Apac X Ray Detectors Market

Market Size in USD Million

CAGR :

%

USD

705.24 Million

USD

1,304.38 Million

2022

2030

USD

705.24 Million

USD

1,304.38 Million

2022

2030

| 2023 –2030 | |

| USD 705.24 Million | |

| USD 1,304.38 Million | |

|

|

|

|

Asia-Pacific X-Ray Detector Market Analysis and Size

China has the region's largest market for X-ray detectors. Furthermore, it has become a major investment destination for well-known corporations. Aside from that, estimates indicate that the country's elderly population will more than double by 2035, accounting for approximately 28.5% of the total population. The government has been forced to build public hospitals because of the increase in the geriatric population. Aside from that, the government is enacting new policies to improve healthcare infrastructure. The Health China 2030 plan, for example, is a set of guidelines for expanding services by 2030. Such initiatives to improve healthcare standards are supplementing X-ray detector market growth.

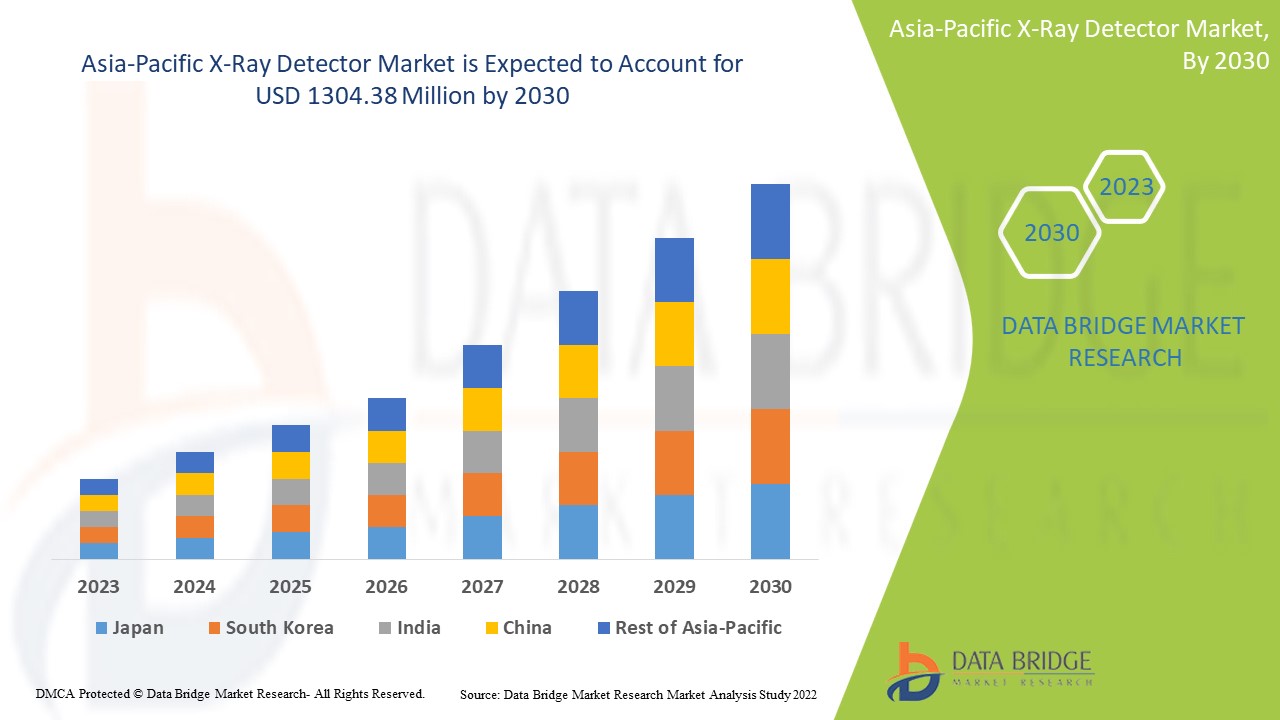

Data Bridge Market Research analyses that the X-ray detector market which was USD 705.24 million in 2022, is expected to reach USD 1304.38 million by 2030, at a CAGR of 7.99% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Asia-Pacific X-Ray Detector Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Flat Panel Detector, Computed Radiography Detectors, Line Scan Detectors, Charged Coupled Device (CCD) Detectors, Mobile Detectors), Application (Medical Imaging, Dental Application, Security Application, Veterinary Application, Industrial Application), Portability (Fixed Detectors, Portable Detectors), End User (Hospitals, Diagnostic Laboratories, Original Equipment Manufacturers (OEM'S), Clinics and ICU) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC) |

|

Market Players Covered |

Almac Group (U.K.), Element Materials Technology (U.K.), Eurofins Scientific (Luxembourg), PPD Inc. (U.S.), LP (U.S.), Source BioScience (U.K.), Intertek Group plc (U.K.), Laboratory Corporation of America Holdings (U.S.), Sigma-Aldrich Co. LLC. (U.S.), Charles River Laboratories (U.S.), WuXi AppTec (U.S.), anacura (Belgium), LGC Ltd (U.K.), Medpace (U.S.), Syneos Health (U.S.), PRA Health Sciences (U.S.), STERIS (U.S.), Frontage Labs (U.S.) |

|

Market Opportunities |

|

Market Definition

X-ray detectors are devices that measure X-ray flux, spatial distribution, spectrum, and/or other properties. Imaging detectors (such as photographic plates and X-ray film (photographic film), which have been mostly replaced by various digitising devices such as image plates or flat panel detectors) and dose measurement devices (such as ionization chambers, Geiger counters, and dosimeters used to measure local radiation exposure, dose, and/or dose rate, to verify that radiation protection equipment and procedures are effective).

