Asia Pacific Hla Typing Transplant Market

Market Size in USD Million

CAGR :

%

USD

193.85 Million

USD

369.57 Million

2025

2033

USD

193.85 Million

USD

369.57 Million

2025

2033

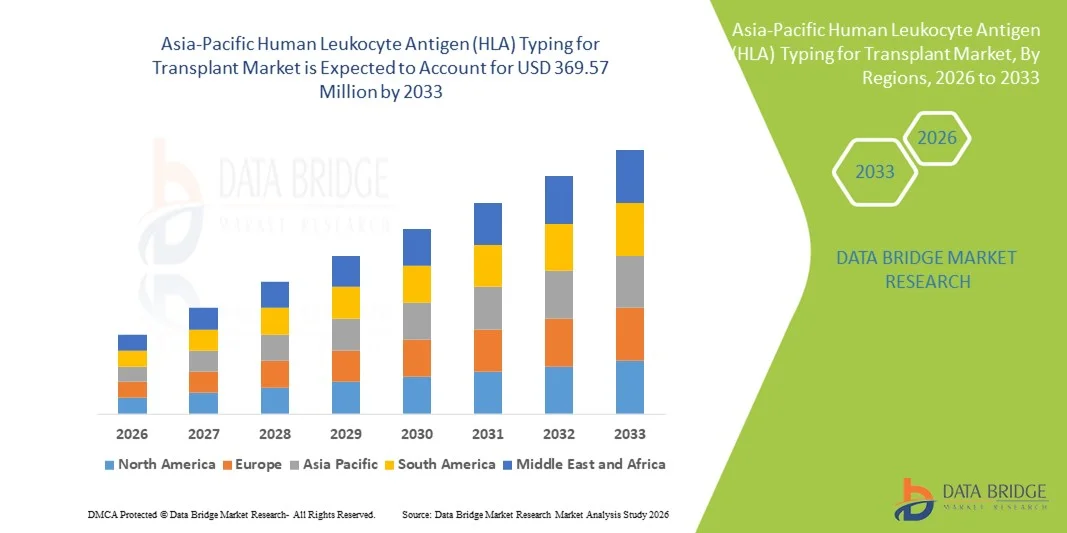

| 2026 –2033 | |

| USD 193.85 Million | |

| USD 369.57 Million | |

|

|

|

|

Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market Size

- The Asia-Pacific Human Leukocyte Antigen (HLA) typing for transplant market size was valued at USD 193.85 million in 2025 and is expected to reach USD 369.57 million by 2033, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by increasing organ transplant procedures, rising prevalence of chronic diseases, and advancements in molecular diagnostics and immunogenetics, driving the adoption of precise HLA typing techniques across the region

- Furthermore, growing awareness among healthcare providers and patients about transplant compatibility, coupled with supportive government initiatives and funding for transplant programs, is positioning HLA typing as a critical tool in successful transplantation. These factors are collectively propelling the adoption of HLA typing solutions, thereby significantly boosting the market's growth

Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market Analysis

- HLA typing, providing precise genetic matching for organ and stem cell transplantation, is becoming an essential component of transplant protocols in both clinical and research settings due to its ability to reduce graft rejection, improve patient outcomes, and enable personalized immunogenetic analysis

- The rising demand for HLA typing is primarily fueled by increasing organ transplant procedures, growing prevalence of chronic and genetic disorders, and the adoption of advanced molecular diagnostic technologies for accurate donor-recipient matching

- Japan dominated the Asia-Pacific HLA typing market with the largest revenue share of 28.5% in 2025, supported by advanced healthcare infrastructure, high transplant volumes, and the presence of leading diagnostic companies offering automated and next-generation sequencing solutions

- China is expected to be the fastest growing country in the Asia-Pacific HLA typing market during the forecast period driven by expanding transplant programs, increasing healthcare expenditure, and rising awareness about transplant compatibility and immunogenetic testing

- Reagents and consumables segment dominated the Asia-Pacific HLA typing market with a significant share of 49.2% in 2025, driven by their essential role in PCR-based and sequencing-based HLA typing workflows and the recurring demand from clinical and research laboratories

