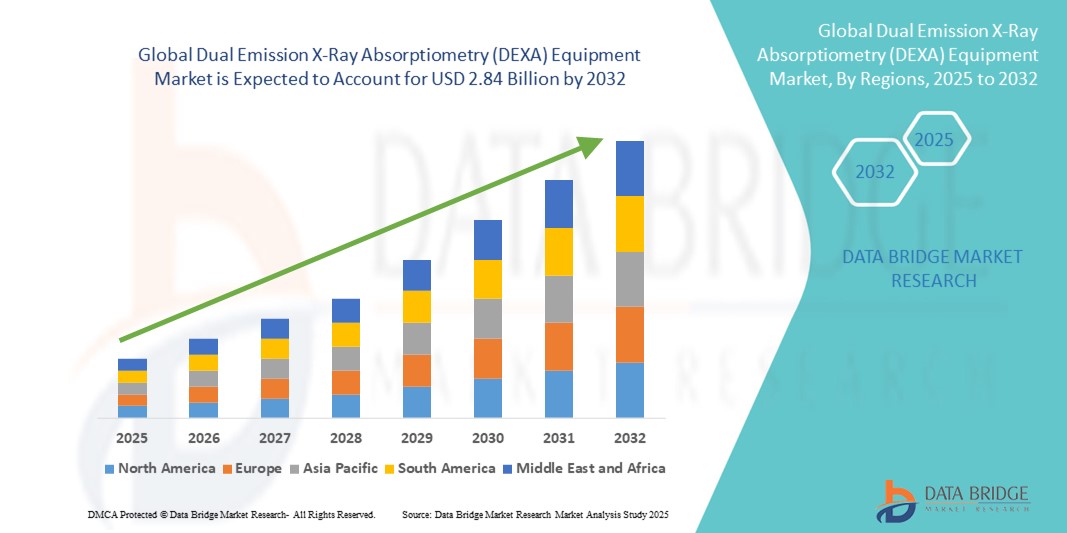

- The global dual emission X-Ray absorptiometry (DEXA) equipment market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 2.84 billion by 2032, at a CAGR of 4.5% during the forecast period

- The market growth is primarily driven by the rising prevalence of osteoporosis and other bone-related disorders, coupled with increasing awareness regarding early diagnosis and management through advanced imaging technologies

- In addition, technological advancements in DEXA devices, such as enhanced scanning speed and accuracy, along with growing adoption in hospitals, diagnostic centers, and research institutions, are fueling demand. These factors together are propelling the market expansion, positioning DEXA equipment as a critical tool for bone health assessment worldwide

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Analysis

- DEXA equipment, providing precise measurement of bone mineral density and body composition, is increasingly essential in diagnosing osteoporosis and other metabolic bone diseases across hospitals, diagnostic centers, and research facilities worldwide

- The rising incidence of osteoporosis, aging populations, and growing awareness about early bone health assessment are key factors driving the demand for DEXA equipment globally. In addition, continuous technological advancements improving scan accuracy and reducing radiation exposure contribute to market growth

- North America dominated the dual emission X-Ray absorptiometry (DEXA) equipment market with the largest revenue share of 39.2% in 2024, attributed to the region’s advanced healthcare infrastructure, early adoption of cutting-edge imaging technologies, and a high prevalence of bone-related disorders, especially in the U.S., supported by ongoing innovations from prominent medical device manufacturers

- Asia-Pacific is projected to be the fastest-growing region in the dual emission X-Ray absorptiometry (DEXA) equipment market during the forecast period, propelled by increasing healthcare expenditure, rising geriatric population, and expanding diagnostic capabilities in emerging economies such as China and India

- The central DEXA scanner segment dominated the dual emission X-Ray absorptiometry (DEXA) equipment market with a 46.1% share in 2024, favored for its comprehensive imaging capabilities and widespread use in clinical and research settings

