The ASEAN video measuring system market refers to the collective landscape within the Association of Southeast Asian Nations (ASEAN) region, encompassing video measurement systems' demand, supply, and trade. It includes the deployment, sales, and adoption of these systems across various industries such as manufacturing, automotive, aerospace, electronics, healthcare, and research and development facilities within ASEAN member countries, comprising Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. This market involves the manufacturing, distributing, and using advanced video measurement technologies for precision, accuracy, quality control, and inspection purposes across diverse industrial sectors within the ASEAN economic region.

Access Full Report @ https://www.databridgemarketresearch.com/reports/asean-video-measuring-system-market

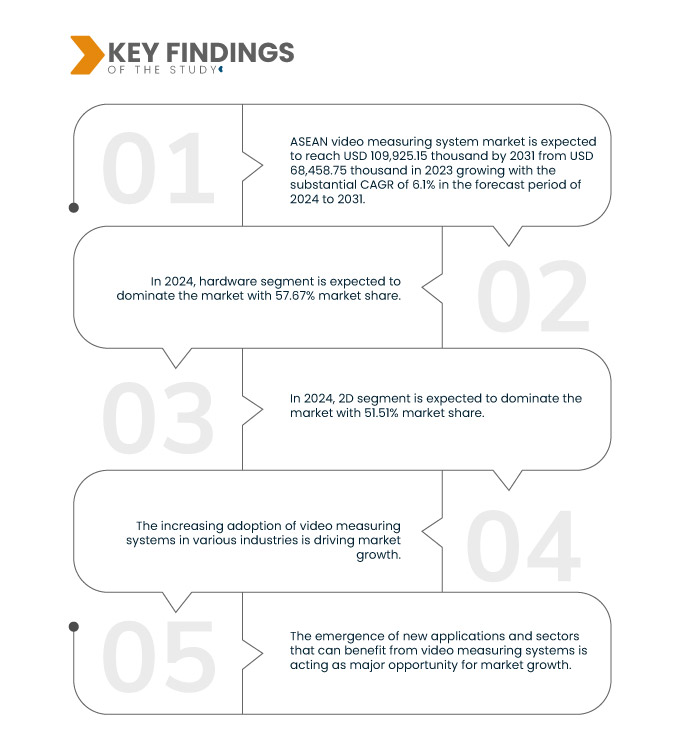

Data Bridge Market Research analyzes that the ASEAN Video Measuring System Market is expected to reach USD 109,925.15 thousand by 2031 from USD 68,458.75 thousand in 2023 growing with the substantial CAGR of 6.1% in the forecast period of 2024 to 2031. The increasing adoption of video measuring systems in various industries and rising need for accurate and precise measurements of complex and intricate parts and components are contributing to the growth of the ASEAN video measuring system market.

Key Findings of the Study

Increasing Adoption of Video Measuring Systems in Various Industries

Industries ranging from automotive and aerospace to electronics and medical are increasingly turning to advanced technologies for their quality control, inspection, and testing needs in the constant search for accuracy and excellence. The transformative shift towards video measuring systems has emerged as indispensable instruments, offering unparalleled accuracy, speed, and versatility. Measurement technologies have been taken into consideration in recent years. In the manufacturing sector, huge numbers of products are manufactured each day. Each part of the product must be produced as per precise specifications to confirm the quality of the finished product.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Component (Hardware and Software), Product Type (Manual Video Measuring System, Automated/CNC Video Measuring System, and Semi Automated Video Measuring System), Type (2D, 3D, and 2.5D), Sample Weight (More than 40 Kgs, 21 Kgs-40 Kgs, and Up to 20Kgs), Power Source (More than 120 V and Upto 120 V), Portability (Desktop and Portable), Magnification (More than 20X, 10X-20X, 3X-10X, and Less than 3X), Microscopy Technique (Confocal Optics and Brightfield Optics), Application (Product Quality Control, Certification & Inspection, Dimensional Measurement, Reverse Engineering, and Others), Vertical (Electronics, Automotive, Aerospace and Defence, Heavy Machinery Industry, Medical, Energy and Power, and Others)

