Asia Pacific Glucose Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.05 Billion

USD

7.06 Billion

2024

2032

USD

4.05 Billion

USD

7.06 Billion

2024

2032

| 2025 –2032 | |

| USD 4.05 Billion | |

| USD 7.06 Billion | |

|

|

|

|

Asia- Pacific Glucose Monitoring Devices Market Size

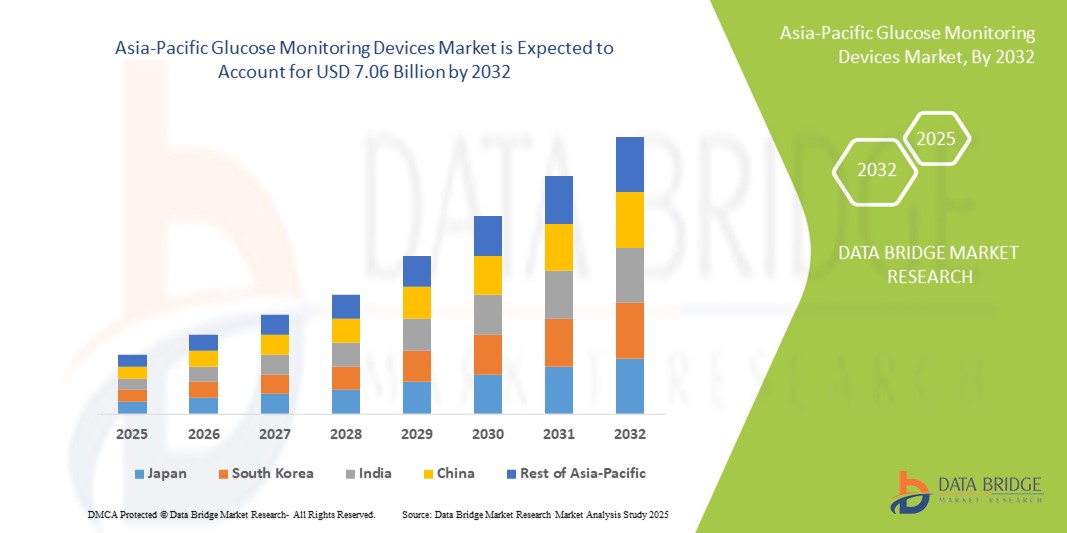

- The Asia- Pacific Glucose Monitoring Devices Market was valued at USD 4.05 Billion in 2024 and is expected to reach USD 7.06 Billion by 2032, at a CAGR of 7.2% during the forecast period.

- This growth is driven by factors such as increasing prevalence of diabetes, rising health awareness, and the growing adoption of digital and wearable health technologies.

Asia- Pacific Glucose Monitoring Devices Market Analysis

- Glucose monitoring devices play a critical role in diabetes management by enabling continuous or point-in-time monitoring of blood glucose levels. These devices are essential for early detection, glycemic control, and prevention of diabetes-related complications. They are widely used in hospitals, home care settings, and increasingly by individuals through self-monitoring systems.

- The demand for glucose monitoring devices in Asia-Pacific is significantly driven by the rising incidence of diabetes, fueled by urbanization, sedentary lifestyles, and aging populations. Technological advancements such as continuous glucose monitoring (CGM) systems and integration with mobile health applications are also contributing to the shift toward proactive and personalized diabetes management.

- China is expected to be the fastest-growing region with a share of 36.4% in the Asia-pacific glucose monitoring devices market during the forecast period. This growth is supported by rapid healthcare infrastructure development, increasing affordability of advanced diagnostic tools, government initiatives for diabetes awareness and screening, and a large undiagnosed diabetic population in countries such as India and China.

- The continuous glucose monitoring (CGM) segment of 34.5% is expected to be the highest-growing segment in the Asia-Pacific glucose monitoring devices market. This is due to its ability to provide real-time data, reduce the frequency of finger pricks, and improve glycemic control. CGM adoption is accelerating, particularly in urban centers, due to its advantages in diabetes management and rising physician and patient awareness.