Report Scope and Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Segmentation

|

Attributes |

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Trends

Advancements in Imaging Technology and AI-Driven Diagnostics

- A key trend in the global DEXA equipment market is the integration of artificial intelligence (AI) and advanced imaging technologies to enhance diagnostic accuracy and operational efficiency. AI-powered software now aids in precise bone density analysis and fracture risk prediction, improving clinical decision-making

- For instance, the Horizon DXA system incorporates AI algorithms to automate bone mineral density (BMD) measurements, reducing scan times and minimizing human error. Similarly, GE Healthcare’s Lunar iDXA utilizes enhanced software for detailed body composition analysis alongside bone health assessment

- AI integration allows for personalized patient assessments by learning from previous scans and medical histories, enabling more targeted osteoporosis management. In addition, these technologies support automated quality control, ensuring consistent and reproducible results

- The development of compact, portable DEXA devices compatible with cloud-based platforms is facilitating remote diagnostics and expanding access in smaller clinics and underserved regions

- This trend towards smarter, more precise, and connected diagnostic equipment is transforming clinical workflows and patient monitoring, with companies such as Hologic and Norland innovating AI-enhanced DEXA systems that streamline patient management and support telehealth initiatives

- The demand for AI-driven DEXA solutions is growing rapidly in hospitals, outpatient centers, and research institutions as healthcare providers prioritize early detection and management of bone-related diseases

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Dynamics

Driver

Increasing Prevalence of Osteoporosis and Aging Population

- The rising incidence of osteoporosis and other metabolic bone disorders, especially among aging populations worldwide, is a primary driver for the growing demand for DEXA equipment. Early diagnosis and monitoring using DEXA are critical for preventing fractures and improving patient outcomes

- For instance, in March 2024, Hologic announced an upgrade to its Horizon DXA system, enhancing scan speed and image clarity, aimed at improving osteoporosis screening efficiency in high-risk groups

- Healthcare providers are increasingly investing in DEXA systems as part of preventive care protocols, driven by government initiatives and reimbursement policies favoring early bone health assessment

- In addition, the increasing adoption of routine bone density testing in geriatrics and osteoporosis management programs is expanding the installed base of DEXA equipment globally

- Growing awareness and education campaigns about bone health by healthcare organizations and governments are encouraging more patients to seek DEXA screening, boosting demand

- The expanding use of DEXA technology beyond bone health, including body composition analysis for obesity management and athletic performance monitoring, is opening new clinical and research applications, further driving market growth

Restraint/Challenge

High Equipment Cost and Regulatory Compliance Barriers

- The relatively high acquisition and maintenance costs of advanced DEXA systems remain a significant restraint, especially for smaller healthcare facilities and clinics in developing regions. This limits the penetration of DEXA technology in price-sensitive markets

- For instance, the cost of upgrading to AI-enhanced systems can be prohibitive despite the long-term clinical benefits, delaying procurement decisions

- Furthermore, stringent regulatory requirements and lengthy approval processes for new DEXA devices and software updates pose challenges for manufacturers, impacting product launch timelines and increasing compliance costs

- Concerns regarding patient radiation exposure, although low with modern devices, also contribute to cautious adoption by some healthcare providers

- Addressing these challenges through cost optimization, flexible financing options, and streamlined regulatory pathways, alongside ongoing patient and clinician education on the benefits and safety of DEXA scanning, will be essential for sustained market growth

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Scope

The market is segmented on the basis of product type, application, and end users.

- By Product Type

On the basis of product type, the dual emission X-Ray absorptiometry (DEXA) equipment market is segmented into Central DEXA and Peripheral DEXA. The Central DEXA segment dominated the market with the largest revenue share of 46.1% in 2024, driven by its comprehensive imaging capabilities, higher accuracy, and widespread adoption in hospitals and research institutions for detailed bone densitometry and body composition analysis. Central DEXA systems are preferred for full-body scans and more precise fracture risk assessment, supporting critical clinical decisions in osteoporosis management.

The Peripheral DEXA segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for portable and cost-effective devices suitable for preliminary screening and remote or mobile health centers. Their compact size and ease of use make them popular in clinics and smaller healthcare settings, especially in emerging markets where access to large centralized systems is limited.