Report Scope and Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market Segmentation

|

Attributes |

Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market Trends

Enhanced Precision Through NGS and AI Integration

- A significant and accelerating trend in the Asia-Pacific HLA typing market is the integration of next-generation sequencing (NGS) with AI-driven data analysis, significantly enhancing accuracy and reducing turnaround time for donor-recipient matching

- For instance, AI-powered HLA typing platforms in Japan can automatically analyze complex sequencing data and generate high-resolution HLA match reports, reducing manual interpretation errors and improving transplant outcomes

- AI integration enables predictive analytics for transplant compatibility, such as identifying potential graft rejection risks and suggesting optimized donor selection, while machine learning algorithms can improve accuracy in complex HLA loci interpretation over time

- The seamless integration of NGS and AI allows centralized laboratory management of HLA typing workflows, facilitating efficient handling of multiple samples and reporting, which accelerates decision-making in transplant programs

- This trend towards more intelligent, high-throughput, and precise HLA typing is reshaping expectations for transplant diagnostics. Consequently, companies such as BGI and Fujirebio are developing AI-enabled solutions for automated high-resolution typing with rapid reporting

- The demand for HLA typing solutions that combine AI and advanced sequencing is growing rapidly across clinical and research laboratories, as healthcare providers increasingly prioritize precision, efficiency, and reduced risk of graft failure

- Continuous improvements in bioinformatics software for HLA typing allow faster analysis of complex donor-recipient compatibility, reducing errors and optimizing patient outcomes

Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market Dynamics

Driver

Rising Organ Transplants and Demand for Accurate Matching

- The increasing number of organ and stem cell transplant procedures across Asia-Pacific, coupled with the growing need for accurate donor-recipient matching, is a significant driver of HLA typing adoption

- For instance, in March 2025, Fujirebio launched a high-throughput HLA typing platform in China to support expanding kidney and bone marrow transplant programs, improving workflow efficiency and match precision

- As awareness of transplant compatibility grows, HLA typing offers advanced features such as high-resolution allelic typing, automated reporting, and reduced turnaround time, providing a crucial upgrade over conventional serological methods

- Furthermore, the expansion of transplant centers and supportive government initiatives promoting organ donation are making HLA typing an essential diagnostic tool across clinical laboratories

- The ability to efficiently match donors and recipients, reduce graft rejection risk, and support personalized transplant protocols are key factors propelling adoption in hospitals and private diagnostic labs, while rising healthcare investments further contribute to market growth

- Strategic partnerships between HLA typing solution providers and hospitals or blood banks are expanding access to testing services, particularly in emerging Asia-Pacific market

- Growing research in immunogenetics and personalized medicine is driving increased demand for high-resolution HLA typing, as clinicians seek to optimize transplant success rates and reduce complications

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced HLA typing platforms, including NGS-based solutions, poses a challenge for widespread adoption in smaller clinics and developing countries

- For instance, the implementation of high-resolution HLA typing in India and Southeast Asia can be limited due to budget constraints and the need for specialized equipment and trained personnel

- Regulatory requirements for clinical diagnostics, including validation, accreditation, and compliance with local health authorities, can slow the deployment of new HLA typing technologies in some Asia-Pacific countries

- Addressing these challenges through affordable reagent kits, streamlined workflows, and adherence to regional regulatory standards is crucial for building trust and facilitating adoption

- While costs are gradually decreasing and government support is increasing, the perceived premium of advanced HLA typing solutions can still hinder uptake, particularly for smaller healthcare facilities without high transplant volumes

- Overcoming these barriers through cost optimization, regulatory compliance, and training programs for laboratory staff will be vital for sustained growth of the HLA typing market across Asia-Pacific

- Limited awareness among patients and some healthcare providers regarding the importance of high-resolution HLA typing can slow adoption, particularly in rural or under-resourced regions

- Variability in reimbursement policies for HLA typing across different countries in Asia-Pacific adds complexity for laboratories and hospitals, restricting broader implementation of advanced typing solutions

Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market Scope

The market is segmented on the basis of products and services, technology, transplant type, application, and end user.