- China and India are expected to lead regional growth due to their large diabetic populations and increasing investments in healthcare technology. Japan, South Korea, and Australia also contribute significantly due to high health consciousness, early adoption of medical technologies, and well-established healthcare systems.

Report Scope Glucose Monitoring Devices Market Segmentation

|

Attributes |

Glucose Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glucose Monitoring Devices Market Trends

“Rising Awareness and Adoption of Diabetes Management Technologies”

- One prominent trend in the Asia-Pacific glucose monitoring devices market is the increasing awareness of diabetes and the importance of regular blood glucose monitoring.

- The growing prevalence of diabetes across Asia-Pacific—especially in countries like China, India, and Indonesia—has led to heightened public health campaigns, government initiatives, and educational programs focused on early detection and management of the disease.

- For instance, public and private healthcare facilities across the region are expanding access to advanced technologies such as Continuous Glucose Monitoring (CGM) systems and flash glucose monitoring devices, which offer real-time, minimally invasive monitoring and help patients maintain better glycemic control.

- This trend is significantly reshaping diabetes care in Asia-Pacific, supporting a transition from reactive treatment to proactive management, reducing the risk of complications, and promoting improved quality of life for diabetic patients.

- The Asia-Pacific Glucose Monitoring Devices market is poised for robust growth, driven by increasing diabetes awareness, expanding healthcare access, and rising adoption of digital health and wearable technologies. As the region continues to invest in smart healthcare infrastructure, advanced glucose monitoring solutions will play a vital role in effective, patient-centered diabetes management.

Glucose Monitoring Devices Market Dynamics

Driver

“Growing Technological Advancements”

- The increasing pace of technological advancements in glucose monitoring devices is significantly driving the demand for smarter, more efficient diabetes management tools across the Asia-Pacific region.

- Innovations such as Continuous Glucose Monitoring (CGM) systems, flash glucose monitors, and integrated digital platforms are reshaping diabetes care by offering real-time data, improved accuracy, and minimal invasiveness compared to traditional finger-prick testing.

- These advancements are enabling better glycemic control, early detection of glucose fluctuations, and personalized treatment plans. As a result, patients are experiencing fewer complications, improved quality of life, and greater independence in managing their condition.

- In addition, next-generation wearable sensors, mobile health applications, and Bluetooth-enabled devices allow seamless data sharing with healthcare providers and caregivers, improving clinical decision-making and remote monitoring capabilities.

- For instance, companies like i-SENS (South Korea) and Arkray (Japan) are introducing compact, user-friendly glucose meters and CGM devices with high precision and mobile integration features, enhancing accessibility and usability across a wider patient base.

- The demand for such advanced solutions is further accelerated by growing smartphone penetration, government-led digital health initiatives, and the rising acceptance of telehealth in countries like India, China, and Southeast Asian nations.

- As Asia-Pacific healthcare systems continue to modernize, technological advancements will remain a key driver, supporting the transition toward patient-centric, proactive, and data-driven diabetes care. The market is expected to witness strong growth as adoption of innovative, connected glucose monitoring solutions becomes more widespread.

Opportunity

“High Strategic Partnerships”

- The rising prevalence of diabetes across the Asia-Pacific region has intensified the need for innovative, scalable, and affordable glucose monitoring solutions. Strategic partnerships between asia-Pacific medical device manufacturers, local healthcare providers, and technology firms are playing a vital role in expanding access to advanced monitoring technologies.

- These collaborations are driving the development of more integrated, user-friendly, and data-driven glucose monitoring systems, such as continuous glucose monitoring (CGM) devices and smart glucometers. The synergy between technical innovation and clinical application is helping to address unique regional challenges, including affordability, infrastructure limitations, and patient education.

- Strategic alliances also support localization of products, regulatory approvals, and the deployment of digital diabetes management platforms across urban and rural areas.

- For instance, in India, Medtronic has partnered with various hospitals and telehealth providers to scale the use of its Guardian Connect CGM system, while Chinese manufacturers like Sinocare have formed partnerships with local distributors to expand their reach across emerging markets in Southeast Asia.

