Abrasives are materials used for grinding, polishing, cutting, or shaping other materials by wear. These materials can be natural, like sandpaper made from garnet or emery, or synthetic, such as silicon carbide or aluminum oxide. Abrasives find extensive applications across industries like manufacturing, construction, automotive, and electronics. In manufacturing, they are crucial for shaping and finishing metals, ceramics, and composites. In construction, abrasives are used for smoothing surfaces and cutting materials like concrete and stone. In automotive, they aid in metal finishing, rust removal, and paint preparation. Additionally, in electronics, abrasives play a vital role in shaping and polishing delicate components like semiconductors and optical lenses, ensuring precision and quality in production processes.

Access full Report @ https://www.databridgemarketresearch.com/reports/us-abrasive-market

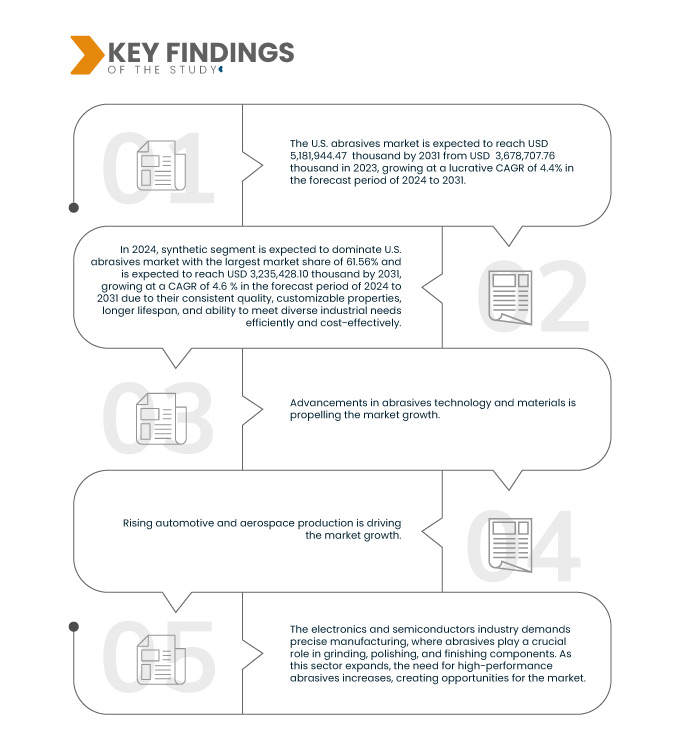

Data Bridge Market Research analyses that the U.S. Abrasives Market is expected to reach USD 5.18 billion by 2031 from USD 3.68 billion in 2023, growing with a substantial CAGR of 4.4% in the forecast period of 2024 to 2031.

Key Findings of the Study

Increasing Metal Fabrication Activities

The demand for metal fabrication, which is a crucial component of various industries, has witnessed a notable surge with the expansion of industrialization across the globe. Metal fabrication involves cutting, welding, grinding, and polishing processes, all of which heavily rely on abrasives for precision and efficiency. This surge in metal fabrication activities, particularly in sectors such as automotive, construction, and aerospace, is directly translating into heightened demand for abrasives.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2021-2016)

|

|

Quantitative Units

|

Revenue in USD Billion, Volume in Tons and Units, Pricing in USD

|

|

Segments Covered

|

By Raw Material (Synthetic, and Natural), Type (Bonded Abrasive, Coated Abrasive, and Super Abrasive), Product (Disc, Cups, Cylinder, and Others), Form (Powdered Form, and Block Form), Application (Grinding, Polishing, Cutting, Finishing, Drilling, and Others), End-Use (Automotive, Building and Construction, Metal Fabrication, Machinery, Aerospace and Defense, Electrical and Electronics, medical devices, Oil and Gas, and Others)

|

|

Countries Covered

|

U.S.

|

|

Market Players Covered

|

ARC ABRASIVES INC. (U.S.), Bullard Abrasives Inc. (U.S.), Engis Corporation (U.S.), INDASA (Portugal), Klingspor Abrasives Limited (Germany), Osborn (U.S.), SAK ABRASIVES LIMITED (India), Tyrolit - Schleifmittelwerke Swarovski AG & Co K.G. (Austria), Asahi Diamond Industrial Co., Ltd. (Japan), CUMI (India), Hermes Schleifmittel GmbH (Germany), Robert Bosch GmbH (Germany), SAIT ABRASIVI S.p.A. (Italy), Mirka USA (U.S.), Saint-Gobain (France), 3M (U.S.), Weiler Abrasives.(U.S), VSM AG (Germany), among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis

The U.S. abrasives market is segmented into six notable segments namely raw material, type, product, form, application, and end-use.

- On the basis of raw material, the U.S. abrasives market is segmented into synthetic and natural

In 2024, synthetic segment is expected to dominate the U.S. Abrasives Market

In 2024, the synthetic segment is expected to dominate the market with a 61.56% market share due to their consistent quality, customizable properties, longer lifespan, and ability to meet diverse industrial needs efficiently and cost-effectively.