- By Products and Services

On the basis of products and services, the market is segmented into reagents and consumables, instruments, and software and services. The reagents and consumables segment dominated the market with the largest revenue share of 49.2% in 2025, driven by their essential role in PCR-based and sequencing-based HLA typing workflows. Laboratories require a constant supply of reagents for high-resolution typing, making this segment highly recurring in demand. Reagents and consumables are integral to both clinical diagnostics and research applications, providing accurate and reproducible results. The segment benefits from technological advancements, such as multiplex PCR kits and NGS-compatible consumables, which improve workflow efficiency and typing precision. In addition, the adoption of automated HLA typing platforms further increases the consumption of reagents, as large-volume testing becomes standard. Cost-effectiveness and reliability of commercially available reagents also contribute to their dominant market position.

The software and services segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of AI-based analysis platforms, cloud-based data management, and bioinformatics solutions for HLA typing. Software solutions enhance data interpretation accuracy and enable high-throughput laboratories to manage complex datasets efficiently. Integration with electronic health records and transplant registries further drives the need for advanced software. Demand is particularly high in hospitals, transplant centers, and reference laboratories seeking automated reporting and analytics tools. The growth is also supported by expanding research applications in immunogenetics and personalized medicine. The recurring nature of software subscriptions and service contracts ensures a steady revenue stream, contributing to rapid segment growth.

- By Technology

On the basis of technology, the market is segmented into sequencing-based molecular assays, molecular assay technologies, and non-molecular assay technologies. The molecular assay technologies segment dominated the market in 2025 due to its widespread use in routine HLA typing. Techniques such as PCR-SSP, PCR-SSO, and real-time PCR are widely adopted for their high accuracy, reproducibility, and relatively low cost. These technologies are standard in clinical laboratories and transplant centers, supporting both solid organ and hematopoietic stem cell transplants. Established workflows, availability of standardized kits, and trained personnel contribute to this segment’s dominance. Molecular assays provide faster results than serological methods, which is critical for urgent transplant decision-making. They also allow medium- to high-resolution typing necessary for improved transplant outcomes. The reliability of molecular assays in diverse sample types, including blood and tissue, ensures continued strong adoption.

The sequencing-based molecular assays segment is expected to witness the fastest CAGR from 2026 to 2033 due to the rising adoption of next-generation sequencing (NGS) platforms. NGS enables high-resolution HLA typing across multiple loci simultaneously, providing comprehensive donor-recipient matching. AI-driven data analysis and bioinformatics integration further enhance sequencing efficiency and accuracy. The growth is supported by increasing organ and stem cell transplants, rising demand for precise immunogenetic profiling, and research applications in personalized medicine. Sequencing-based assays are particularly attractive for large laboratories and transplant centers looking to minimize typing errors and improve graft survival rates. Decreasing costs of NGS and improvements in workflow automation further accelerate market adoption.

- By Transplant Type

On the basis of transplant type, the market is segmented into solid organ transplant and hematopoietic stem cell transplant. The solid organ transplant segment dominated the market in 2025, driven by the higher number of kidney, liver, and heart transplants performed across Asia-Pacific. Accurate HLA typing is crucial in solid organ transplants to minimize graft rejection and improve post-transplant survival. Government-supported organ donation programs and increasing awareness of transplant compatibility further support the demand. Hospitals and transplant centers prefer high-throughput molecular assays for rapid and precise donor-recipient matching. The dominance is also reinforced by established protocols that require mandatory HLA testing before transplantation. Recurrent testing for living donors, paired kidney exchanges, and pre-transplant crossmatching further increase market consumption.

The hematopoietic stem cell transplant segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising bone marrow and stem cell transplant procedures in countries such as China, India, and Japan. High-resolution HLA typing is essential to ensure compatibility and reduce graft-versus-host disease (GvHD) in stem cell transplants. Expanding research in immunogenetics and personalized stem cell therapies is also driving adoption. Increasing collaborations between stem cell banks and diagnostic laboratories boost demand for high-throughput and automated typing solutions. The growth is further supported by technological advancements in sequencing-based assays that allow rapid identification of rare alleles critical for stem cell matching.