- As healthcare systems in Asia-Pacific focus on digitization and patient-centric care, strategic partnerships enable quicker innovation cycles, wider market penetration, and enhanced care delivery.

- The surge in such alliances is expected to create a robust ecosystem for the glucose monitoring devices market, unlocking growth opportunities through improved access, affordability, and patient outcomes across diverse populations.

Restraint/Challenge

“High Costs and Regulatory Hurdles”

- The high costs associated with advanced glucose monitoring devices, such as continuous glucose monitoring (CGM) systems and smart insulin-integrated technologies, present a significant challenge in the Asia-Pacific region. These devices often require substantial investment, limiting their accessibility in price-sensitive and underserved markets across developing nations.

- Smaller healthcare facilities, rural clinics, and budget-constrained public health programs may struggle to adopt cutting-edge glucose monitoring solutions, slowing market penetration and limiting widespread adoption across diverse patient populations.

- Additionally, the complex and often fragmented regulatory landscape across Asia-Pacific countries, including varying approval requirements and compliance protocols, creates hurdles for device manufacturers. Delays in regulatory approvals and difficulties in harmonizing standards across multiple countries can increase the time-to-market for new product.

- For instance, in Southeast Asia, several manufacturers face prolonged timelines for device registration and reimbursement approvals due to inconsistent regulations and lack of mutual recognition frameworks across countries like Indonesia, Vietnam, and the Philippines.

- Furthermore, out-of-pocket payment models prevalent in many parts of Asia further intensify the affordability issue for patients, especially for long-term use of CGMs or real-time monitoring tools.

- As a result, both high costs and regulatory complexities are major constraints that may impede the equitable expansion of the glucose monitoring devices market in Asia-Pacific, particularly in low- and middle-income regions. Overcoming these challenges will require policy alignment, increased healthcare funding, and innovation in cost-effective monitoring solutions.

Glucose Monitoring Devices Market Scope

The market is segmented on the basis, product, Ergonomics, type, Application, technique, distribution channel and end user.

|

Segmentation |

Sub-Segmentation |

|

Product |

|

|

Ergonomics |

|

|

Type |

|

|

Application |

|

|

Technique |

|

|

Distribution Channel |

|

|

End-User |

|

In 2025, the Continuous Glucose Monitoring (CGM) is projected to dominate the market with a largest share in product segment

The Continuous Glucose Monitoring (CGM) segment is expected to dominate the Glucose Monitoring Devices market with the largest share of 38.14% in 2025 due to its growing adoption among diabetic patients and increasing preference for real-time glucose tracking. CGM systems offer significant clinical benefits, including continuous insights into glucose fluctuations, trend analysis, and the ability to detect hypoglycemia or hyperglycemia before symptoms appear. Despite the availability of traditional blood glucose monitoring systems (SMBG), CGM is increasingly becoming the standard of care, particularly in countries like Japan, China, and India, where the diabetes burden is high. CGM devices are favored for their ability to provide a more comprehensive glycemic profile, aiding better treatment decisions and improving long-term outcomes.

The Diabetes Type 2 is expected to account for the largest share during the forecast period in application market

In 2025, the Diabetes Type 2 segment is expected to dominate the Glucose Monitoring Devices market with the largest market share of 45.22% is primarily driven by the high and rising prevalence of type 2 diabetes across the region, particularly in populous countries such as China, India, and Indonesia. Lifestyle changes, including sedentary behavior, unhealthy diets, and increasing obesity rates, are contributing significantly to the growing burden of type 2 diabetes. Glucose monitoring devices, especially continuous glucose monitoring (CGM) and self-monitoring blood glucose (SMBG) systems, are widely adopted among type 2 diabetes patients for maintaining glycemic control and preventing complications. Technological advancements and the availability of affordable and user-friendly devices are further encouraging routine use among patients and caregivers.

Glucose Monitoring Devices Market Regional Analysis

“China is the Dominant Country in the Glucose Monitoring Devices Market”

- China is expected to lead the Asia-Pacific glucose monitoring devices market, accounting for the largest regional share due to its massive diabetic population, rapid urbanization, and growing healthcare investment. With over 140 million adults living with diabetes, China represents one of the world's largest markets for glucose monitoring technologies.