Asia-Pacific X-Ray Detector Market Dynamics

Drivers

- Rising cancer cases

According to the National Cancer Institute, approximately 1,735,350 new cancer cases were diagnosed in the United States in 2018. Furthermore, the institute predicts that 439.2 new cases of cancer will be diagnosed per 100,000 men and women each year. It also predicts that the number of new cancer cases in the United States will rise to 23.6 million by 2030. The rise in cancer incidences increased demand for cancer diagnosis, propelling the use of mammography. For instance, EOS Imaging, a global medical device company, recently installed its fourth EOS system at the Hospital for Special Surgery (HSS) in New York City, USA, which provides low dose full body stereo-radiographic images of patients.

- Technological advancements of x-ray detectors

Over the last few decades, X-ray detectors have undergone continuous innovation in terms of performance and size, aided by technological advancements and increasing demand from a wide range of end-user verticals. Furthermore, significant advancements in analytical procedures, such as indirect excitation of X-ray spectra bulk samples and combinations of instruments in a smaller space, are expected to boost the market during the forecast period.

Opportunities

- Growing market demand for mobile equipment

Growing market demand for mobile equipment, mainly from end-users such as oil and gas, power generation and others, to inspect equipment installed in remote locations not accessible via traditional X-ray inspection solutions, is driving several market innovations.

For instance, In May 2019, Varex, a well-known vendor in the X-ray detector market, introduced two new X-ray detectors aimed at industrial applications and inspection service providers: the 3030DXV-I and 3020DXV-I. According to reports, these detectors will have frame rates of up to 45fps and a high dynamic range (1.5k x 1.5k), providing excellent sensitivity and dynamic range. As X-ray inspection techniques become more common in a variety of end-user applications, such product releases are expected to increase during the forecast period.

Restraints/Challenges

- High cost of device

The rise in the expense regarding the device installation is further projected to impede and further challenge the growth of the X-ray detector market during the forecast period.

This X-ray detector market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the X-ray detector market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the X-Ray Detector Market

The outbreak of the COVID-19 pandemic is expected to have a significant impact on the market in the short term, due to the market's reliance on manufacturing facilities of industrial X-ray film providers, chemical companies, and semiconductor manufacturers. The result of a production halt, particularly in East Asia, has resulted in a massive increase in equipment prices. The increasing spread of COVID-19 has placed most of the world's countries on temporary lockdown and significantly impacted industries throughout the value chain. Furthermore, the prolonged lockdown is forcing the imposition of the 2020 recession, which is expected to disrupt the production of testing equipment and required software infrastructure.

Recent Developments

- In 2021, Konica Minolta Precision Medicine collaborated with AWS to develop the next generation of precision diagnostics. Amazon has made a financial investment in KMPM as part of this collaboration. Konica Minolta, Inc. announced a collaboration with Shimadzu Medical Systems USA in December 2019 to accelerate the commercialization of Dynamic Digital Radiography (DDR) in the US healthcare market.

- In 2021, FUJIFILM Medical Systems U.S.A., Inc., a leading provider of endoscopic and endosurgical imaging technology, announced the commercial release of the ELUXEO 7000X System, a new video imaging technology developed to enable real-time visualization of haemoglobin oxygen saturation (StO2) levels in tissue using laparoscopic and/or endoluminal imaging.

Asia-Pacific X-Ray Detector Market Scope

The X-ray detector market is segmented on the basis of type, application, portability and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Flat Panel Detectors

- Computed Radiography (CR) Detectors

- Line Scan Detectors

- Charge-coupled Device (CCD) Detectors

Application

- Medical

- Industrial

- Security

- Veterinary

- Dental

- Others

Portability

- Fixed Detectors

- Portable Detectors

End User

- Hospitals

- Diagnostic Laboratories

- Original Equipment Manufacturers (OEM'S)

- Clinics and ICU

X-Ray Detector Market Regional Analysis/Insights

The X-ray detector market is analyzed and market size insights and trends are provided by country, type, application, portability and end user as referenced above.

The countries covered in the X-ray detector market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

China is dominating the X-ray detector market because of the presence of well-developed healthcare infrastructure and favourable reimbursement policies in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The X-ray detector market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for X-ray detector market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the X-ray detector market. The data is available for historic period 2011-2021.

Competitive Landscape and X-Ray Detector Market Share Analysis

The X-ray detector market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to X-ray detector market.

Some of the major players operating in the X-ray detector market are:

- Almac Group (U.K.)

- Element Materials Technology (U.K.)

- Eurofins Scientific (Luxembourg)

- PPD Inc. (U.S.)

- LP (U.S.)

- Source BioScience (U.K.)

- Intertek Group plc (U.K.)

- Laboratory Corporation of America Holdings (U.S.)

- Sigma-Aldrich Co. LLC. (U.S.)

- Charles River Laboratories (U.S.)

- WuXi AppTec (U.S.)

- anacura (Belgium)

- LGC Ltd (U.K.)

- Medpace (U.S.)

- Syneos Health (U.S.)

- PRA Health Sciences (U.S.)

- STERIS (U.S.)

- Frontage Labs (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.