- By Application

On the basis of application, the dual emission X-Ray absorptiometry (DEXA) equipment market is segmented into body composition analysis, fracture diagnosis, bone densitometry, and fracture risk assessment. bone densitometry dominated the market with the largest revenue share in 2024, due to the high clinical importance of bone mineral density testing in diagnosing osteoporosis and monitoring treatment efficacy.

The Body Composition Analysis segment is expected to witness rapid growth during forecast period, owing to the rising interest in obesity management, sports medicine, and wellness programs that leverage DEXA’s ability to accurately measure fat, muscle, and bone mass distribution

- By End Users

On the basis of end users, the dual emission X-Ray absorptiometry (DEXA) equipment market is segmented into hospitals, clinics, mobile health centres, and others. Hospitals accounted for the largest market share in 2024, due to their advanced infrastructure and ability to support comprehensive diagnostic workflows requiring Central DEXA systems for a broad patient base.

Clinics are expected to register the fastest growth during the forecast period, as they increasingly adopt DEXA equipment for routine screenings and body composition analysis, driven by outpatient care trends and rising awareness of bone health.

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Regional Analysis

- North America dominated the dual emission X-Ray absorptiometry (DEXA) equipment market with the largest revenue share of 39.2% in 2024, attributed to the region’s advanced healthcare infrastructure, early adoption of cutting-edge imaging technologies, and a high prevalence of bone-related disorders, especially in the U.S., supported by ongoing innovations from prominent medical device manufacturers

- Healthcare providers and patients in the region increasingly prioritize accurate and early bone health assessment, supported by government initiatives and reimbursement policies promoting osteoporosis screening and preventive care

- This widespread adoption is further bolstered by substantial investment in healthcare R&D, availability of skilled professionals, and the presence of key market players developing cutting-edge DEXA systems, establishing the region as a leader in both clinical and research applications

U.S. Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Insight

The U.S. dual emission X-Ray absorptiometry (DEXA) equipment market captured the largest revenue share of 82% in 2024 within North America, driven by the country’s advanced healthcare system and growing emphasis on early diagnosis and prevention of osteoporosis and metabolic bone diseases. Increasing geriatric population, coupled with government initiatives supporting bone health screening, is accelerating demand. The integration of AI-powered imaging technologies and the availability of reimbursement policies further fuel market growth.

Europe DEXA Equipment Market Insight

The Europe dual emission X-Ray absorptiometry (DEXA) equipment market is projected to grow at a substantial CAGR throughout the forecast period, supported by rising osteoporosis prevalence and aging populations across the region. Strict healthcare regulations and growing investments in diagnostic infrastructure are key drivers. Increasing awareness campaigns and expanding use of DEXA for fracture risk assessment in clinical guidelines are encouraging adoption in both established hospitals and outpatient centers.

U.K. DEXA Equipment Market Insight

The U.K. dual emission X-Ray absorptiometry (DEXA) equipment market is expected to grow steadily, driven by increasing demand for bone health monitoring and preventive care. The government’s focus on reducing osteoporosis-related fractures and enhancing diagnostic access in community healthcare settings supports market expansion. The rising incidence of metabolic bone disorders and the integration of portable DEXA systems for outreach programs also contribute to growth.

Germany DEXA Equipment Market Insight

The Germany dual emission X-Ray absorptiometry (DEXA) equipment market is anticipated to expand at a notable CAGR during the forecast period, fueled by a well-developed healthcare ecosystem and strong research activities focused on bone and metabolic health. Growing patient awareness and the adoption of AI-enhanced DEXA technologies in diagnostic centers are accelerating market penetration. Sustainability initiatives and regulatory compliance further encourage the use of advanced imaging systems.

Asia-Pacific DEXA Equipment Market Insight

The Asia-Pacific dual emission X-Ray absorptiometry (DEXA) equipment market is poised to register the fastest CAGR of 22% from 2025 to 2032, driven by rising osteoporosis prevalence, increasing healthcare expenditure, and expanding diagnostic infrastructure in countries such as China, India, and Japan. Government health programs focusing on early bone disease detection and the growing geriatric population underpin demand. In addition, the increasing availability of affordable and portable DEXA devices is enabling wider adoption in rural and semi-urban areas.