- By Application

On the basis of application, the market is segmented into diagnostic applications and research applications. The diagnostic applications segment dominated the market in 2025, driven by its use in routine donor-recipient matching for organ and stem cell transplantation. Hospitals and transplant centers rely on high-resolution HLA typing to prevent graft rejection and improve patient outcomes. The segment benefits from standardized laboratory workflows, automated platforms, and a recurring need for testing as transplant programs expand. Government initiatives promoting transplantation and the growing number of transplant centers across Asia-Pacific contribute to its dominance. Diagnostic applications also include pre-transplant crossmatching and post-transplant monitoring, increasing the frequency of tests. The widespread adoption of molecular assays ensures continued strong demand.

The research applications segment is expected to witness the fastest growth from 2026 to 2033 due to rising immunogenetics studies, personalized medicine research, and HLA-related disease investigations. Academic institutes and biotechnology companies increasingly leverage HLA typing for population genetics studies, vaccine development, and autoimmune disease research. Sequencing-based assays and AI-driven bioinformatics solutions enable high-throughput, precise data generation for complex research projects. Expanding collaborations between research institutions and diagnostic labs further enhance adoption. The segment’s growth is accelerated by government and private funding in immunogenetics research.

- By End User

On the basis of end user, the market is segmented into independent reference laboratories, hospitals and transplant centers, and research laboratories and academic institutes. The hospitals and transplant centers segment dominated the market in 2025, due to the high volume of transplants requiring accurate HLA typing. Hospitals rely on in-house or partner laboratories for rapid and precise donor-recipient matching to ensure optimal transplant outcomes. Government-supported transplant programs and increasing organ donation awareness further drive demand. The segment benefits from automated molecular assay adoption and integration with electronic health records for streamlined reporting. Recurrent testing for living donors, pre-transplant crossmatching, and follow-up monitoring increase market consumption. Strong partnerships with HLA typing solution providers reinforce the segment’s dominance.

The independent reference laboratories segment is expected to witness the fastest growth from 2026 to 2033, fueled by outsourcing of HLA typing services by hospitals and clinics seeking cost-effective, high-throughput solutions. Reference labs leverage sequencing-based assays and AI-enabled software to provide accurate, high-resolution typing across large sample volumes. The growth is further supported by the increasing number of transplant procedures and the rising demand for specialized immunogenetic testing in emerging countries. Expansion of laboratory networks and partnerships with hospitals accelerate adoption. Reference labs also benefit from recurring demand for reagents, consumables, and data analysis services.

Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market Regional Analysis

- Japan dominated the Asia-Pacific HLA typing market with the largest revenue share of 28.5% in 2025, supported by advanced healthcare infrastructure, high transplant volumes, and the presence of leading diagnostic companies offering automated and next-generation sequencing solutions

- Hospitals and transplant centers in the country highly value the accuracy, speed, and reliability offered by modern HLA typing technologies, which reduce graft rejection and improve post-transplant outcomes

- This widespread adoption is further supported by well-established organ transplant programs, government support for transplant initiatives, and increasing investments in molecular diagnostics, positioning Japan as a key market in the region

The Japan Human Leukocyte Antigen (HLA) Typing for Transplant Market Insight

The Japan Human Leukocyte Antigen (HLA) Typing for Transplant market is gaining momentum due to the country’s advanced healthcare infrastructure, high transplant volumes, and early adoption of automated and sequencing-based HLA typing technologies. Japanese hospitals and transplant centers prioritize high-resolution typing to reduce graft rejection and improve patient outcomes. Integration of AI-driven analysis and automated reporting systems is enhancing laboratory efficiency. Moreover, government support for organ and stem cell transplant programs, combined with increasing investments in precision medicine, is driving demand for HLA typing across both clinical and research applications.

China Human Leukocyte Antigen (HLA) Typing for Transplant Market Insight

The China Human Leukocyte Antigen (HLA) Typing for Transplant market is expected to expand at the fastest CAGR during the forecast period, driven by growing transplant volumes, rising awareness about transplant compatibility, and adoption of advanced molecular diagnostic technologies. Hospitals, transplant centers, and reference laboratories increasingly rely on sequencing-based assays and AI-enabled software for accurate donor-recipient matching. Expansion of stem cell banks, government-supported transplant programs, and partnerships with diagnostic solution providers further accelerate growth. Rapid urbanization and increasing healthcare spending are also boosting the accessibility and adoption of HLA typing solutions across the country.