|

|

Countries Covered

|

India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Vietnam, and Rest of Asia-Pacific

|

|

Market Players Covered

|

Mitutoyo Corporation (Japan), Zeiss Group (Germany), QES GROUP BERHAD (Malaysia), Nikon Corporation (Japan), Sipcon (India), ACCU-TECH MEASUREMENT SYSTEMS (India), Hexagon AB (Sweden), KEYENCE CORPORATION (Japan), AMETEK.Inc (Parent Corporation of Zygo Corporation) (U.S.), Wenzel Group (Germany), Dynascan Inspection Systems Company (India), Quality Vision International (New York), Radical Scientific Equipments Pvt. Ltd. (India), Vision Engineering Ltd (U.K.), Sinowon Innovation Metrology Manufacture Limited (China), Rational Precision Instrument (China), Banbros Engineering Pvt. Ltd. (India) and among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis

|

Segment Analysis

The ASEAN video measuring system market is segmented into ten notable segments which are based on the component, product type, type, sample weight, power source, portability, magnification, microscopy technique, application, and vertical.

- On the basis of component, the market is segmented into hardware and software

In 2024, hardware segment is expected to dominate the ASEAN video measuring system market

In 2024, the hardware segment is expected to dominate the market with a 57.67% share due to video measuring systems being extensively used across industries such as manufacturing, automotive, aerospace.

- On the basis of product type, the market is segmented into manual video measuring system, automated/CNC video measuring system and semi-automated video measuring system

In 2024, manual video measuring system segment is expected to dominate the ASEAN video measuring system market

In 2024, the manual video measuring system segment is expected to dominate the market with a 56.09% share, manual systems are often more affordable than automated or CNC-based systems.

- On the basis of type, the market is segmented into 2D, 3D, and 2.5D. In 2024, 2D segment is expected to dominate the market with a 51.51% share

- On the basis of sample weight, the market is segmented into more than 40 Kgs, 21 Kgs-40 Kgs, and up to 20Kgs. In 2024, more than 40 Kgs segment is expected to dominate the market with a 44.38% share

- On the basis of power source, the market is segmented into more than 120 v and up to 120 v. In 2024, more than 120 v segment is expected to dominate the market with a 67.94% share

- On the basis of portability, the market is segmented into desktop and portable. In 2024, desktop segment is expected to dominate the market with a 54.43% share

- On the basis of magnification, the market is segmented into more than 20X, 10X-20X, 3X-10X, and less than 3X. In 2024, more than 20X segment is expected to dominate the market with a 44.07% share

- On the basis of microscopy technique, the market is segmented into confocal optics and brightfield optics. In 2024, confocal optics segment is expected to dominate the market with a 58.53% share

- On the basis of application, the market is segmented into product quality control, certification & inspection, dimensional measurement, reverse engineering, and others. In 2024, product quality control is segment is expected to dominate the market with a 42.50% share

- On the basis of vertical, the market is segmented into electronics, automotive, aerospace and defence, heavy machinery industry, medical, energy and power, and others. In 2024, electronics segment is segment is expected to dominate the market with a 32.91% share

Major Players

Data Bridge Market Research analyzes Mitutoyo Corporation (Japan), Zeiss Group (Germany), QES GROUP BERHAD (Malaysia), Nikon Corporation (Japan), and Sipcon (India) as the major market players in this market.