Japan DEXA Equipment Market Insight

The Japan dual emission X-Ray absorptiometry (DEXA) equipment market is growing steadily due to the country’s aging population and high healthcare standards. The increasing focus on preventive healthcare and the integration of DEXA technology with other diagnostic modalities are driving demand. Japan’s emphasis on advanced medical technology adoption and public awareness about osteoporosis screening further support market growth.

India DEXA Equipment Market Insight

The India dual emission X-Ray absorptiometry (DEXA) equipment market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, growing middle-class population, and increasing awareness of bone health. Expanding healthcare infrastructure and government initiatives targeting osteoporosis management and preventive diagnostics are propelling market growth. The availability of cost-effective DEXA systems and rising private healthcare investments are further encouraging adoption across hospitals and diagnostic centers.

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Share

The dual emission X-Ray absorptiometry (DEXA) equipment industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- GE Healthcare (U.S.)

- Hitachi, Ltd. (Japan)

- Norland Medical Systems, Inc. (U.S.)

- Furuno Electric Co., Ltd. (Japan)

- OsteoSys Co., Ltd. (South Korea)

- DMS Imaging (France)

- Osteometer MediTech A/S (Denmark)

- Mindways Software, Inc. (U.S.)

- OsteoDiagnostic Technologies, Inc. (U.S.)

- OsteoCare Solutions, Inc. (U.S.)

- Stratec Medizintechnik GmbH (Germany)

- Siemens Healthineers AG (Germany)

- Shimadzu Corporation (Japan)

- PerkinElmer (U.S.)

- Quidel Corporation (U.S.)

- MEDILINK, Inc. (Japan)

- Biospace Co., Ltd. (South Korea)

- Rayence Co., Ltd. (South Korea)

- Toshiba Medical Systems Corporation (Japan)

What are the Recent Developments in Global Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market?

- In May 2025, The UK government announced it is rolling out 13 new DEXA scanners across England to improve bone health services. This investment, part of the government's "Plan for Change," aims to deliver an extra 29,000 bone scans per year, which will aid in the earlier diagnosis of conditions such as osteoporosis. The new scanners, described as "state-of-the-art," are equipped with advanced technology to identify bone quality in minute detail. The initiative is a direct action by a national government to increase the availability and use of DEXA equipment

- In March 2024, Hologic unveiled an upgraded Horizon DXA system with enhanced image clarity and faster scan times, designed to improve osteoporosis diagnosis efficiency and accuracy in clinical settings. The new version supports higher patient throughput while maintaining precision in bone mineral density measurement, addressing the growing demand for preventive bone health care worldwide

- In February 2024, Fujifilm India announced the installation of its FDX Visionary-DR, an advanced DEXA machine, at the Center for Sports Injury in Delhi. This new machine integrates "3D-DXA technology," which can generate 3D models of the femur from standard bone-mineral-density images. The machine also features a 2D Fan Beam for high-resolution imaging and fast, 15-second assessments. The move is part of Fujifilm's strategy to address the high prevalence of bone-related health issues in India, and to make advanced diagnostic capabilities more accessible to practitioners. This is a concrete, real-world action by a major company in the DEXA market

- In November 2023, GE Healthcare introduced an updated software suite for its Lunar iDXA system, adding advanced body composition analysis tools useful in sports medicine, nutrition, and clinical diagnostics. The upgrade expands the utility of DEXA scans beyond bone density to holistic health evaluations, reflecting evolving market needs

- In February 2022, Aurora Spine and Echolight Medical, a manufacturer of a radiation-free portable densitometer called EchoS, announced a joint co-marketing agreement. The partnership, known as the "Aurora DEXA Platform," involved the two companies promoting each other's products to their respective customer bases. This collaboration allowed Aurora Spine to integrate Echolight's bone health assessment technology with its DEXA Technology-based spinal implants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.