- On the basis of type, the U.S. abrasives market is segmented into bonded abrasive, coated abrasive, and super abrasive

In 2024, the bonded abrasive segment is expected to dominate the U.S. Abrasives Market

In 2024, the bonded abrasive segment is expected to dominate the market with a 56.31% market share. due to their versatility, durability, and ability to maintain precise shapes during use, making them ideal for a wide range of grinding and cutting applications.

- On the basis of product, the U.S. abrasives market is segmented into disc, cups, cylinder, and others. In 2024, the disc segment is expected to dominate the market with a 52.54% market share

- On the basis of form, the U.S. abrasives market is segmented into powdered form and block form. In 2024, the powdered form segment is expected to dominate the market with a 59.62% market share

- On the basis of application, the U.S. abrasives market is segmented into grinding, polishing, cutting, finishing, drilling, and others. In 2024, the grinding segment is expected to dominate the market with a 38.85% market share

- On the basis end-use, the U.S. abrasives market is segmented into automotive, building and construction, metal fabrication, machinery, aerospace and defense, electrical and electronics, medical devices, oil and gas, and others. In 2024, the automotive segment is expected to dominate the market with a 25.98% market share

Major Players

Data Bridge Market Research analyzes 3M (U.S.), Robert Bosch Power Tools GmbH (Germany), Saint-Gobain (France), Tyrolit - Schleifmittelwerke Swarovski AG & Co K.G. (Austria), Klingspor Abrasives Limited (Germany) as the major player of the U.S. abrasives market.

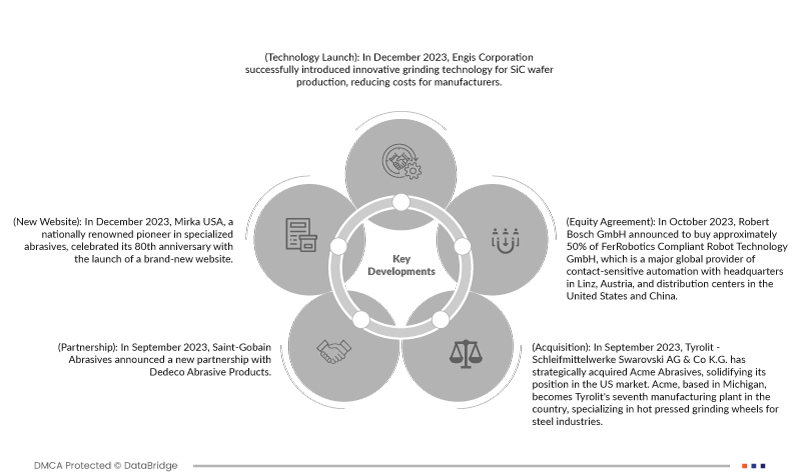

Recent Developments

- In December 2023, Engis Corporation successfully introduced innovative grinding technology for SiC wafer production, reducing costs for manufacturers. The advanced grinding system, including the Hyprez EAG model, offered economic benefits with precise wafer thickness control. Investment in the system minimized initial capital expenditure while maximizing performance with Engis grinding wheels. The technology aimed to produce ultra-flat wafers in a fully automated operation, optimizing surface roughness and wheel life. Further investments in Engis tools were planned for the future

- In December 2023, Mirka USA, a nationally renowned pioneer in specialized abrasives, celebrated its 80th anniversary with the launch of a brand-new website. The new site showcases Mirka's excellent abrasives, equipment, and dust-free sanding solutions, as well as a know-how area for industries such as collision repair, carpentry, and interior finishing. It will help clients and professionals to solve their business needs and problems in a simple, quick, and efficient way

- In October2023, Robert Bosch GmbH announced to buy approximately 50% of FerRobotics Compliant Robot Technology GmbH, which is a major global provider of contact-sensitive automation with headquarters in Linz, Austria, and distribution centers in the United States and China. Robert Bosch GmbH and FerRobotics signed agreements to this effect on September 29, 2023. With the anticipated equity participation in FerRobotics, the company will open up new market niches in the accessories industry

- In September 2023, Saint-Gobain Abrasives announced a new partnership with Dedeco Abrasive Products. The addition of Dedeco's Sunburst product line to the Saint-Gobain Abrasives distributor sales team in North America provides customers with an even broader selection of abrasives across industrial markets

- In September 2023, Tyrolit - Schleifmittelwerke Swarovski AG & Co K.G. has strategically acquired Acme Abrasives, solidifying its position in the US market. Acme, based in Michigan, becomes Tyrolit's seventh manufacturing plant in the country, specializing in hot pressed grinding wheels for steel industries. The move expands Tyrolit's product portfolio for steel, foundry, and rail industries, enhancing operational competitiveness

For more detailed information about the U.S. Abrasives Market report, click here – https://www.databridgemarketresearch.com/reports/us-abrasive-market