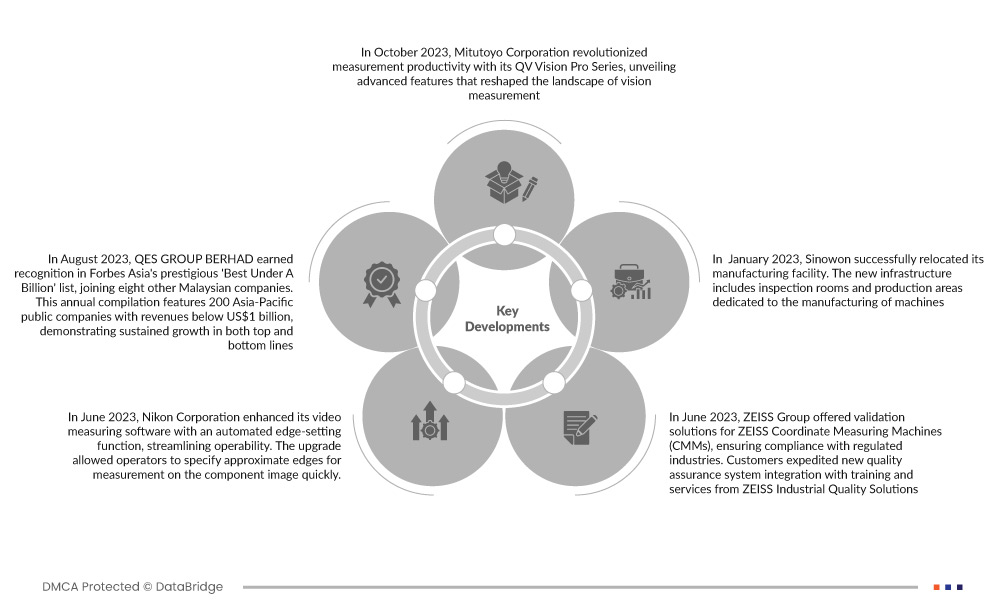

Market Developments

- In October 2023, Mitutoyo Corporation revolutionized measurement productivity with its QV Vision Pro Series, unveiling advanced features that reshaped the landscape of vision measurement. The StrobeSnap vision measuring function accelerated quality run time by 35 to 45 percent, surpassing competitors. Achieving remarkable throughput and high-precision measurements, the autofocus on the QV Pro Series operated 39 percent faster than its predecessors, maintaining unparalleled accuracy. The innovative enhancements mark a significant leap forward in vision measurement technology and benefited the company in meeting the customer's needs, resulting in increased revenue

- In August 2023, QES GROUP BERHAD earned recognition in Forbes Asia's prestigious 'Best under a Billion' list, joining eight other Malaysian companies. This annual compilation features 200 Asia-Pacific public companies with revenues below US$1 billion, demonstrating sustained growth in both top and bottom lines. The inclusion in this esteemed list is a testament to QES GROUP BERHAD financial stability and consistent performance. The acknowledgment from Forbes Asia not only boosts the company's reputation but also underscores its ability to navigate and thrive in a competitive market, reflecting positively on its overall business resilience and strategic management

- In June 2023, Nikon Corporation enhanced its video measuring software with an automated edge-setting function, streamlining operability. The upgrade allowed operators to quickly specify approximate edges for measurement on the component image. The software then autonomously pinpointed precise feature positions, facilitating efficient manual selection of the correct edge from suggested options. This has helped the company to compete with the competitors

- In February 2022, AMETEK Inc. launched the innovative DF3 Series digital force gauges, featuring a user-friendly design, large color display, and intuitive interface. It has time-saving features such as test setup, auto-save, and extended battery life, enhancing efficiency in force testing. The gauge supports various functions for comprehensive measurement capabilities. This has helped the company to diversify its product portfolio

- In August 2021, Hexagon AB revealed the HP-L-10.10, a groundbreaking non-contact laser sensor for Coordinate Measuring Machines (CMMs). The "no compromise" CMM laser scanning by Hexagon's Manufacturing Intelligence division promises manufacturers a 70% faster inspection process with ultra-high accuracy. This innovation allows dimensional measurements comparable to tactile probing and quicker inspections of nearly any surface. This has helped the company to expand its product portfolio and meet the demand of customers

Regional Analysis

Geographically, the countries covered in the ASEAN video measuring system market report are India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Vietnam, and Rest of Asia-Pacific.

As per Data Bridge Market Research analysis:

India is expected to dominate and be the fastest growing country in the ASEAN video measuring system market during the forecast period

India is expected to dominate and be the fastest growing country in the ASEAN video measuring system market due to its growing pool of tech talent, innovation focus, digital market, government support, cost-effectiveness, and addressing local needs make it appealing for video measurement technologies.

For more detailed information about the ASEAN Video measuring system market report, click here – https://www.databridgemarketresearch.com/reports/asean-video-measuring-system-market