- The Chinese government's heightened focus on chronic disease management, coupled with nationwide screening and awareness campaigns, is significantly boosting the adoption of glucose monitoring devices—especially continuous glucose monitoring (CGM) and self-monitoring blood glucose (SMBG) systems.

- The market is further supported by strong local manufacturing capabilities, growing health tech startups, and increasing private-public partnerships aimed at improving diabetes care and accessibility to monitoring technologies in both urban and rural areas.

- In recent years, China has also witnessed a surge in the use of mobile health applications and wearable glucose monitors, aligning with the country's push toward digital health integration and smart chronic disease management systems. Domestic companies like Sinocare and Yuwell are expanding their portfolios and affordability of glucose monitors, while asia-Pacific players such as Abbott, Roche, and Dexcom are strengthening their market presence through regulatory approvals and local partnerships.

- Additionally, favorable government reforms such as inclusion of CGM devices under provincial medical insurance schemes and a fast-track regulatory pathway for innovative medical devices are accelerating product launches and market expansionmarket

“China is Projected to Register the Highest Growth Rate”

- India is expected to experience substantial growth in the Asia-Pacific Glucose Monitoring Devices market, driven by a rapidly increasing diabetic population, rising healthcare awareness, and expanding access to advanced medical technologies across urban and rural areas.

- The government’s initiatives such as the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS), along with rising investments in healthcare infrastructure, are fueling demand for efficient glucose monitoring solutions.

- Increasing affordability of glucose monitoring devices, coupled with expanding distribution networks and growing penetration of digital health platforms, is enhancing access to self-monitoring and continuous glucose monitoring technologies across the country.

- Private sector participation and the rise of telemedicine services are further facilitating remote glucose monitoring, especially in underserved and remote regions, enabling better disease management and patient compliance.

- India’s healthcare market is also witnessing increased adoption of innovative glucose monitoring devices integrated with mobile health apps, which cater to tech-savvy younger populations and chronic disease patients seeking real-time health data.

- These factors collectively position India as a key growth market within the Asia-Pacific region, with the potential for rapid expansion driven by demographic trends, government support, and technological advancements in diabetes care

Glucose Monitoring Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Terumo Corporation (Japan)

- Arkray, Inc. (Japan)

- Nipro Corporation (Japan)

- Ypsomed Asia Pte Ltd (Singapore)

- Suzuken Co., Ltd. (Japan)

- Bionime Corporation (Taiwan)

- i-SENS, Inc. (South Korea)

- All Medicus Co., Ltd. (South Korea)

- ARKRAY Healthcare Pvt. Ltd. (India)

Latest Developments in Asia- Pacific Glucose Monitoring Devices Market

- In March 2025, Abbott Laboratories launched the next-generation FreeStyle Libre 3 continuous glucose monitoring system across key Asia-Pacific markets, offering enhanced accuracy, real-time glucose data, and improved user convenience. This launch is expected to accelerate the adoption of continuous glucose monitoring (CGM) devices in the region, especially among patients seeking non-invasive, easy-to-use diabetes management solutions.

- In January 2025, Medtronic announced a strategic partnership with a leading Indian healthcare provider to expand access to its Guardian Connect CGM system. The collaboration aims to integrate Medtronic’s advanced glucose monitoring technology with telemedicine platforms, improving remote diabetes care and monitoring capabilities across urban and rural India.

- In October 2024, Dexcom expanded its presence in China by launching its G7 CGM system, featuring a smaller sensor and longer wear time. The product launch aligns with China’s growing focus on digital health innovation and government support for chronic disease management, which is expected to significantly boost demand for advanced glucose monitoring devices.

- In September 2024, Roche Diagnostics introduced its Accu-Chek Solo micropump and glucose monitoring integration in several Asia-Pacific countries, emphasizing seamless connectivity and ease of use. This development caters to the rising need for integrated diabetes management systems, fostering better glycemic control and patient adherence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.