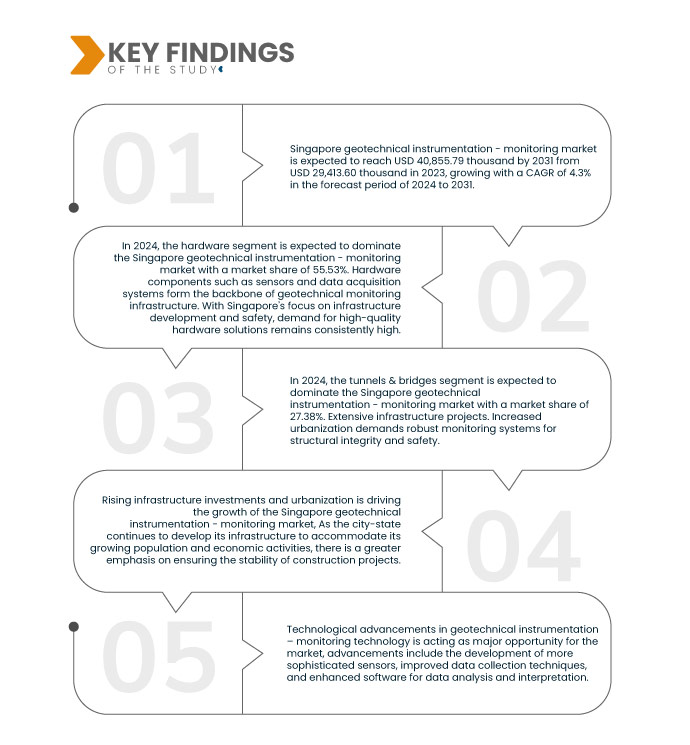

Rising infrastructure investments and rapid urbanization are key factors driving the demand for geotechnical instrumentation and monitoring in Singapore. As the city-state continues to develop its infrastructure to accommodate its growing population and economic activities, there is a greater emphasis on ensuring the stability of construction projects. Geotechnical instrumentation plays a crucial role in monitoring various aspects of soil and structure behavior, such as ground movement, foundation stability, and groundwater levels, to mitigate risks and ensure the longevity of infrastructure assets.

Access full Report @ https://www.databridgemarketresearch.com/reports/singapore-geotechnical-instrumentation-monitoring-market

Data Bridge Market Research analyses that Singapore Geotechnical Instrumentation - Monitoring Market is expected to reach USD 40,855.79 thousand by 2031 from USD 29,413.60 thousand in 2023, growing with a CAGR of 4.3% in the forecast period of 2024 to 2031.

Key Findings of the Study

Rise in Demand for Real-Time Monitoring

The rise in demand for real-time monitoring has significantly driven the Singapore geotechnical instrumentation and monitoring market. Geotechnical instrumentation plays a critical role in assessing and managing risks associated with construction projects, infrastructure development, and environmental monitoring. Real-time monitoring allows for continuous data collection and analysis, enabling early detection of potential hazards such as ground movements, soil instability, and structural deformations. This proactive approach enhances safety, minimizes project delays, and reduces overall costs by facilitating timely interventions and adjustments.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Offering (Hardware, Software, Services), Structure (Tunnels & Bridges, Buildings & Utilities, Dams, Road/Rails, Metros, Nuclear Power Plant, and Others), Networking Technology (Wired, Wireless), Technique (Deformation of Ground & Structure Observation, Data Management & Monitoring System, Monitoring Service for Construction, Water Observation, Tilt & Surface Settlement), End-User (Building and Infrastructure, Mining, Oil & Gas, Energy & Power, Manufacturing, Government, Aerospace, Agriculture, and Others)

|

|

Country Covered

|

Singapore

|

|

Market Players Covered

|

SENSINGTECH PTE. LTD. (Singapore), Applus+ (Spain), Exponent, Inc. (U.S.), GEO-Instruments (U.S.), Fugro (Netherlands), GEOKON (U.S.), Monitoring Solution Providers Pte Ltd. (Singapore), GeoSIG, Ltd (Switzerland), RST Instruments Ltd. (Canada), SERCEL (France), TRITECH ENGINEERING and TESTING (SINGAPORE) PTE LTD (Singapore), Worldsensing (Spain), Encardio Rite (India), CSC Holdings Limited (Singapore) and among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis

|

Segment Analysis

Singapore geotechnical instrumentation - monitoring market is segmented into five notable segments, based on offering, structure, networking technology, technique and end-user.

- On the basis of offering, the market is segmented into hardware, software and services

In 2024, the hardware segment is expected to dominate Singapore geotechnical instrumentation - monitoring market

In 2024, the hardware segment is expected to dominate the Singapore geotechnical instrumentation - monitoring market with a market share of 55.53% because hardware components such as sensors and data acquisition systems form the backbone of geotechnical monitoring infrastructure.