India Human Leukocyte Antigen (HLA) Typing for Transplant Market Insight

The India Human Leukocyte Antigen (HLA) Typing for Transplant market accounted for a significant market share in Asia-Pacific in 2025, attributed to the increasing number of organ and stem cell transplants, rising investments in healthcare infrastructure, and growing adoption of molecular diagnostic technologies. Independent laboratories and hospitals are increasingly implementing high-resolution HLA typing to ensure better transplant outcomes. Government initiatives promoting organ donation, combined with awareness programs and collaborations between hospitals and diagnostic service providers, are driving market expansion. In addition, cost-effective HLA typing kits and AI-assisted software solutions are enhancing accessibility for smaller clinics and research institutes.

South Korea Human Leukocyte Antigen (HLA) Typing for Transplant Market Insight

The South Korea Human Leukocyte Antigen (HLA) Typing for Transplant market is witnessing steady growth due to the country’s advanced healthcare system, rising organ transplant procedures, and growing adoption of molecular and sequencing-based HLA typing technologies. Hospitals and transplant centers are increasingly investing in high-resolution HLA typing to improve graft survival and patient outcomes. The market is also supported by strong government initiatives promoting organ donation and transplant safety. Integration of AI-driven platforms for faster and more precise typing, alongside collaborations between diagnostic companies and hospitals, is accelerating adoption. The focus on research and precision medicine further drives demand for HLA typing in both clinical and academic settings

Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market Share

The Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Netherlands)

- Illumina, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- BD (U.S.)

- Luminex Corporation (U.S.)

- CareDx, Inc. (U.S.)

- Immucor, Inc. (U.S.)

- BAG Diagnostics GmbH (Germany)

- inno-train Diagnostik GmbH (Germany)

- CeGaT GmbH (Germany)

- Bionobis (France)

- ProImmune Ltd (U.K.)

- Eurofins Scientific SE (Luxembourg)

- HistoGenetics, Inc. (U.S.)

- Immudex (Denmark)

- GenDx (Netherlands)

- DiaSorin S.p.A. (Italy)

- Omixon Biocomputing Ltd (Hungary)

What are the Recent Developments in Asia-Pacific Human Leukocyte Antigen (HLA) Typing for Transplant Market?

- In October 2025, CareDx announced new IVD products and IVDR certification for its advanced HLA typing platforms, including AlloSeq Tx11, which features expanded Class II coverage and incorporates additional biomarkers to enhance donor‑recipient compatibility profiling for both solid organ and stem cell transplants globally with implications for Asia‑Pacific implementation

- In August 2025, experts highlighted a critical need for local HLA matching and cross‑matching facilities in Bhopal, India, due to a rise in kidney transplant procedures and logistical delays when compatibility testing is done in distant labs. AIIMS‑Bhopal proposed establishing an HLA and crossmatching laboratory to improve turnaround times and transplant success in the region

- In August 2025, a Journal of Global Health article underscored that HLA‑B*58:01 screening (associated with severe reactions to certain drugs) is becoming recognized as a clinical and ethical imperative across several Asia‑Pacific healthcare systems, prompting discussions about integrating broader HLA screening frameworks in public health programs

- In March 2025, Thermo Fisher Scientific launched its One Lambda™ HybriType™ HLA Plus Typing Flex kit in the Asia‑Pacific region, offering enhanced hybrid capture NGS technology designed to improve read balance and typing accuracy for transplant immunogenetics research and donor‑recipient matching. This development supports faster, more reliable high‑resolution HLA typing workflows

- In February 2025, the Asia‑Pacific Histocompatibility and Immunogenetics Association (APHIA) Annual Scientific Meeting 2025 was held from 5–7 February 2025 in Bangkok, Thailand, bringing together leading experts in histocompatibility, immunogenetics, and transplant diagnostics. The conference featured plenary sessions and workshops focused on advances in HLA genomics and clinical relevance in organ and bone marrow transplantation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.