- On the basis of structure, market is segmented into tunnels & bridges, buildings & utilities, dams, road/rails, metros, nuclear power plant, and others. In 2024, the tunnels & bridges segment is expected to dominate the Singapore geotechnical instrumentation - monitoring market with a market share of 27.38%

- On the basis of networking technology, the market is segmented into wired and wireless. In 2024, the wired segment is expected to dominate the Singapore geotechnical instrumentation - monitoring market with a market share of 78.46%

- On the basis of technique, the market is segmented into deformation of ground & structure observation, data management & monitoring system, monitoring service for construction, water observation, and tilt & surface settlement

In 2024, the deformation of ground & structure observation segment is expected to dominate the Singapore geotechnical instrumentation - monitoring market

In 2024, the deformation of ground & structure observation segment is expected to dominate the Singapore geotechnical instrumentation - monitoring market with a market share of 34.90% because of increasing construction projects and infrastructure developments.

- On the basis of end-user, the market is segmented into building & infrastructure, mining, oil & gas, energy & power, manufacturing, government, aerospace, agriculture, and others. In 2024, the building & infrastructure segment is expected to dominate the Singapore geotechnical instrumentation - monitoring market with a market share of 21.46%

Major Players

Data Bridge Market Research analyzes Soil Investigation Pte Ltd. (A part of CSC Holdings Limited) (Singapore), CAST Laboratories Pte Ltd. (Singapore), Geoscan Pte Ltd. (Singapore), Fugro (Netherlands), Geocomp, Inc. (A Part of SERCEL) (U.S.) as the major market players in this market.

Market Development

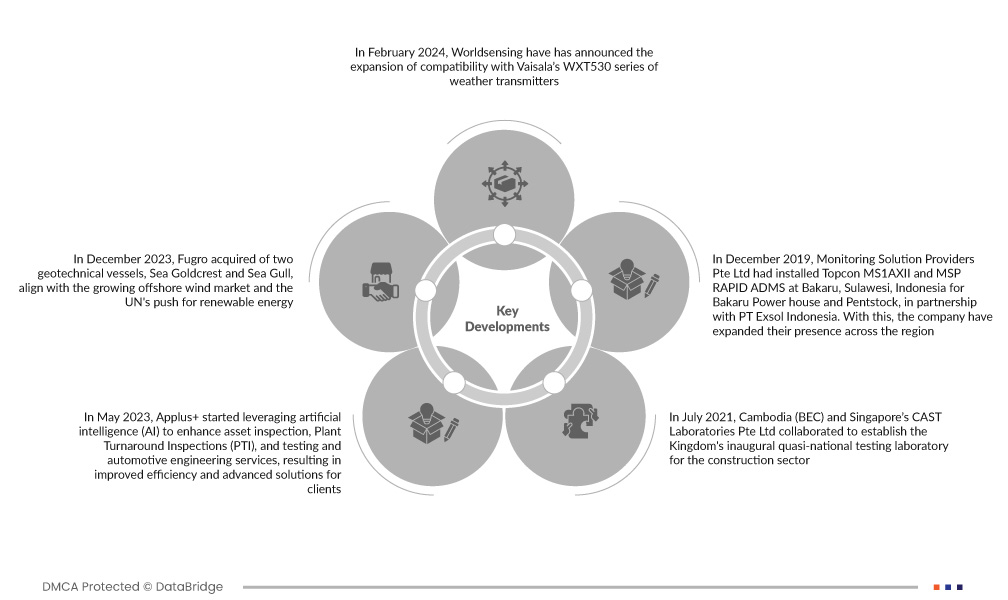

- In February 2024, Worldsensing have has announced the expansion of compatibility with Vaisala’s WXT530 series of weather transmitters. This development marks the culmination of their partnership, initiated with the introduction of compatibility for the WXT536 model in August 2020

- In December 2023, Fugro acquired of two geotechnical vessels, Sea Goldcrest and Sea Gull, align with the growing offshore wind market and the UN's push for renewable energy. Securing long-term vessel capacity, Fugro aims to meet the demands of the offshore wind industry, enhancing its market-leading position and flexibility for future projects. This strategic move emphasizes Fugro's commitment to providing comprehensive geotechnical solutions essential for sustainable offshore development

- In May 2023, Applus+ started leveraging artificial intelligence (AI) to enhance asset inspection, plant turnaround inspections (PTI), and testing and automotive engineering services, resulting in improved efficiency and advanced solutions for clients. AI enabled automated analysis of non-destructive testing data and images, such as assessing pipeline wall thickness and providing technical support to inspectors, while learning-based solutions are applied in areas like autonomous driving adaptation and crash-test signal validation. Such services help the company to enhance its portfolio and increase its customers

- In July 2021, Cambodia (BEC) and Singapore’s CAST Laboratories Pte Ltd collaborated to establish the Kingdom's inaugural quasi-national testing laboratory for the construction sector. The Board of Engineers, Cambodia Laboratory (BECL), launched in July, successfully introduced new standards and industry best practices. The collaboration empowered BECL to provide comprehensive product testing, verification, inspection, and certification services for the building sector, enhancing its capabilities and contributing to industry advancement

- In December 2019, Monitoring Solution Providers Pte Ltd had installed Topcon MS1AXII and MSP RAPID ADMS at Bakaru, Sulawesi, Indonesia for Bakaru Power house and Pentstock, in partnership with PT Exsol Indonesia. With this, the company have expanded their presence across the region

As per Data Bridge Market Research analysis:

For more detailed information about Singapore geotechnical instrumentation - monitoring market report, click here – https://www.databridgemarketresearch.com/reports/singapore-geotechnical-instrumentation-monitoring-market